Binance employees helped Chinese users with identity verification. What is known about this?

The largest cryptocurrency exchange, Binance, has paid a lot of attention to the issue of transparency in the industry following the FTX collapse. However, the day before, information was made available to journalists that reveals interesting details regarding alleged fraud within the platform in China. According to CNBC staff, Binance was helping local users bypass customer identity verification (KYC) procedures. We tell you more about what’s going on.

To recap, KYC or “Know Your Customer” is a standard procedure that has come to the cryptocurrency world from traditional finance. It involves the user disclosing their identity, which helps the platform comply with anti-money laundering regulations. That is, keeping track of users’ identities helps prevent them from creating multiple accounts to more actively deal with assets that may have been obtained illegally.

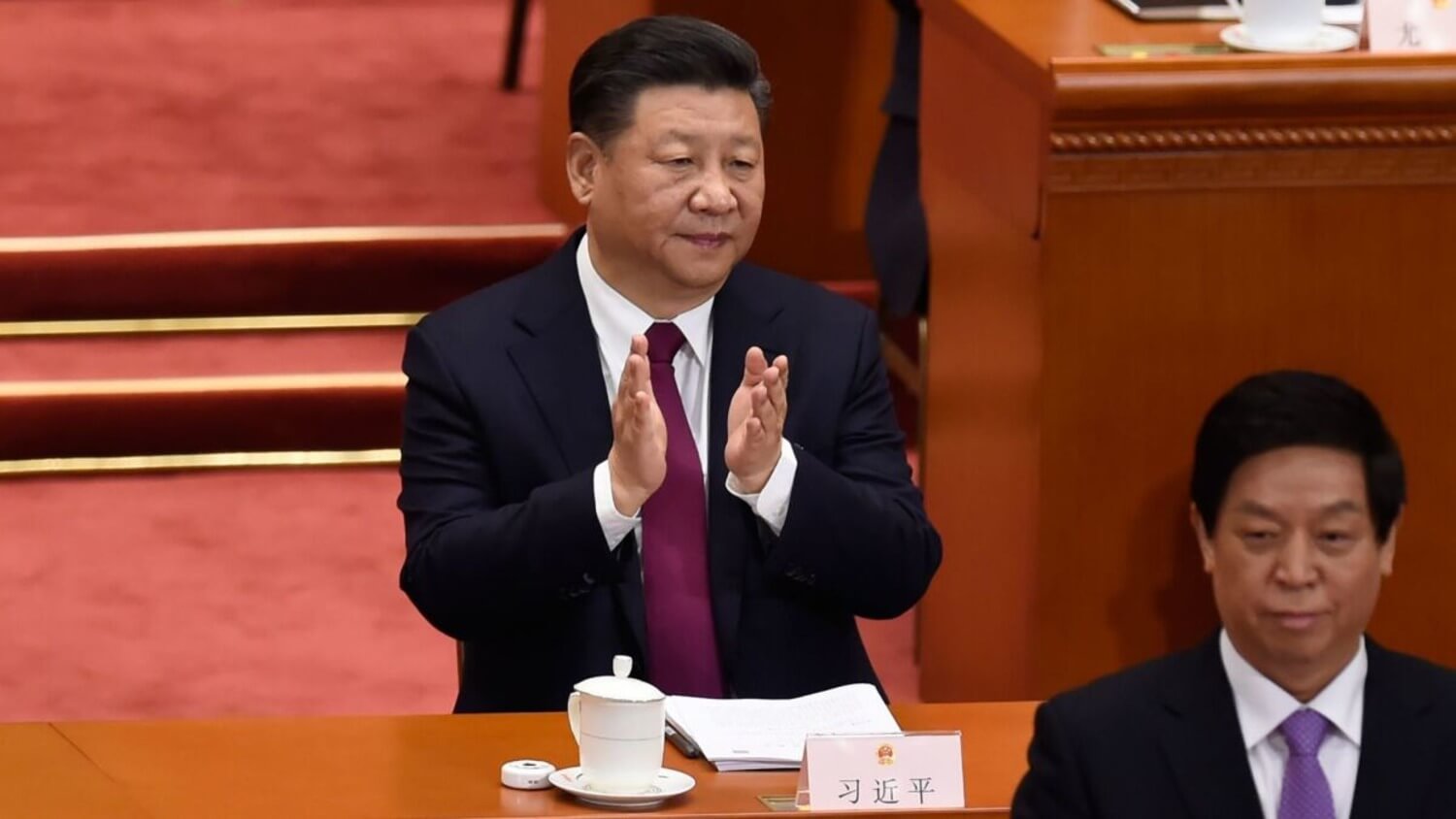

Head of cryptocurrency exchange Binance

Generally, Binance is often criticised because it is somehow the largest player in the cryptocurrency world. However, sometimes the arguments against the platform are flawed. The activity of Forbes journalists at the end of February comes to mind here.

Back then, they claimed that Binance was helping the activities of bankrupt trader Alameda along with Cumberland/DRW. According to the journalists, the equivalent of $1.8 billion was withdrawn from the exchange, which was used to secure the positions of said companies. However, it turned out that the latter had withdrawn their assets from the exchange, while Binance had nothing to do with it.

However, the current claims against the platform were more substantiated, for which Binance representatives had to respond.

What are they criticizing Binance crypto-exchange for

Journalists point to Binance’s official Chinese-language chat rooms, which have more than 220,000 registered users. Their users have allegedly gained access to messages with methods to circumvent KYC protocols. This information is allegedly distributed from the accounts of Binance employees and representatives.

Among the methods described were forging bank documents, confirming false addresses and other simple manipulation of the system. A Binance spokesperson commented on the allegations against the exchange.

We have taken action against employees who may have violated our internal policies, including inappropriately asking for or giving advice that is not permitted or does not meet our standards.

It is clear here that the individuals at fault for this particular situation were the individual representatives of the exchange, not its management or the platform as a whole. And this is logical, because such actions can cost a trading platform its reputation, the loss of which is certainly not worth a little income or any other benefits.

As a reminder, problems due to Binance employees have arisen before. In particular, in 2021 an anonymous trader bought coins just before they were listed on this exchange. And because such news is positive and almost always leads to a short-term rise in the value of the asset, the trader made money rather quickly. However, this method of trading is not allowed, because insider trading is illegal.

Message in Chinese chat

After the publication of this news in Cointelegraph, the publication was indeed contacted by a representative of the exchange. He stated that Binance will launch an internal investigation regarding alleged incidents with Chinese users. In other words, a leak regarding KYC circumvention instructions did take place.

As a reminder, China itself continues to have strict measures in place to ban digital assets. In 2021, Bitcoin mining was completely banned in the country, although some miners are still operating there. In addition, trading and interaction with cryptocurrencies in general will become completely legal for Hong Kong residents in the summer of 2023.

???? YOU CAN FIND MORE INTERESTING THINGS FROM US AT YANDEX.ZEN!

Binance CEO Changpen Zhao has so far refrained from commenting on the incident. He is usually quick enough to highlight his stance on important developments on his Twitter account. Here we can assume that Zhao’s attention is occupied by other issues.

Indeed, on Friday, the exchange suspended deposits and withdrawals for several hours due to a problem with the display of charts in spot trading, in addition, trading on spot markets was completely suspended. After technical works, Binance resumed operations of all exchange components.

Binance tweet about trading suspension

We believe that the current situation should not affect the reputation of the industry's largest cryptocurrency exchange. Obviously, in this case, the culprit of what was happening was certain employees of the company who wanted to take advantage of what was happening. After an internal investigation, they will surely be fired, which will be reported by Binance representatives.