Researchers have determined that cryptocurrency investors often experience mental health problems. Why?

“Dark personality traits” on a spectrum from narcissism to psychopathy are most common in people who own cryptocurrencies. This is the subject of a recent study by scientists from the University of Toronto and the University of Miami. The study surveyed 1,001 American adults to examine the relationship between crypto ownership and various political, psychological and social characteristics. The sample included 900 men and 1,101 women, with an average age of 48.

Cryptocurrencies do involve stress. This is primarily due to the fact that coin trading takes place around the clock, rather than at a specific time interval, which is relevant for stock exchanges. Because of this, traders can conduct trades all the time – as well as catch liquidations or something similar.

In addition, problems can arise when digital assets are stored independently outside of centralised platforms, where the user is responsible for their security.

Ledger Flex Hardware Cryptocurrency Wallet

In such a case, the possible loss of the hardware wallet and cid-phrase is able to lead to the loss of all coins without the possibility of their recovery.

In addition, we can not forget about the activity of hackers and scammers who want to get the coins of their victims by any means. And their actions do lead to the result.

How cryptocurrency investors differ

Constant study of the crypto market, investment in risky assets and work with blockchain affect the human psyche. At least such a correlation was noticed by researchers in the scale of their survey statistics.

Here’s a relevant rejoinder on the matter, as cited by Decrypt.

We found that cryptocurrency ownership is associated with belief in conspiracy theories and “dark” personality traits. For example, the “dark triad” of narcissism, Machiavellianism, psychopathy and sadism. There is also a link to the more frequent use of alternative social media platforms.

Buying cryptocurrencies by investors

Overall, cryptocurrencies attract the most attention among men who share the aforementioned characteristics. Experts continue.

When looking at a more comprehensive multivariate model, the variables that most strongly predict cryptocurrency ownership are being male, using alternative social media as a primary source of news, being argumentative, and aversion to authoritarianism.

Cryptocurrency investors during the bullrun

The study asked participants to provide demographic data including age, gender, income, education, religious and political views, psychological traits, and media use. All of this was needed to create a detailed profile of cryptocurrency owners.

While most digital asset enthusiasts are known for their libertarian views, the survey found that respondents were more liberal in their political views and more likely to identify as Democrats.

That said, the study’s authors cautioned that the correlations here were small and may not indicate a strong or consistent political pattern among cryptocurrency holders.

Among commentators on Twitter, among others, the study’s findings faced criticism. Users noted that financiers and bankers are inherently psychopathic and narcissistic in a much more pronounced form.

However, study author Steve Littrell of the University of Toronto said his work was simply misunderstood. Here is the expert’s comment.

This man claims to be a scientist, but aggressively misrepresents the results of our work to his 700,000+ subscribers. It is sad to see a supposed scientist spreading rabid misinformation about legitimate scientific research.

Crypto trading sure beats morality

There is no shortage of colourful characters in the cryptocurrency space, but financial experts say that targeting one investment class for research is unusual in itself.

Professor Andrew Urquhart of the University of Birmingham, who was not involved with the study, shared this opinion.

I wouldn’t say that people who hold gold or silver are psychopaths.

Urquhart added that a basic finance course at the university teaches students how to diversify their portfolios. Here’s the line.

We all know that when things go bad, you go into gold because it does very well in bad times. So cryptocurrencies were seen as a safe haven for capital in 2018, 2019 and 2020.

According to Urquhart, cryptocurrencies can’t be seen as a hedging or risk mitigation tool right now because they are increasingly correlated to traditional markets. In addition, owning digital assets should not determine the mental state of investors.

The growth of the cryptocurrency market

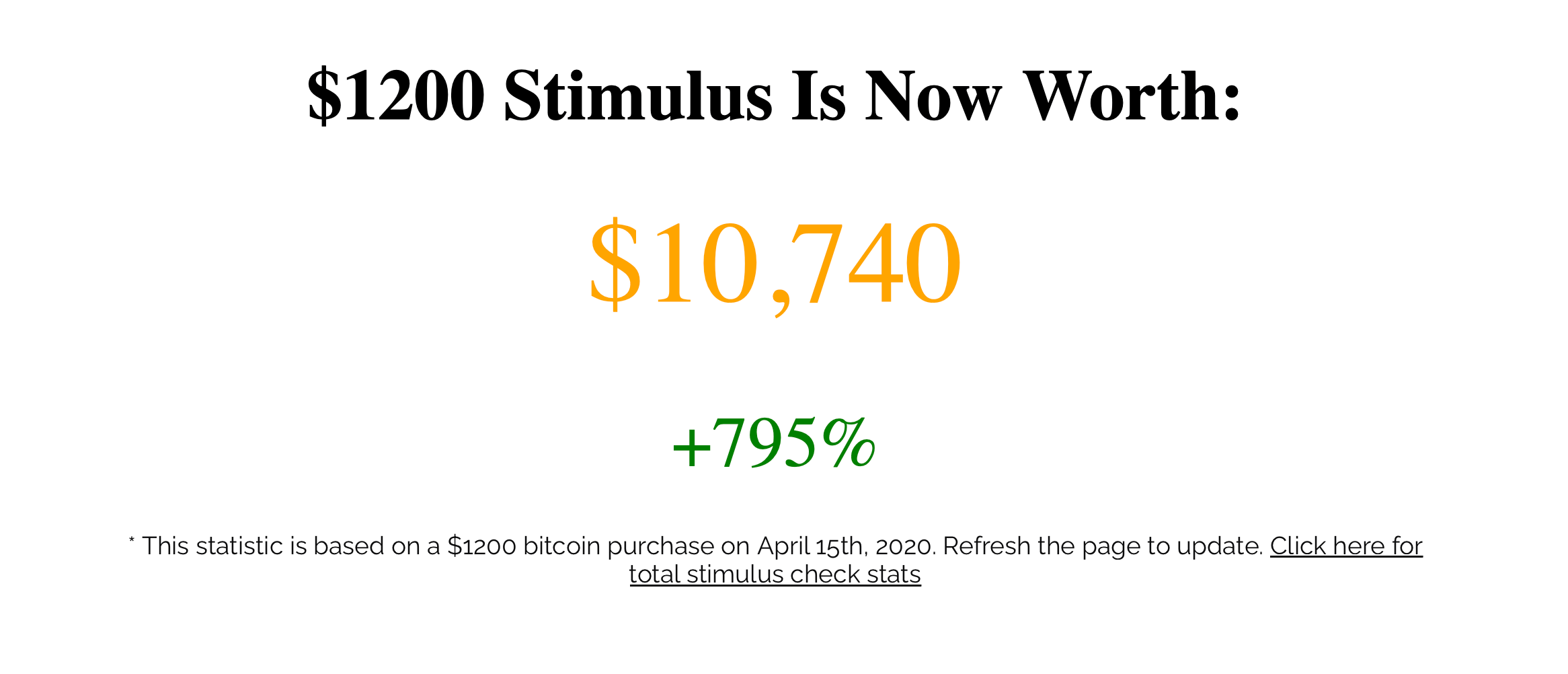

At the same time, the professor acknowledged that crypto investors tend to be young men with not the best education. According to him, during the COVID-19 pandemic, quite a few people in the United States used the money to trade crypto after receiving $1,200 in cheques from the government.

As of today, however, that amount invested in Bitcoin immediately after receiving it in April 2020 would be valued at $10,740. This is 795 per cent more than the initial investment, meaning that this investment can be safely called a success. Therefore, it is also possible to argue with such an argument of the researchers.

The actual value of bitcoins bought with $1,200 from the state in April 2020

In addition, on 11 January 2024, spot Bitcoin-ETFs started trading in the US, which are now available on major US exchanges. Since then, net inflows into such instruments have totalled $17.85 billion to date, with giants like Morgan Stanley and Goldman Sachs among the buyers of exchange-traded fund shares.

Cryptocurrencies and instruments based on them are gaining more and more fans and becoming a recognised instrument for investing capital. Therefore, it is hardly relevant to talk about the tendency to psychopathy in buyers of digital assets. However, a full-fledged connection with coins can indeed affect a person's condition.