Senators have called on the SEC to clarify the regulator’s position on cryptocurrency airdrops. What does it mean?

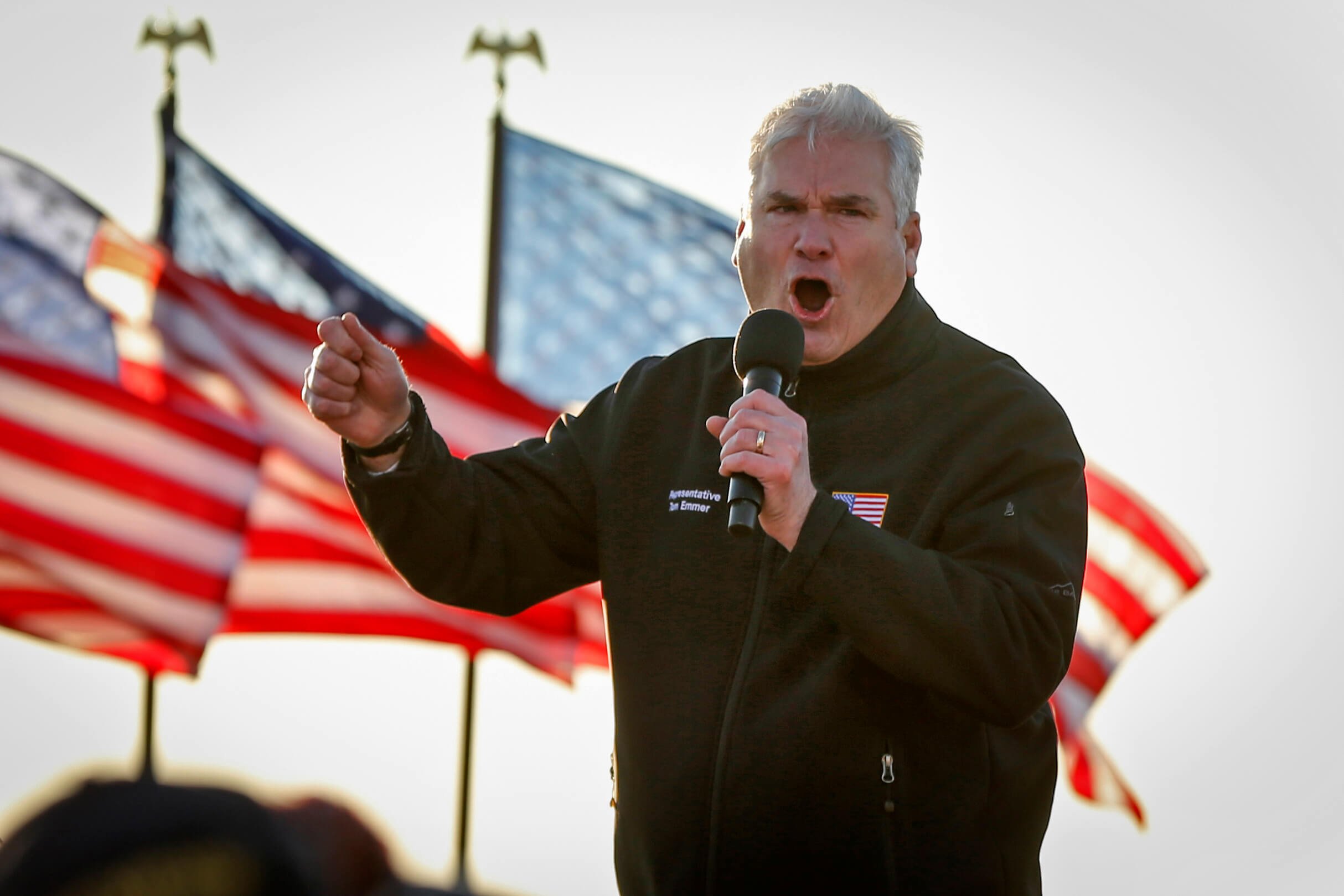

Representatives of the US Republican Party want to get a clear answer from the Securities and Exchange Commission (SEC) on the regulation of digital assets. In particular, they are now interested in the regulator’s attitude to airdrops in the cryptocurrency industry. In an open letter sent to SEC Chairman Gary Gensler on Tuesday, House Financial Services Committee Chairman Patrick McHenry and House Majority Leader Tom Emmer accused the SEC of “putting its finger on the scales,” meaning it is biased against digital assets.

Recall, airdrop is a procedure of free distribution of tokens among the participants of the project's community. They are usually held to promote new platforms, increase interest in the ecosystem or reward users for participating in its development.

Often the conditions for receiving tokens include performing certain actions such as subscribing to the project’s social networks, registering on the platform, or actively participating in promotion. In the case of decentralised finance platforms, receiving coins also requires providing liquidity, which we successfully did earlier in the spring.

The interface of the Kamino lending platform based on the Solana network

What’s happening with cryptocurrencies in the US

In an open letter to the SEC, there is the following quote published by representatives of The Block.

By creating a hostile regulatory environment, including making airdrop allegations in various cases and repeating warnings of additional enforcement actions, the SEC is putting its finger on the scale and denying American citizens the opportunity to shape the next stage of the internet’s evolution.

The SEC has indeed become a punitive body of sorts. Still, the regulator refuses to create an adequate framework for regulating digital assets and regularly fines popular cryptocurrency companies.

The day before, SEC representatives said that previous comments about cryptocurrencies belonging to securities were inaccurate, because the staff was referring to a set of contracts, expectations and understandings associated with such assets. However, digital asset enthusiasts did not appreciate such an apology. Lawyer John Deaton said that the damage to the coin niche due to the regulator's strange actions reached $15 billion.

Senator Patrick McHenry

The politicians also cited instances where the SEC has directly mentioned the issue of airdrops: at the time, the regulator said they could be considered “sales or distribution of securities.”

Emmer and McHenry argue that developers “have been forced to block Americans” from receiving crypto during such campaigns. Still in this way they protect themselves from possible problems with US regulators, which quite often result in huge fines.

US Congressman Tom Emmer

Politicians continue.

By banning Americans from participating in Airdrop, the SEC is preventing cryptocurrency users from realising the full benefits of blockchain technology.

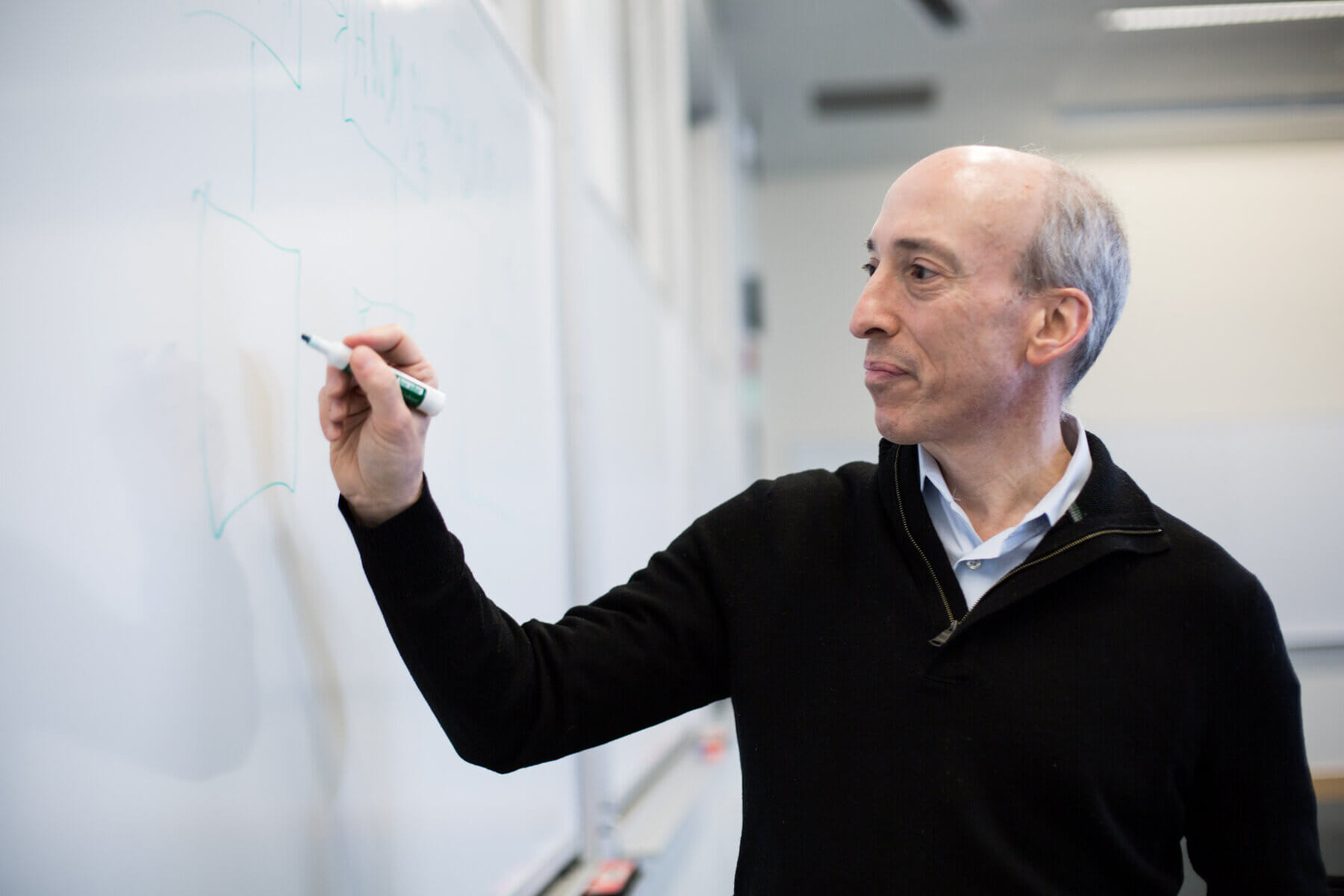

Republicans asked Gensler a series of questions – including how the Commission plans to distinguish airdrops from free airline miles or credit card points.

They said they want an answer from Gensler by 30 September. At the same time, SEC representatives have not commented on the appeal.

SEC head Gary Gensler

McHenry and Emmer have criticised Gensler over the past few years for his approach to regulating cryptocurrencies. Gensler has argued that most cryptocurrencies are securities and, at the same time, encouraged crypto platforms to register with the SEC.

Meanwhile, McHenry and Emmer led an initiative to pass a cryptocurrency market structure bill in the House of Representatives that would split jurisdiction over cryptocurrencies between the SEC and give new powers to the Commodity Futures Trading Commission (CFTC).

Things would go much better for crypto investors under one more condition – if U.S. spot ETFs based on Etherium were to launch in early 2024. This was stated by Bitstamp’s CEO of the Americas, Bobby Zagotta, whose remarks are cited by Cointelegraph. Here’s the relevant quote.

I think ETFs have underperformed expectations, but I attribute that to the current moment in time. Cryptocurrencies are now behaving like any other risk asset, which shows the maturity of this market compared to a year ago or even two years ago.

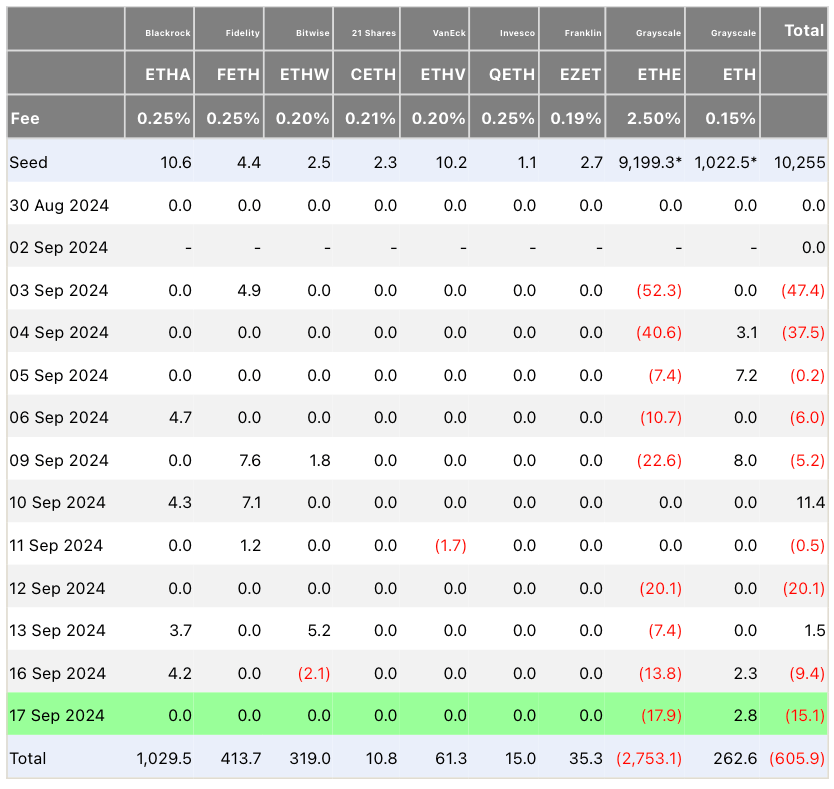

In the last 24 hours, spot Efirium-ETFs recorded a net outflow of $15 million. According to the Farside platform, total outflows since the launch of Efirium exchange-traded funds have reached $605.9 million.

Inflows and outflows from Efirium ETFs in the US

Bitcoin-based spot ETFs were launched in the U.S. on 11 January 2024, but Efirium ETFs only started trading in July. The reason for this was primarily the decision of the Securities Commission, which took a long time to review the applications submitted by issuing companies.

Zagotta added that the launch of the Efirium ETF was not a good time for the market as a whole. However, the industry had already moved into what is known as a sideways trend, which means trading in a certain price range without a clear dominance of buyers or sellers.

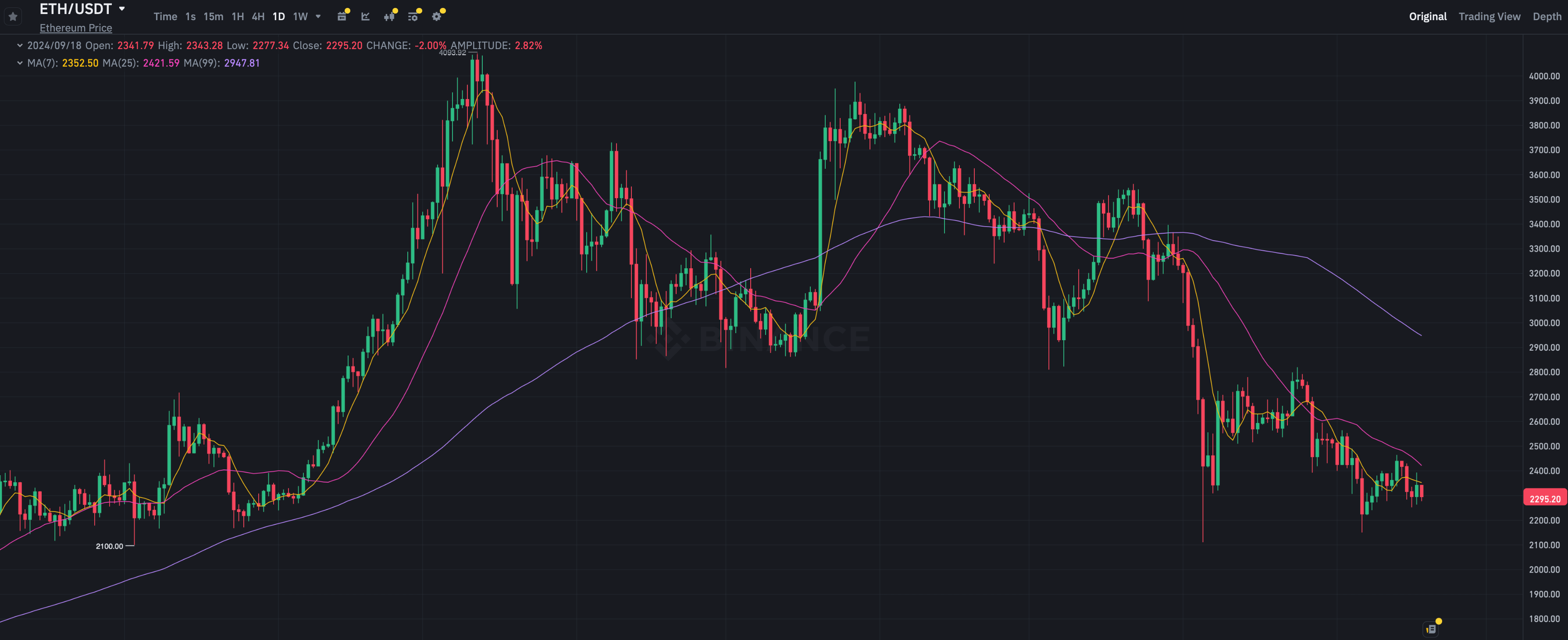

Daily chart of the Etherium ETH rate on the Binance exchange

The expert continues.

So I think additional factors influenced the launch of the ETF. If the Efirium-ETF had been launched at the same time as the Bitcoin exchange-traded funds, I think things would have worked better.

In 38 trading days, less than a third of Efirium-ETFs have recorded positive net inflows. The stats are mostly spoilt by continued outflows from Grayscale’s ETHE fund and the relatively poor performance of all other ETFs.

The senators' questions are a reminder of the problems with the regulation of digital assets in the US. Still, despite the popularity of cryptocurrencies in the country, blockchain platform developers typically prohibit Americans from receiving free coin giveaways because of the risks of regulatory attention. It's certainly time for the SEC to clarify its own position here at least in 2024.