Does the closure of Binance USD (BUSD) mean trouble for all Stablecoins: expert response

Paxos Trust Co. has been targeted by the US Securities and Exchange Commission (SEC) and the New York Financial Services Department (NYDFS), with the issue of the Binance USD (BUSD) steblycoin together with the Binance cryptocurrency exchange the cause of the problems. Overall, the SEC notified Paxos of the imminent lawsuit, and NYDFS representatives obliged the giant to stop issuing BUSD. And although the overall situation looks rather dire, there is no talk of a targeted campaign by regulators against all stackablecoins yet. We’ll tell you more about what’s going on.

Recall, the situation with BUSD was very unpleasant. Paxos has been obliged to stop issuing new tokens, which will cause its supply to go down. The giant's representatives agreed to the terms, although they later said they were ready to defend their own interests in court.

At the same time, representatives of cryptocurrency exchange Binance started looking for new issuers of stablcoin. In addition, the platform’s management is considering launching a digital asset tied to a fiat currency other than the dollar. Apparently, in this way, Binance employees want to protect themselves from similar problems in the future.

Binance CEO Changpen Zhao

What’s going to happen to stabelcoins?

Marcus Thielen, head of platform Matrixport, spoke more about the regulators’ motives and goals. According to him, the root of the problem could be in the actions of Paxos itself, meaning that the claims of the regulators do not seem unfounded with a proper analysis of the incident.

According to the expert, Paxos Trust Co. most likely did not comply with strict token action reporting criteria. In a recent publication, Thielen also added that the problem “has nothing to do with stabelcoins per se”. Here’s his rejoinder to what’s going on.

The problem doesn’t seem to be related to stabelcoins per se, as market players initially feared. The issue is that Paxos management has not been strict enough in its reporting on BUSD. Paxos breached its obligation to conduct ad hoc periodic risk assessments and due diligence on Binance customers as well as BUSD accounts.

According to Cointelegraph’s sources, Paxos representatives confirmed that the company received notice of a possible lawsuit from the Securities and Exchange Commission as early as 3 February 2023. The document said that Paxos has not registered BUSD as a security, so it is the litigation that “needs to be addressed”.

Paxos promises to maintain BUSD until at least 2024

Paxos management disagrees with the Commissioners’ view that the Binance USD token is a security. The company, however, is ready to “vigorously pursue the issue in court” if forced to do so, Decrypt reports. Here’s a quote from Paxos’ official statement.

We vehemently disagree with the SEC officials because BUSD is not a security under the federal securities laws. To be clear, there are no other allegations against Paxos.

It should be noted that the value of BUSD is tied to the price of the dollar, so there's no question about the prospects of an increase in the value of the Stablecoin. So, the owners of the token did not expect to get profit after the purchase of BUSD - and Paxos did not promise anything like that either. According to experts, the reason for the problems could be the profit and its further split with the Binance exchange. However, Tether and Circle earn income under the same scheme on their stabelcoins, so the actions of regulators do not seem particularly logical.

With that in mind, Paxos is preparing to terminate its partnership with Binance, which dates back to 2019. One of its conditions was the issuance of BUSD with the approval of the NYDFS. However, the same regulator had earlier demanded to stop the issuance of BUSD, and Paxos had to comply with this demand. In a week’s time, the issuance of the Stablecoin will be stopped, while the tokens can be sold and exchanged for fiat until at least February 2024.

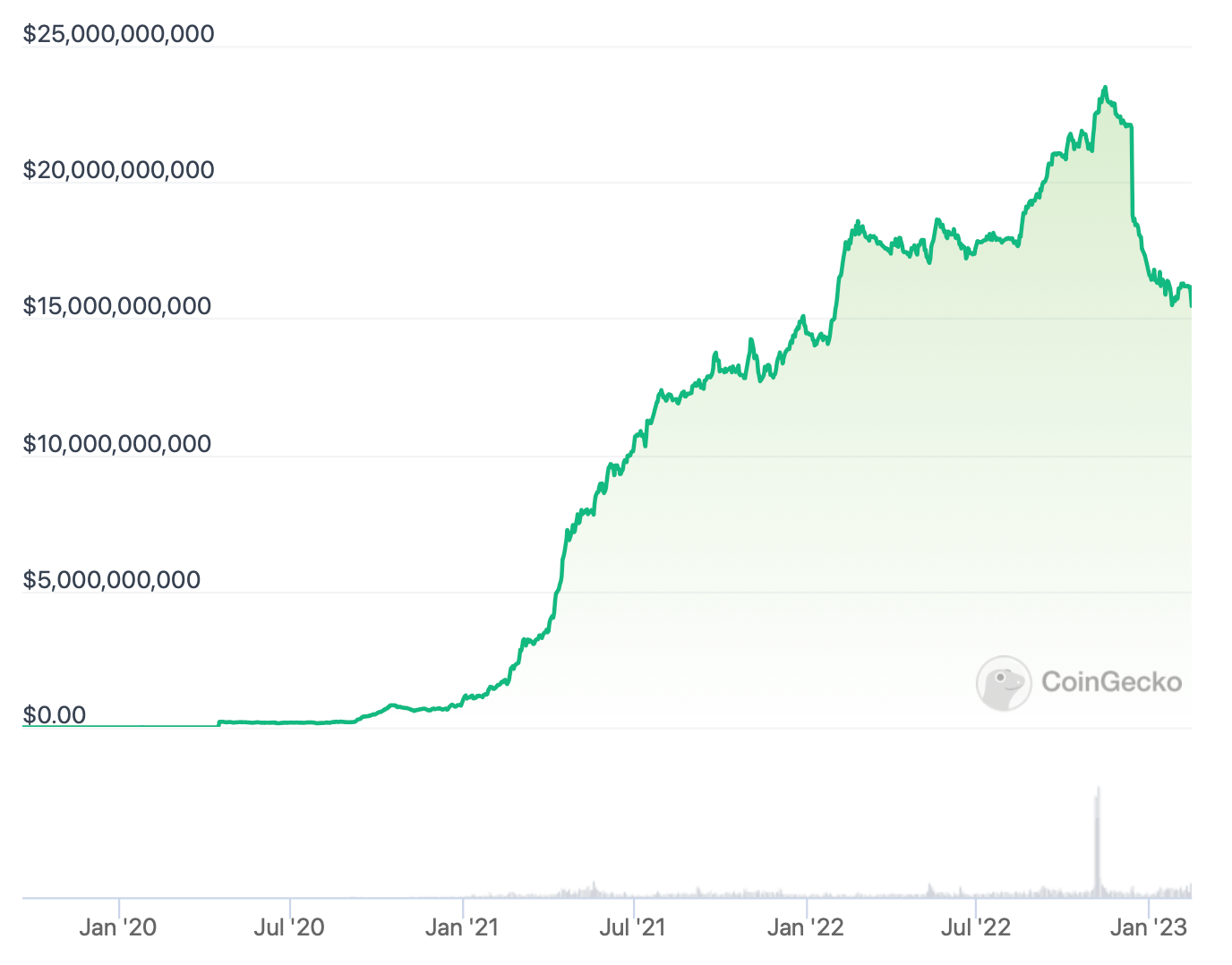

BUSD capitalisation

The New York Department of Financial Services has overseen the process of issuing BUSD on Etherium, overseeing the full collateralisation of the tokens with US dollars. That said, BUSD is also issued on Binance Smart Chain - and there are nuances. To issue BUSD on Binance Smart Chain, the exchange holds a certain amount of BUSD issued by Paxos as collateral and then issues the Stablecoin on its blockchain at a one-to-one ratio.

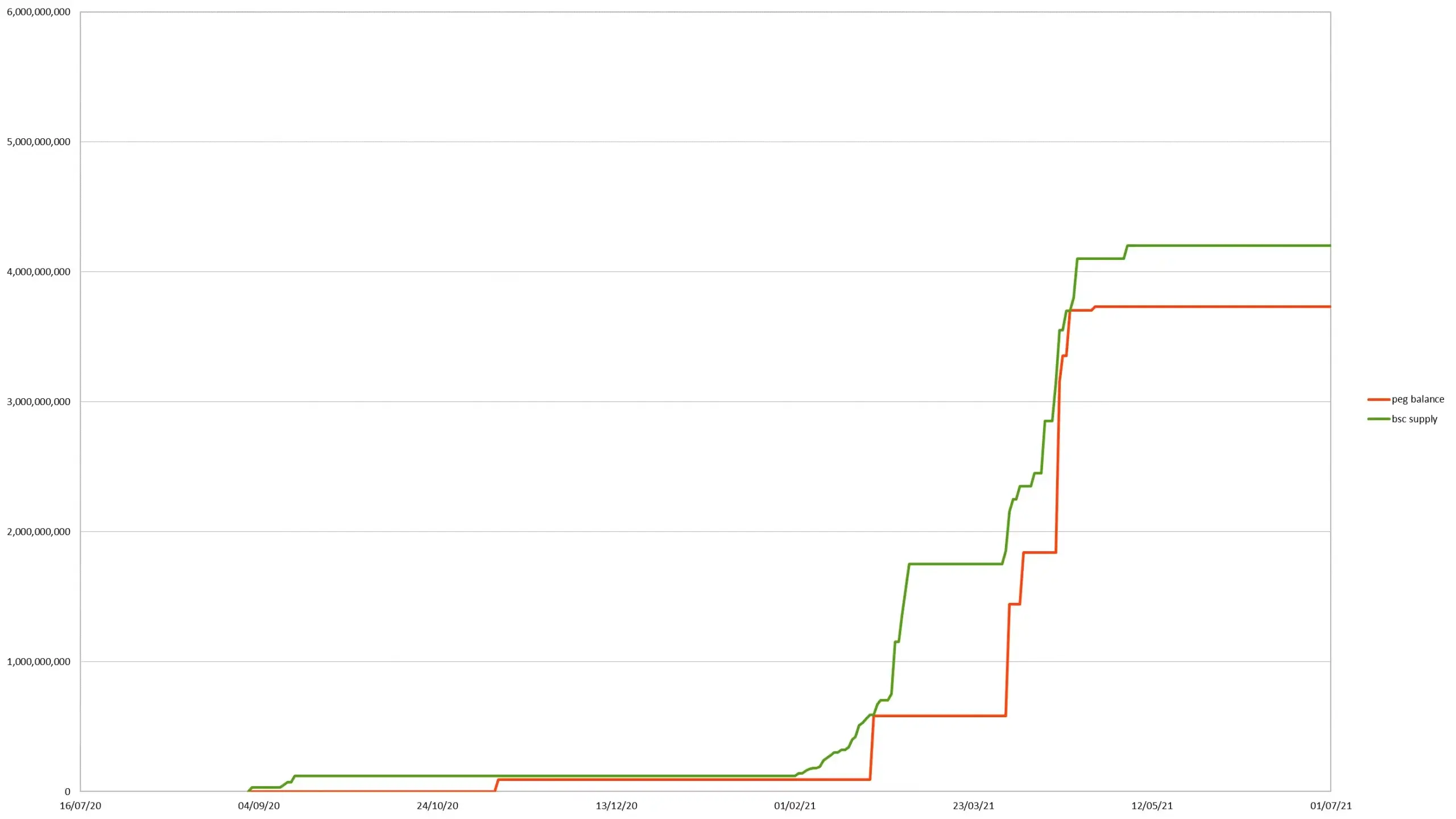

However, the balance between the two types of BUSD on different blockchains has often been unstable, ChainArgos analysts Jonathan Reiter and Patrick Tan said in their study. On at least three occasions between 2020 and 2021, there was insufficient collateral for tokens worth more than a billion dollars, while the amount of BUSD on Binance Smart Chain exceeded the amount of collateral held by the exchange.

BUSD collateral mismatch

In other words, Binance was issuing more tokens than Paxos, which means they could be transferred on the Binance Smart Chain blockchain and were not sufficiently collateralised in equal proportion. Regulators have not yet made a claim against the exchange over this, but its representatives have already managed to state that the discrepancies in the balance sheet were caused by “delays in capital formation”.

To be more specific, Binance Smart Chain has about $4.8 billion worth of BUSD in its network. NYDFS has a claim about these particular tokens – at least that’s all that’s known so far. However, the overall situation looks worrying, especially in the context of the recent US Securities and Exchange Commission sanctions against Kraken. Although here we can also assume that regulators’ activity will not spread to other popular stackablecoins in the future, which means that the cryptocurrency industry as a whole will be fine.

We believe that regulators' interest may indeed be limited to Binance USD, meaning that the rest of the dollar-linked coins are, in theory, not threatened. However, the SEC has acted unexpectedly and illogically many times before - and the ban on cryptocurrency steaking for US residents on Kraken the day before is a clear proof of that. So there is, alas, no way to be sure in the case of US regulators.