Analysts have identified the most relevant narratives for the cryptocurrency market. What are they?

The crypto market is constantly reacting to news, trends and community discussions on various topics. Knowing the relevant narratives gives investors an advantage, as they can spot a trend change in time or connect with a segment that then becomes popular in a niche. With this in mind, Santiment analysts have identified the key trends that shaped what was happening in the coin market the day before, and their impact on the value of coins is still relevant.

What are the main trends in crypto

Firstly, in 2024, the topic of large holders of cryptocurrencies or so-called whales is in serious demand, because social networks often discuss their influence on asset prices. The consensus among traders and investors remains the same: too much crypto and market power is still concentrated in the hands of a small group of people.

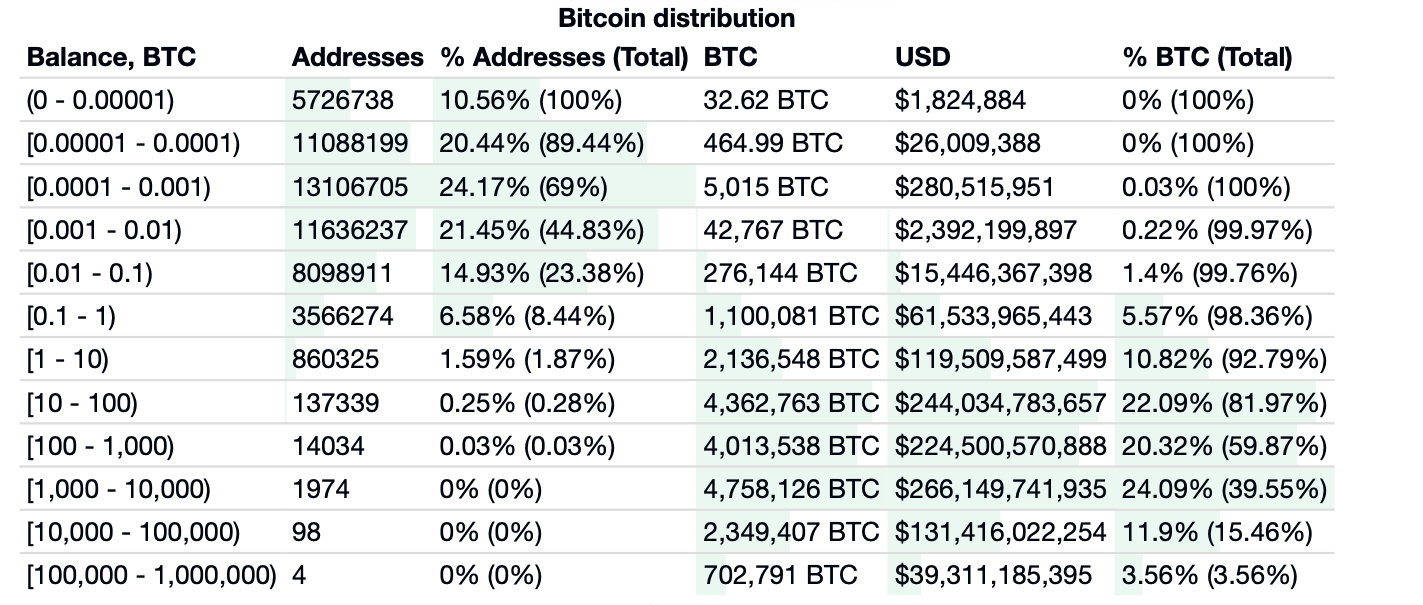

To illustrate, consider the following graph of bitcoin distribution among different addresses. As you can see, there are now 102 addresses on the network that have at least 10 thousand BTC. In total, the owners of such accounts own 15.46 percent of the total supply of the first cryptocurrency.

Distribution of bitcoins by wallets

Over the years, however, the situation in this regard has become better. According to analysts, the number of cryptocurrency wallets with a relatively small amount of BTC in the account has now grown significantly. This means that crypto is gradually distributed to more and more people, which means that the number of investors is growing.

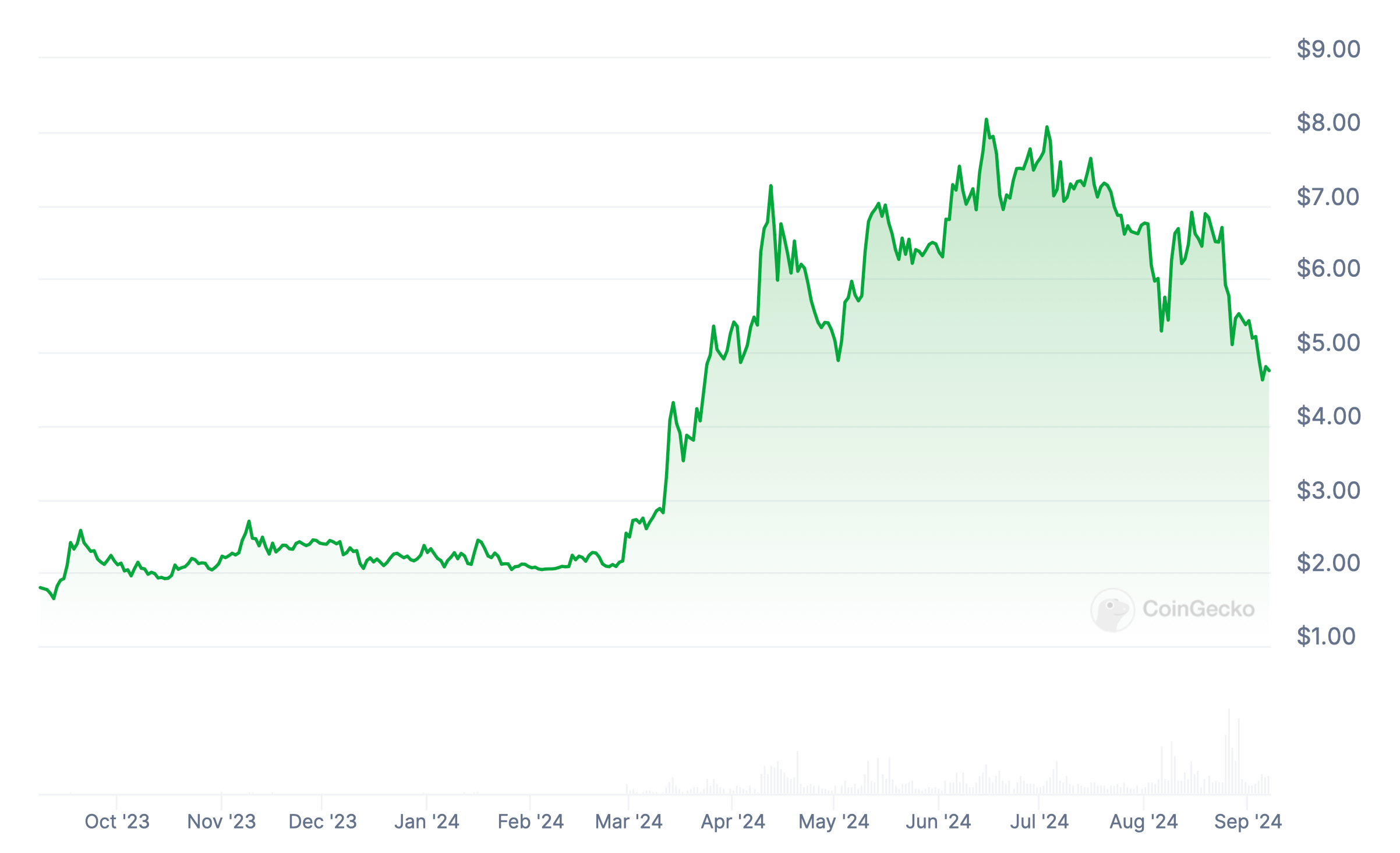

The second trend of 2024 is the TON project, which is being developed in close co-operation with the Telegram messenger. Against the background of high interest of institutional investors, the rate of the native token Toncoin has grown significantly this year.

However, the position of the TON ecosystem came under pressure the day before, which happened shortly after the arrest of Telegram creator Pavel Durov in France.

He was accused of facilitating crimes that are committed using the messenger. In addition, Pavel was accused of refusing to co-operate with government agencies.

Changes in the exchange rate of the cryptocurrency Toncoin over the past year

Pavel now remains in France and will most likely stay there until March 2025 due to the travel ban issued. As a result, his situation remains relatively stable for now, but the news still had a significant negative impact on the Toncoin exchange rate. In addition, it left an unpleasant residue in the form of worrying signs of the fight against freedom of speech in Europe.

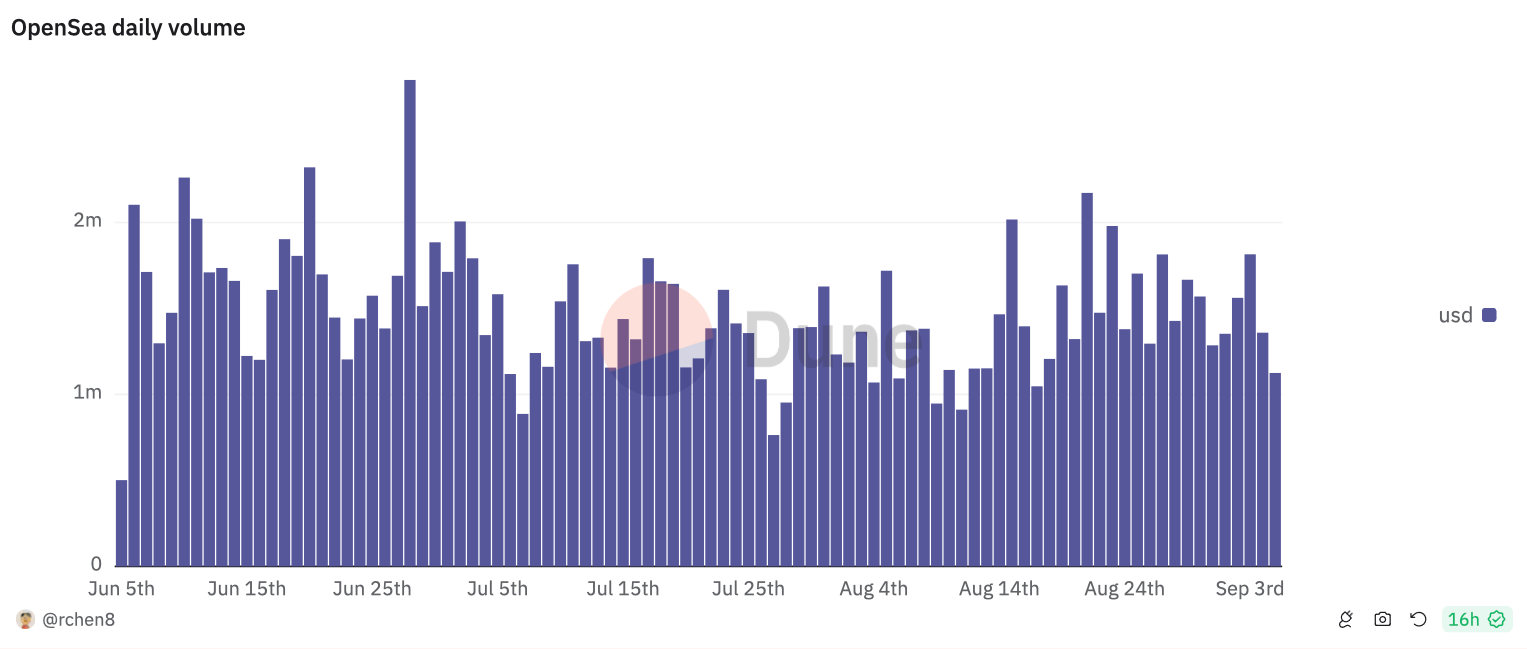

The third narrative mentioned by analysts is the friction between the NFT-platform OpenSea and the US Securities and Exchange Commission (SEC). In August, it was reported that the SEC wants to try to recognise NFTs as unregistered securities and is preparing a lawsuit against the platform.

Volume of transactions with unique tokens on OpenSea

This outcome does not mean that the SEC will succeed in realising its plan. Nevertheless, the news is capable of causing serious concern among investors and NFT holders, as well as a corresponding wave of sales of popular crypto-assets.

The fourth narrative is the hype surrounding meme tokens of the highest calibre. Here’s a comment from Santiment analysts on the subject.

The hype around “old meme tokens” like DOGE and SHIB has not yet died down completely, with most of the speculation around them taking place on social networks. We should expect that such assets can and most likely will rise again once Bitcoin starts its uptrend. This will redistribute profits in favour of assets that are the most “gambling” for ordinary investors.

Dogecoin and Shiba Inu were the hits of the previous bullrun in 2021. However, so far, investor demand for these assets leaves much to be desired, which confirms the lagging of current meme-token rates from their historical maximum. Today, DOGE is 86 per cent cheaper than the record price of 73 cents from 8 May 2021, while SHIB is 84 per cent below its peak of 0.00008616 cents.

With this in mind, some analysts have conceded that the current bullrun in the meme sphere will see new leaders emerge in the form of assets that have been launched over the past two years. Examples of such coins include Dogwifhat, POPCAT and PEPE.

The Dogwifhat meme token is one of the big hits of this stage of the crypto market

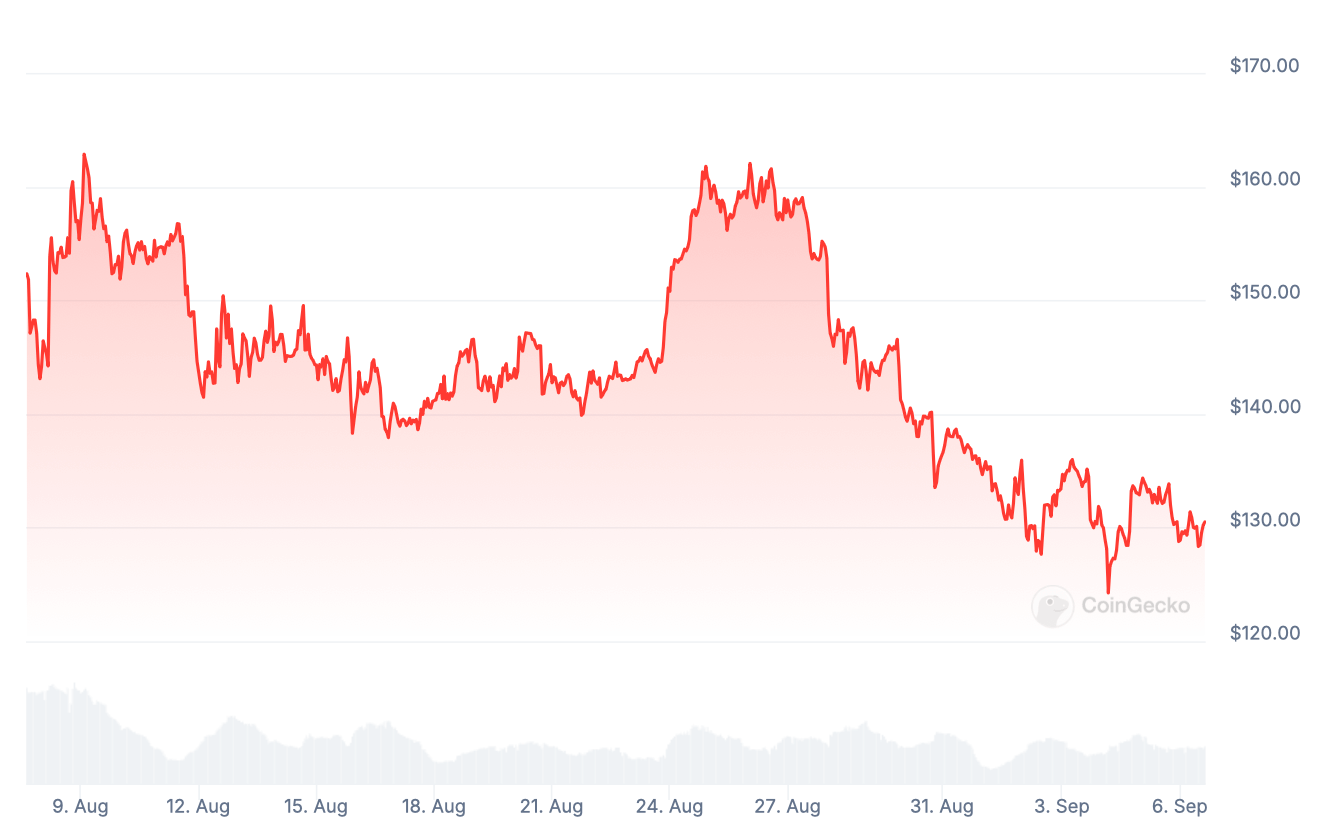

The popularity of meme tokens has led to the rapid growth of Solana, whose network has become home to the majority of promising memes due to its low fees and high speed.

The pump.fun platform, created specifically for launching new meme tokens, has also contributed to SOL’s growth. However, its popularity has recently declined slightly in favour of analogues on the Tron blockchain.

Changes in the rate of cryptocurrency Solana

The fifth trend is the active application of artificial intelligence (AI) in everything related to the crypto market. Here are the experts’ comments on the subject.

Talk of integrating artificial intelligence with blockchain technology continues to drive market trends – especially for smart contracts and decentralised applications. The potential for AI to revolutionise the execution of contracts on blockchain remains a hot topic.

The first wave of hype around artificial intelligence has served as a test-pump for many tokens positioned as related to this field. Nevertheless, this is just the beginning – AI-related initiatives of large companies will continue to develop in the future.

The trends noted seem relevant, so the experts have clearly identified them correctly. Perhaps the strongest of them all remains meme tokens, which continue to attract investors' attention despite the uncertainty in the industry. This means that niche players should familiarise themselves with this asset category in advance, rather than already as the market reverses and the current bullrun continues.