The US government will continue to sell bitcoins confiscated from the Silk Road platform. What does this mean for cryptocurrencies?

Tens of thousands of new bitcoins from US government cryptocurrency wallets may soon be dumped on the market. We are talking about coins confiscated almost ten years ago from the darknet platform Silk Road, whose founder is Ross Ulbricht. According to experts, certain signs in favour of approaching crypto sales are already becoming visible.

As of today, the US government has the equivalent of $12.3 billion in cryptocurrency in its wallets. Most of this amount is 203.2 thousand BTC worth 11.94 billion.

The total balance of cryptocurrency wallets of the US government

Then come ether and USDT at $132 million and $121 million, respectively.

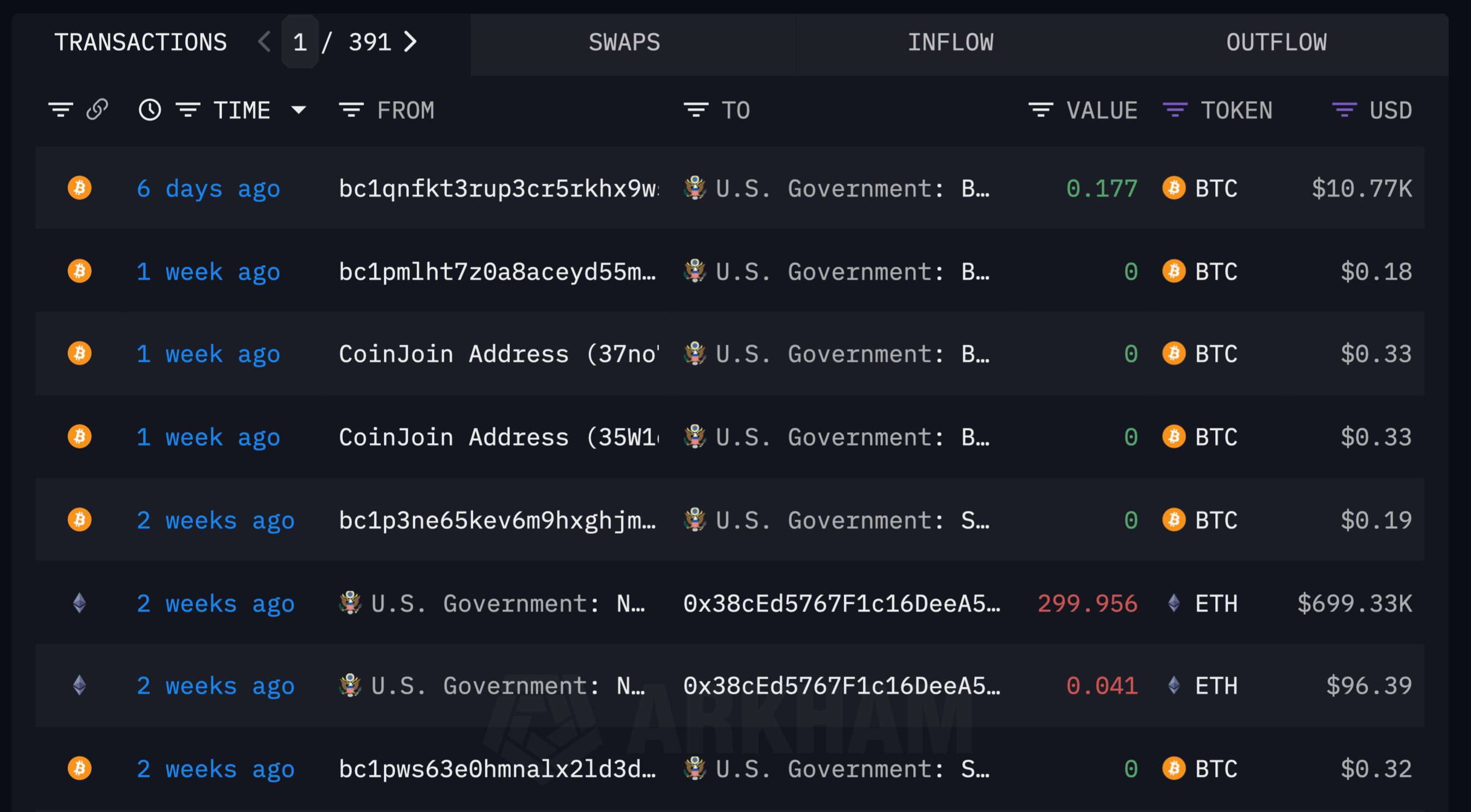

At the same time, the last transaction with the withdrawal of coins took place a fortnight ago. Then the representatives of the authorities conducted a transaction with 300 ETH for 699 thousand dollars.

The latest transactions conducted from cryptocurrency wallets of the US government

We wrote in detail about the history of the Silk Road darknet marketplace and the capture of Ross Ulbricht in a separate material. We recommend reading to keep up to date with one of the most high-profile stories that impacted the digital asset niche.

What’s going on with Silk Road’s bitcoin platform

The U.S. Marshals Service (USMS) has already begun the process of accepting agreements with Coinbase, the largest cryptocurrency exchange in the United States, to realise the aforementioned bitcoins. This was announced by lawyer Scott Jonsson, who specialises in finance-related cases. Jonsson posted a tweet warning of the start of BTC sales, meaning government agencies are clearly going to get rid of them.

According to Cointelegraph’s sources, the lawyer’s speculation is based on a service agreement signed between USMS and Coinbase in June. According to Jonsson, the document states that once bitcoins hit Coinbase Prime, it is a clear sign that the Marshals Service has either sold or is about to sell assets. Here’s a quote from an expert on the subject.

The U.S. Marshals Service is sending BTC to the custodian’s address as required by the terms of the service agreement it entered into with Coinbase in June.

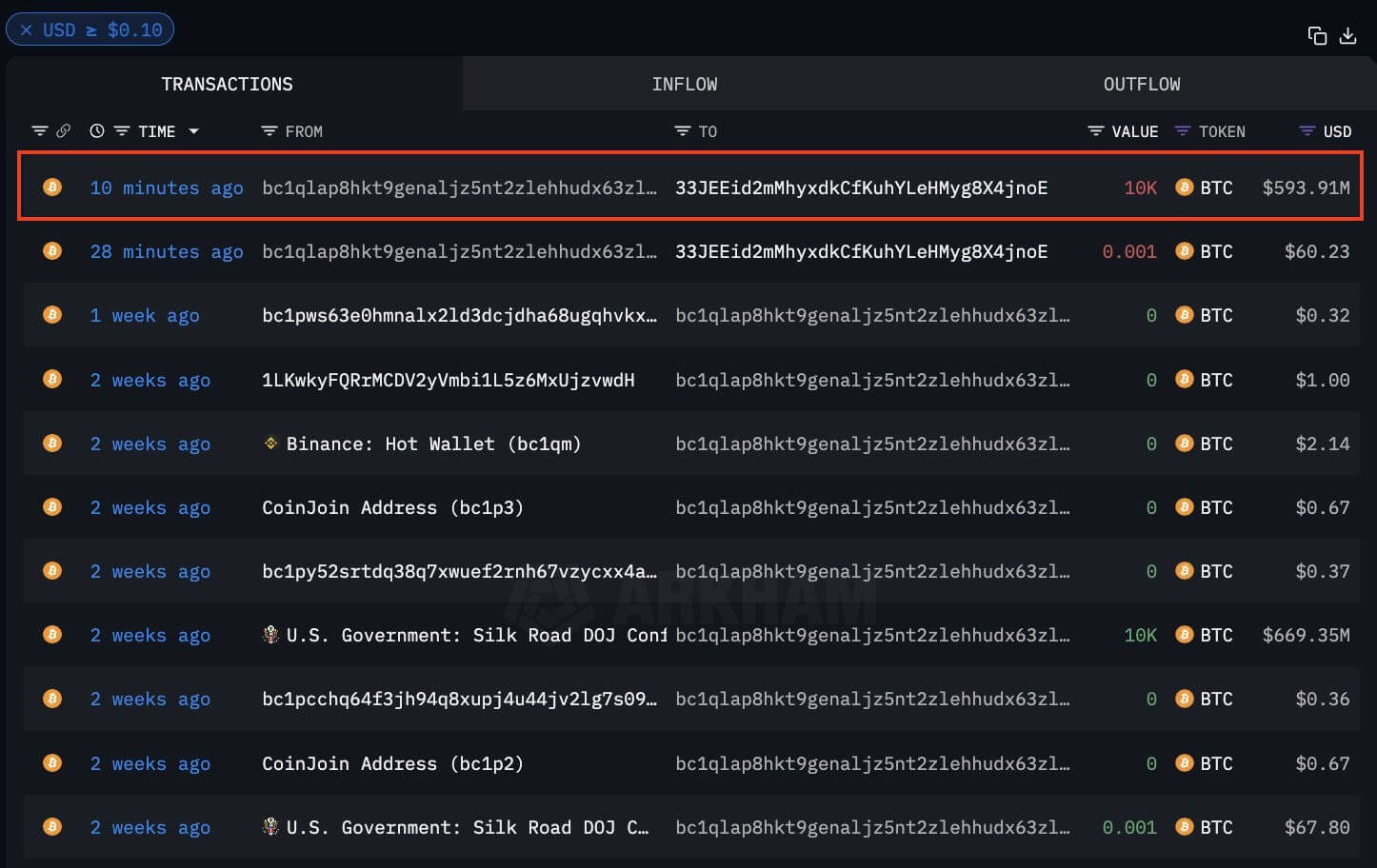

Sending bitcoins by the US government to Coinbase’s Prime platform on 14 August

As a reminder, Prime is an institutional platform from Coinbase for large clients. In theory, transactions from linked government wallets on Prime can be tracked on the blockchain. In practice, it is difficult to estimate potential sales volumes in this way.

We will learn more final details in the publication of the Department of Justice's report on the asset forfeiture programme for the 2024 financial year. The document is expected in January.

Not all experts agree with Jonsson’s position. For example, Ryan Lee, chief analyst at Bitget Research, believes that Silk Road coins will not be sold at all. Although according to the analytical platform Arkham Intelligence, on 14 August, the US government transferred 10 thousand BTC worth about $600 million to Coinbase. The coins were sent to the Coinbase Prime deposit wallet, which means these digital assets have probably already been sold.

So far, the United States of America ranks first in the world in terms of the number of bitcoins in government wallets. This trend should continue for the future – such a promise was previously made by US presidential candidate Donald Trump.

Former US President Donald Trump

Also in the Republican Party, an initiative to create a national crypto reserve was born: senator Cynthia Lummis proposed to purchase 1 million BTC over a long period of time. Most importantly, this cryptocurrency should be stored for twenty years, and it will be possible to get rid of it only for the repayment of the US national debt.

The list of Trump’s promises also includes the release of Ross Ulbricht, the founder of the Silk Road darknet platform, who was sentenced to two life sentences and 40 years on top, which essentially makes parole impossible.

Supporters of the decision believe that Ulbricht has already served enough time for his actions. Still, he didn’t directly distribute drugs or other illegal substances. It is hoped that if Trump takes over as president, the market will be able to avoid a surge in BTC sales.

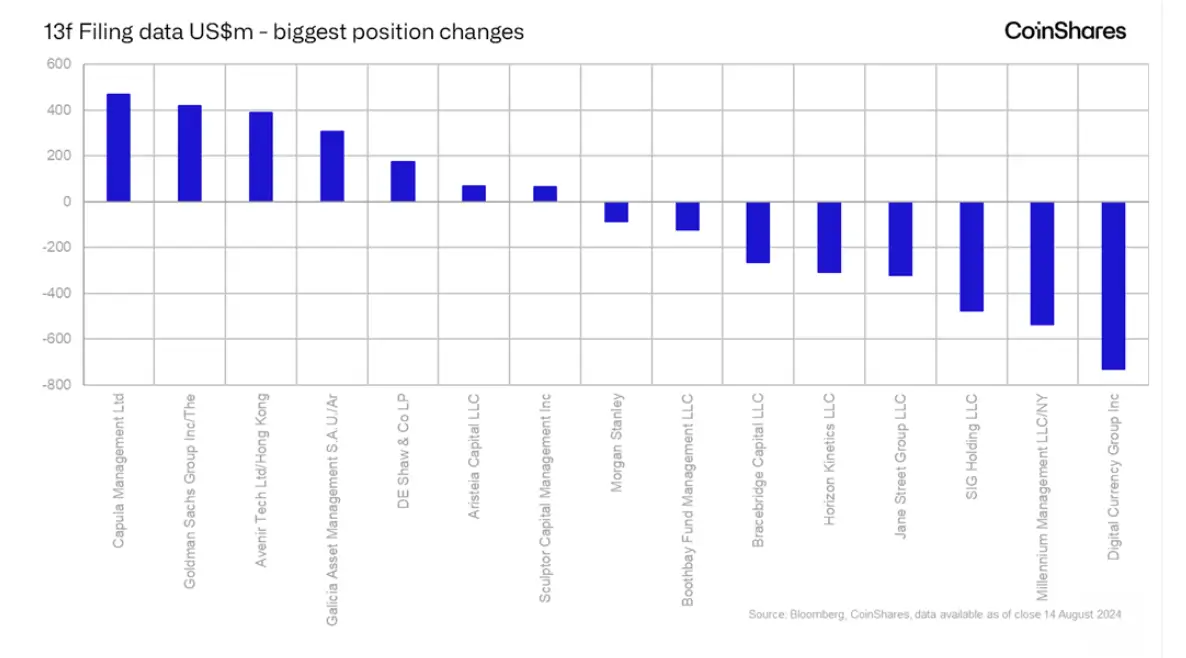

Be that as it may, there is always demand on the other side of the supply side of the market, and in this bull cycle, institutional investors have been the driving force. And according to sources, financial giants Goldman Sachs, Capula Management and Avenir Tech have become the biggest buyers of Bitcoin-based spot exchange-traded fund shares in the second quarter of 2024. The data was shared by analysts at CoinShares.

An analysis of 13F’s quarterly reports showed that the three named managers collectively bought about $1.3 billion worth of Bitcoin-ETF shares. Specifically, since March, Capula has bought about $470 million worth of shares, while Goldman Sachs and Avenir have bought $419 million and $388 million, respectively.

The fact of large-scale ETF adoption was also confirmed by Dave LaValle, head of global ETF operations at Grayscale. Here is a quote on the matter.

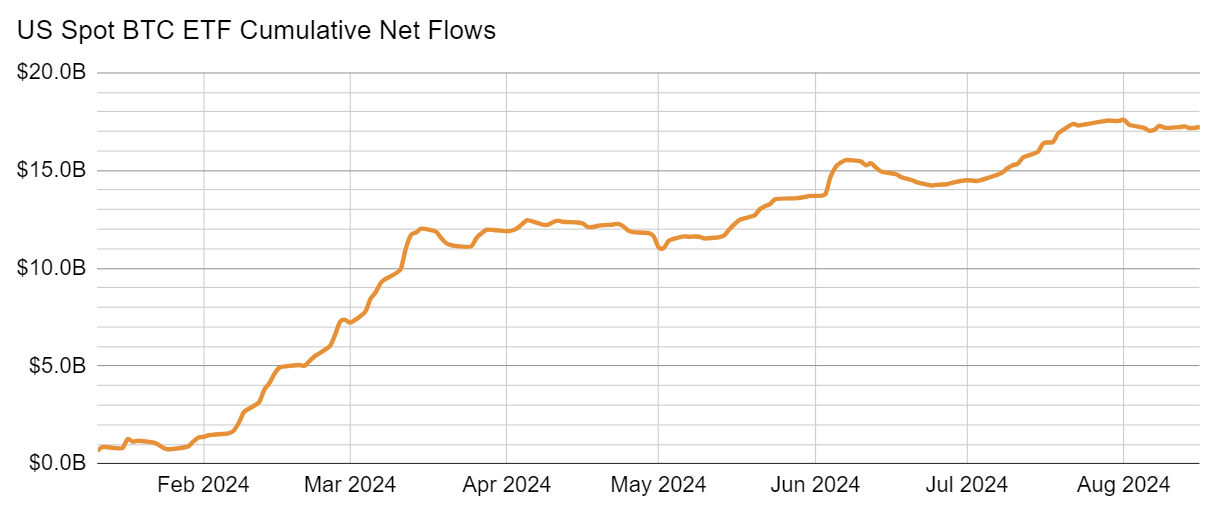

Funds inflows since listing day have totalled more than $15 billion. This is more than three times the largest annual inflow into any ETF in the history of these instruments.

To be more precise, total net inflows into spot Bitcoin ETFs in the US since their launch on 11 January 2024 have been $17.22 billion. Things are much worse for Efirium-based exchange-traded funds: so far, their launch on 24 July has only resulted in net outflows of $418.7 million. This is mainly due to Grayscale's ETF, which used to exist in the form of a trust and has now made it possible for investors to get rid of relevant stocks without waiting for a certain lockup period.

The influx of capital into spot Bitcoin-ETFs in the US

Hedge funds now have the largest portfolio investments in Bitcoin – we’re talking about an average allocation of 2.2 per cent of the total portfolio. Private equity firms also have relatively large shares with an average result of 1.4 per cent.

Banks and pension funds, on the other hand, still have small shares – 0 and 0.1 per cent respectively. Over time, however, ETFs should become much more attractive to big capital. In addition, as it became known the day before, the National Pension Fund of South Korea invested in the shares of MicroStrategy, which is the largest holder of BTC among public companies. This means that the perception of digital assets is getting better one way or another.

The positions of the largest companies in the Bitcoin-ETF

It seems that the US authorities continue to prepare for large-scale sales of BTC that were previously confiscated from criminals. So far, everything points to the fact that the operations will take place in the coming months. Well, the only thing that will be able to stop them beforehand is Donald Trump's victory in the US presidential election, who has already promised to form the country's strategic reserve out of coins.