Cryptocurrency mining has become legal in the Russian Federation. What does this mean for the digital currency market and ASIC owners in practice?

Cryptocurrency mining first encountered mass popularity in 2017, when the mining of coins with the help of video cards was actively carried out right in flats. Despite all the hype, all this time the niche was not controlled by the state. The situation has changed in the summer of 2024: now the Russian Federation has adopted a bill to regulate the mining of digital assets, because of which this sphere will no longer be the same as before. We tell you with examples what exactly will change for owners of computing equipment.

Content

- 1 The essence of the law on mining in the Russian Federation: pros and cons

- 2 What is happening with cryptocurrency mining? Popular coins for mining

- 3 How the law on mining in the Russian Federation will affect the cryptoindustry.

- 3.1 There will be fines and harsh penalties for violations

- 3.2 Illegal devices will be a thing of the past

- 3.3 Getting caught for illegal mining will be easier

- 3.4 Taxes will have to be paid for the activity

- 3.5 Why pay tax for mining

- 4 Conclusions about the situation with cryptocurrency mining

The essence of the law on mining in the Russian Federation: pros and cons

Legalisation of cryptocurrency mining in the Russian Federation took place in the summer. At the end of July, the corresponding bill in the second and third reading was adopted by the State Duma, and already on 8 August it was signed by President Vladimir Putin.

As a result, the law became effective on 18 August, and the clause on the register of miners will become relevant on 1 November.

Bitcoin in the Russian Federation

So, what are the features of the new law? First of all, it defines popular terms such as “mining”, “mining pool” and “operator of the mining infrastructure”, thus introducing them into official circulation and making them the basis for further provisions.

At the same time, the document allows for the mining of digital assets by legal entities and individual entrepreneurs, who will be registered in a special register managed by the Ministry of Digital Economy. Individuals can avoid getting into the database, but for this they must fit into certain limits of energy consumption, that is, to conduct activities of a limited scale.

Owners of computing equipment must report their activity to the tax authorities. And it is not just a question of sending figures of earnings in coins, but of providing an address for receiving rewards for work. Thus, the data on profits can be easily cross-checked with the help of ordinary blockchain observers.

A separate point in the law is the possibility of the government banning mining in selected regions. However, it appears that this prospect will only be relevant in extreme cases, and there are no plans to address it under normal circumstances.

The bans in the document also affected the advertising of cryptocurrency projects, exchanges, mining companies and other representatives of the industry. It is believed that in this way the citizens of the Russian Federation will be more reliably protected from fraudsters. As the experience of previous bullruns shows, as crypto rates rise sharply, even those people who have not previously been interested in blockchain technology or heard of it will get involved with it.

Cryptocurrency Miner

In general, the law creates a good basis for regulating the relevant sphere. As a plus, we can note the direct permission to sell digital assets without involving the Russian infrastructure, which means that the likelihood of claims for earning money on coins in case of compliance with the rules is minimised.

Alas, there are some downsides, which is quite typical for draft laws in relatively new areas of activity. For example, the documents do not specify penalties for violations, which creates uncertainty. It is also worth waiting for the details of the mechanism of payment of the relevant taxes to be clarified. Finally, the prospect of registration in the registry also raises concerns – at least from the point of view of personal data security.

What is happening with cryptocurrency mining? Popular coins for mining

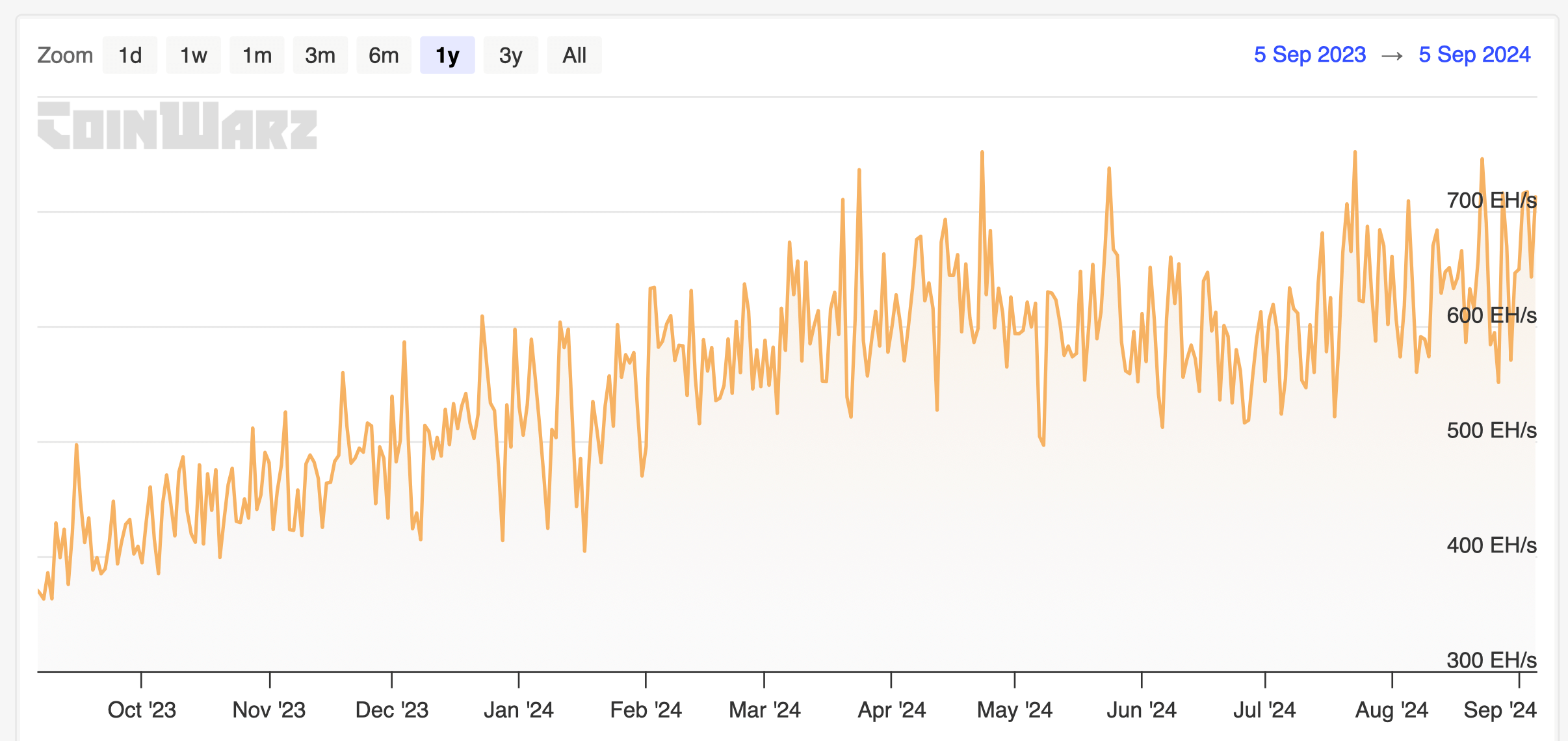

Mining of digital assets continues to gain momentum. In the case of Bitcoin, this is confirmed by the hashrate – that is, the total processing power of the equipment in a given network.

On 23 July 2024, this indicator set a historical maximum at 859 hashpower per second. At the same time, the hashrate graph for the last year clearly shows an upward trend, which confirms the growing popularity of BTC mining.

Bitcoin network hashrate change over the last year

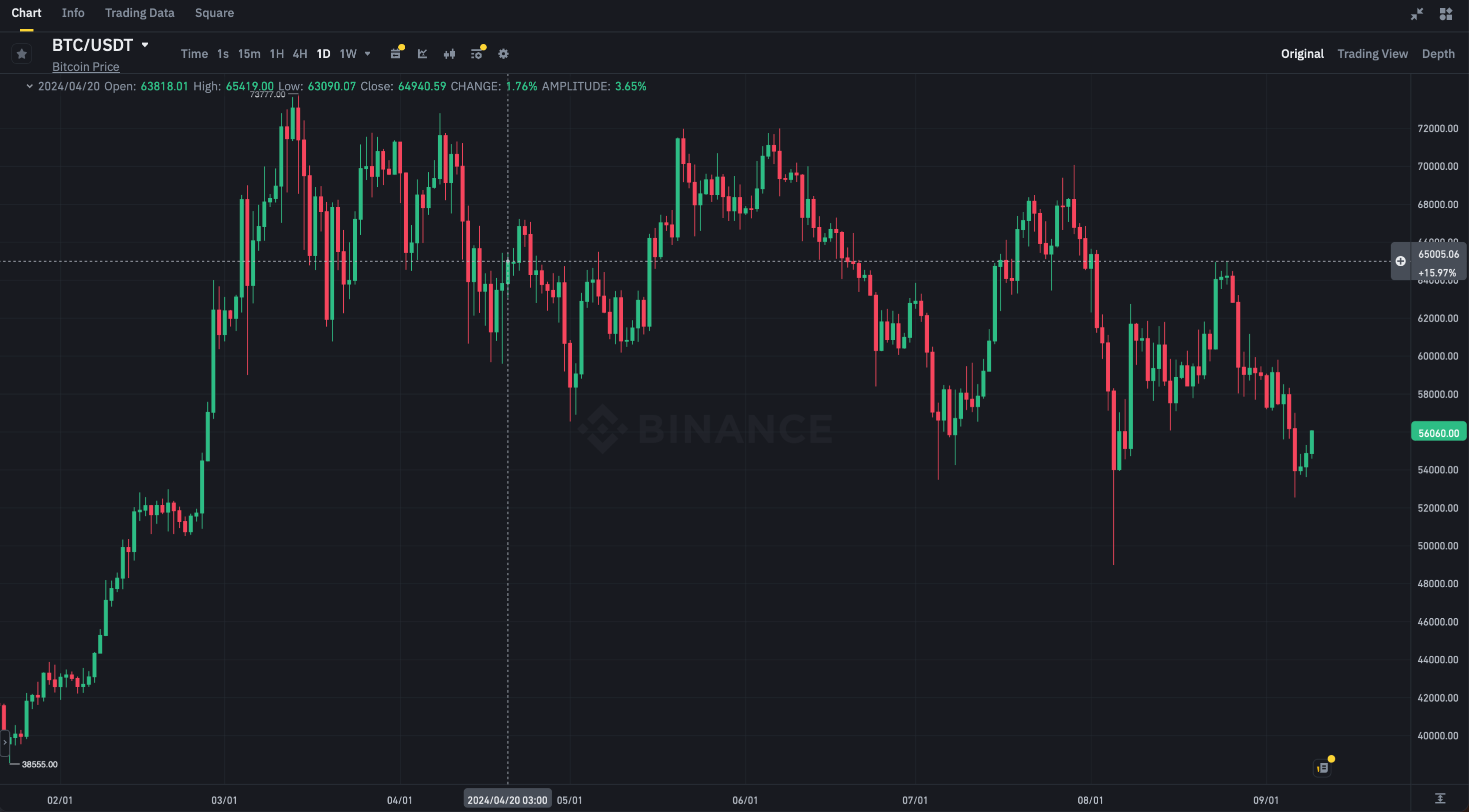

This point is very important in the context of another halving, which took place in the Bitcoin network on 20 April 2024. In a procedure that occurs every 210,000 blocks or approximately four years, the reward to miners for mining a block dropped from 6.25 to 3.125 BTC.

In addition, on that day Bitcoin was valued at approximately $65,000, which is noticeably higher than today's $56,000 level. In other words, back then, miners received more for their work in terms of cryptocurrency, which in addition was more expensive.

Daily Bitcoin exchange rate chart with the specified halving day of 20 April 2024

Despite all of the above, the hashrate continues to grow and set new records. Innovation in the form of using more affordable sources of electricity by large mining companies is also leading to this.

How the law on mining in the Russian Federation will affect the crypto industry

Now to continue earning money on digital assets, it is necessary to take into account the norms of the new law, which changes the situation with crypto mining in practice already now – here are the most notable changes by item.

There will be fines and harsh penalties for violations

Thanks to the regulatory base, mining will no longer be a grey area. Now it will be under the control of the state, which means that it is worth adjusting to this.

Also from this point follows the risk of administrative and criminal liability for violating the law. For example, in July 2024 in Priangarie found about 500 units of equipment for coin mining, which were connected to the electrical grid of the Irkutsk district and consumed electricity at a preferential tariff for household needs.

The damage on the case amounted to 200 million roubles, and in addition, a case was opened for fraud on a particularly large scale. All the miners were eventually seized.

Hunt for illegal cryptocurrency miners

Previously, a miner from Irkutsk used a subsidised tariff for mining on a large scale, mining coins in two buildings that consumed 500,000 kWh each month. As a result, Irkutskenergosbyt obtained a compulsory recalculation of the electricity consumed, which resulted in a 29 million rouble debt. In other words, saving money on crypto mining by cheating others did not work here.

Illegal devices will be a thing of the past

After the adoption of the law, the authorities have been actively engaged in tracking cases of circumventing customs duties and importing illegal equipment without the appropriate documents. In particular, the FCS conducts raids and confiscates equipment.

Sometimes seizures take place directly at customs. For example, in February, Buryat customs officers found two undeclared WhatsMiner M21 ASIC miners in a car. They were being transported by a Mongolian citizen who received 400 rubles for the transport service. In the end, two cases were opened for non-declaration of goods and non-compliance with prohibitions and restrictions, and the equipment was seized.

ASIC-miner for Bitcoin mining

A week later, Krasnodar customs officers reported a similar case. They found five coin mining devices that were hidden inside a Volkswagen Polo car for illegal importation into the country. All the miners were confiscated.

It will be easier to get caught with illegal mining

Many analysts agree that the current bullrun is at a nascent stage. Accordingly, in the future, the rate of most coins may increase significantly along the lines of 2017 and 2021, which will definitely draw people’s attention to the industry

Increased awareness of digital assets will also lead to more uncovered cases of illegal mining, which happens even now.

ASIC miners for cryptocurrency mining

For example, in July, a mining farm illegally connected to the power grid by a 63-year-old owner was discovered in Novosibirsk. The damage to this activity totalled 3 million roubles, and a case was opened for causing property damage by deception or breach of trust.

The pensioner was detained.

Taxes will have to be paid for the activity

Of course, the regulation of mining involves taxation of this activity. However, deductions in exchange for the absence of any legal problems is not the worst idea.

Cryptocurrency miner who paid taxes

In addition, if the version with the continuation of the actual bullrun does turn out to be true, then the earnings of amateurs of digital assets in the future will grow significantly.

Why pay tax for mining

It would seem that mining “in white” will cause additional problems, because for this you will have to register in a special registry and report on income, while paying taxes.

However, experts believe that thanks to the advanced electronic document flow, the process will eventually turn out to be quite simple. In addition, legalisation and cooperation with the authorities will allow for state protection in case of any malfunctions such as equipment theft.

Conclusions about the situation with cryptocurrency mining

Legalisation of mining is a step in the right direction, as it allows you to engage in cryptocurrency mining officially and in an understandable way.

ASIC miners for cryptocurrency mining

It is also worth remembering the example of the United States, where the lack of an adequate regulatory framework for cryptocurrencies leads to claims of regulators to blockchain developers on the spot. In addition, as Howard Lutnick, head of financial giant Cantor Fitzgerald, noted the day before, the unclear situation with regulators also prevents representatives of traditional finance from finally starting to use Bitcoin.