Tether has recovered more than a hundred million dollars stolen by fraudsters. How is the company helping the authorities?

Since its launch in 2014, USDT Tether, the issuer of USDT Tether steiblcoin, has worked with more than 145 law enforcement agencies around the world. In total, the company has helped track down and recover over $108.8 million in stolen crypto funds. At the same time, Tether management once again emphasised that the giant is committed to working with government agencies in the context of ensuring transparency and security of the crypto industry.

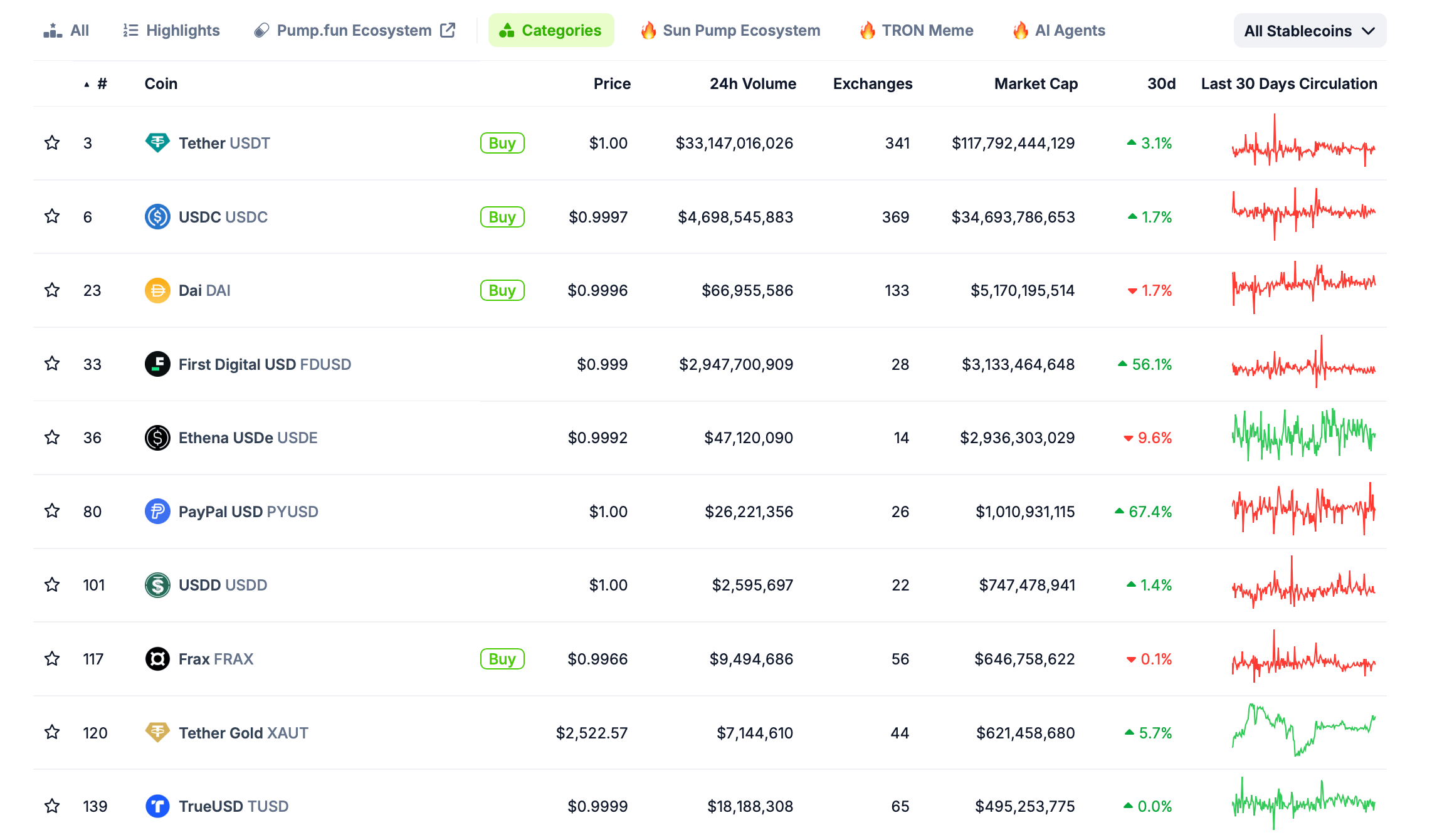

Today, the capitalisation of the stablecoin industry exceeds the level of $170 billion. About 69 per cent of this figure falls on Tether, which also has the best result in the world in terms of net profit per employee.

The Cryptocurrency Industry’s Largest Stablecoins by Market Capitalisation

Despite its obvious leadership in the niche, the giant has no plans to stop. In particular, in the first half of August it became known about Tether’s plans to double the number of employees – up to 200 people by the middle of 2025.

In addition, last week the company’s management announced a plan to launch a stablecoin based on the price of the United Arab Emirates dirham. So the demand for the giant’s products will surely only increase.

What Tether does

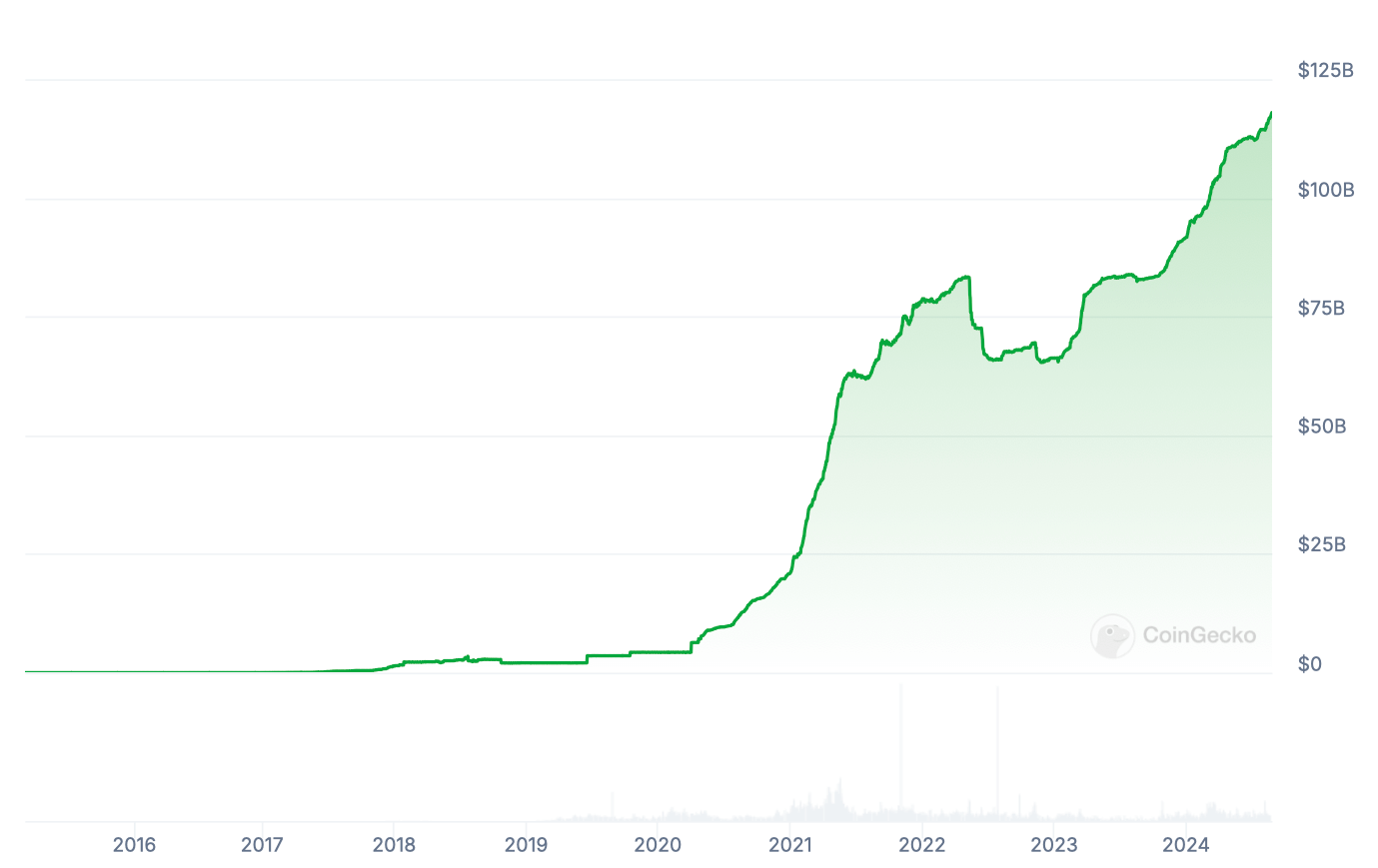

USDT is the largest crypto market steiblcoin by capitalisation. It is the most popular asset in its class, whose representatives are traditionally the main bridge between the world of fiat and digital assets. Still, new steibles are issued after paying the appropriate amount in regular money by large investors who want to enter the niche of coins. Therefore, the trend of growth in the capitalisation of such tokens speaks about the interest of players in what is happening in the coin industry.

In view of the above, it is not surprising that Tether is constantly attracting the attention of various agencies.

Tether CEO Paolo Ardoino

Tether CEO Paolo Ardoino confirmed in a fresh statement that fighting crime and ensuring transparency will remain a priority for Tether. Here’s his quote, as cited by Cointelegraph.

Tether remains a strong supporter of law enforcement efforts to combat the illegal use of cryptocurrencies. We condemn the misuse of USDT or any other cryptocurrency for criminal activity. Our company is fully committed to continuing to work with law enforcement to combat fraud.

Tether CEO Paolo Ardoino

The day before, Tether helped the US Department of Justice seize $5 million in USDT from fraudsters involved in romance scams. Typically, such attackers try to generate romantic interest in their victims in order to entice them to transfer crypto.

Note that this scheme of deception is just about the longest running in the blockchain industry. Fraudsters can take weeks or months to gain the victim's trust. Well, scam is most often reduced to a proposal to use a fake platform to steal access data from a popular exchange or to buy a certain cryptocurrency created directly by scammers.

.

Tether said the seizure of the funds “signifies a significant victory in the ongoing fight against digital fraud.”

It also noted that the investigation included Tether’s connection to the Federal Bureau of Investigation (FBI) and US Secret Service platform “to create synergies in investigations.”

Capitalisation of Tether’s USDT, the largest USDT stablecoin

According to journalists, romance scams are still a serious problem for the industry. For example, in 2023, fraud revenues in this area more than doubled from the previous year, and they have increased 85 times since 2020.

Such schemes are characterised by serious consequences for victims, as fraudsters receive on average relatively large sums from each incident. Accordingly, the considerable amount of effort involved pays for itself.

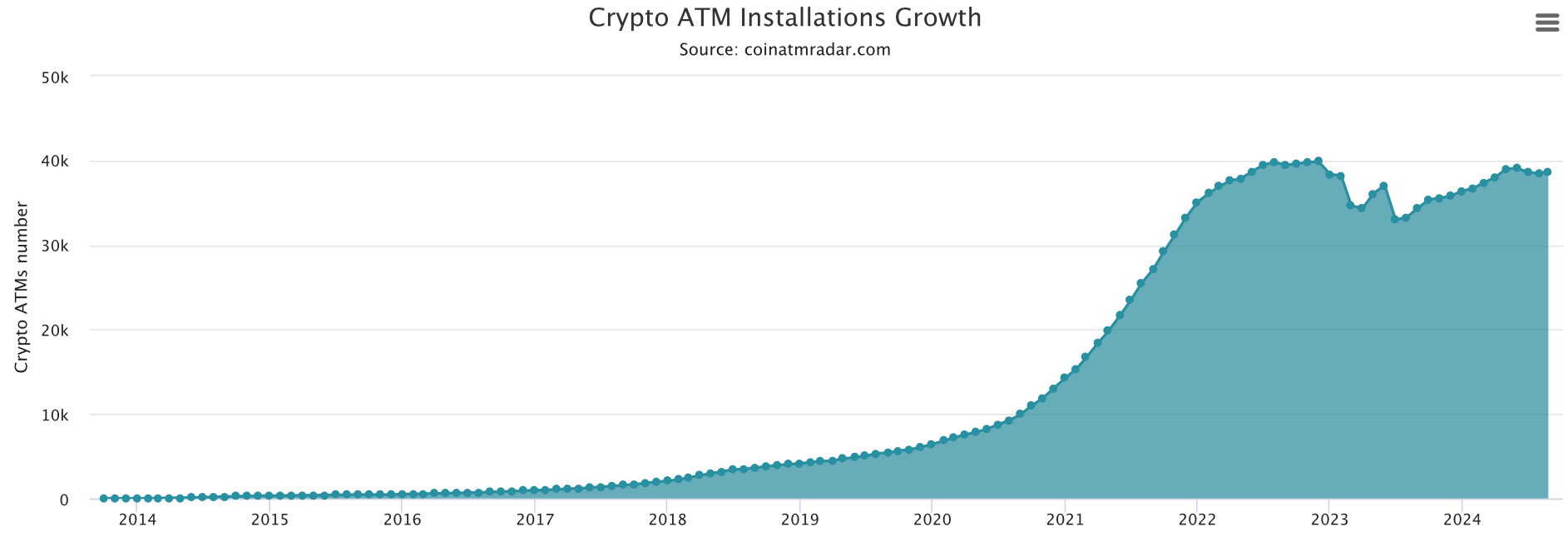

The fight against criminals is taking place even in the crypto-mat sector. The day before, German law enforcement authorities confiscated 250,000 euros in cash and 13 crypto machines during a nationwide anti-fraud campaign.

The operation, led by the Federal Financial Supervisory Authority (BaFin), is part of a larger effort to increase oversight of the country’s rapidly growing cryptocurrency sector, CryptoPotato reports.

Crypto machines are on the rise globally

During the campaign, law enforcers visited around 35 locations where crypto machines were allegedly operating without proper licensing. In an official statement, BaFin representatives highlighted the dangers associated with unlicensed platforms and also noted their frequent use in illegal activities.

The agency reiterated its commitment to protecting Germany’s financial system and enhancing consumer safety. Operators found to be in breach of licensing laws face serious penalties – including the prospect of up to five years in prison.

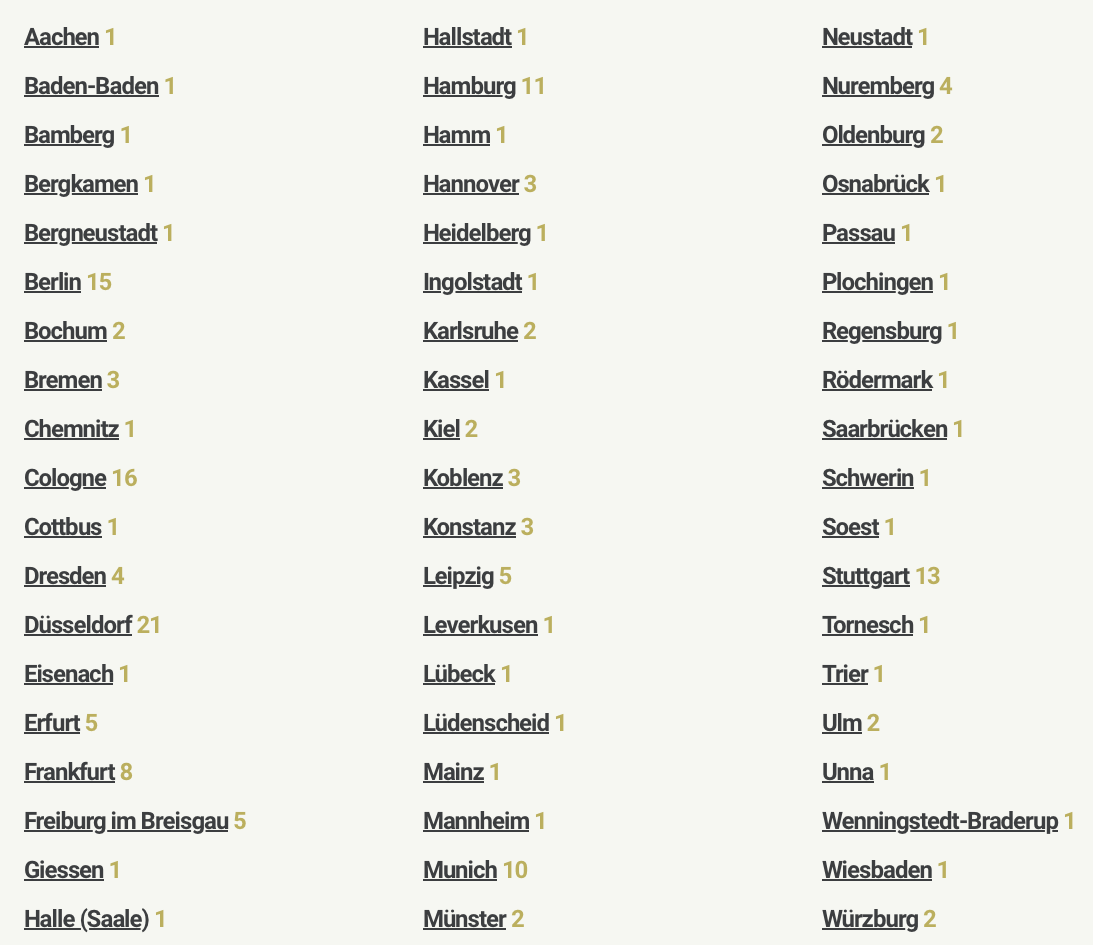

Number of crypto machines by city in Germany

According to Coin ATM Radar, there are 177 crypto machines in Düsseldorf, Berlin and Stuttgart. These machines operate under the Banking Act, which requires operators to obtain authorisation from the BaFin to ensure compliance with regulatory standards.

Tether is one of the most prominent names in the blockchain industry, whose earnings for the first half of 2024 totalled a record $5.2 billion. This speaks to the popularity of the company's services and products, whose stablecoin provides a quick entry into the industry. With this in mind, the giant's co-operation with law enforcement agencies seems quite obvious and justified.