Bitcoin has received a tangible boost to its price. What factors influence the approach of a new bullrun wave?

Bitcoin rose more than 6 per cent in a couple of hours after the US Federal Reserve announced an interest rate cut. This happened on Wednesday, and the scale of the reduction was not minimal and amounted to 50 basis points. In addition to changes in Fed policy, the growth of the first cryptocurrency was supported by the weakening of the Japanese yen – this is stated by trader Gordon Grant.

The cryptocurrency market is beginning to grow again

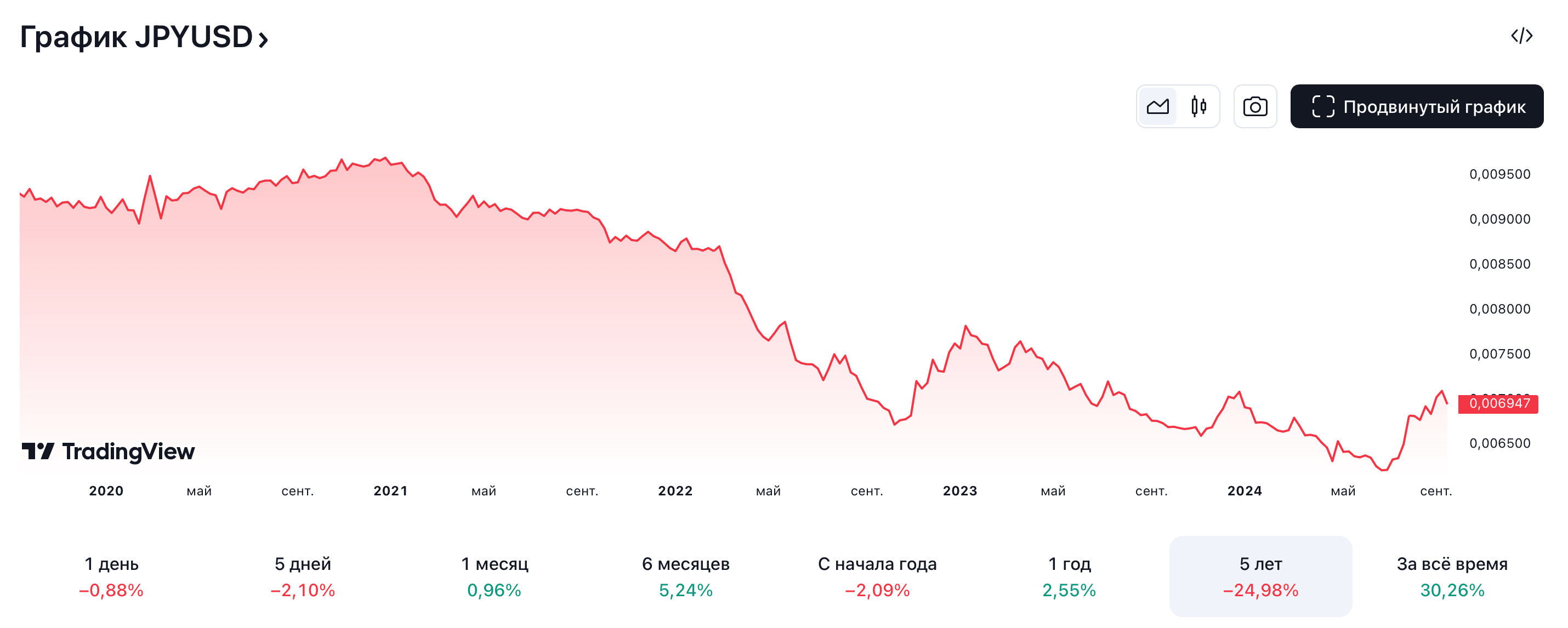

The dollar has been strengthening its position against the yen since Monday, which creates additional potential for Bitcoin growth. According to the expert, the crypto can capitalise on such specific currency dynamics.

Historically, a stronger dollar against the yen has supported the investor narrative to invest in high-risk assets, as the yen is often used as a currency to finance “risky transactions.”

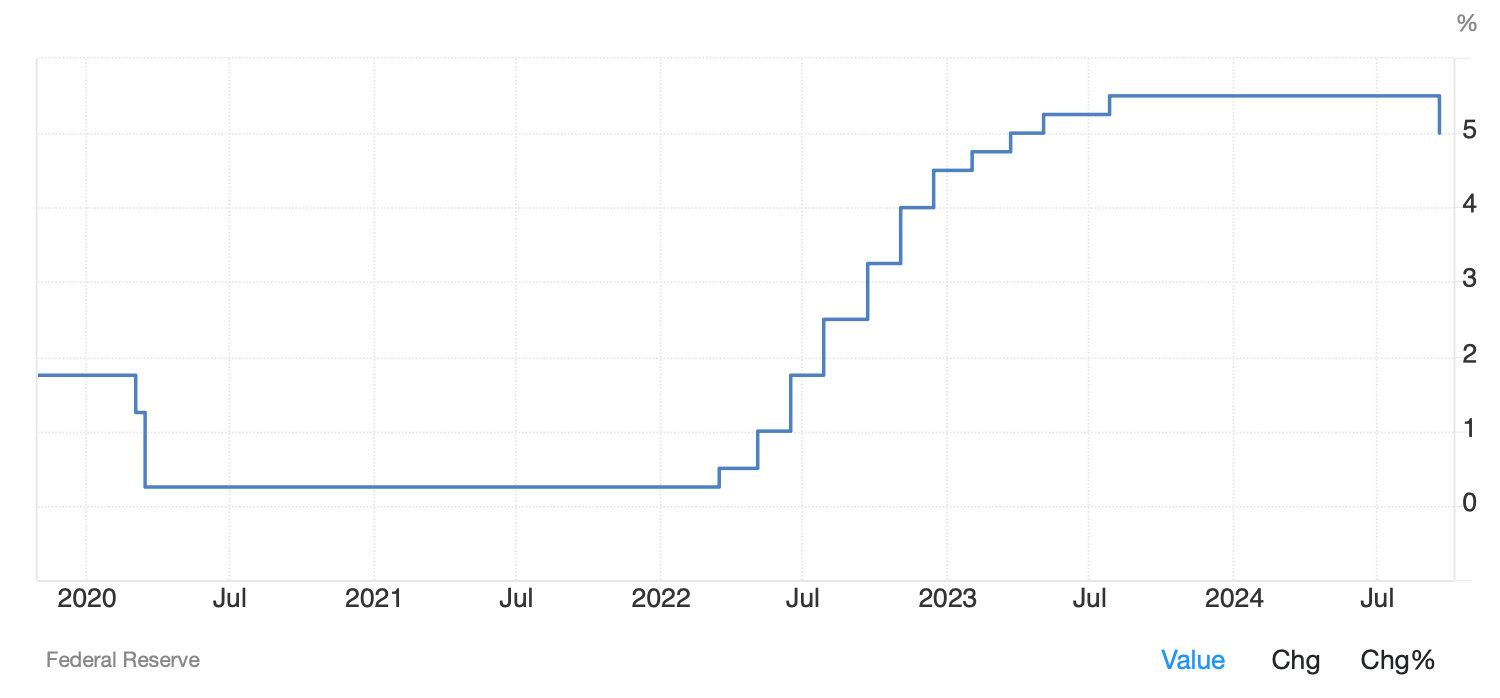

The US Federal Reserve cut rates for the first time in four years

According to Grant’s, the yen’s current weakness against the dollar is playing a key role in the market. Here is the expert’s commentary on what is happening.

The dollar’s 1 per cent appreciation solely against the yen has boosted assets such as gold, silver and Bitcoin.

The macroeconomic environment, characterised by a strengthening dollar and weakening yen, was further reinforced on Friday when the Bank of Japan showed hesitance to raise the interest rate.

Bankers then decided to leave the rate unchanged at 0.25 per cent. According to The Block’s sources, BOJ officials said in July that they would continue to raise the rate if inflation follows the projected path.

Japanese yen to US dollar exchange rate over the past five years

However, despite expectations of higher consumer price index (CPI) inflation in 2025 due to the “dampening” effect of government measures, the central bank decided to keep the rate unchanged.

After the US Fed rate cut, analysts were divided over Bitcoin’s near- and long-term price prospects. For example, 21Shares expert Matt Mena said that the rate cut could lead to volatility in the market in the near future.

Still, holders of digital assets in the current environment trivially do not know what to expect from the industry in the perspective of a few months.

In the short term, a 50 basis point rate cut could signal a slowing economy to the market, hinting at underlying problems that may not yet be apparent. This is in a position to worry both traditional and cryptocurrency investors, potentially causing initial volatility.

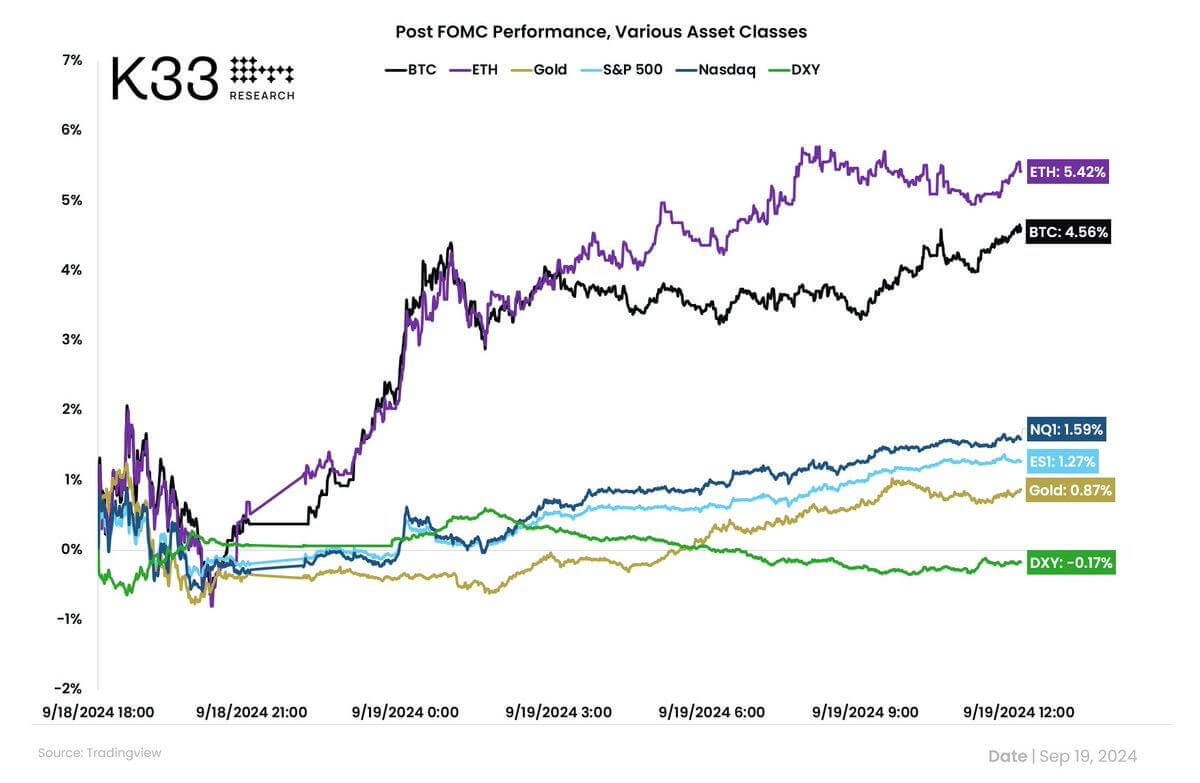

The reaction of different asset classes to the base interest rate cut has been quite different. That said, as noted by analysts at K33 Research, Etherium and Bitcoin were able to outperform other popular instruments like gold. Here is a relevant comparison of asset behaviour over half a day.

A comparison of the behaviour of different asset classes on a base interest rate cut

BRN analyst Valentin Fournier, on the other hand, gave a more cautious long-term outlook for digital assets.

Technical indicators suggest that Bitcoin’s upward momentum could be nearing its peak. Price is approaching the upper Bollinger Bands and the stochastic RSI is signalling a possible trend reversal. For now, we recommend to keep the risk level low and to consider reinvestment only around $56,000 and below.

By tradition, we remind you that all investors make mistakes in forecasts. Therefore, this commentary should be taken only as a possible version of developments in the niche.

In the foreseeable future, there may be much more interesting things in the Efirium ecosystem. At least that is what Jasper de Maire from Outlier Ventures hints at.

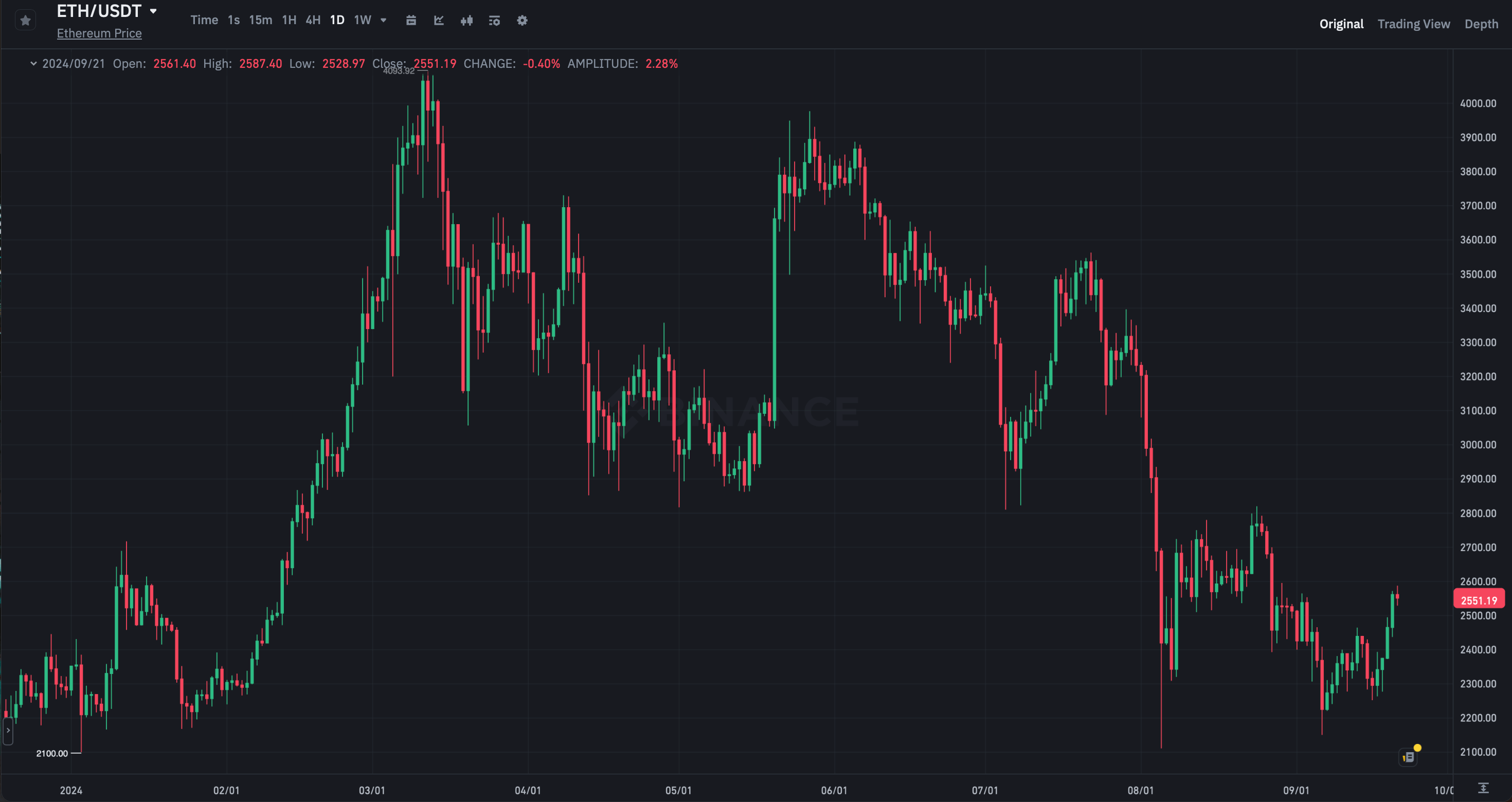

Daily chart of the Etherium ETH rate on the Binance exchange

He noted that as market conditions improve, activity on the Etherium blockchain will also increase significantly. The trend will be driven primarily by speculation as well as increased involvement in decentralised finance.

We will see a surge in activity on the blockchain as the markets move. Obviously, there’s speculation that’s moving into the use of decentralised applications and indicators of activity across the blockchain. I would say speculation will continue to be the driving force and activity will be fuelled by airdrops and new projects entering the mainnet.

Note that ETH has been facing criticism from investors lately, which is primarily due to the cryptocurrency's poor performance. Still, on 1 January 2024, the coin was valued at $2,350, while today its rate is in the zone of 2.5 thousand. Accordingly, it was a bad idea to invest in this project at least for this period of time.

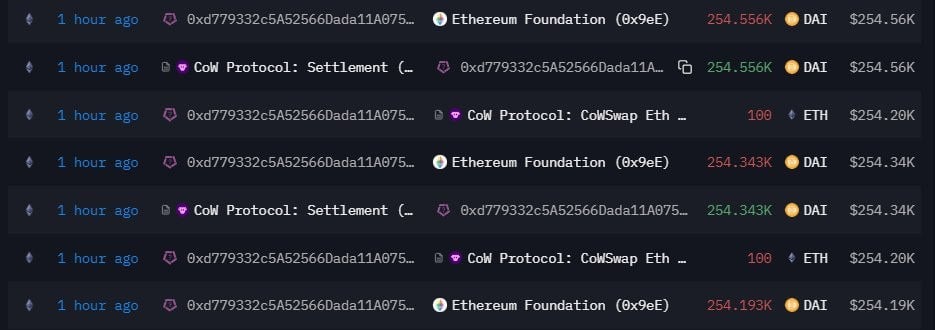

In addition, representatives of the Ethereum Foundation, which is engaged in the development of the blockchain ecosystem, yesterday again reduced its own stock of ETH. Its representatives got rid of 300 ETH equivalent to 760 thousand dollars.

Fresh sales of ether by the Ethereum Foundation organisation

The head of research said that there is currently significant pent-up demand from projects looking to launch on Etherium. As market conditions improve, there could be a wave of new offerings to stimulate activity in various crypto sectors.

However, this does not prevent investors from getting rid of the cryptocurrency. At the end of Thursday, more than 150,000 ETH were deposited on centralised exchanges. According to IntoTheBlock analysts, the figure was a record since January 2024, which confirms the growing pressure of sellers.

Deposits and withdrawals of ETH ether from cryptocurrency exchanges

Bitcoin and other cryptocurrencies have reacted positively to the base interest rate situation. Next, we will have to see what the next phase of the US Federal Reserve's actions will turn out to be. And most importantly, whether the economy will be able to avoid recession given the slowdown in the labour market.