Analyst explained the reason for the lack of sharp growth of altcoins. What is happening to the cryptocurrency market?

The best period for making relatively easy money from crypto is the so-called altcoin season, when most digital assets show rapid growth over a short period of time as the focus on Bitcoin diminishes. And while the current bullrun tentatively began almost a year ago, this period has yet to occur. According to trader and analyst James Cheek, the reason lies in the behaviour of new market participants. They rush to buy the most speculative assets too early, and the periods of active growth of the latter cannot last forever.

Now some experts are betting on the activation of the crypto market growth in the near future. The main reason for this should be the improvement of the situation in the economy due to the reduction of the base interest rate by the leadership of the U.S. Federal Reserve System.

The long-awaited reduction for the first time in 2.5 years will take place on 18 September at the next FOMC meeting. Thanks to this, capital loans will become more affordable, which will encourage more frequent purchases of various assets – including cryptocurrencies.

US Federal Reserve Chairman Jerome Powell

The industry will also be well affected by the possible victory of Donald Trump in the US presidential election. He has been supporting cryptonisha since the spring of 2024 and promises to fix the situation of the coin sphere. So this variant of the development of events is also worth counting on.

When will altcoins grow?

The analyst compared the current behaviour of traders with their actions during the previous bullrun, which peaked in 2021. Unlike the previous cycle, now more and more traders are trying to “outsmart” the market, immediately moving to buying the most popular meme tokens.

The Dogwifhat meme token is one of the big hits of this bullrun

This, in turn, leads to a sharp rise in the value of such assets, profits for investors and their realisation. Well, mass sales of digital assets prevent the coin industry from following the usual scenario of its development, as it happened before.

In general, during the last stage of market growth, memes like Dogecoin and Shiba Inu usually took off towards the end of the rally. This time around, however, assets in this asset class are growing faster than ever before. Here’s a comment from experts on the matter, as quoted by Cointelegraph.

In 2021, we had the “everything bubble” where there was such a beautiful waterfall of capital in Bitcoin, Efirium, altcoins, tokens from decentralised finance and even NFTs with monkeys.

What the expert means is that during the previous bullrun, capital flowed smoothly from assets with larger market capitalisation to more speculative tokens with lower capitalisation. Thus, the growth cycle of the industry was quite logical and long. Now money is actively flowing into memes, which makes the collapses and crashes of the coin sphere much more frequent.

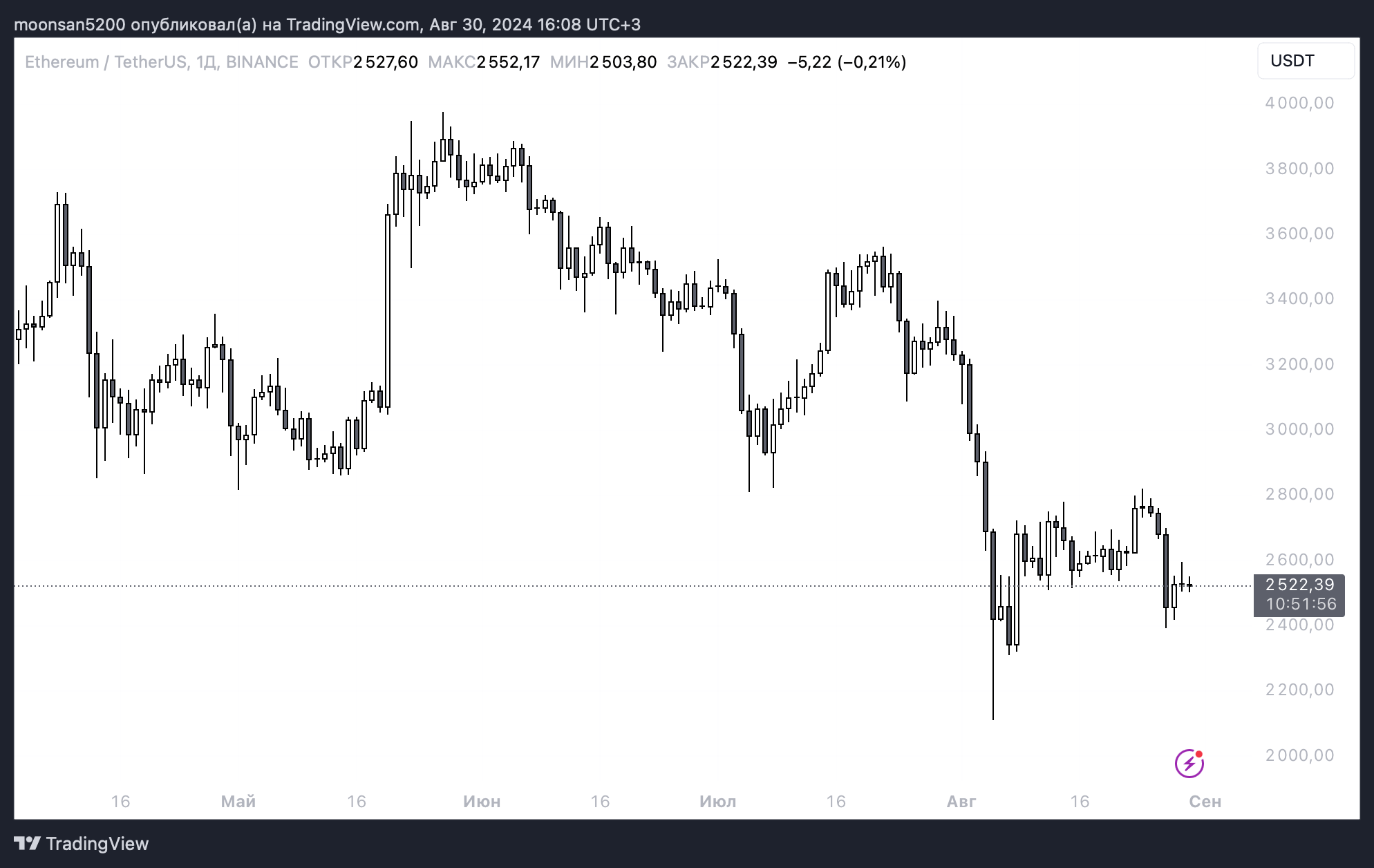

ETH rate

Over a couple of years, market players have become much smarter – already now they know the “punchline of the whole joke”. According to the expert, now it is enough to buy the most stupid coin from a fundamental point of view, so that it will bring the trader Xs.

Along with this, Cheek argues that the approval of spot Bitcoin-ETFs in the US on 11 January 2024 has actually benefited meme tokens rather than the main cryptocurrency.

A prime example of this is the meteoric rise of a joke crypto asset called PEPE. On 15 May, one trader made a profit of $46 million from the token, which is 15,718 times his initial investment of $3,000 made just a month ago.

It is important to realise that such a case is one in a million, and there is probably no point in expecting to repeat it with another asset. In addition, it should be remembered that in this case the investor's earnings were caused by other people's losses.

Growth of PEPE meme-token value

A new trend in bullrun formation makes it difficult to predict. Memes have now become an important part of the market and that is unlikely to change in any way in the near future.

Another fact is that comparing the duration and profitability of the current trend to previous ones is becoming less and less useful. Firstly, because of memes, investors are becoming less patient, because some of them initially count on short trades.

Secondly, such crypto-assets due to the hype around them give out a larger growth than can be predicted. Of course, as a result, there are often strong falls, but there is still an opportunity to earn money.

Growth of the digital asset market

Buying BTC for the long term is always a winning strategy. Unfortunately, not all organisations are willing to make such investments.

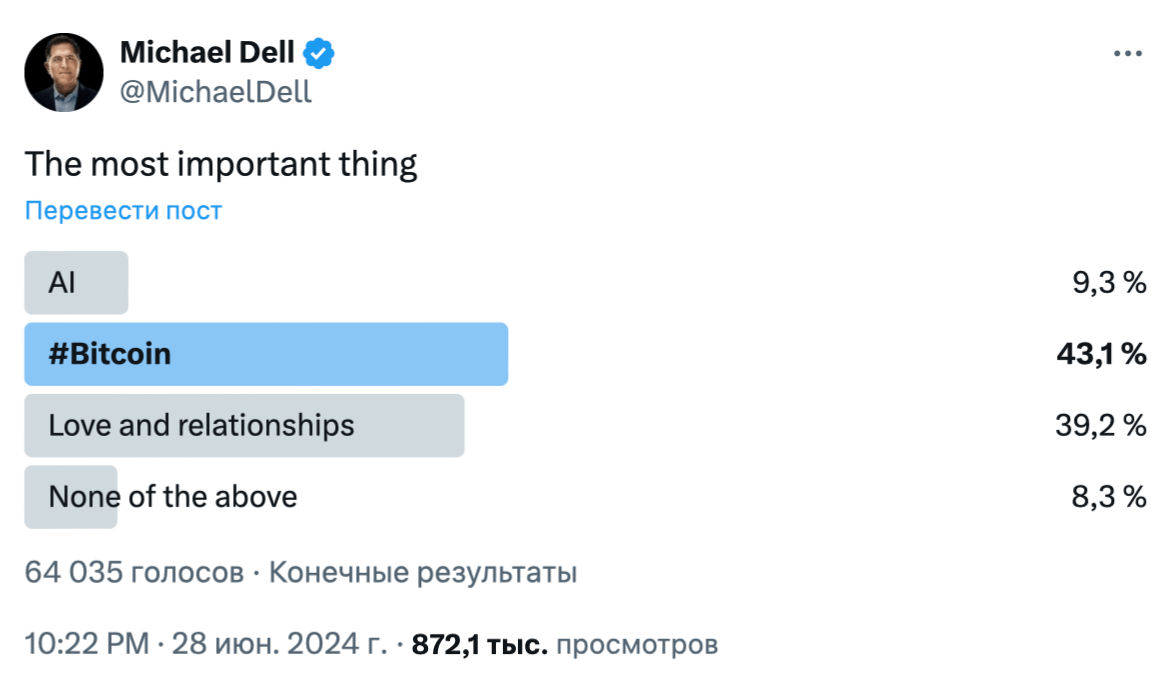

For example, the publication of its Q2 2024 financial statements showed that Dell did not purchase bitcoins for its balance sheet. That said, back in late June, its CEO Michael Dell posted a cryptic tweet.

Scarcity creates value.

Fans of digital assets saw here a hint of Bitcoin, whose maximum supply is limited to 21 million coins. On top of that, their rate of issuance falls by 50 per cent roughly every four years during so-called halving. And although more than 94 per cent of the first cryptocurrency's maximum supply is now in circulation, the last whole coin will not be mined until closer to 2140.

There was a lot of speculation among commentators that the company might buy some bitcoins after Dell’s public remarks. On top of that, the executive later only added fuel to the fire.

First, he reposted a tweet by MicroStrategy executive chairman Michael Saylor and then posted a picture of a biscuit monster eating Bitcoin.

A poll on Michael Dell’s page mentions Bitcoin

However, there is no indication in Dell’s filings that the company bought BTC or other cryptocurrencies, meaning expectations were not met.

The company’s total revenue was $25 billion, up 9 per cent from last year. Meanwhile, record revenue from servers and networking solutions was $7.7 billion – this figure is 80 per cent ahead of the previous year.

Apparently, in the current bullrun, investors are trying to cheat the system and are immediately getting involved with the most hype category of crypto assets. By doing so, they are essentially breaking the traditional growth structure of the coin market and accelerating the cycles of local growth and decline. Therefore, coin lovers should clearly take this feature into account when choosing a crypto to buy.