Demand for Bitcoin-ETFs grew in the second quarter of 2024. Coinbase experts called the trend “promising”

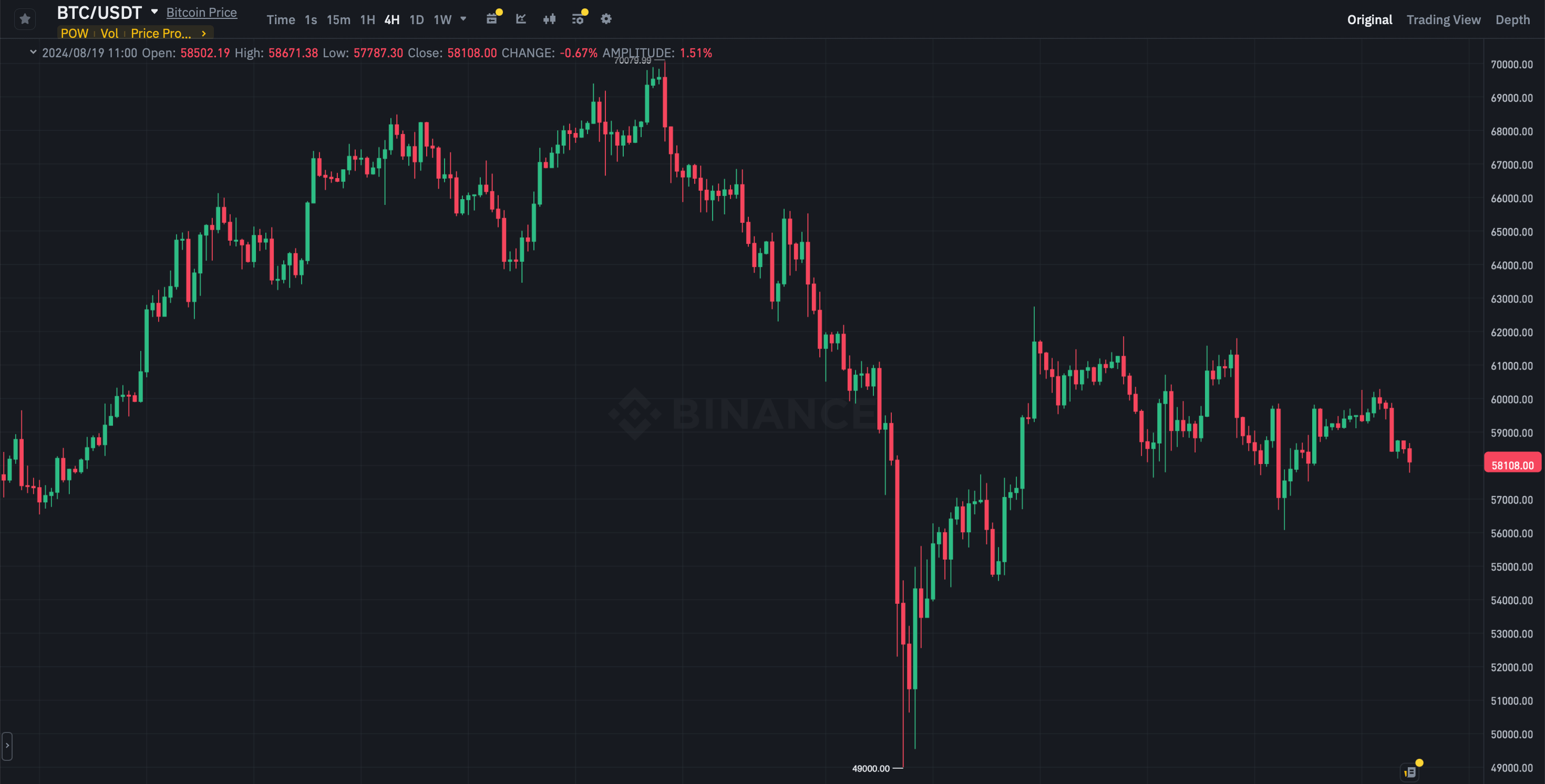

Bitcoin-based spot exchange traded funds (ETFs) released their quarterly Form 13F filings last week. Given the results, Coinbase analysts believe that the ETFs performed well even in the crisis situation for the entire crypto market, which was observed in the first days of August. In particular, experts noted serious inflows of funds from institutional investors. And this confirms the demand for digital assets among major players.

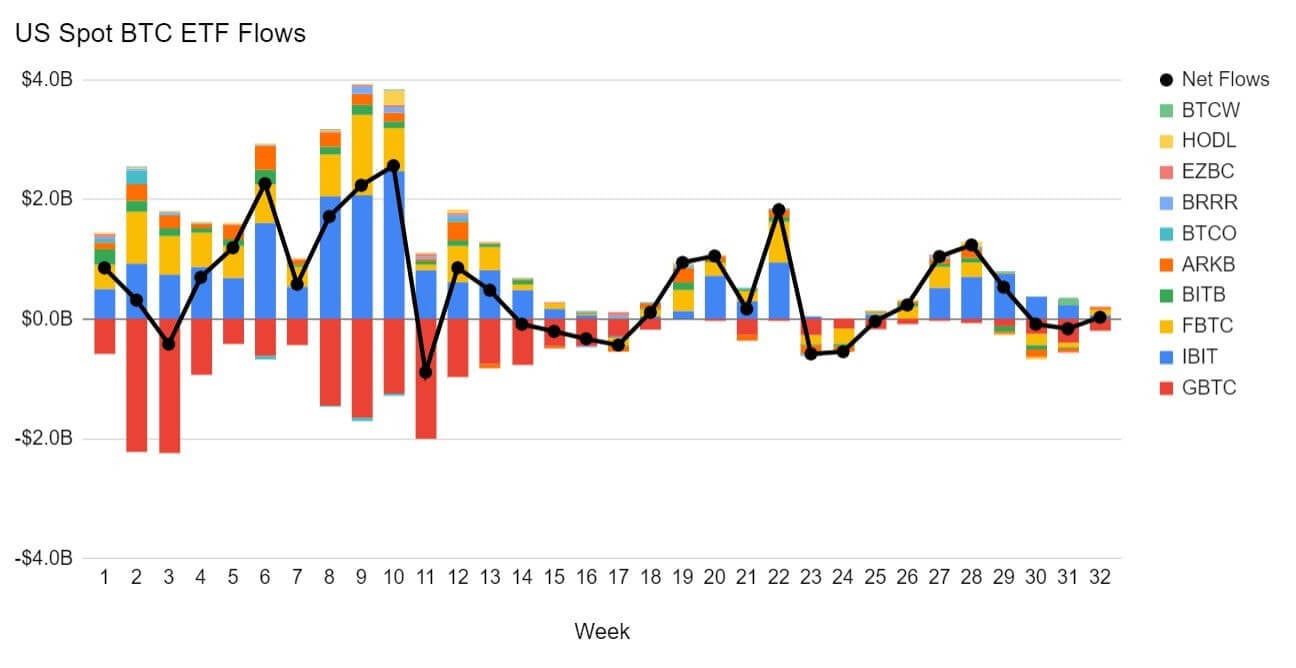

Spot Bitcoin-ETFs in the U.S. continue to attract capital, despite the general uncertainty in the coin market and the global economy. In particular, last week ended with a net inflow of $32.4 million for such instruments.

Influx into spot Bitcoin-ETFs in the US by week

The popularity of exchange-traded funds, among other things, affects the overall market situation. For example, Bitwise platform analyst Ryan Rasmussen previously said that the collapse of the coin industry at the beginning of the month could have been much more widespread.

That said, purchases of exchange-traded shares and corresponding buying pressure have essentially cushioned the collapse.

Who’s buying Bitcoin-ETFs?

Analysts David Duong and David Han commented on the results of their research. Here’s the relevant quote, as cited by The Block.

We believe that continued inflows into Bitcoin-ETFs during the main cryptocurrency’s decline may be a promising indicator of sustained interest in the asset class from new pools of capital accessed by exchange-traded funds.

A four-hour chart of the Bitcoin (BTC) exchange rate on the Binance exchange

Bitcoin-based spot ETFs began trading on the stock exchange on 11 January 2024. Their launch was one of the most successful in the history of this category of investment instruments, with BlackRock’s iShares Bitcoin Trust proving to be the fastest-growing ETF in general.

In general, crypto has long been of interest to large investors, and now they can make money on the Bitcoin exchange rate without having to purchase the coins themselves. In this case, professional custodians are responsible for safeguarding the digital assets at the heart of spot exchange traded funds.

The most popular among them is the largest American crypto exchange Coinbase. However, the investment fund Valkyrie in early February decided to diversify the number of such companies. As a result, a popular platform called BitGo also joined the list of custodians.

Coinbase cryptocurrency exchange chief Brian Armstrong

Form 13F reports are filed only by companies with more than $100 million in assets under management, and this minimum threshold allows us to gauge the level of enthusiasm of the largest players for the coin industry.

According to experts, ETFs attracted noticeably more attention in the second quarter of 2024 than in the previous similar period. Here’s a commentary on the matter.

Share ownership of cryptocurrency ETF companies rose from 21.4 per cent to 24 per cent.

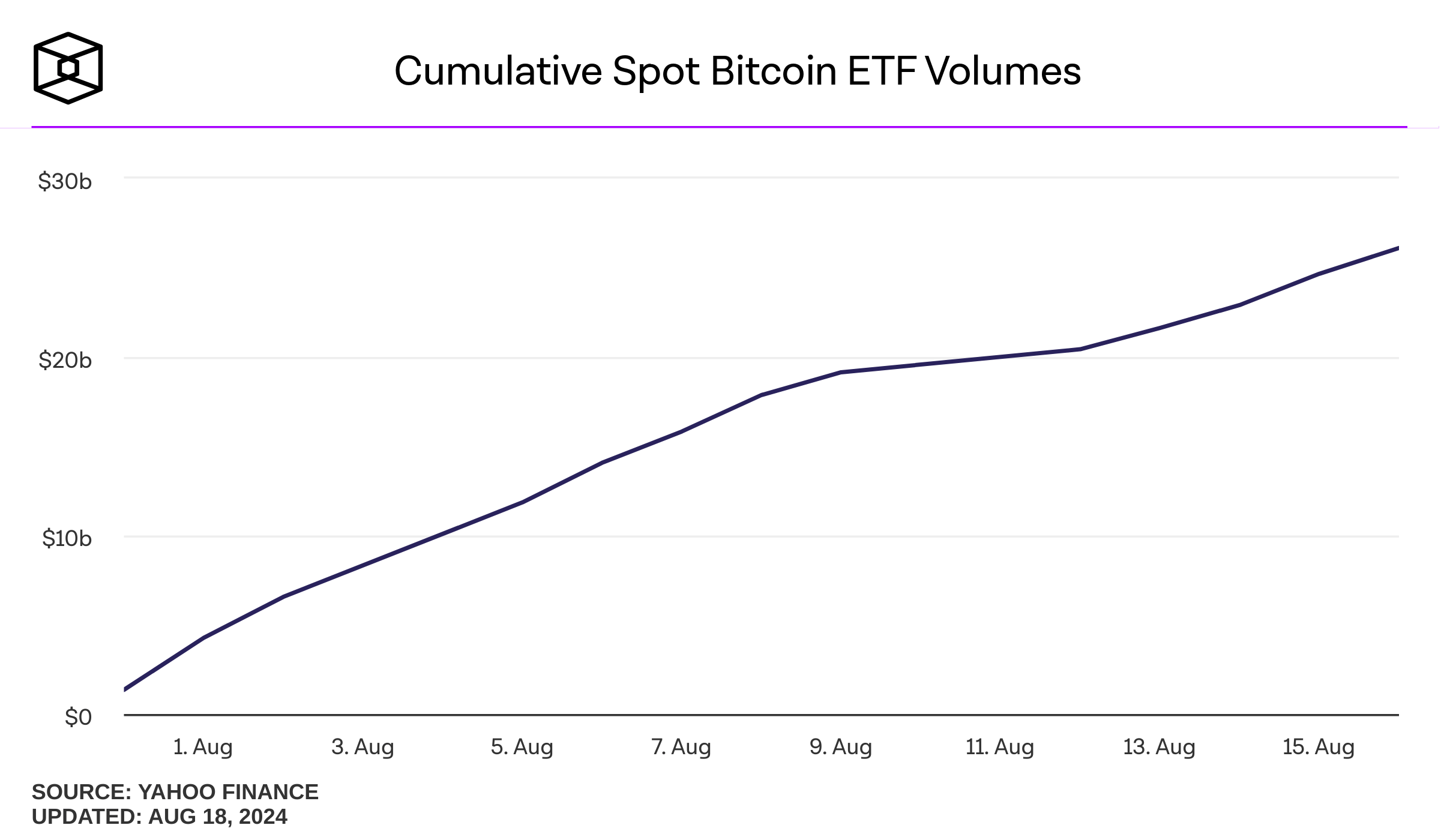

Cumulative trading volume of spot Bitcoin ETFs in the US

The report also highlighted increased inflows from institutional investors in the “investment adviser” category.

These advisors manage significant amounts of capital, often making decisions about asset allocation, investment strategies and specific securities purchases on behalf of their clients. Here’s another quote.

The percentage of institutional holders categorised as “investment advisers” increased from 29.8 per cent to 36.6 per cent.

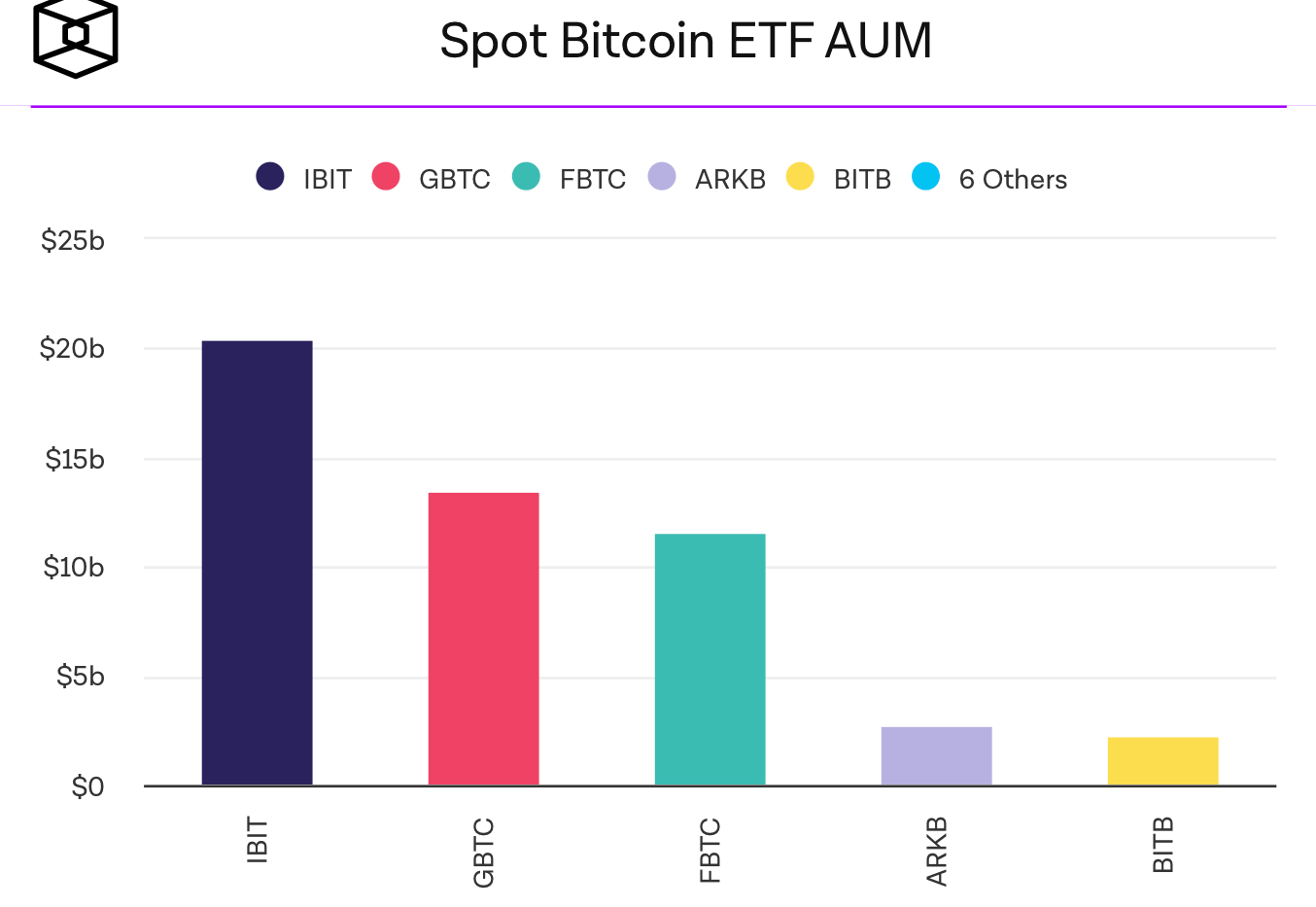

The amount of funds under management of different Bitcoin-ETFs

Last quarter, Goldman Sachs and Morgan Stanley were added to the list of notable holders of Bitcoin-based investment vehicles.

Goldman Sachs holds shares of the US spot Bitcoin-ETF worth about $418 million as of 30 June, while Morgan Stanley’s figure was $190 million. BlackRock’s iShares Bitcoin Trust (IBIT) iShares Bitcoin Trust (IBIT) accounts for the majority of that $187.8 million.

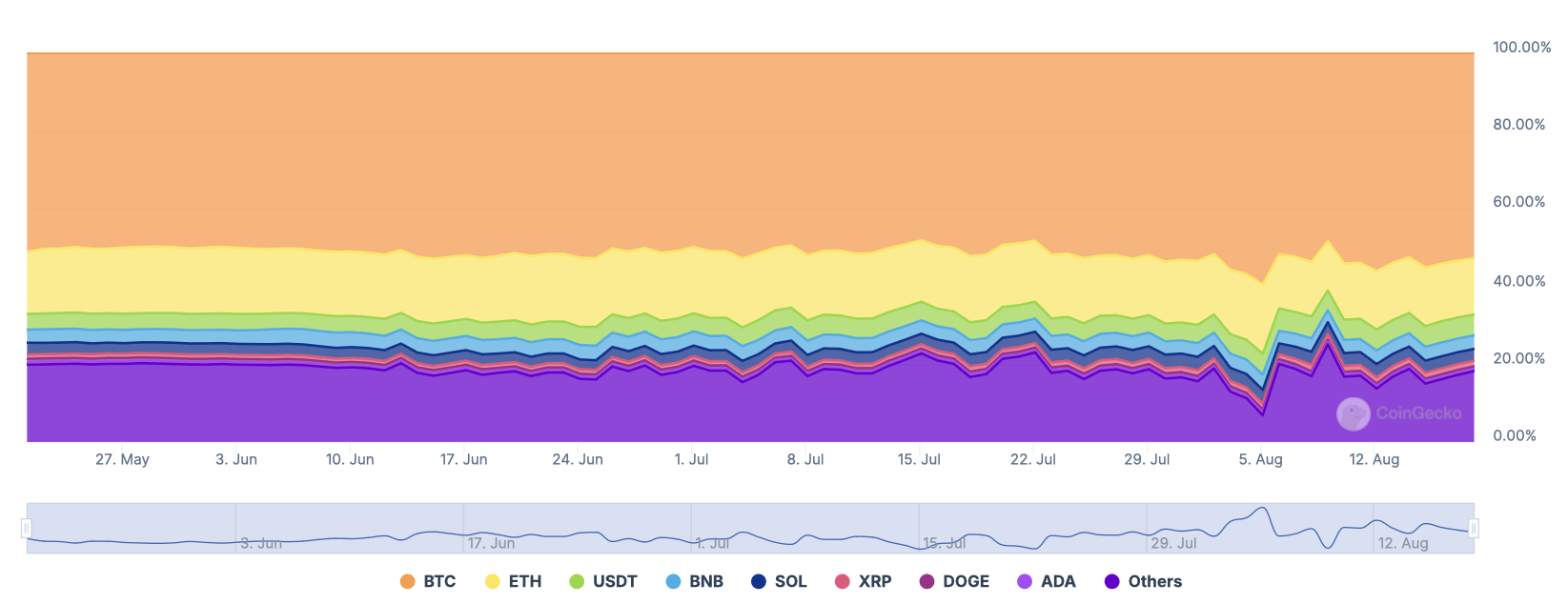

The crypto market is constantly changing and will no longer be the same as it was during the previous bull cycle. In particular, this concerns the Bitcoin dominance index – the share of the main cryptocurrency in the total market capitalisation.

According to Into the Cryptoverse founder Benjamin Cowan, the BTC dominance index is unlikely to return to its maximum values. His remarks are cited by Cointelegraph.

I don’t think it will return to the 70 per cent level, my target for bitcoin dominance is 60 per cent.

Such a scenario suggests additional growth opportunities for altcoins. Particularly popular in this category in 2024 are meme tokens, which can create a hype in the niche and attract serious investments, leading to a sharp growth. However, this version remains only an expert's point of view, which means that it may not become reality.

The share of the most popular cryptocurrencies in the crypto market capitalisation

Cowan explained that during altcoin seasons – that is, stages of sharp growth in the value of such assets along the lines of the events of 2021 – the Bitcoin dominance index tended to decline, but then “slowly” returned to its previous level after the breakdown.

However, in this cycle, circumstances are different: even when Bitcoin reaches its peak of dominance, it will not be able to approach previous highs.

I think there is a market share for Etherium and many other cryptocurrencies.

In the crypto industry, the best times to invest in altcoins are during periods of Bitcoin's collapse in dominance. Such things happen during the influx of capital into such crypto-assets. And since their capitalisation is much lower than BTC, investments usually end up with a much larger growth.

According to the analyst’s prediction, Bitcoin will “take the final step” towards 60 per cent in terms of the index as early as September or late December. For now, though, the prospects for investing in altcoins look dim.

Their value has fallen by tens of per cent after the large-scale correction of BTC in August, and there are no clear signs of a trend reversal at least yet.

Changes in the market capitalisation of the cryptocurrency industry in 2024

The popularity of spot cryptocurrency ETFs is indeed a good sign. Still, it speaks to the improving reputation of digital assets in the eyes of investors of varying capital. And the longer this continues, the more people will follow suit and also get involved with coins.