The new artificial intelligence-based economy of the future will benefit from cryptocurrencies. Why?

Artificial intelligence will definitely transform the global economy in the future. However, in order for this process to take place without delays, financial transactions need the integration of micropayments in cryptocurrency. This is the opinion of the experts of the brokerage firm Bernstein, who have analysed the possible consequences of the development of this sphere and described the role of digital assets in what is happening.

According to some experts, the main option for the application of digital assets in recent years are stablecoins. They fulfil two important tasks.

First of all, dollar-linked tokens allow residents of countries with troubled economies to protect their capital from depreciation in the local currency. In addition, staples in some states offer a much more accessible path to the dollar.

Bitcoin and the dollar struggle

The second scenario is the ability to secure earnings from the government. Still, having assets in a blockchain makes them virtually unavailable for seizure by states, and they’re also easier to store and “transport.”

However, Bernstein analysts see an extremely promising direction for the use of digital assets.

How artificial intelligence will help cryptocurrencies

The modern global financial system is built on the basis of networks created in different jurisdictions. They are linked together by global superstructures like SWIFT for cross-border transactions.

However, to access this system, individuals and businesses must prove their identity to obtain bank accounts or credit cards. This presents an obvious challenge for automated AI without the necessary identity documents.

A major hurdle for the economy of the future will be the inability of the financial system to efficiently process micropayments. Artificial intelligence may need to make small transactions almost instantaneously, for example – transferring money for data or content consumption. However, the high fees of traditional systems due to the complexity of technology and human involvement make such a process unprofitable.

Popular cryptocurrencies

According to The Block’s sources, to support the needs of an AI-driven economy, the financial system must evolve to provide seamless and low-cost micropayments. This is where cryptocurrencies come to the rescue.

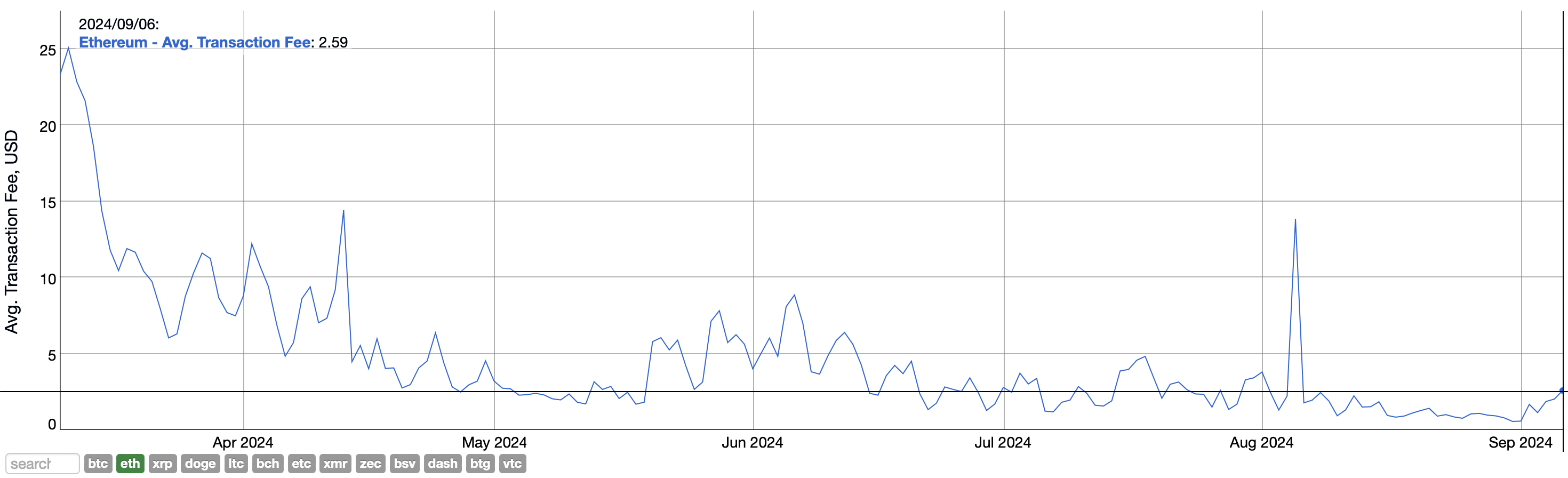

It is important to note that not all blockchains are suitable for fast and small transactions. As of yesterday, the average cost of an operation in the Etherium network was the equivalent of $2.59, which is too much to send several transfers over the course of a day.

Accordingly, modern blockchains with high-speed, low-cost transactions like Solana would be more appropriate here. In it, a typical transfer of value costs a hundredth of a cent.

Graph of the average fee on the Etherium network

Fast transactions using artificial intelligence require instant identity verification with settlement and minimal costs. Cryptocurrencies could meet these needs by providing global digital payments and enabling microtransactions with near-instant machine-to-machine settlement.

AI agents without the ability to open bank accounts could use crypto wallets based on popular blockchains, processing small payments down to the 16th decimal place. In addition, zero-disclosure proof-of-stake technology could link AI identities to owners among individuals or businesses.

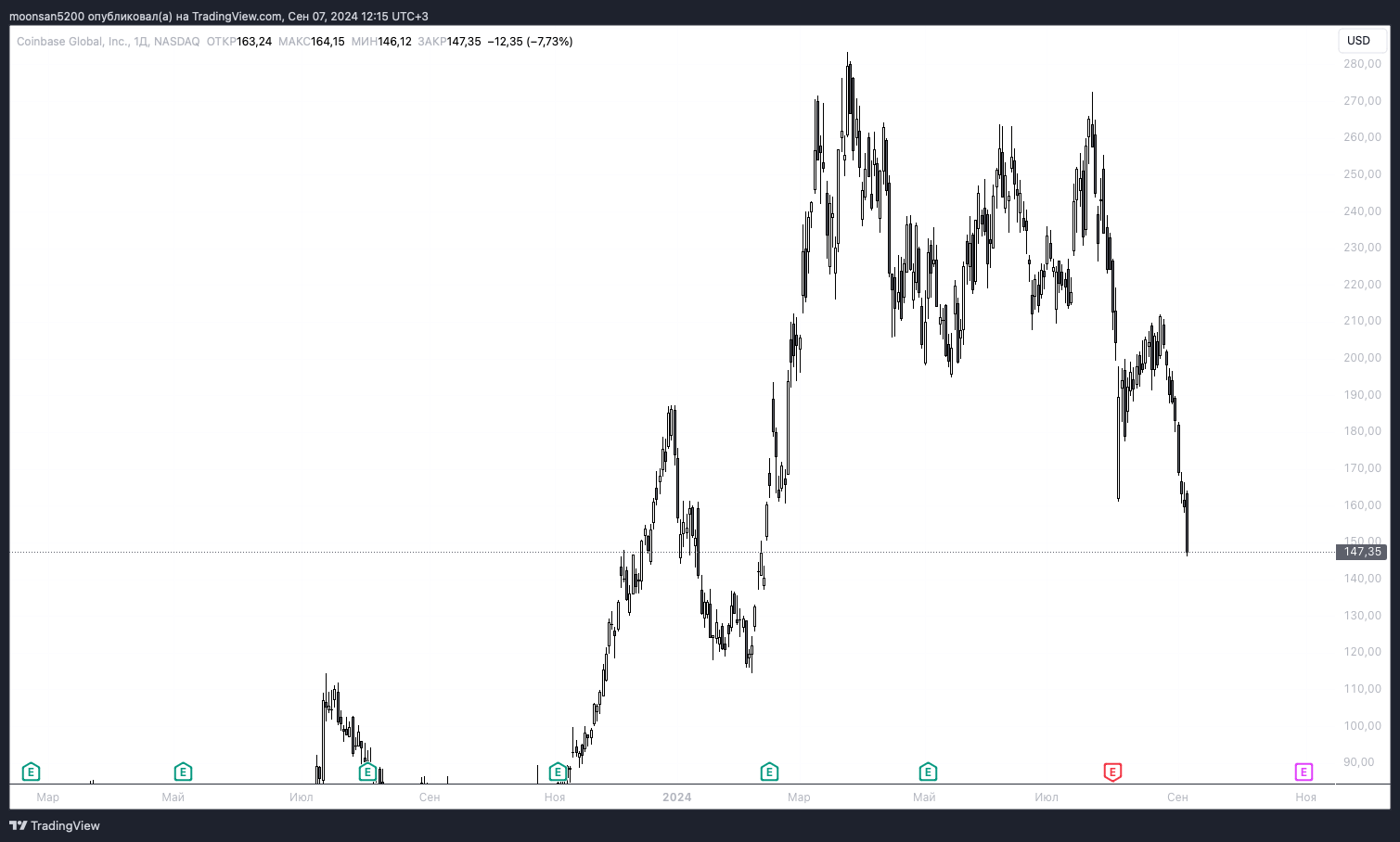

Another clear sign of the success of crypto adoption is the growth of companies in the industry. The day before, banking giant Barclays improved its rating of the largest US crypto exchange Coinbase and platform Robinhood.

According to experts, both companies have become “more mature”. In particular, Coinbase may benefit from a more favourable regulatory environment for the industry as a result of the US presidential election in November.

Changes in Coinbase’s share price

At least one US presidential candidate has taken a friendly stance towards the digital asset industry, and has also promised to turn America into the crypto and Bitcoin capital of the world.

The country has also approved several spot exchange traded funds (ETFs) based on BTC and ETH. Here’s a comment from experts, as quoted by Coindesk.

While we still see risks to Coinbase, the improving environment, profit and loss profile, gradual ongoing diversification, clear industry leadership in the U.S., and recent stock performance point to a more balanced risk/reward ratio for investors. We move the stock to a higher valuation category.

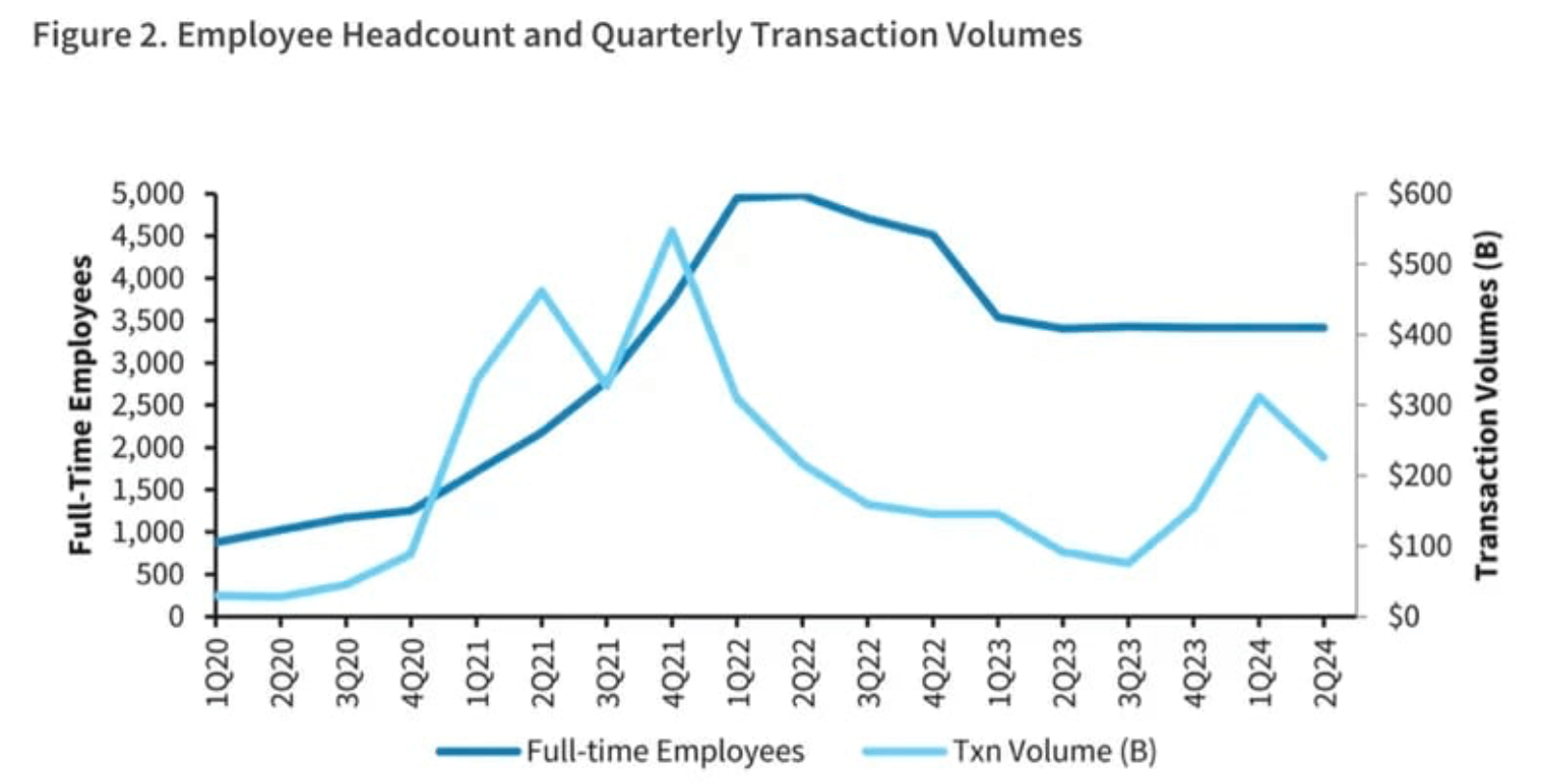

Coinbase’s headcount dynamics and transaction volume on the exchange

While the exchange still derives most of its revenue from trading commissions, other areas of the business have also slowly started to contribute more and more to the overall profits. We’re talking about both staking and transaction revenue in the role of custodian.

As a reminder, Coinbase provides custodian services for issuers of several Bitcoin-based ETFs in the US. In other words, the trading platform assists companies in storing coins and conducting transactions with them. Such co-operation is beneficial for financial giants issuing exchange-traded funds. Still, Coinbase has the necessary experience in managing large volumes of coins and the appropriate infrastructure to do so.

Brian Armstrong, head of the cryptocurrency exchange Coinbase

Bernstein experts consider digital assets extremely promising for use in the field of artificial intelligence. However, as we have already learnt, modern blockchains with low fees are suitable for micropayments. This is another reason to look at the native assets of such networks as an investment.