Investors are willing to take more and more risk on cryptocurrencies. How will this affect the market for digital assets?

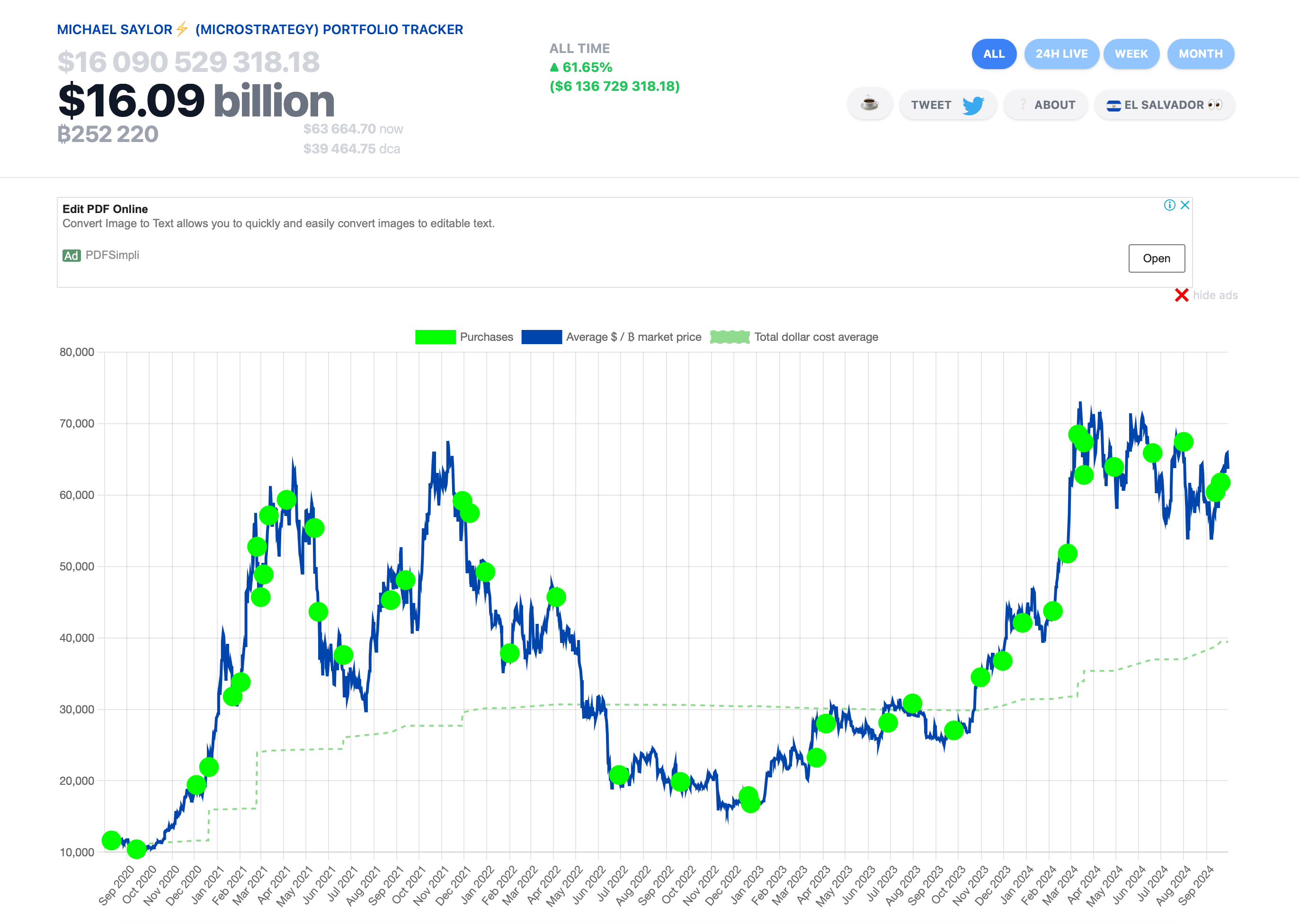

Investors’ appetite for risk is growing – at least that’s the conclusion we can draw given the popularisation of new exchange-traded funds based on MicroStrategy shares. We are talking about the giant from Michael Saylor, which is the largest bitcoin holder among publicly traded companies. It started acquiring its first BTC back in August 2020 – since then, MicroStrategy’s coin balance has grown to 252,220 BTC with a total value of about $16 billion at today’s cryptocurrency exchange rate. And now capital holders are paying more and more attention to this company.

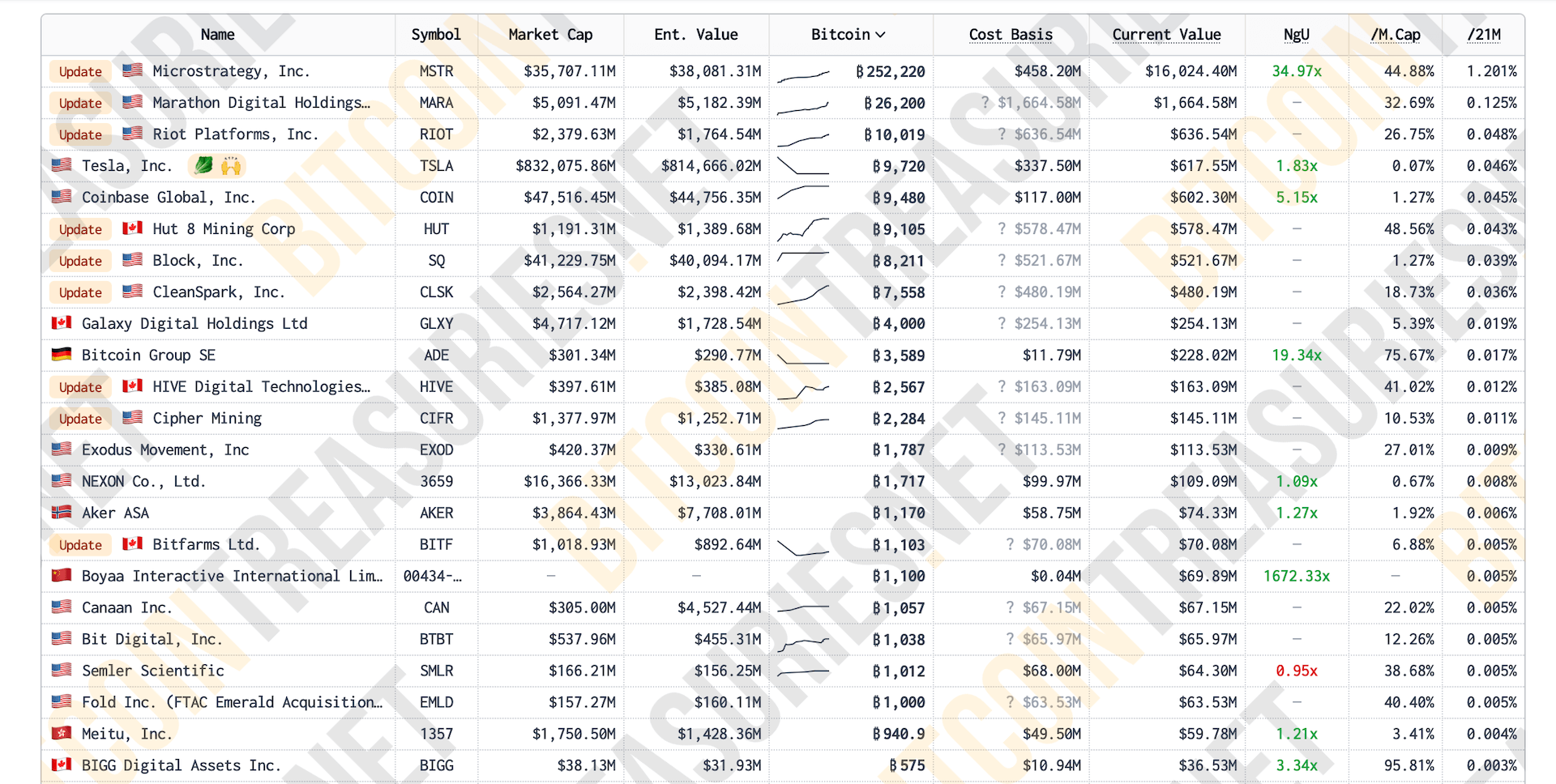

This is what the current ranking of public companies by the number of bitcoins at their disposal looks like. As you can see, MicroStrategy’s stock beats its nearest competitor by almost ten times.

The largest holders of bitcoins among public companies

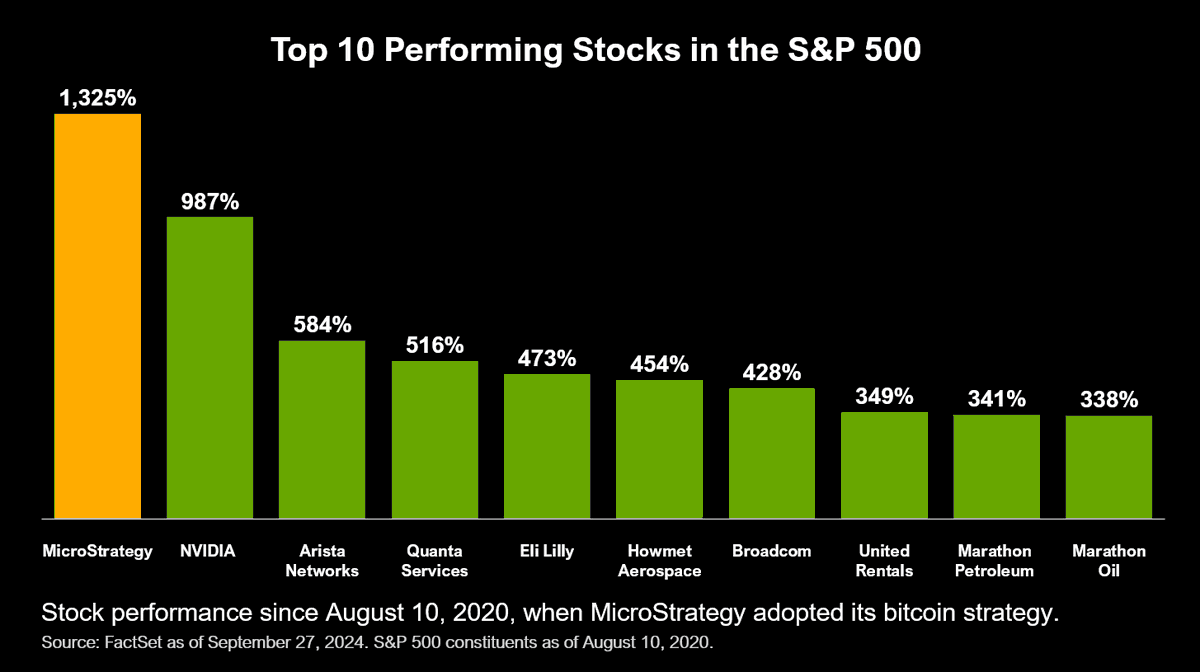

In addition, the company’s stock showed a much better growth result compared to the most profitable representatives of the S&P500 index from 10 August 2020 – that’s when MicroStrategy acquired the first BTC.

Over that span, MSTR shares rose 1,325 per cent in value, while second-place holder Nvidia jumped 987 per cent. Here’s the relevant comparison, which MicroStrategy co-founder Michael Saylor posted on his Twitter.

A comparison of MicroStrategy’s returns since 10 August 2020 and the top performers in the S&P500 index

What’s going on with MicroStrategy stock

MSTX is the ticker symbol for the Daily Target 1.75X Long MSTR ETF, a leveraged exchange traded fund. This instrument provides an opportunity to use 1.75X capital to capitalise on fluctuations in the price of MSTR.

The ETF itself is designed for traders who want to maximise their returns through market movements in equities.

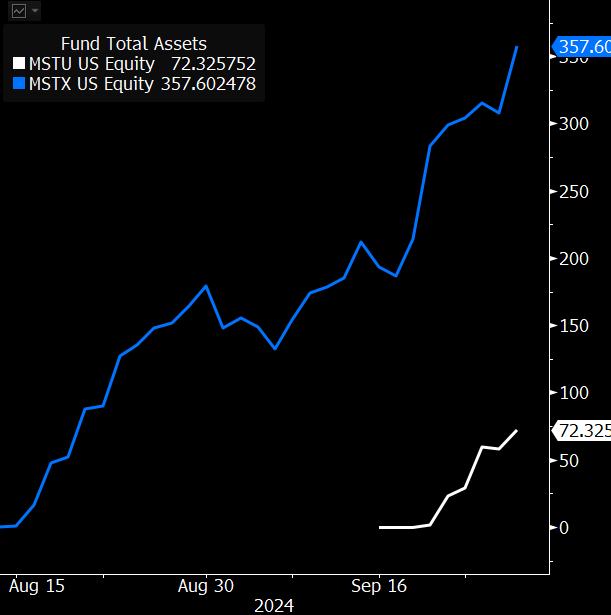

Gains in funds under management for MSTU and MSTX

Given MicroStrategy's near-total involvement in the crypto market, the fluctuations of both MSTR and exchange traded funds are noticeably exposed to Bitcoin volatility. For many investors, this may cause concern, as digital assets are sometimes capable of producing drawdowns of several tens of per cent per day.

However, the reputation of BTC and other cryptocurrencies in general is improving over time, which is primarily due to the situation with spot ETFs on bitcoin and ether. These were launched in the US in January and July 2024 respectively, after which they attracted the attention of investors - especially in the case of BTC. In addition, the biggest names in the world of finance are increasingly in favour of companies adopting the coins. The latest to endorse this view was Cantor Fitzgerald CEO Howard Lutnick.

MicroStrategy’s share price change over the past year

According to Decrypt’s sources, MSTX was launched in August 2024 by Defiance ETFs, a company specialising in financial derivative products. Just a couple of weeks after launch, MSTX has already attracted more than $300 million in assets under management, indicating high interest in the instrument among traders.

MSTU is an even riskier ETF that launched the week before last. It offers 2x leverage for traders. That means the fund seeks to provide a 2x return relative to the asset being tracked.

MSTU has also seen significant capital inflows, having raised more than $80 million under management in the short period after launch. All of this suggests that large-cap holders are increasingly looking at the realm of digital assets for communication.

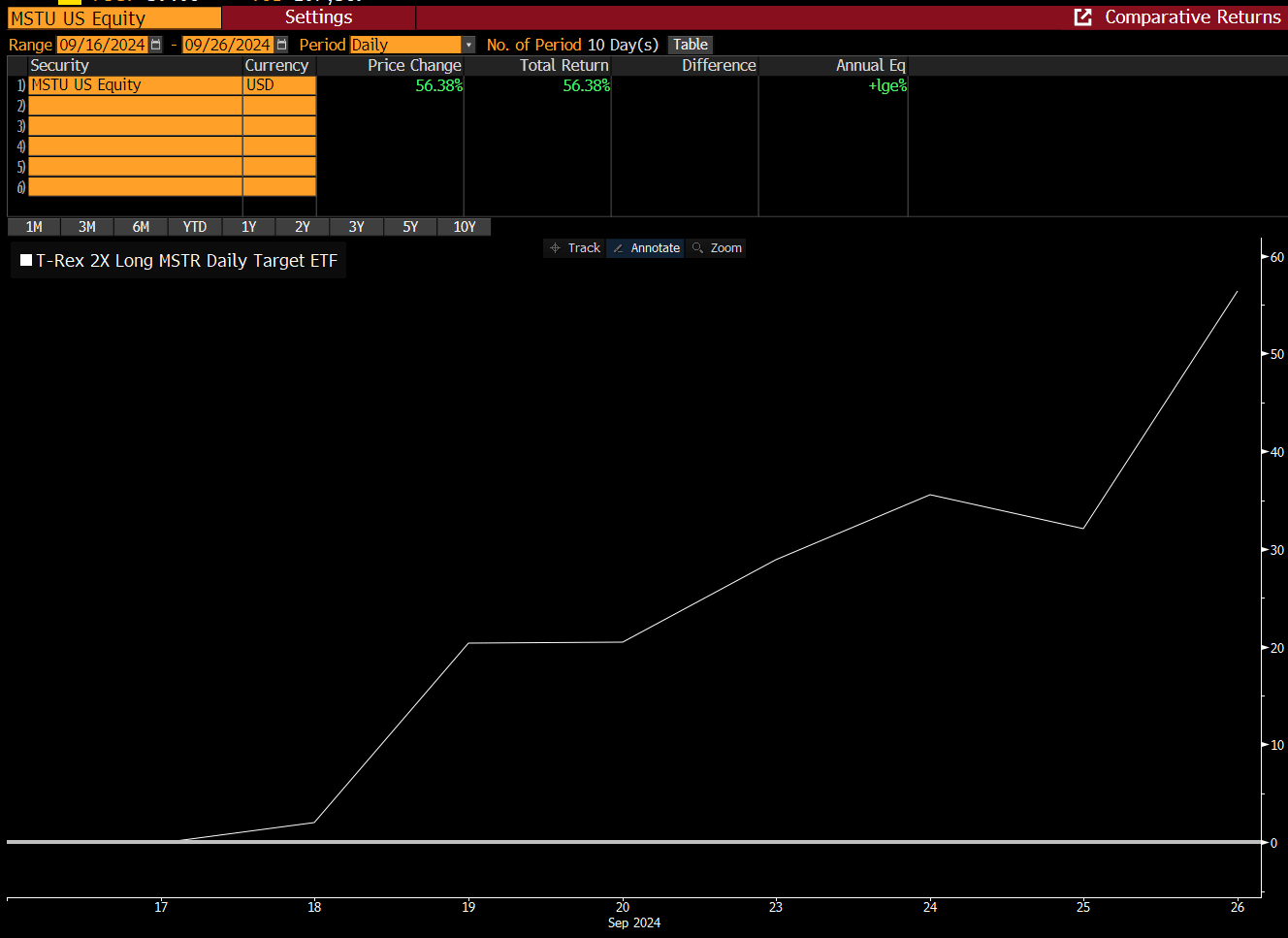

MSTU is among the top 20 U.S. ETFs in terms of returns

Similar to MSTX, the MSTU instrument is a leveraged fund, meaning it uses borrowed money for positions. This creates potentially higher returns for investors, but also increases the risk of loss, especially in the event of unfavourable market movements.

Investors considering such products are clearly prepared for significant swings in the charts.

MicroStrategy continues to mess around with cryptocurrencies

Bloomberg analyst Eric Balchunas expressed surprise at the popularity of new risky investment products in the form of MSTX and MSTU. He noted that he did not expect such a high demand for such investments, calling their popularity a “wild” phenomenon.

According to him, the instruments are characterised by too high risk. And judging by the first glance, they are unlikely to find a hype in the sphere of traditional finance.

MicroStrategy’s bitcoin purchases

That said, MicroStrategy is already positioning itself as a “Bitcoin ecosystem development company.” It attracts investors looking to gain indirect access to the largest cryptocurrency through the purchase of its shares.

MicroStrategy is also exploring other projects in the ecosystem, including the Lightning Network and digital identities on the blockchain.

Lightning Network is a second-tier solution based on Bitcoin's network that enables faster and cheaper transactions. And while the blockchain has been around for quite some time, it is still criticised due to its less than intuitive user interaction and low prevalence. We got to know LN and the most popular online wallets in practice. The process and its conclusions are described in detail in a separate material.

MicroStrategy Executive Chairman Michael Saylor

The ETFs listed provide leverage based on MicroStrategy shares, which makes them extremely volatile. For example, the company that created the MSTX fund has warned that it is not intended for investors who do not plan to actively manage their portfolios. Thus they emphasise the need for constant monitoring and risk management when investing in such products.

The conclusions from the situation are positive: many members of the financial market are willing to mess with instruments based on a company that interacts with bitcoins. This is a risky activity in itself, but in addition they also choose leveraged exchange-traded funds, and the demand for such a thing surprises Bloomberg employees. As a result, we can talk about the normalisation of crypto and its increasing spread in the markets.