What happened to the developers of the Terra cryptocurrency ecosystem after it collapsed?

Where do the developers of major crypto projects go when they turn to dust in a couple of days? What happened to the Terra ecosystem may answer that question. According to a report by analysts at Electric Capital, more than half of Terra’s development staff, which at the time of the collapse consisted of 323 people, have completely stopped working at any startups within the crypto industry. We recount the events in more detail.

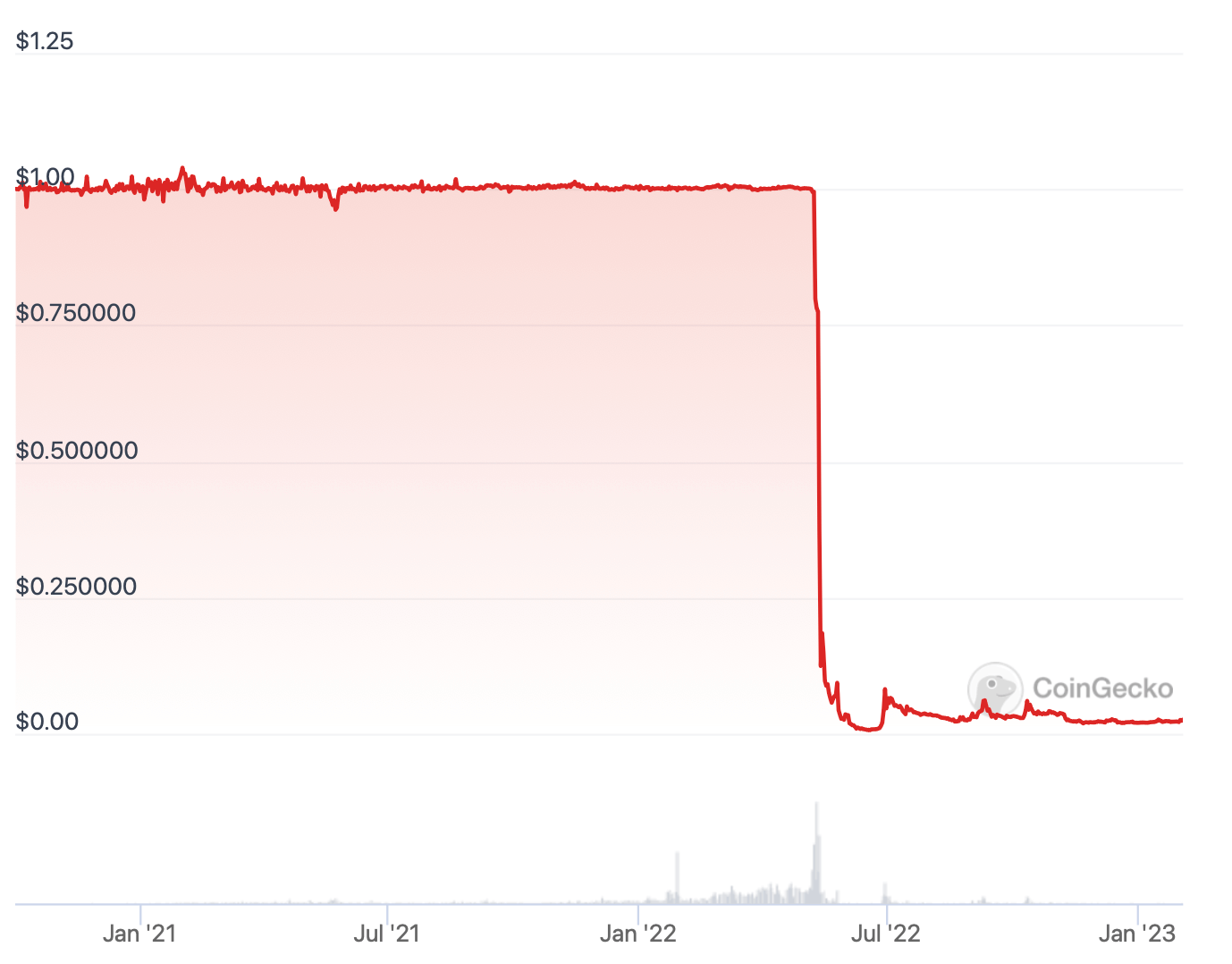

As a reminder, the original Terra project experienced a collapse in May 2022, when the algorithmic stablcoin TerraUSD lost its peg to the US dollar, resulting in a loss of more than $40 billion. By today, 180 developers of the Terra ecosystem have already stopped contributing to any crypto projects.

How cryptocurrencies are losing their jobs

Of those developers who continued to work on their profile after Terra closed, 42 have moved on to other projects in the Cosmos ecosystem. Another five now work in various Solana-based startups.

And 35 people haven’t left at all – they are now developing Terra 2.0, the second version of the Terra ecosystem, the creation of which back in May gave rise to some hopes for a full resumption of project activity. The project’s financial figures, however, hint that such expectations were not realistic.

TerraUSD stabelcoin price plunge

According to Decrypt’s sources, the Terra disaster was a major blow to the decentralised finance industry. The startup was quite popular, well, many investors were using its platform to make permanent DeFi-type transactions.

After Terra’s second blockchain relaunch, teams from other networks began efforts to help second-tier solutions migrate to new blockchains. For example, Cosmos-based startup Juno Network was one of the first to create a grant programme to help Terra projects migrate to their network. TronDAO launched a $10 million fund to attract developers. Another large group of developers also moved to Polygon.

Terra ecosystem creator Do Kwon

All in all, with enough skills, a developer in digital assets is always a sought-after talent. Electric Capital’s statistics also confirm this. According to experts, the number of active programmers in the crypto industry grew by 5 per cent in 2022, even with all the market challenges.

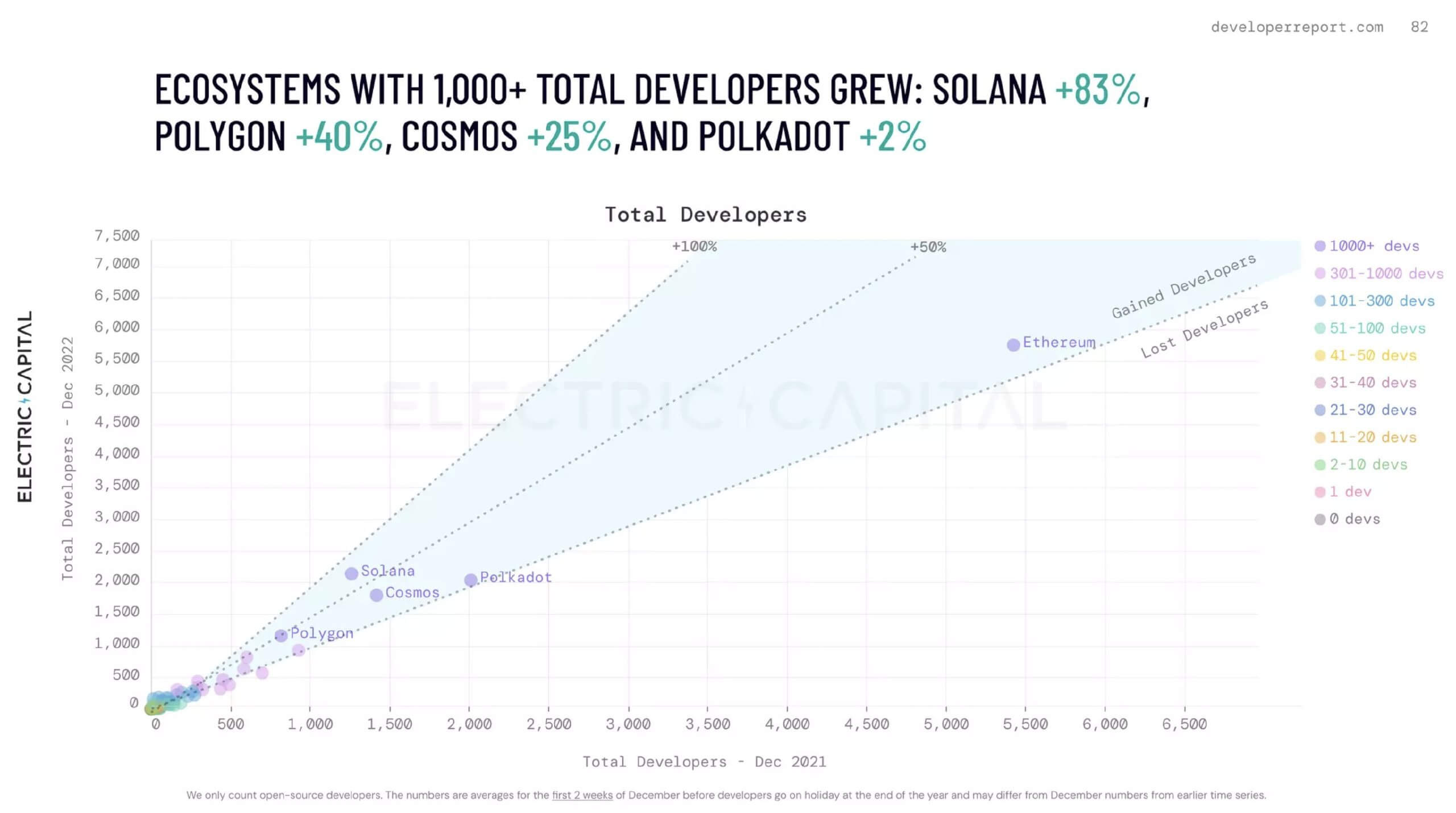

The most popular choice for developers among large projects is Solana. As you can understand from DeveloperReport platform data, it is the one that has become the leader over the last year among projects with at least a thousand developers. The growth rate of Solana’s total number of developers was 83 percent. Second and third places went to Polygon and Cosmos, with growth rates of 40 and 25 percent, respectively.

Changes in the number of developers in large blockchain projects over the past year

😈 YOU CAN FIND MORE INTERESTING THINGS ON US AT YANDEX.DEN!

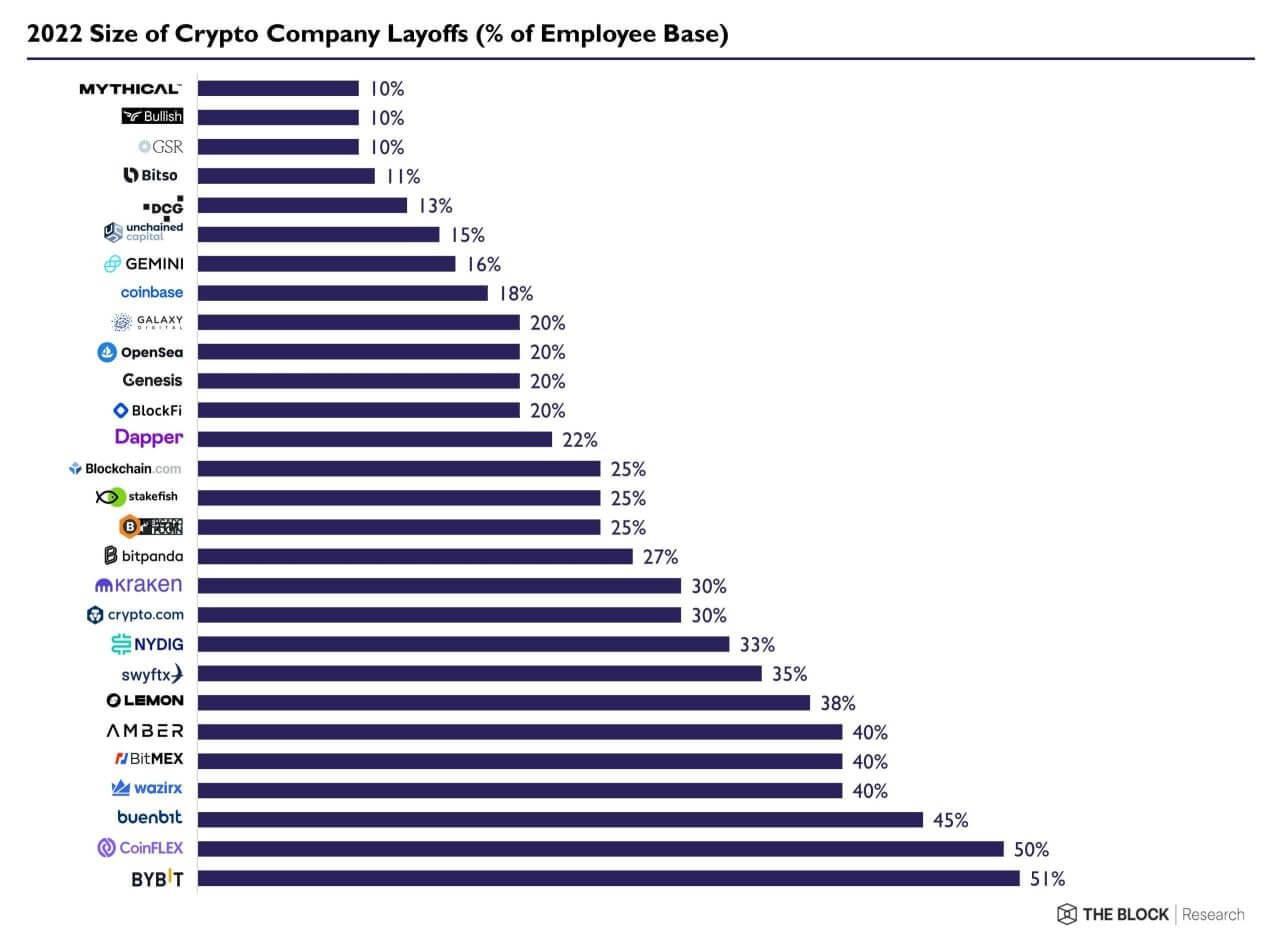

Meanwhile, among centralised companies in the cryptocurrency industry, layoffs continue. For example, cryptocurrency exchange Gemini announced a series of layoffs at the end of January. Their staff will be reduced by 10 percent. And here are the results of layoffs at cryptocurrency companies for 2022.

Share of staff cuts at various cryptocurrency companies in 2022

In 2023, many institutional traders, i.e. market participants with large amounts of capital, are also showing reluctance to get involved with cryptocurrencies. At least that is what a recent JPMorgan survey shows. The survey survey surveyed 835 traders from 60 different regions of the world, and asked respondents about technical changes and macroeconomic factors that will affect trading performance in 2023.

The survey showed traders’ hesitancy to trade digital assets, Cointelegraph reported. Only 14 percent of respondents said they would either continue trading crypto or start doing so this year. Another 14 percent of survey participants said they have no plans to invest in 2023, but may do so within the next five years.

JP Morgan survey data

The vast majority of institutional traders, represented by 92 percent, said they were not holding any digital asset in their investment portfolio at the time of the January 3-23 survey. This could be because almost half of the respondents cited volatility in the crypto market – that is, sharp spikes in the value of digital assets – as the biggest challenge to successful day-to-day operations.

The US Federal Reserve’s monetary policy measures in 2022 also played a role, with 22 percent of respondents citing problems with liquidity availability as the most influential factor hindering successful trading. Overall, 72 per cent reacted sharply negatively to the prospect of dealing in crypto at all for the foreseeable future, which sounds rather odd given the rise in digital asset prices the day before.

The collapse of Terra seems to have had a major impact on this ecosystem, as most developers have left the digital asset niche. However, it was a positive development in any case, as it gets rid of unreliable players and makes the digital asset niche as a whole a better place.