The government of El Salvador is launching a massive Bitcoin education programme. Why is it needed?

The National Bitcoin Office (ONBTC), which is directly managed by the government of El Salvador, has launched a large-scale educational programme for local public service employees. As part of this initiative, 80,000 employees will be trained in the basics of Bitcoin and blockchain, after which they will receive certificates. This project is in line with the general policy regarding the adoption of digital assets in the country.

El Salvador is a small country in Central America, which was the first country in the world to recognise Bitcoin as an official national currency on a par with the dollar in September 2021. Since then, the state government has launched many crypto-related initiatives.

These include the formation of a national crypto reserve, the development of mining companies and even Bitcoin backed bonds. At the same time, the country's president Nayib Bukele actively supports the above ideas and periodically mentions the first cryptocurrency in his tweets.

As of today, the Salvadoran government has 5,849 Bitcoins worth $346 million in its wallet. That’s 51.7 million more than was originally invested in the digital asset.

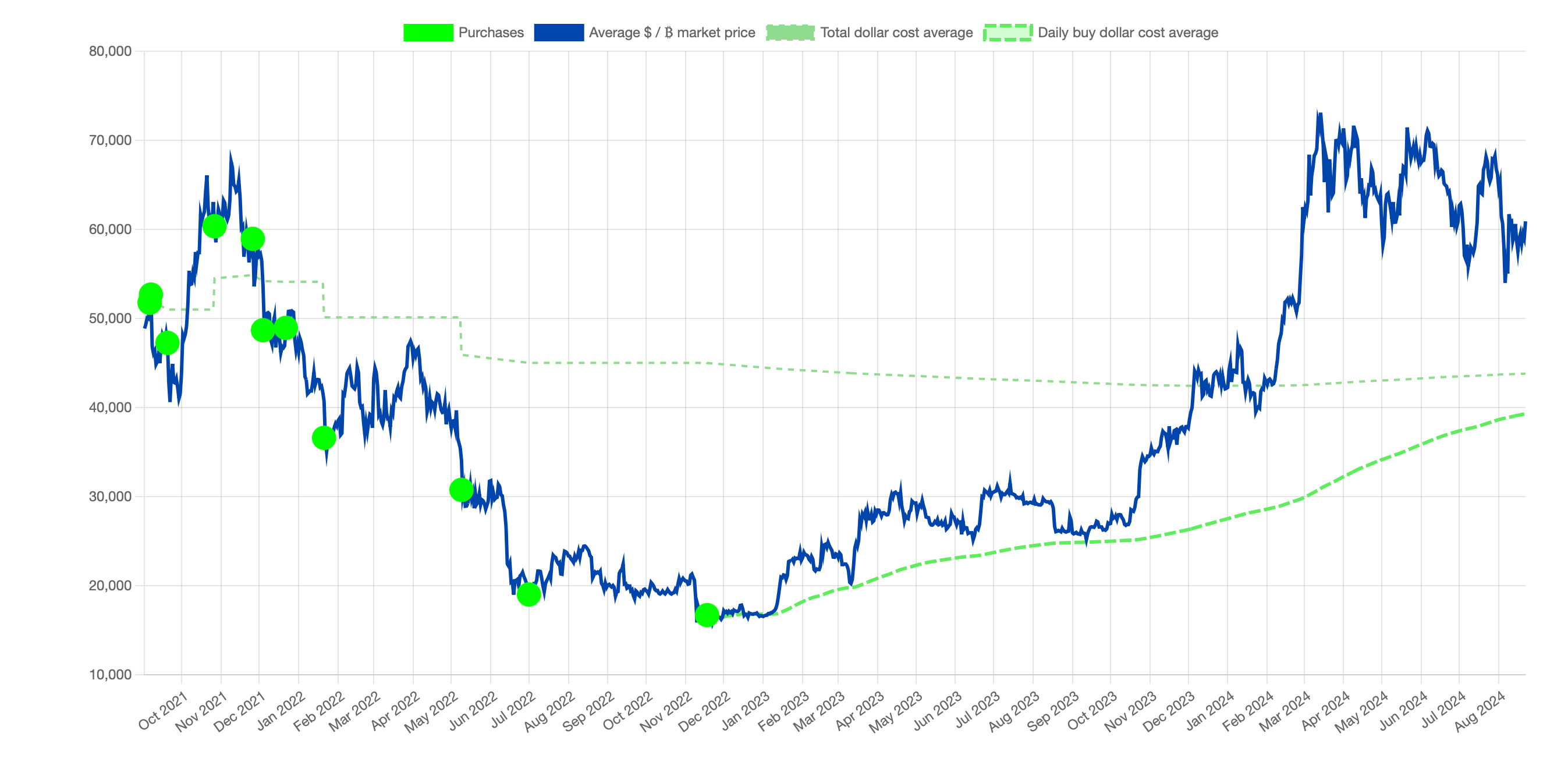

Bitcoin purchases by the government of El Salvador

The figure is indicative as it is not possible to verify the purchases. In addition, on 17 November 2022, Nayib Bukele announced purchases of 1 BTC every day.

Whether this scheme is still valid is unknown. In addition, it is unclear at what time of day the transactions take place, which also adds to the inaccuracy of calculations.

What’s happening with cryptocurrencies in El Salvador?

The educational course launched will focus on the intricacies of Bitcoin management and public strategies. The overall course consists of a 160-hour virtual training session that is divided into seven modules.

Each module covers the concepts and laws, as well as the skills and management techniques involved in using Bitcoin as legal tender.

Mention of Bitcoin in El Salvador

Stacy Herbert, head of the National Bitcoin Office, expects the training for government employees to have a “holistic impact” on El Salvador’s economy driven by the Bitcoin ecosystem. To that end, she plans to announce other new educational initiatives. Here’s a rejoinder on the matter, as quoted by Cointelegraph.

These educational projects are not time-consuming for the long-term success of El Salvador and its Bitcoin and technology policies.

The certification of course participants is done by the Higher School of Innovation in Public Administration (ESIAP), which President Nayib Bukele inaugurated in August 2021.

According to experts, El Salvador’s financial success due to the large-scale adoption of Bitcoin has caught the attention of other governments whose economies are suffering from hyperinflation. For example, in May, the Argentine government began working with El Salvador to learn from its experience in adopting BTC and other cryptocurrencies.

El Salvador’s President Nayib Bukele

Representatives from Argentina's National Securities Commission (CNV) previously met with officials from CNAD, the regulator from El Salvador. They discussed the adoption and regulation of cryptocurrencies through co-operation between the two countries.

Initially, the recognition of BTC as a means of payment was promoted by Salvadoran President Nayib Bukele. A couple of years ago, this idea seemed extremely risky and bold. Now, when the price of BTC reached a new all-time high of $73,777 in March 2024, this strategy has definitely paid off.

However, it is important to remember that Bitcoin was recognised as the national currency of El Salvador two months before the cryptocurrency reached a high in the $69,000 zone for that bullrun.

The market then reversed and went into a bearish trend, meaning the timing for such a change was definitely not the best. Still, prolonged periods of decline in the coin market have a serious impact on investor sentiment, which may cause novice users to decide to quit the niche.

Studying Bitcoin is a good idea considering what has been happening in the global economy over the past few years. On top of that, BTC continues to actively absorb the market share previously held by Efirium.

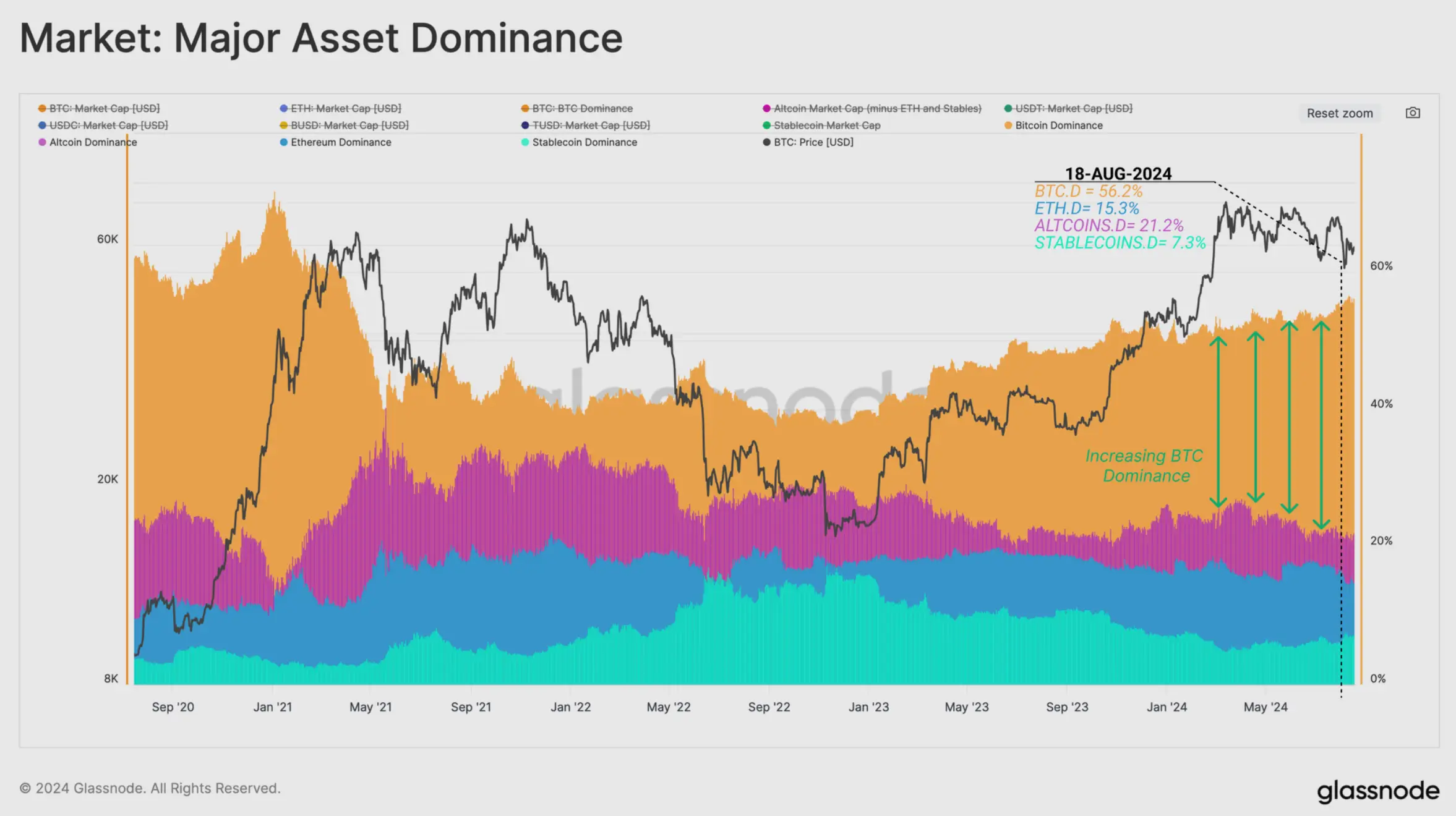

Bitcoin’s strength

In particular, since reaching the bottom of the cycle in November-December 2022, the ETH dominance index has been in steady decline, Glassnode analysts noted. Their replica is cited by The Block.

Since the cycle low set in November 2022, Efirium has seen its dominance index decline by more than 1.5 per cent. Meanwhile, the altcoin sector as a whole has seen its share of market capitalisation fall even further, by 5.9 percent.

This indicates not only the growth in the value of the first cryptocurrency, but also the depreciation of some altcoins. Still, such projects sometimes may not survive a bearish trend amid a decrease in the number of investors and trading volumes. So in such periods it is safer to keep funds either in BTC or in other large altcoins like ETH or SOL, which will definitely survive the stages of drawdown. Stable-value stablecoins are also an excellent option here.

Market capitalisation share for top cryptocurrencies

Since November 2022, the price of ETH has risen by around 66 per cent, while Bitcoin’s price has risen by more than 73 per cent. That said, on the scale of the last year, BTC has proven to be a far more favourable investment. The cryptocurrency has risen in price by 133 per cent over the period, while Etherium has only jumped by 57 per cent.

Bitcoin’s exchange rate changes over five years

The key narrative of the current bullrun phase has been the flow of capital into the largest cryptocurrencies by capitalisation through the launch of spot Bitcoin-ETFs in the US in January 2024. With this, exchange-traded funds based on the digital asset are trading on major US exchanges and attracting huge capital from sophisticated investors.

The Glassnode report also mentioned that Bitcoin’s dominance index has increased from 38 per cent in November 2022 to the current 56 per cent. Therefore, the major cryptocurrency will continue to remain the undisputed leader in everything related to long-term investment in digital assets.

Cryptocurrency investors during the bullrun

Such initiatives on the part of the government clearly indicate the growing popularity of digital assets. Perhaps, the majority of civil servants will not start using crypto after going through the relevant programme. However, someone will in any case appreciate the advantages of Bitcoin in the form of limited maximum supply, regularly decreasing issuance rates and decentralisation, which will benefit the crypto's popularity.