Macroeconomics and the ‘death cross’: what will this week be like for Bitcoin and the cryptocurrency market in general?

After record returns in January, Bitcoin is not yet performing at its best this month. On Monday, the cryptocurrency failed to consolidate above $22,000 after last week’s plunge, a clear sign of local market weakness. In addition, on the scale of the weekly chart for BTC for the first time in history, the so-called “cross of death” – a particular crossing of the average moving lines in technical analysis – has formed. About it, as well as economic factors that will affect Bitcoin in the short term, we discuss below.

Right now the cryptocurrency market is going through a collapse phase. First of all, this is due to a quite normal correction after a serious rise at the beginning of the year. Still, Bitcoin was up almost 40 percent in January, while some other cryptocurrencies like Solana delivered significantly higher returns.

Changes in Bitcoin’s value by month

Compounding the current market situation has been the activity of regulators. In particular, last week the US Securities and Exchange Commission caused the shutdown of the Kraken platform for Americans. Now the regulators are targeting the BUSD Stablecoin from Paxos and Binance. More details about this situation can be found in this material.

Contents

- 1 What’s happening to Bitcoin now

- 2 The first “death cross” for Bitcoin

- 3 The impact of the US economy

- 4 Long-term investors are not giving up

What’s happening with Bitcoin now

The current correction, though overshadowed by the sudden news of SEC sanctions against cryptocurrency exchange Kraken and the BUSD steiblocker, was still expected by many market players. As a result, Bitcoin is now balancing at one of the important support levels on the scale of the 2-hour chart. An analyst under the nickname Crypto Tony commented on the trading situation.

I’m afraid that in this case so far everything is very boring, my target remains at $21,400. From there we will be able to really assess whether the bulls have the power to save the bears, or they are leading them to the slaughter.

As a reminder, bulls in the financial markets are defined as people who play on the upside, i.e. they bet on rising asset values by buying them. At the same time, they are opposed by bears, who are interested in a market decline due to open short positions.

Crypto Tony forecast

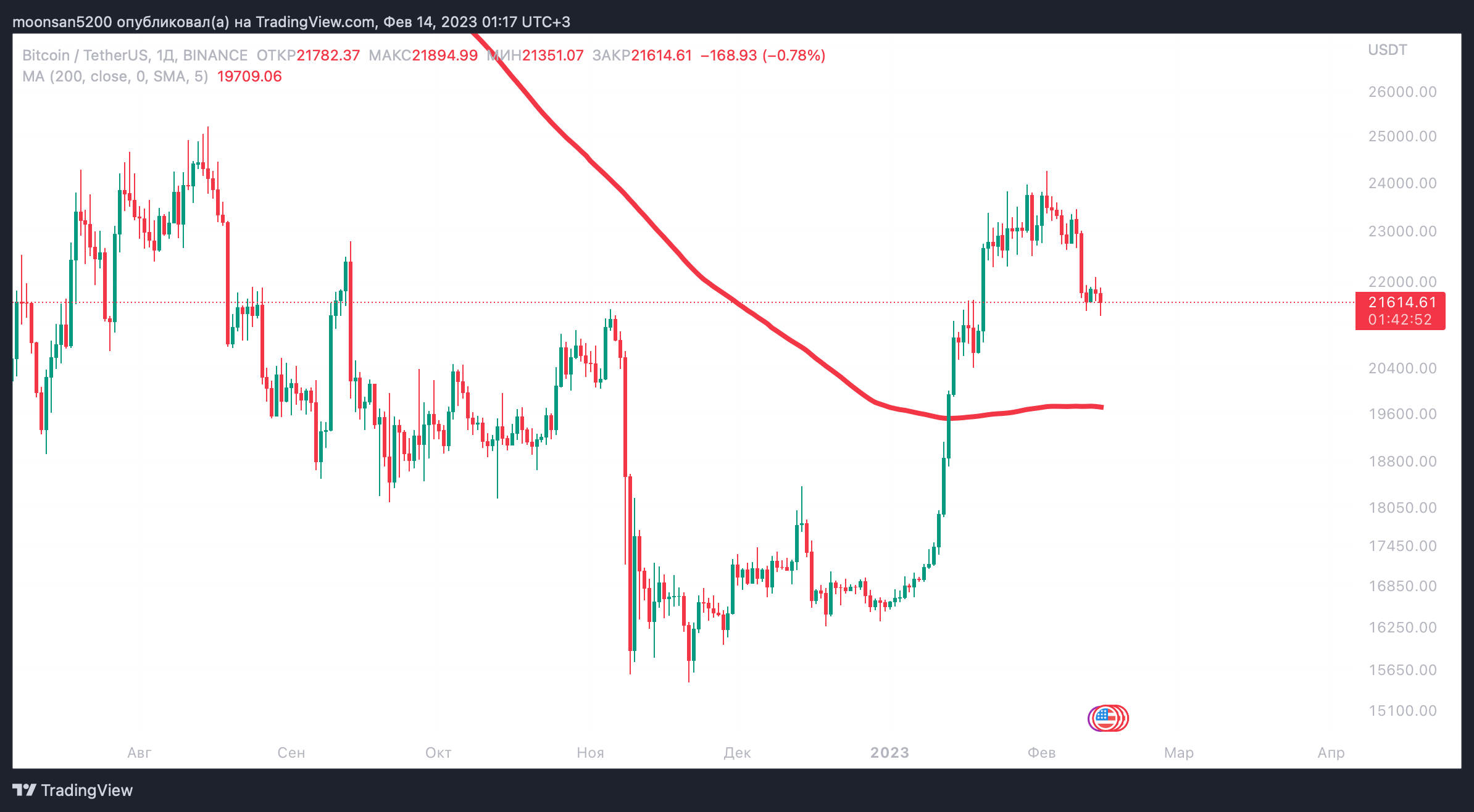

Another key level remains the 200-day moving average line. It is around $19,740 right now, so in a worst-case scenario, the Bitcoin could well drop to this level. Also keep in mind the $20,000 line, which is the 2017 bullrun high, which the bulls have also held for quite a while with Bitcoin falling as early as 2022.

The 200-day moving average line on the Bitcoin chart

Traditionally, we should note that all price predictions can easily fail to come true, as they estimate future developments that no one knows. Therefore, one should only treat such predictions as a possible version of the future and not a final verdict.

The first “death cross” for Bitcoin

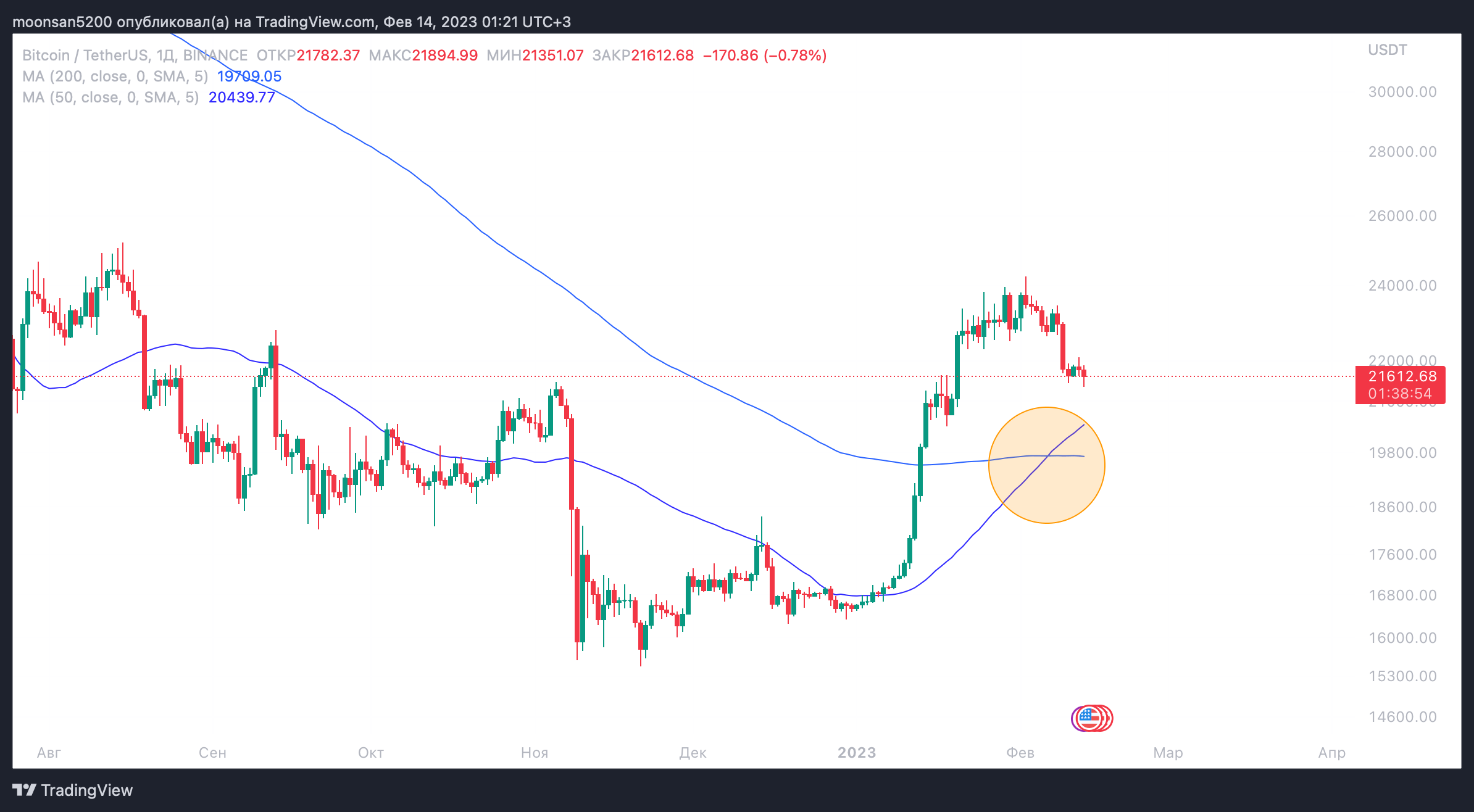

According to Cointelegraph’s sources, an interesting situation has formed in trading – the price of Bitcoin is caught between two crosses. We are talking about the so-called “golden cross” on a daily chart scale and the “death cross” on a weekly chart scale. The second one is the first time in the history of cryptocurrency trading.

The “death cross” on the scale of Bitcoin’s 1-week chart

In the past, “death crosses” have often led to a drop in the price of the asset at the scale at which they were formed, although there have been some serious exceptions in 2020. Another cross is forming between the 1-year and 3-year EMA lines for the first time in Bitcoin’s history. Senior analyst at Cubic Analytics Caleb Franzen noted that what is happening on the chart highlights the strength of the 2022 global bearish trend.

Franzen also believes that new trends could significantly extend the timing of a global market bottom. Here’s his rejoinder.

While many investors note that BTC usually bottoms about 400 days after the peak of a bullish trend, this chart suggests that things could be different this time around.

No one knows exactly how things will turn out, so Franzen also shares a version with complete ignorance of further developments.

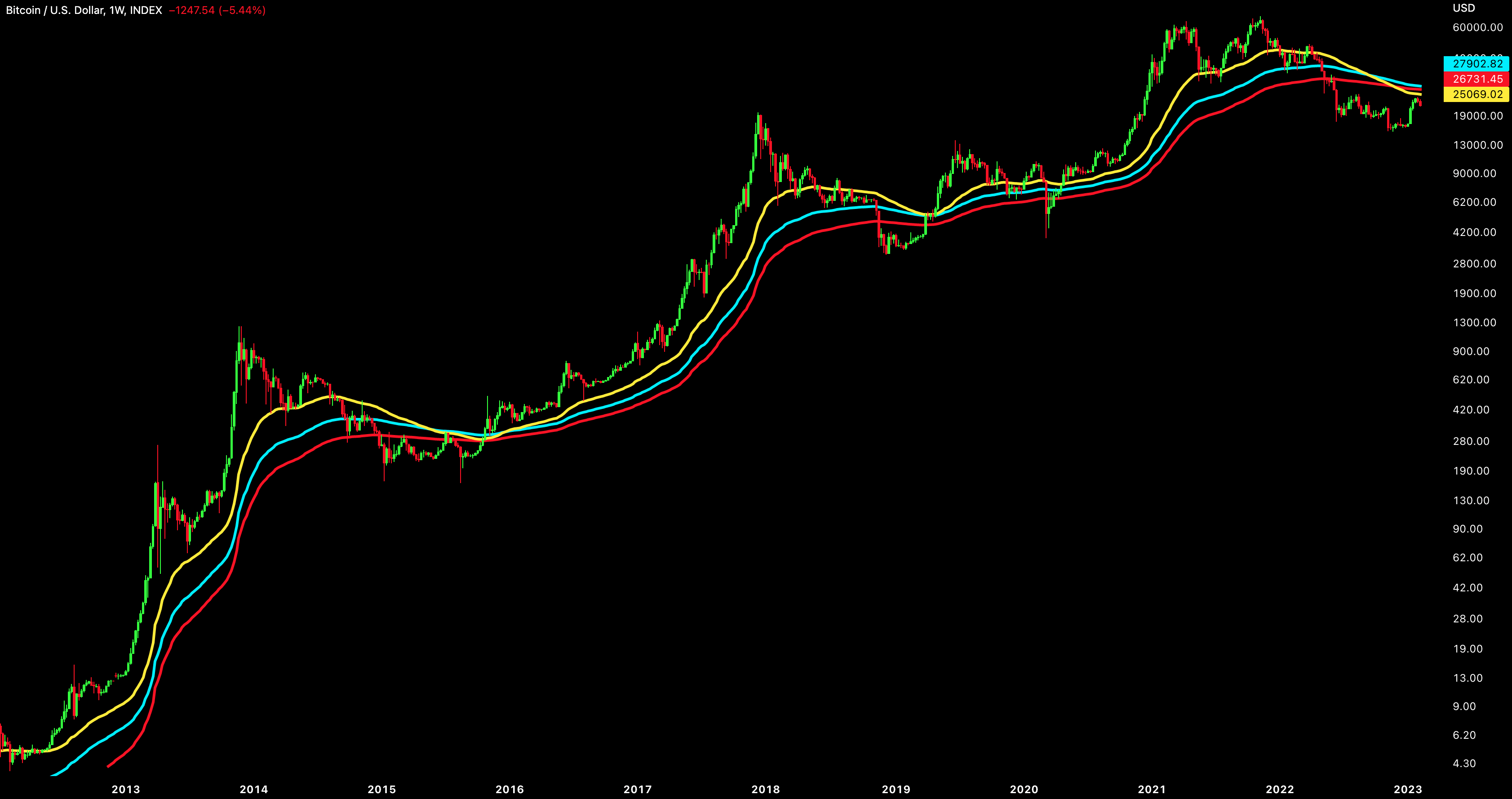

Moving averages on a global scale

Bitcoin’s trading history with relatively high liquidity is even shorter than its entire existence – more or less “notable” capital globally only started pouring into the crypto market during the 2017 bull run. It is possible that traders simply haven’t seen a “really heavy bearish trend” yet.

In particular, experienced traders and developers note that during the collapse phase of cryptocurrencies in 2018-2019, almost all major investors disappeared from the market. They were not prepared for an industry collapse of such magnitude, they lost a lot of dollar equivalent assets in various cryptocurrencies and were therefore afraid to get involved with new projects.

However, there are exceptions here too. It was on this bearish trend that the developers of the blockchain Solana attracted a large investment. This and other trivia from the life of this project was told the day before by its co-founder Anatoly Yakovenko in the Bankless podcast issue. The relevant clip is available below.

The impact of the US economy

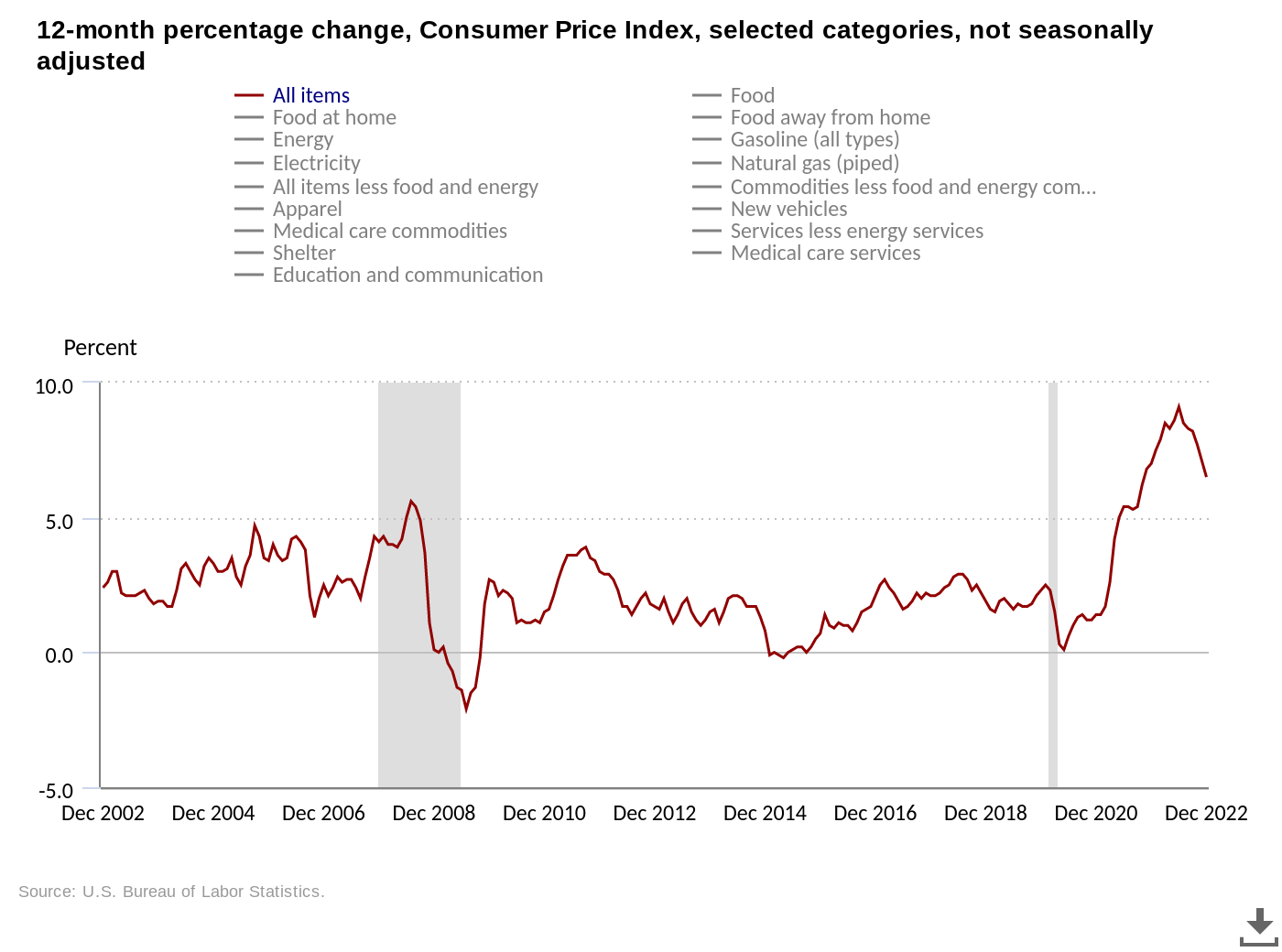

As early as today, the latest data on inflation in the US economy will be published. The consensus of experts is that the consumer price index (CPI) will again be lower than expected, indicating lower inflation and also potentially leading to a policy shift by the Federal Reserve.

Journalists at The Kobeissi Letter explained on Twitter why today’s CPI report is so important. Here’s their rejoinder.

Tuesday’s CPI report is the most important report to date. After a strong jobs report for January and an upward revision to December’s CPI, uncertainty reigns all around. Both bulls and bears need the report to be in their favour. Whichever side is right will determine the market over the next month.

US inflation data

Generally speaking, the only negative news on the macroeconomic front will be higher CPI numbers than previously expected. The guess is short lived.

Long-term investors are not giving up

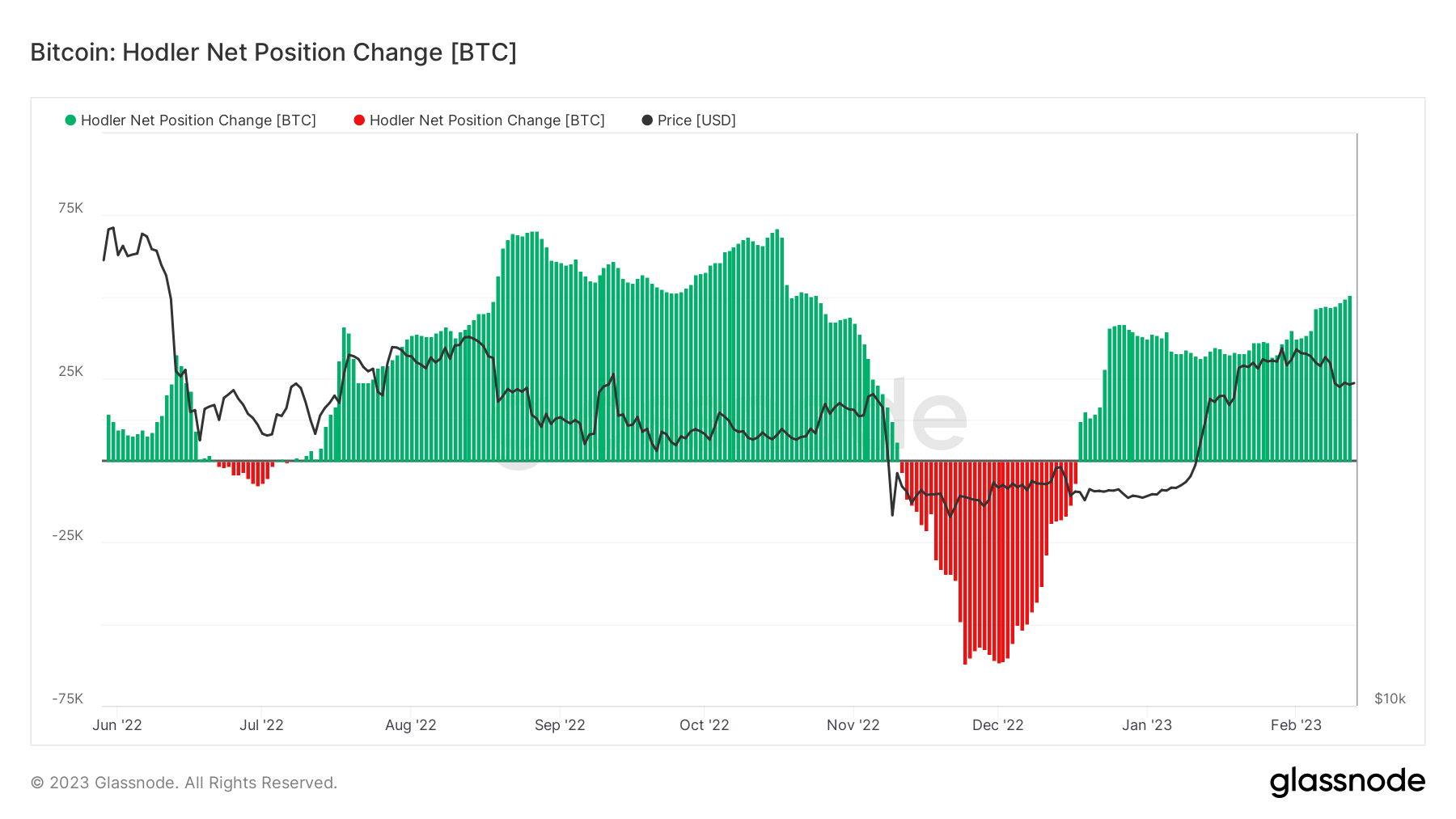

According to analyst platform Glassnode, long-term Bitcoin holders have been accumulating new positions in the cryptocurrency over the past month, which means they have been buying BTC.

Activity of long-term Bitcoin holders

Based on the data received, BTC holdings activity has reached its peak since the bankruptcy of cryptocurrency exchange FTX last November. And that’s not bad news – it looks like Bitcoin still has enough “fuel” for a new local bull run.

It seems that the situation in the cryptocurrency market is not good right now. And while the digital assets themselves are logically correcting after strong growth, regulators have traditionally decided to put a stick in the wheel of the Web3 sphere. Whether companies will wait for them in court, time will tell, but in the meantime crypto investors should be prepared for a possible deterioration in what is happening.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THE ACEME IS COMING SOON!