The number of Bitcoin wallets has reached an all-time high. What makes people get involved with cryptocurrencies?

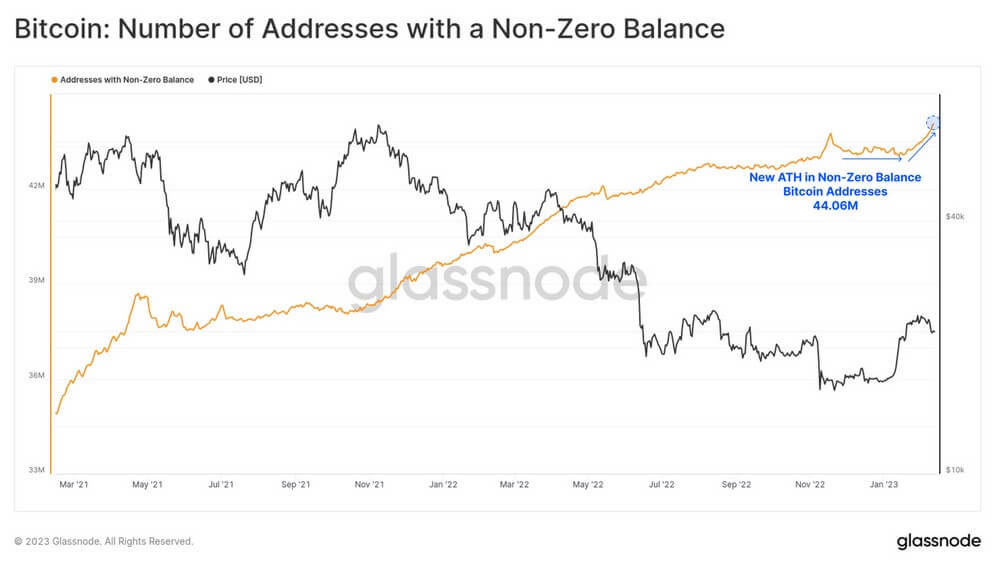

The number of Bitcoin wallets with non-zero balances has risen to an all-time high above 44 million addresses. This was announced by Glassnode analysts in a recent report. They also cited the likely reason for the rapid rise in the figure – the popularization of unique Bitcoin-based NFT tokens in a project called Ordinals. We tell you more about what’s going on.

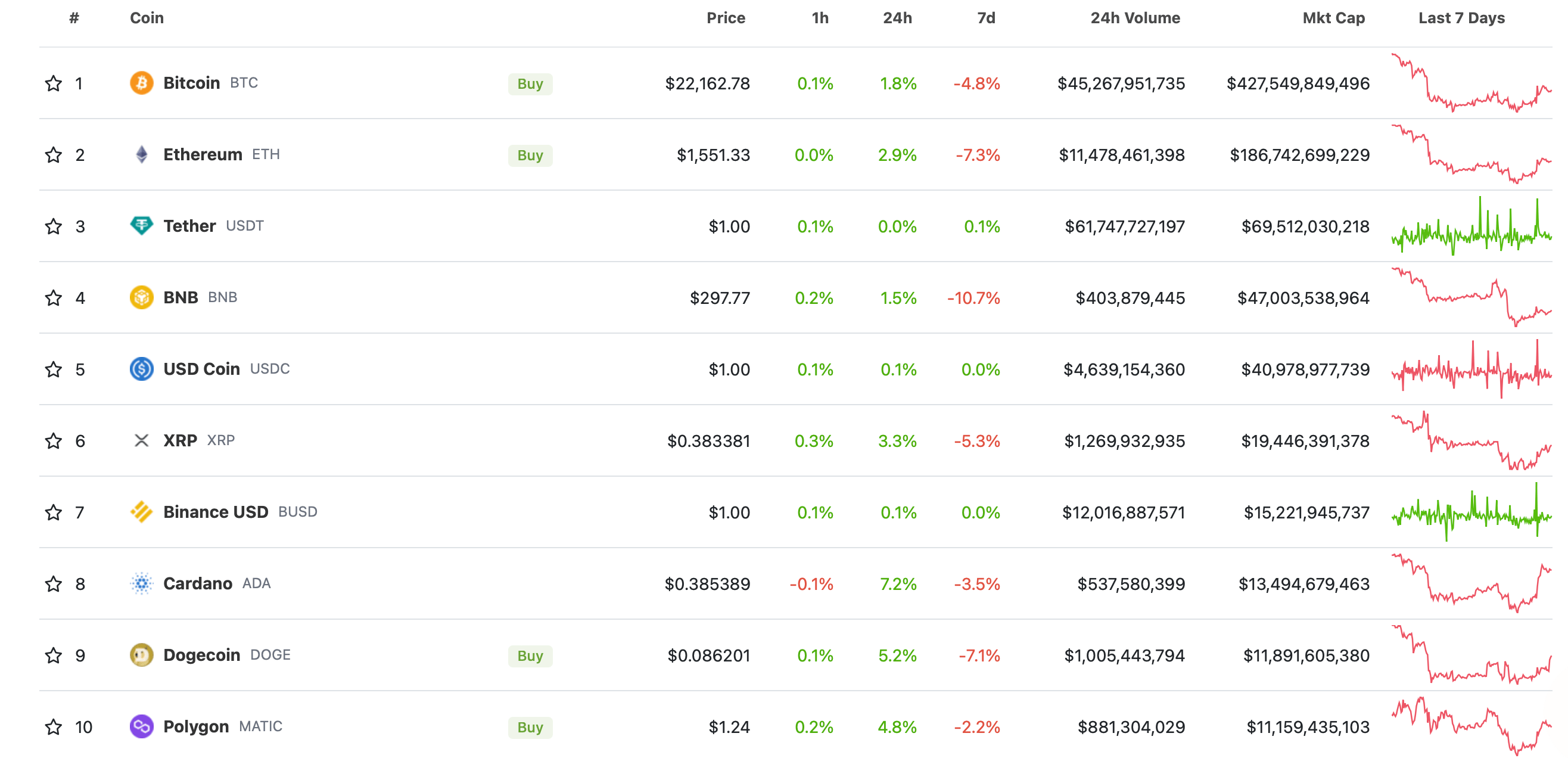

Today, the situation in the cryptocurrency market looks positive. Bitcoin gave out almost 2 percent growth in 24 hours, while the leader among the largest coins by market capitalization was Cardano with 7 percent.

Top cryptocurrencies by market capitalisation

The growth of the coin market was not hindered by the US consumer price index data published yesterday. It turned out that year-over-year inflation rose by 6.4 percent, although experts had predicted a 6.2 percent increase. Generally, this situation means that the Fed is not coping with inflation, which means that we can expect further hikes in the base key rate.

However, investors were not confused and within several minutes after the data was published, markets went up.

New record for Bitcoin

Ordinals was only launched last month, but has already managed to cause a real furor in the cryptocurrency community. The project involves leaving "inscriptions" on the smallest indivisible parts of BTC called satoshi by changing the information in the transaction. Because of this, Ordinals has also been openly criticized: yet its active use leads to Bitcoin blockchain overloading and higher fees.

Glassnode noted that for the first time in fourteen years of Bitcoin’s existence, its network resources are being used for purposes other than peer-to-peer money transfers. Here’s a relevant rejoinder from the analysts.

This is a new and unique moment in Bitcoin’s history, with the innovation generating network activity without the classic transfer of a volume of coins for the purpose of money exchange.

Indeed, the Bitcoin network does not support smart contracts, as it does with Etherium. As such, the blockchain functionality of the first cryptocurrency is predominantly limited to the transfer of value between addresses. And since the trend is now changing one way or another, analysts consider the new trend to be almost a historical change.

The upward trend in wallets immediately after the launch of Ordinals can be clearly seen in the chart below.

The number of wallets with non-zero balances

What’s more, it’s Ordinals that is responsible for most of the activity on the main cryptocurrency network at the moment. Glassnode experts continue.

The main source of this activity has to do with Ordinals. Instead of an increase in the amount of capital transferred on the blockchain, there has been an increase in the amount of data on the blockchain and new active users. This indicates growth in the user base through usage beyond typical investment and remittance cases.

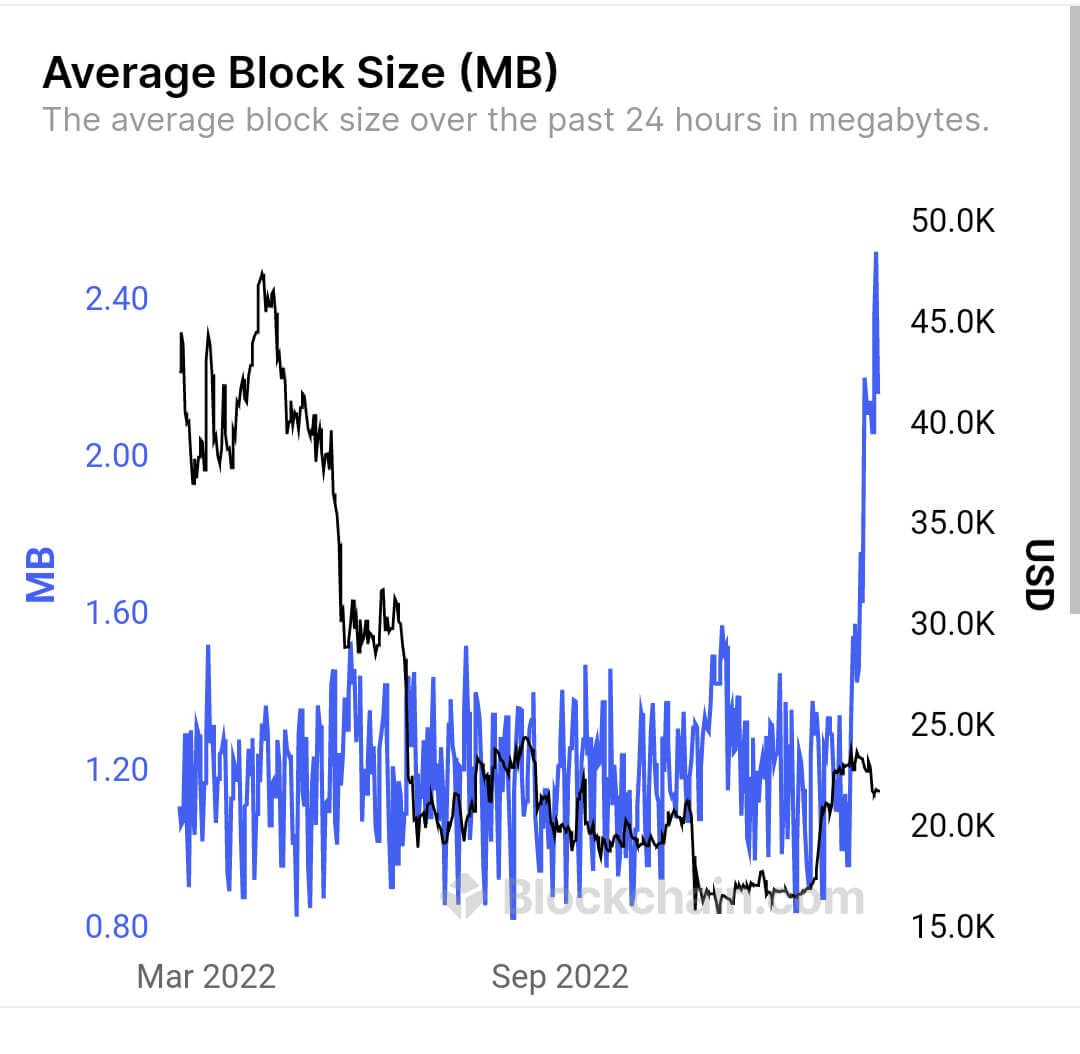

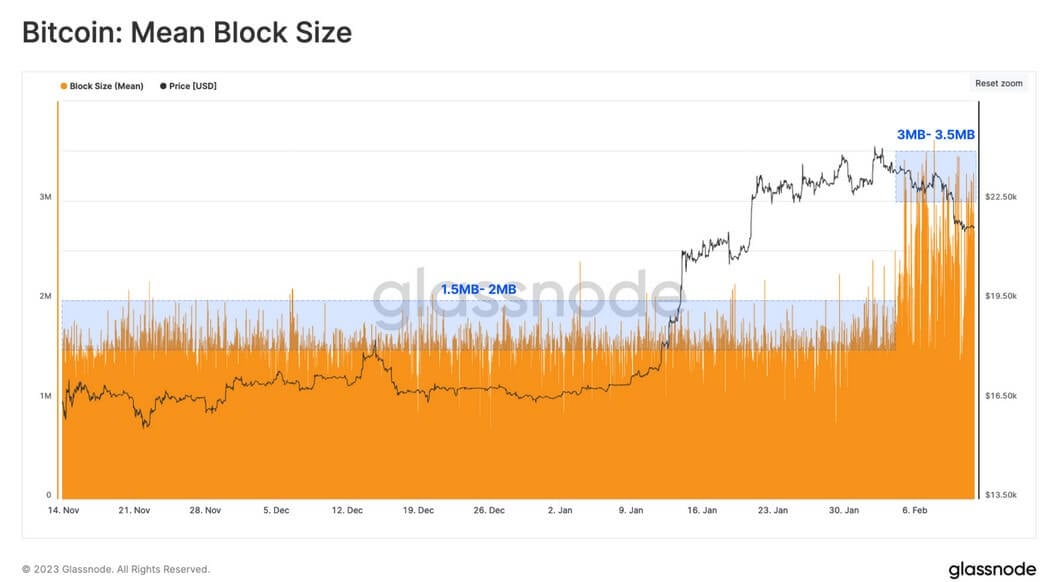

The amount of data transferred on the Bitcoin network is indeed growing, as evidenced by the average block size in the cryptocurrency's blockchain, among other things. The day before, it exceeded the 2 megabyte mark and then continued to grow. So the popularity of NFT is really putting a noticeable strain on the blockchain.

Graph of the average block size in the Bitcoin network

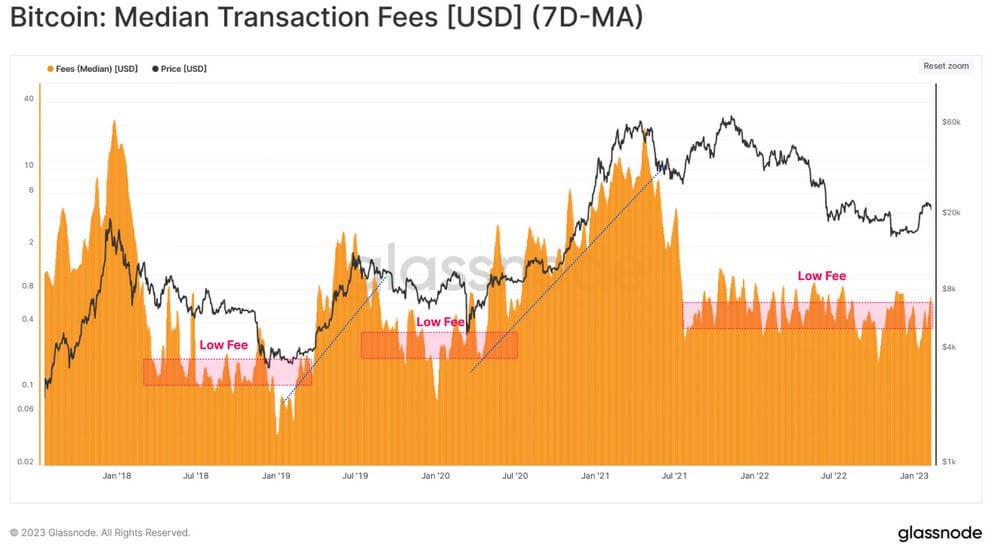

According to Cointelegraph sources, Ordinals are now competing for demand for space on the blockchain, which is “creating increased pressure on the commission market” among miners. That said, for now the situation is relatively stable – the popularity of the project has not yet led to an exorbitant increase in average transaction fees, as was the case in the bullrun days.

Bitcoin network fees

As a reminder, the Bitcoin network fees do not depend on the value of the transaction, but on its size. The latter is determined by the number of UTXOs and the parameters of the block. We wrote more about the calculation of the commissions in a separate article. We suggest you to read it to better understand the details of what is happening in BTC network.

Since the start of Ordinals on January 21, the upper block size range of Bitcoin has increased from 1.5-2.0 megabytes to 3-3.5 megabytes. Note that this is the actual figure, not the average.

Bitcoin block size dynamics

The increase in the number of transactions also affects the load of the mempool, a queue of unconfirmed transfers for approval by the miners. They automatically select from the mempool the most expensive transactions, that is, those for which they can get the most revenue in the form of fees. The more transactions in a mempool, the more money ordinary users need to pay to get their transfers processed in a timely manner.

Of course, when transferring BTCs, you can manually set the commission value based on satoshi per byte. However, if it will be much lower than average at the time of transaction, you will have to wait for a long time – sometimes it may take several days for the transaction to be approved.

NFT on Bitcoin

Ordinals does not pose a threat to the Bitcoin blockchain so far, but the project is developing at a high rate. If just a week ago it issued just over 11 thousand NFTs, now the figure has already exceeded 78 thousand NFTs. Obviously, sooner or later Bitcoin developers will have to pay attention to the problem and make efforts to optimize the project’s use of network resources.

It is worth noting that earlier some prominent Bitcoin fans suggested, among other things, to censor transactions related to NFT. This way they wanted to preserve the blockchain resources of the first cryptocurrency and keep it from being overloaded along with increasing transaction fees. And such proposal sounded very funny, because in this case the developers wanted to go against the ideals of freedom and decentralization, essentially turning away from the precepts of Satoshi Nakamoto, the anonymous creator of BTC. So far, the proposed "spam filters" have not been implemented.

Cryptocurrency user

It looks like the Bitcoin network will continue to see an increase in blockchain strain and fees going forward. How this will end, and how the developers will react to what is happening, is unknown. Eventually, however, many users will realise the practical benefits of modern networks and become interested in more efficient blockchains like Solana or Avalanche. With the latter, much smaller amounts of money, often as little as a cent, will be enough to make transactions.