Experts don’t know how the Bitcoin exchange rate will behave given today’s cut in the benchmark interest rate. Why?

Predicting the Bitcoin rate for the next few days or weeks is hardly the most difficult task at the moment. It’s all about the upcoming FOMC meeting, where representatives of the US Federal Reserve will announce a decision on the base interest rate. Analysts at trading firm Zerocap believe that the Federal Reserve’s strategy is hard to guess. As a result, the price of Bitcoin may react to the event as a sharp rise or fall, which is also relevant for the entire cryptocurrency market as a whole.

Recall that when the Fed raises the rate, the cost of financial borrowing for banks and businesses rises, which reduces the overall liquidity in the market. Investors in such conditions tend to transfer capital from riskier assets like Bitcoin and other cryptocurrencies to more stable and conservative instruments like gold. As a result, the demand for digital assets is decreasing, which can lead to a fall in their prices.

But when the base interest rate falls, the availability of credit stimulates capital inflows into riskier and more volatile assets like cryptocurrencies. Investors are often looking for alternatives to traditional financial instruments against the backdrop of declining returns, with BTC becoming a rather attractive means of portfolio diversification.

Still, over the past year, the cryptocurrency has increased in value by 125 per cent – and this is an excellent rate of return for such a short period of time.

Bitcoin BTC rate changes over the past year

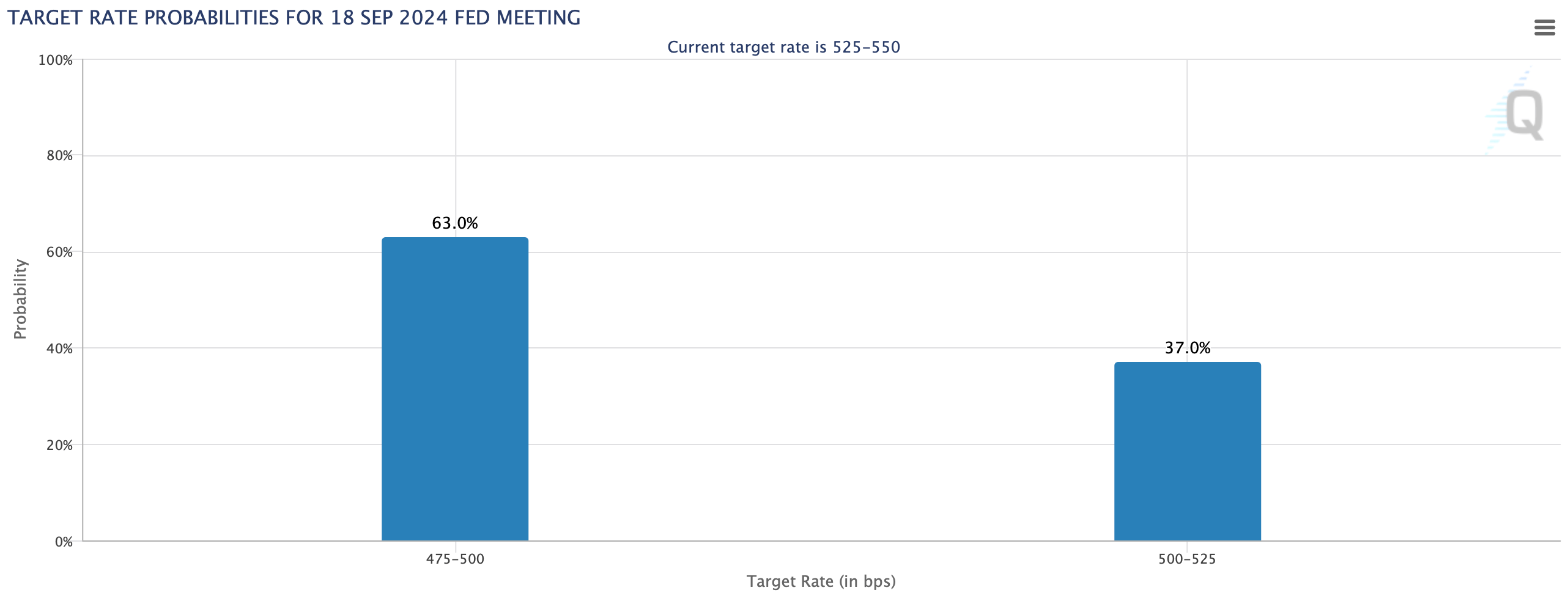

As of this morning, traders believe that the Fed will still cut the rate by 50 basis points. The probability of this happening is estimated at 63 per cent.

The probability of the US Fed officials cutting the benchmark interest rate by 50 and 25 basis points respectively today

This is an important event, as the US Fed has not cut the rate for more than four years. Accordingly, the impact of the event on the market will be tangible.

What will happen to the Bitcoin rate?

Zerocap Chief Investment Officer Jonathan de Wet said in an interview with Cointelegraph that the market now expects a rate cut of at least 50 basis points or 0.5 per cent with a 62 per cent probability. Such expectations and rumours have already contributed to a short rally that saw BTC surpass the $60,000 mark on September 13.

Recall that a larger reduction in the base interest rate is generally better, because it will more noticeably ease the pressure on the economy. However, in this case, experts are afraid that such a move by the U.S. Federal Reserve hints at significant risks of recession in the U.S. economy, which in theory will create panic in the markets. Therefore, it is premature to talk about the optimal size of the rate cut - everything depends on the explanations of the Fed representatives.

Change in the market capitalisation of the cryptocurrency industry over time

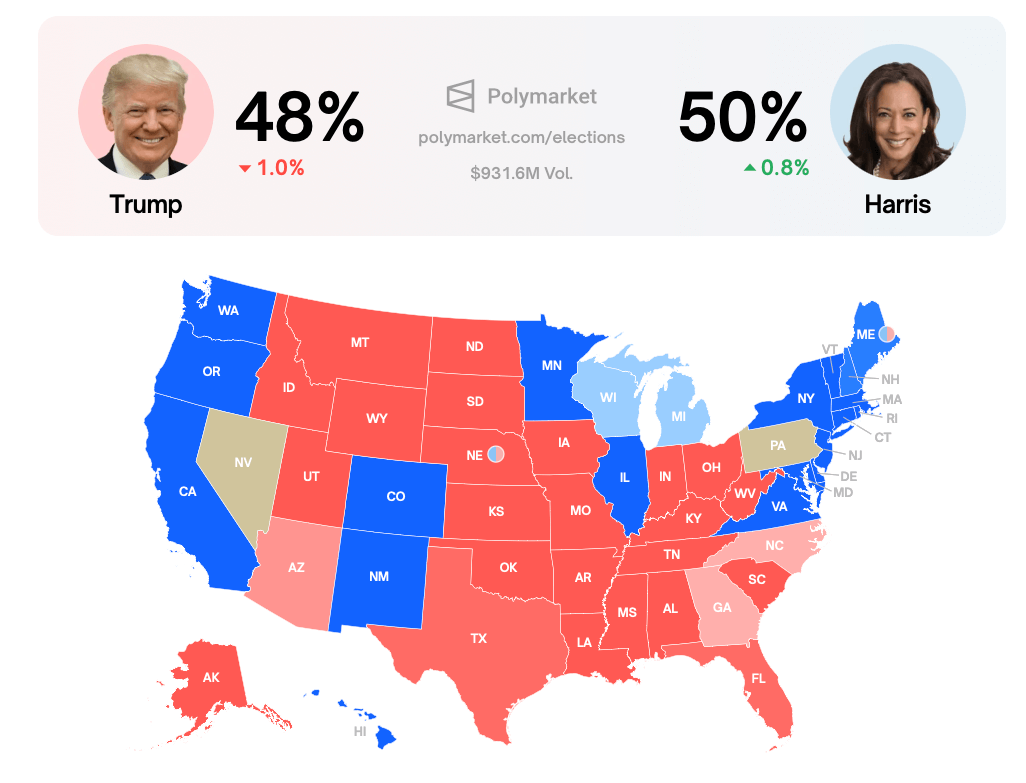

According to the expert, the price dynamics of digital assets is “difficult to predict” because of the continuing uncertainty about the impact of a rate cut in the short term. On top of that, all of this is further complicated by instability due to the upcoming US election in November. Here is a commentary on the matter.

We see a downside target for BTC at $53k after the recent range lows, and an upside target at $65k after an upside breakout from the descending wedge on the chart. Until we get closer to the election, it’s hard to say which direction to go next, but the upside risk environment should lead to short-term positive sentiment.

U.S. presidential candidate Kamala Harris

De Wet added that the ongoing uncertainty surrounding the upcoming US presidential election is putting pressure on the crypto market.

Still, investors are trivially unaware of how the victory of Kamala Harris can affect crypto in the United States. Recall, for all this time she never commented on her own attitude to the coin industry.

Harris is leading in the polls and won a convincing victory over Trump in the recent debate. If those odds start to shift towards the Republicans, watch for long trades in banks, energy and Bitcoin should Trump win.

Recall that Donald Trump has previously promised to support the digital asset industry, which is evident in his actions. The day before, he announced the launch of a family DeFi project called World Liberty Financial, which we wrote more about in a separate article.

The odds of Trump and Harris winning according to the Polymarket platform

De Wet confirmed that Zerocap management remains on the side of the forecast that the Fed will lower the rate by 50 basis points at once. On the one hand, this could be a good signal for Bitcoin’s growth. However, too sharp a rate cut may frighten investors because of the prospect of approaching recession.

Meanwhile, analysts at QCP Capital see an increase in implied volatility in the options market as the expiration date approaches at the end of the week. As Bitcoin’s spot price has remained relatively stable over the past 24 hours, the current put/call ratio has tilted in favour of put options, indicating a more cautious stance by traders. Here’s the analysts’ view as quoted by The Block.

As the first Fed rate cut of the cycle approaches, market tensions are rising, amplifying the impact of any unexpected macroeconomic data, and the probability of a 50 basis point rate cut has risen sharply. This is reflected in rising volatility – on Friday, implied volatility rose 8 points for Bitcoin and 20 points for Etherium.

Cryptocurrency investors during the bullrun

A fresh report from Bitfinex Alpha also predicts an increase in crypto market volatility, driven by investor expectations regarding the US Federal Reserve’s actions.

We believe that the potential for market volatility this week is quite high due to investors’ expectation of the Fed’s rate cut decision.

Experts specified that the market reaction may differ significantly depending on the size of the cut. A 25 basis points rate cut can support moderate risk, while a more significant rate cut of 50 basis points can provoke active buying. The reverse scenario is also relevant, i.e. profit taking among cautious investors.

As a result, the opinions of different analysts sometimes turn out to be completely opposite. However, it will be possible to find out the peculiarities of the market behaviour in response to the US FRS decision soon. Today's FOMC meeting will be held at 21:00.