SEC Chairman Gary Gensler was accused of deliberately causing problems for the cryptocurrency industry. What was his response?

On Tuesday, a US Congressional hearing was held, along with invited SEC commissioners and the regulator’s chairman Gary Gensler. The latter was subjected to lengthy questioning by politicians: still, many congressmen are unhappy with how harshly the SEC treats the crypto industry, while providing no clarity for its representatives. Gensler was also hinted at the need to integrate new laws to regulate stablecoins, as well as clearly illustrating several times the wrongness of the SEC chairman in his attitude towards the coin market.

How the SEC’s Gary Gensler was criticised

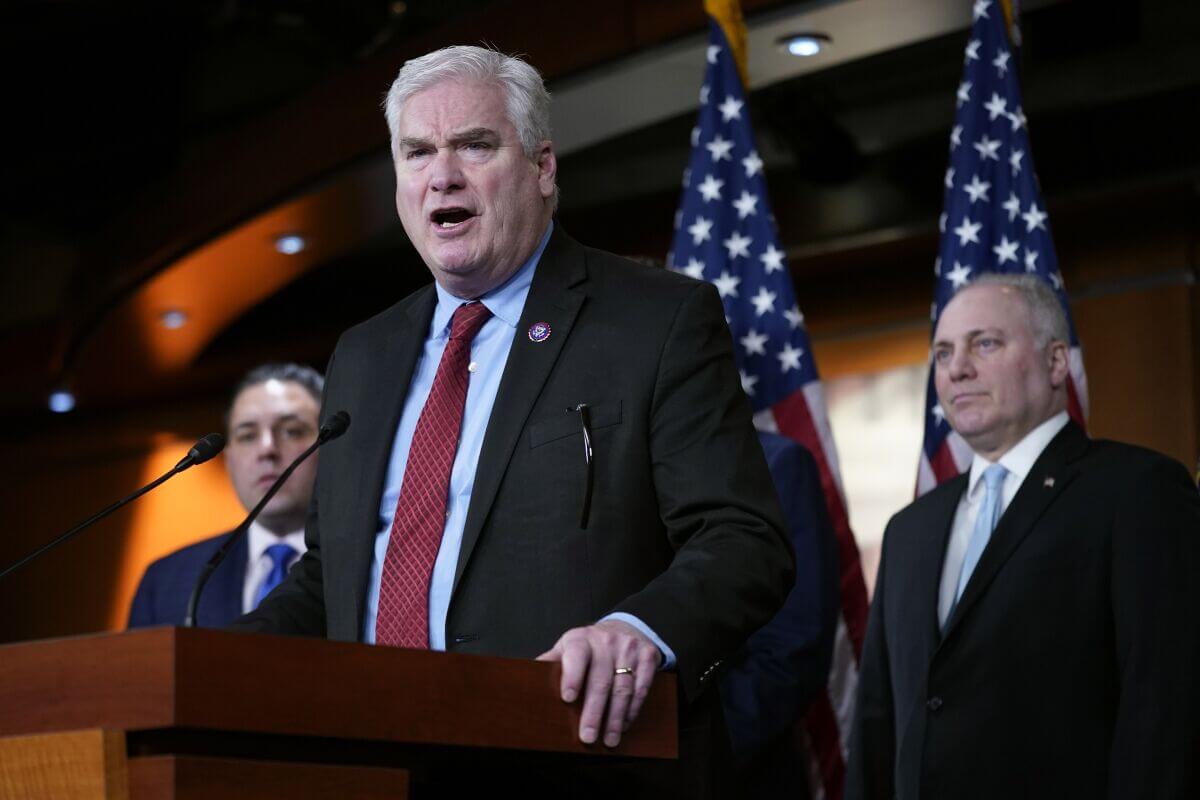

During a tense debate in the House Financial Services Committee, Republican majority member Tom Emmer asked the SEC chairman about the case of startup DEBT Box.

Congressman Tom Emmer

Recall that a federal judge in Utah had previously criticised the SEC's actions in the case and said the regulator had acted in bad faith. As a result, the SEC was ordered in March to pay sanctions, including attorneys' fees and costs. In addition, the judge criticised what he described as misleading statements by the SEC.

The day before, SEC officials said that they did not actually consider cryptocurrencies to be unregistered securities when they referred to them as such. What was meant was a set of contracts, expectations and understandings related to the sale of such assets. However, market participants did not accept such a position of the Commission, because the regulator's actions have already caused serious damage to the niche.

Securities Commission Chairman Gary Gensler

According to The Block’s sources, Emmer didn’t forget to mention the regulator’s failure in a direct confrontation with Gensler. Here’s one of his questions posed to the SEC head.

Does the fact that we’re talking about this today embarrass you in the slightest?

Gary himself, however, traditionally preferred to dodge the question. All he said was that things really didn’t go according to plan with DEBT Box. Emmer noted that the correct answer here is yes. That is, Gensler should be properly worried that the regulator under his leadership misled market representatives.

During the hearing, some politicians also criticised the SEC’s approach to regulating cryptocurrencies: they said that the rules to control the industry are still not clear, while clarity in this matter is demanded by millions of representatives of the industry.

Congresswoman Maxine Waters

In contrast, Democrat Congresswoman Maxine Waters praised the SEC for doing its job to protect investors.

However, even Waters had cause for concern. She said a bill to regulate U.S. issuers of stablecoins needs to be finalised this year.

I want us to get a grand bargain on steblecoin and other long overdue bills. I firmly believe we can strike a deal that prioritises robust consumer protections and strong federal oversight.

This difference of opinion on Gary Gensler's performance may be due to politicians belonging to different forces. Still, he was appointed to the post of SEC head by President Joe Biden, who belongs to the Democrats. Therefore, the endorsement of the Commission's actions from Waters does not seem surprising.

The aforementioned bill on stablecoins is being developed in co-operation with Republican Patrick McHenry, who plans to retire by the end of the year. In response to Waters, he confirmed that Congress is capable of coming to a consensus on the issue.

The closer the presidential election gets in November, though, the harder it will be to find common ground between Democratic and Republican representatives.

Congressman Patrick McHenry

McHenry also declared the SEC’s policies “predatory.” He criticised the actions of the regulator’s leadership, which eventually led to the start of multiple lawsuits.

McHenry also disliked the lack of clear language even for individual asset classes from the SEC chairman.

Democrat Richie Torres peppered Gensler with questions about how the agency defines securities, using a ticket to a New York Yankees game as an example. The politician asked Gensler if a ticket to a Yankees game would be considered an unregistered security because it could be resold and increase in value, as well as provide access to the game. Gary’s answer was in the negative.

Torres asked the question for a reason, as the SEC had previously sued the Stoner Cats project from actress Mila Kunis. It was a cartoon film that was accessed exclusively by holders of eligible NFTs.

Congressman Ritchie Torres

The Commission saw in what was happening the signs of unregistered securities, as such tokens can grow in value because of their value. Everything ended up with the closure of the project and even destruction of the tokens, which was also insisted on by the SEC.

However, Torres sees no fundamental difference between a ticket to a sports team game and a similar NFT. Here’s his rejoinder.

In terms of the federal securities laws, is there a legal difference between buying a Yankees game ticket that offers you an experience of a Yankees game and buying an NFT that offers you an experience of unique content?

Gensler responded that it’s all about how something is offered and marketed and “whether people are committed to a common enterprise in the expectation of profit,” citing the Howey test. That test is based on a 1946 U.S. Supreme Court decision, often cited by the SEC to determine whether an asset qualifies as an investment contract.

Torres stopped Gensler, however, because essentially the chairman of the regulator has taken to listing the properties of securities. Here is the relevant video.

U.S. House of Representatives member Tom Emmer accused Gensler of using the term “cryptocurrency securities,” which isn’t actually listed anywhere. According to him, Gary coined the term himself and used it to create problems for the coin industry, and he did it on purpose.

The conclusions of the meeting are clear - Gary Gensler is a terrible SEC chairman, under whose leadership the regulator has become a tool to fight the coin niche. This is a universally recognised assessment of the Commission's performance, and one with which we can agree. Alas, that's exactly what the future for crypto may hold if Kamala Harris wins the presidential election. Still, she is tentatively considering Gensler's candidacy for the post of Treasury Secretary, which means that he will obviously have more opportunities to fight the industry in that case.