Etherium collapsed more than 20 per cent after new ETFs listed in the US. What is hindering the cryptocurrency’s growth?

On 23 July 2024, US spot exchange-traded funds based on Efirium began trading. The event was a long-awaited one for the crypto market – and especially considering the protracted approval procedure for these instruments. However, the Securities and Exchange Commission (SEC) approved the emergence of the Efirium-ETF in late May after the deadline for reviewing applications from potential issuers. However, it is difficult to call the launch of the ETF a success so far, and ETH itself has lost a fifth of its price.

The situation for spot ETFs on Efirium in the U.S. continues to be tense. On Monday, such instruments recorded a net capital outflow of $13.5 million.

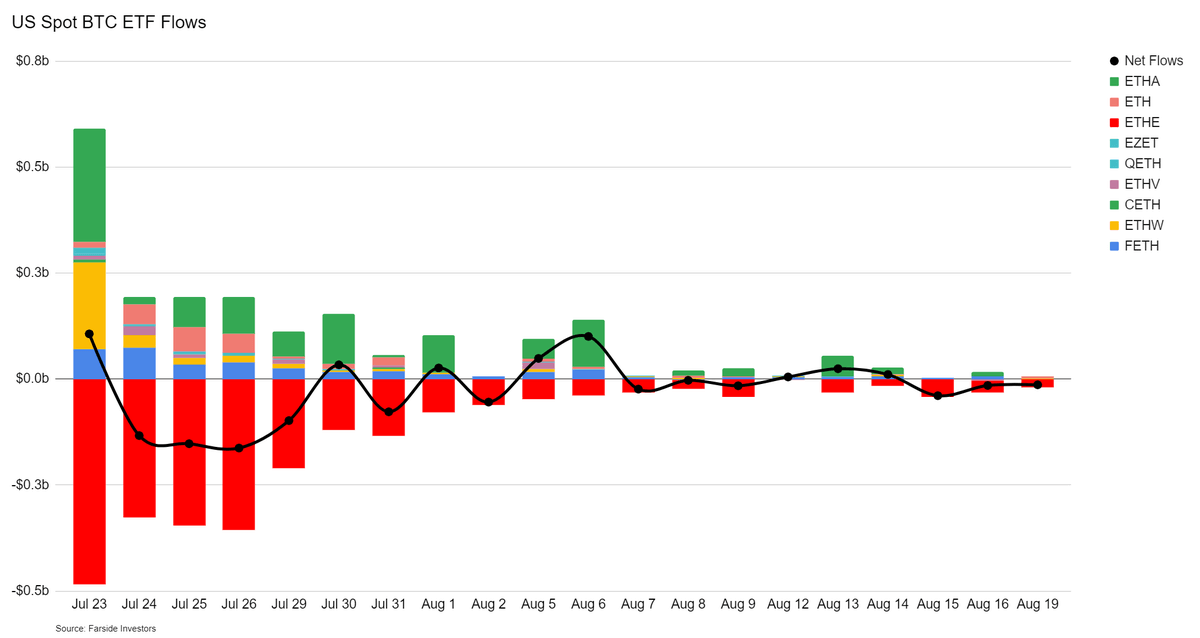

Capital inflows and outflows from spot Efirium ETFs in the US

In general, ETH-based exchange-traded funds have clearly not generated enough attention from investors in recent days.

Why is the Efirium exchange rate falling?

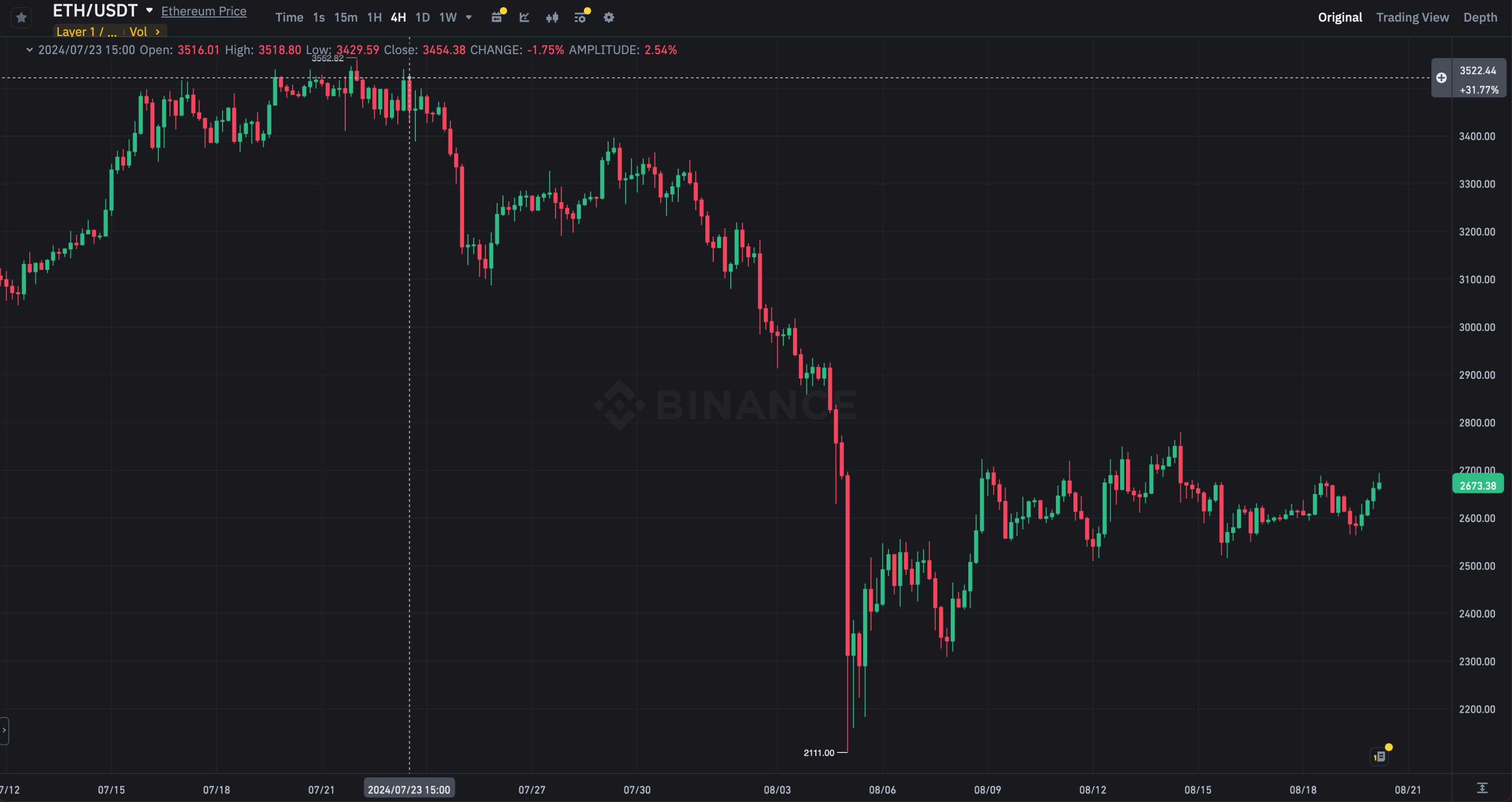

Since the start of trading as of this morning, the value of ETH has sagged by 22 per cent. On top of that, there is an increase in the available supply of coins and a significant impact of an update called Dencun on what is happening on the cryptocurrency network.

The scale of the ETH rate collapse can be appreciated in the four-hour chart below. The start of ETF trading, the moment of which is marked on the chart, only intensified the altcoin’s fall.

Four-hour chart of the ETH Etherium exchange rate

In part, it was just the new investment instruments that led to this correction. Still, as of today, they are recording a net capital outflow of the equivalent of $434 million. This means that the volume of capital withdrawal exceeded the inflow of funds by this amount.

A significant portion of this figure is due to withdrawals from Grayscale’s ETHE exchange-traded fund.

As we have already mentioned, before its conversion into an exchange-traded fund, this instrument existed in the form of a trust, whose shares could not be sold for a certain period of time after their purchase. Converting to an ETF eliminated this lock-up period, and as a result, everyone was able to get rid of their shares.

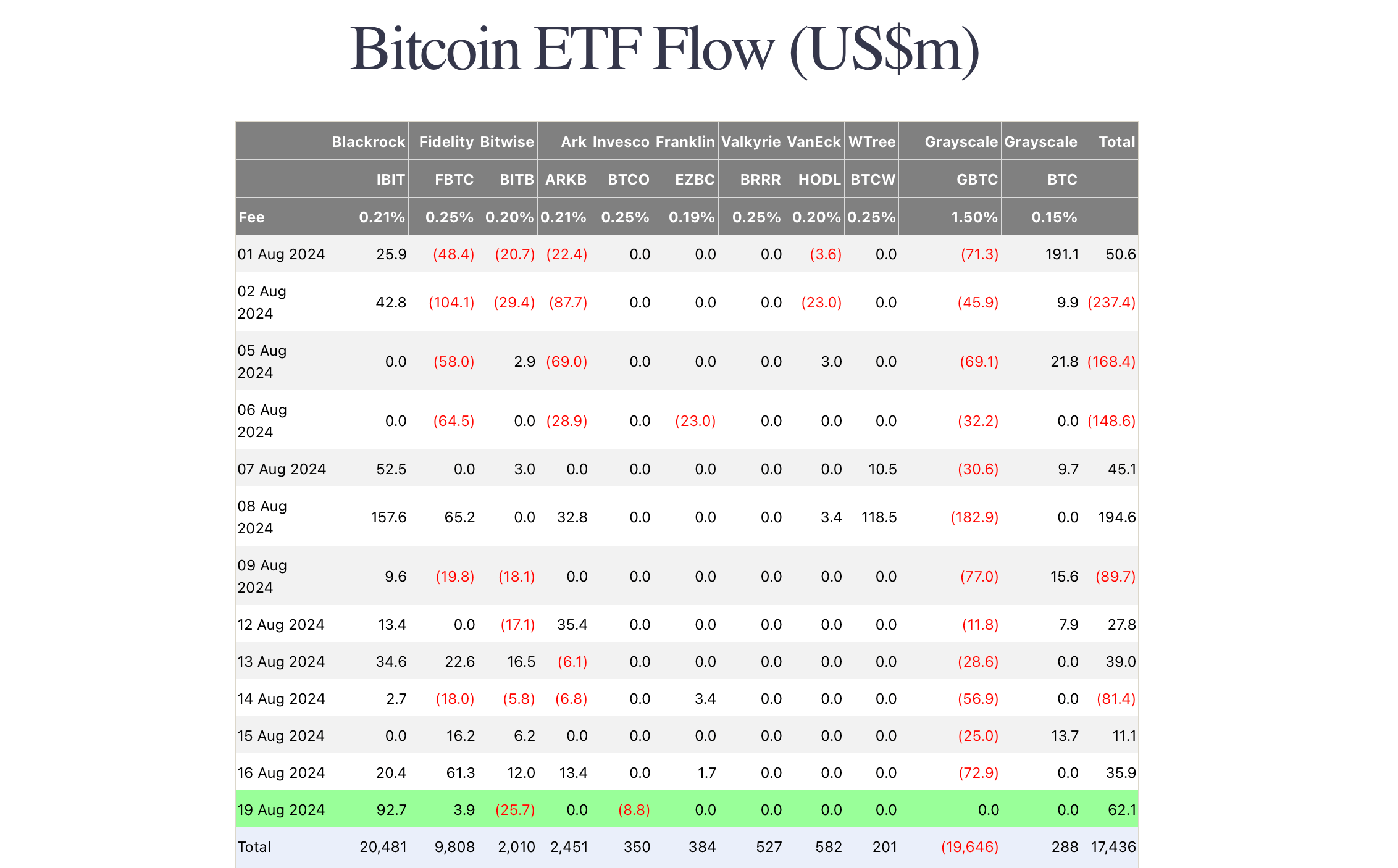

A similar situation was observed with the Bitcoin-based instrument from Grayscale, which happened due to the peculiarities of converting the GBTC Bitcoin Trust into an exchange-traded fund. Before the conversion, GBTC shares were traded at a discount to the BTC price on the spot, but the procedure completely levelled out this difference, allowing the holders of the shares to lock in an instant profit.

This is why GBTC has predominantly recorded outflows since the spot Bitcoin-ETF began trading in the US on 11 January 2024. As of today, the total amount of capital withdrawals from this product stands at $19.6 billion.

The result of spot Bitcoin-ETF trading in the US as of today

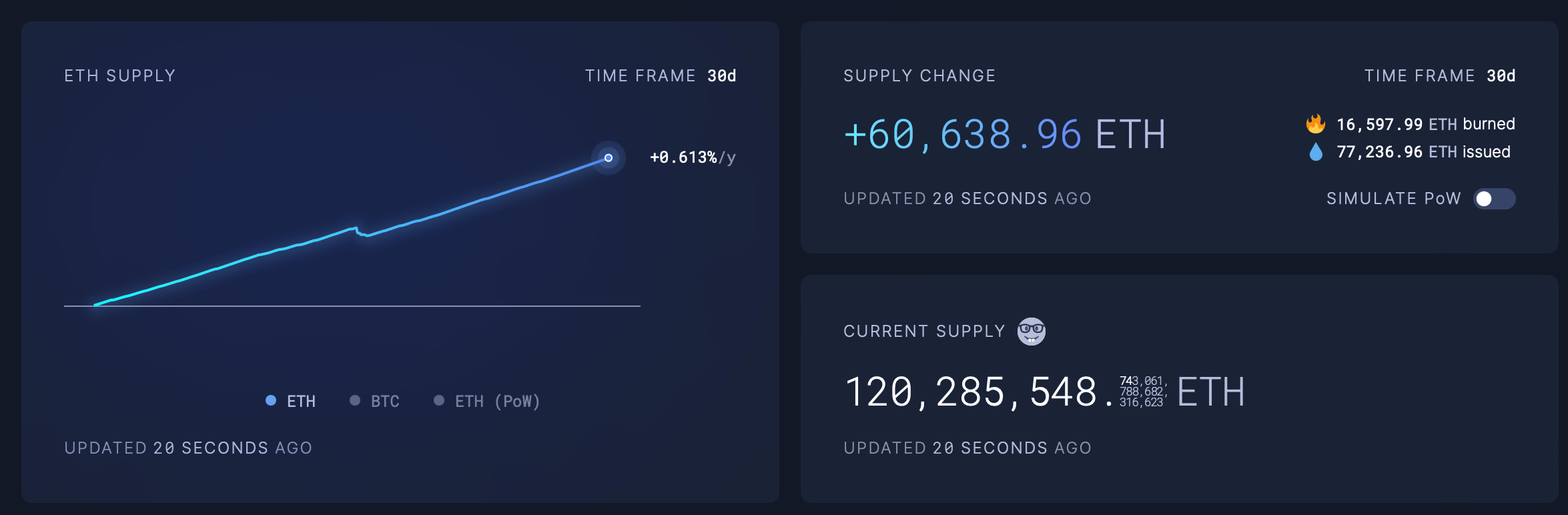

Another factor that influenced the correction is the increase in the total supply of Efirium. Since the ETF’s launch date, it has grown by more than 60,600 ETH. At the altcoin’s exchange rate, this is equivalent to $155 million.

The increase in the supply of ethers is due to low user activity on Eth networks. Because of this, transaction fees in this blockchain have fallen to their local minimum in the zone of 1 gwei per unit of gas. This has a direct impact on the amount of the burned part of the commissions, which leads to the inflation of the digital asset.

When the activity of users in the network is high, the commissions grow, and the number of cryptocurrency destroyed increases noticeably. Moreover, it often overlaps the volume of new coins issued as a reward for validators for each block. As a result, cryptocurrency can become deflationary.

The burn rate of the cryptocurrency Etherium ETH

Thus the growth rate of the total supply of Etherium over the past 30 days was 0.61 per cent annually. At the same time, the annual issue volume was 940 thousand ETH, and the number of burned coins reached 203 thousand ETH.

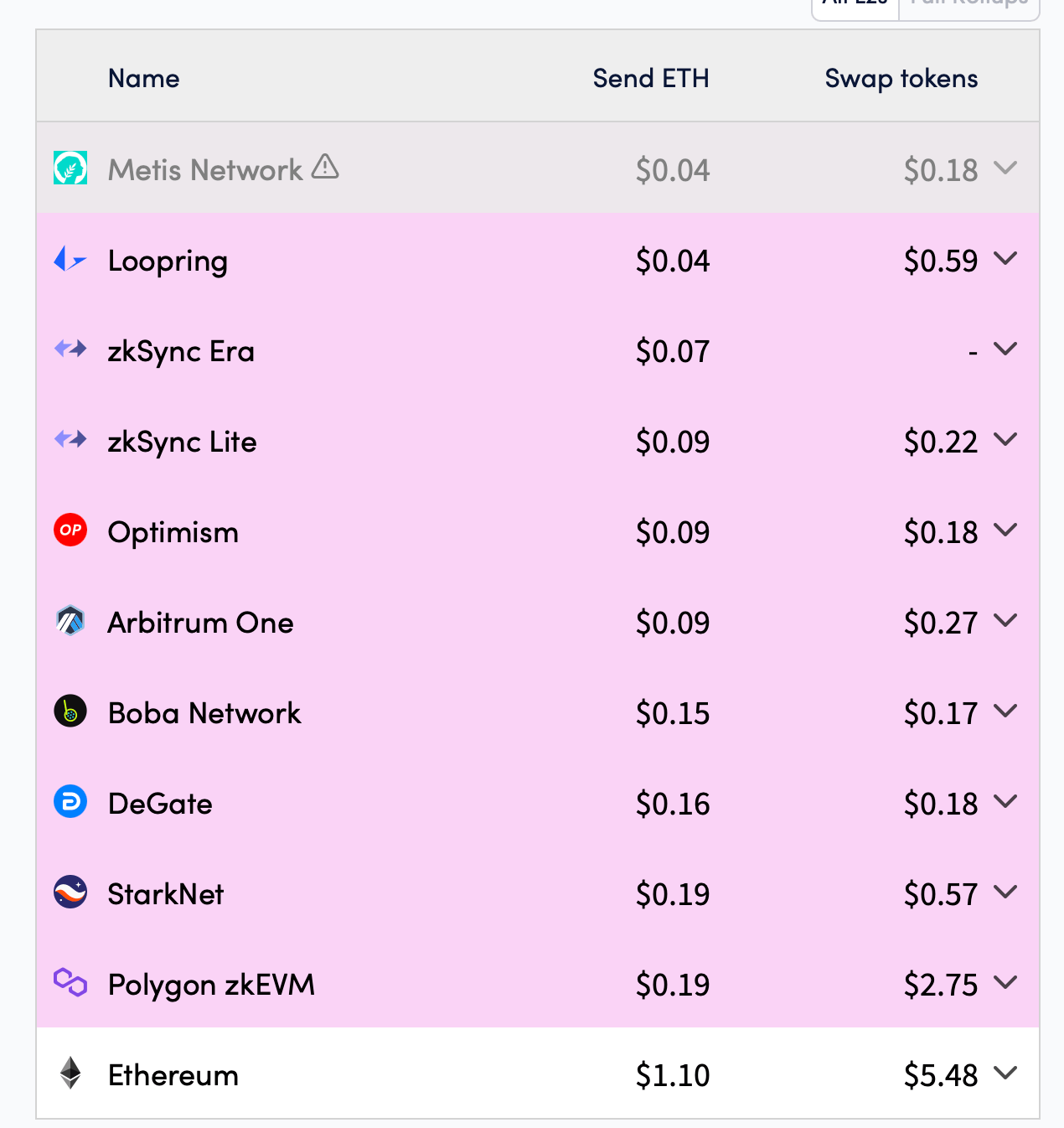

On 13 March 2024, the Dencun update was activated on the Etherium network, which significantly reduced transaction fees on Layer 2 networks. CryptoQuant analysts have noted a trend – since the launch of Dencun, the rate of this cryptocurrency cannot overcome the main resistance levels on the chart.

Here is a quote on the matter, which is cited by Cointelegraph.

Despite the ETF approval, the price of ETH has been in a downtrend since the Dencun update. In that timeframe, the altcoin’s supply has increased by more than 197,000 ETH, while its price has fallen by 35 per cent.

Commissions in the networks of L2 projects based on Efirium

The aforementioned factors are not taken into account in the market movement forecast from Aurélie Barter, an analyst at the Nansen platform. According to her, outflows from ETFs and other technicalities of the altcoin ecosystem have little impact on the overall situation.

BTC is down 14 per cent since July 23. I believe that risk appetite among market players has declined markedly, and this is not due to the launch of ETFs.

The cryptocurrency industry faced quite a few problems over the summer, which affected investor sentiment and the general atmosphere in the crypto industry. For example, one can recall the German government's sales of bitcoins and the distribution of crypto to former clients of the bankrupt trading platform Mt.Gox, whose collapse took place a decade ago. We can also recall the problems in the global economy, panic on stock exchanges, geopolitical tensions and other similar factors that contributed to the market collapses the day before.

One of the former users of the Mt.Gox crypto exchange at a protest after the platform was hacked

The crypto market is still recovering from the August 5 correction, which reduced the industry’s total capitalisation by more than $510 billion. Yet the collapse was caused by a wider range of factors, experts say. Here’s the cue.

We know that the first correction in March led to realised losses – especially among traders exposed to many popular narratives. Then there was a second collapse in July and August, which has a correlation with traditional assets. All of this occurred against a backdrop of problems with a slowing economy and overheated markets.

Cryptocurrency market crash

Barter added that the length of time crypto asset prices fall will further depend on the actions of the US Federal Reserve. If the Fed manages to reduce the rate relatively quickly and maintain economic growth, the situation in crypto will stabilise, which will primarily affect the coin rates.

Apparently, the moment of listing of spot Efirium-ETFs in the U.S. was not the most successful. At that time, the market was actively pressured by the distribution of bitcoins from the bankrupt Mt.Gox exchange, in addition, the expectations of experts from the global economy were not the best. However, with the long-awaited lowering of the base interest rate by representatives of the US Federal Reserve System, investor sentiment will surely improve.