Losses from cryptocurrency scammers have almost halved in the past year. How are they most likely to operate?

Last year was a bad year for the industry because of the severe drop in the price of Bitcoin and other cryptocurrencies, but even in such situations there is a silver lining. For example, there was a significant drop in the amount of fraudsters’ profits. According to analysts at the platform Chainalysis, fraudsters have managed to “earn” around $5.9 billion in total – a 46 percent drop from 2021. We tell you more about what’s going on.

Note that cryptocurrency fraud can occur without overtly stealing other people’s digital assets. This was particularly evident this week when the US Securities and Exchange Commission filed a lawsuit against Do Kwon, the creator of the Terra ecosystem. Recall that its collapse due to the UST steblecoin’s decoupling from the dollar led to the collapse of LUNA and multi-billion dollar losses for users.

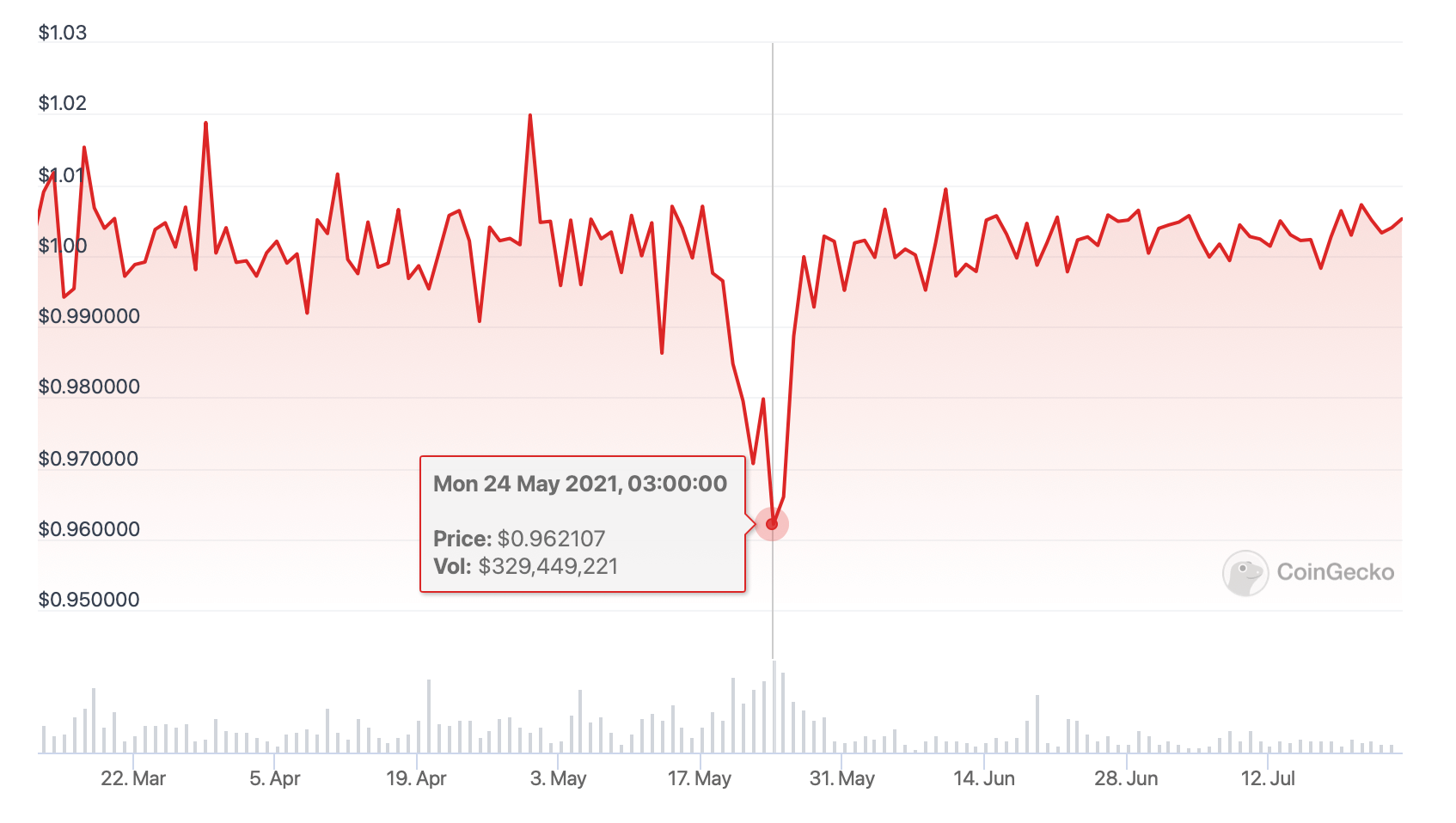

As it became clear from the court case materials, the illegal actions of Terra’s representatives began a long time ago. They started in May 2021, a year before the final collapse of the ecosystem. At that time, the value of the UST algorithmic stabelcoin fell below $1 for the first time. As you can see from the charts, the price dropped as low as 96 cents.

UST Stablecoin rate chart in May 2021

At that time, Do Kwon received third-party help from a third party who bought a huge amount of UST to stabilise the value of the token. Kwon presented the event as a “triumph of decentralisation”, which also supposedly confirmed the reliability of the algorithmic steblecoin and the mechanism behind it. In fact, however, UST survived solely because of outside help.

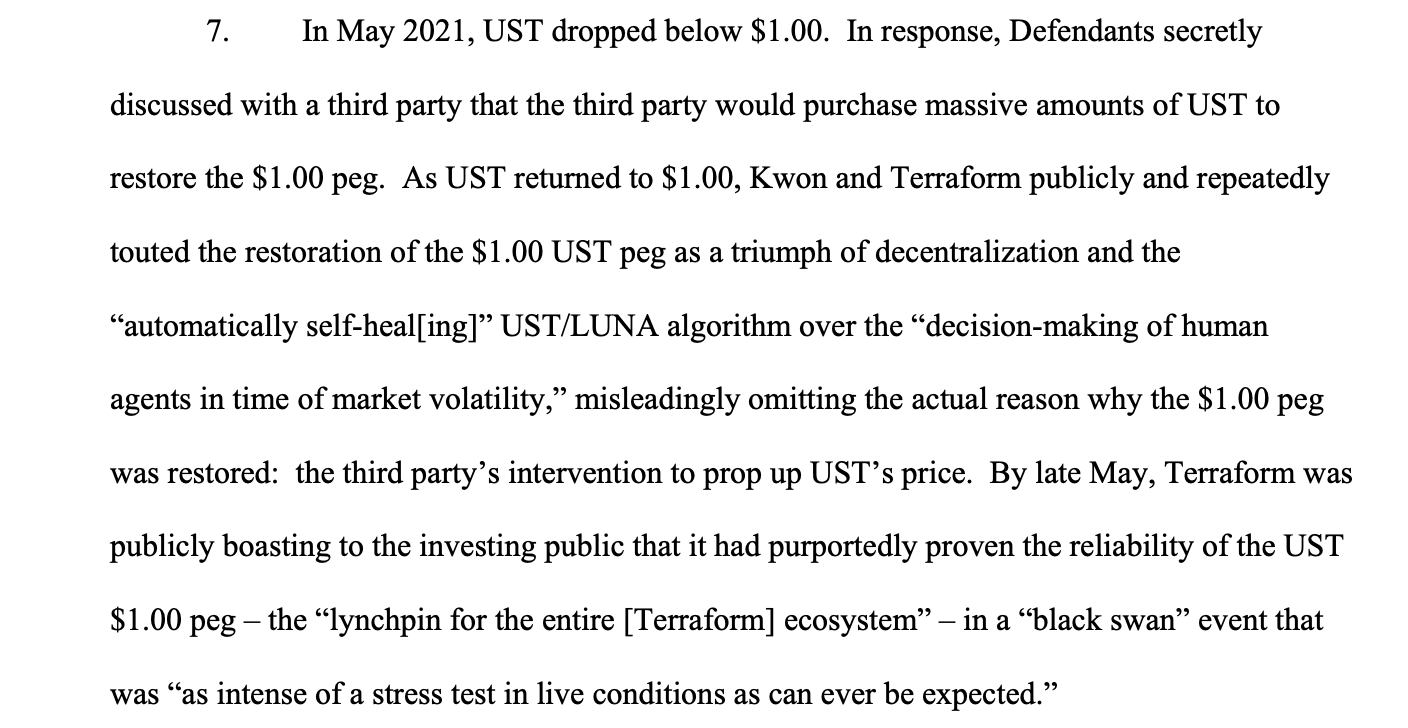

Securities and Exchange Commission charges against Do Kwon of Terra

In this connection, all subsequent statements of the team representatives about the stability of TerraUSD can be considered as acts of fraud. In fact, the management of the company hid the fact of problems from investors, which is illegal.

How much do cryptocurrency fraudsters “earn”

The expert report states that the main reasons for such a strong decline in performance were the decline in the crypto market and general investor activity. Although there are two types of scams that have managed to remain relatively immune to falling prices – “free” coin giveaways and romance scams. Here’s a relevant quote from experts.

Scam revenues have followed the Bitcoin price almost perfectly throughout the year, consistently maintaining a three-week lag between price changes and revenue changes. However, not every single type of scam follows this pattern – in some types of scam, revenue changes increase as the price of crypto-assets decreases.

Total losses from scams by year

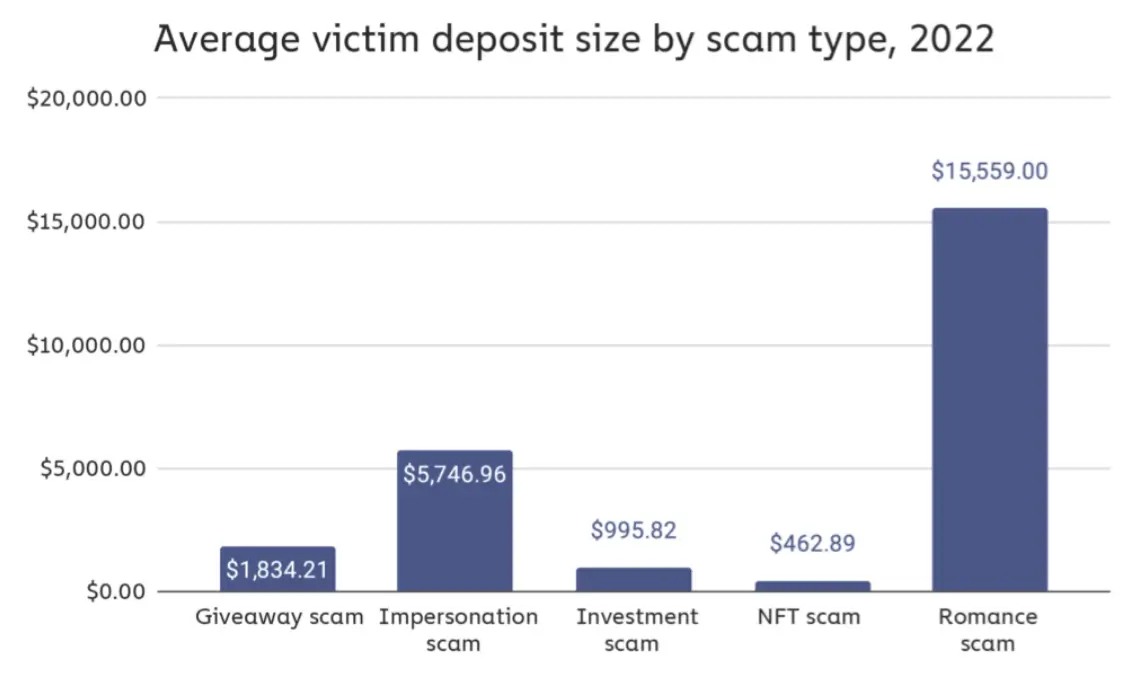

Romance scams, despite the lower overall revenue category, racked up the highest average victim loss of around $16,000 during the year, nearly three times as much as the next highest scam type. Such schemes usually involve establishing a relationship with the victim, with the scammer convincing them that they need help, or inducing them to invest in digital assets through fake websites.

As a reminder, a romance scheme involving cryptocurrencies has been reported by the FBI, among others. Its key difference is the length of the preparatory period for the scam, as it sometimes takes weeks to months to establish a relationship with a prospective victim.

According to Cointelegraph’s sources, romance scams remain relevant because scammers manage to play on the victim’s feelings, which have little regard for the overall movement of the crypto market. Here’s a pertinent rejoinder to that.

This kind of emotional pitch is probably equally effective regardless of trends in the overall market, because the victim’s main goal is not to get rich quick, but to help the person they consider to be a potential romantic partner.

Average losses per incident by type of fraud

Another type of scam put into a separate statistic are pamp and dump schemes. In 2022, at least $4.6 billion was invested in them. To recap, they involve the purchase of a certain token in advance, followed by active advertising among victims to whom the token is sold.

This is often done through social media groups that promise easy money because of the community's alleged ability to influence the value of assets. In reality, the creators of such schemes make money by buying the coins in advance for PR, and then selling them at the rise in value because of the corresponding "signal" to the community.

Chainalysis classified tokens as potential instruments of such a fraudulent scheme if they had at least ten exchanges and traded on decentralized exchanges for four consecutive days within a week of launch. Of the 1.1 million new tokens launched last year, only 40.5 thousand assets met these criteria.

We believe these statistics are generally positive. Thanks to them, we can see that old scam schemes like promising to double the sent cryptocurrency are becoming less and less relevant, and digital asset owners are not buying into the scheme. Certainly, scammers are adapting and finding new ways to "make money," but the blockchain industry is also becoming more sophisticated over time. Hopefully, this trend will continue.