Why scammers steal far more cryptocurrencies specifically during the bullrun: a Ledger spokesperson’s response

The crypto market regularly goes through global bull cycles. According to Ledger’s CXO Ian Rogers, bullruns are accompanied by an increased risk of fraudster and hacker activity. The problem is that many industry participants are literally relaxed, distracted only by the growth of cryptocurrencies. In general, they care little about cybersecurity as long as such negligence leads to dire consequences. Of course, ideally, one should constantly take care of the safety of one’s coins, using special tools and rules.

Cybersecurity risks among crypto owners

Rogers shared his thoughts in an interview with Cointelegraph journalists at the Token2049 event. Here’s his rejoinder to the situation.

In every bull cycle, there are people who have some seemingly rational reason to compromise on security, self-storage of assets, or both.

Ian talked about the periods of expansion that quickly follow bull cycles. He said many cryptocurrency holders prefer to store their assets on centralised exchanges rather than self-storage.

Ledger Nano X hardware wallet

And this is not a good trend, although it does indicate the emergence of new players in the niche who have not yet had time to familiarise themselves with the concept of cid-phrases, the features of hardware wallets and the risks of hot web interfaces.

If not self-storage, then why own cryptocurrency at all?

Note that in general, storing digital assets on large exchanges like Binance or Coinbase should not cause problems, because these are the giants of the industry, which carefully take care of the safety of coins and have the relevant experience. However, one way or another, users' crypto held on exchanges do not essentially belong to them. Still, even for basic operations such as withdrawal of coins in this case will need the permission of representatives of the trading platform. And this is not decentralisation, the ideals of which are met by the top cryptocurrencies.

Ledger Flex hardware cryptocurrency wallet

The expert expressed concern about the risks associated with relying on centralised exchanges – and especially during corrections. Rogers did not forget to mention one of the most tragic events of the crypto industry in 2022 – the collapse of the FTX crypto exchange.

Recall, then it was found out that the management of the trading platform secretly used the funds of its clients for personal needs like buying real estate, funding political campaigns and crypto trading.

Therefore, when many users wanted to withdraw their own coins amid rumours about the instability of the trading platform, FTX was unable to satisfy withdrawal requests. Well into the niche, a capital hole of $8-9 billion became known. Ledger’s spokesperson continues.

They were giving their money to someone in the Bahamas who was entering a column into a spreadsheet. That’s not called crypto. It’s called fraud.

Ledger Stax hardware wallet

Outside of the cryptocurrency sphere, Rogers noted a larger trend emerging as cybercrime increases globally.

He argues that the frequency and sophistication of cyberattacks will increase. Which means digital asset holders should be even more cautious about their online behaviour.

You’ll be able to say that this year has been the worst year in terms of hacker activity literally every year for the rest of your life – and you won’t be wrong.

An illustration of the rise in scammer activity we saw this week. It turns out that a group of young men from the US successfully attacked one secured lender of bankrupt platform Genesis. In total, they stole $243 million worth of the victim's bitcoins, but for some reason they decided to record a stream of what was going on. During the recording, the hackers also revealed their real identities as they used their own accounts. Read more about the story in a separate piece.

To mitigate and combat this growing threat, Rogers advocates secure self-storage of digital assets through hardware and software solutions. In particular, the latter includes “transparent signature” technology.

CXO at Ledger Ian Rogers

This refers to the ability of interfaces to translate transaction data into a comprehensible form that allows transaction authors to understand exactly what terms they are agreeing to.

And because Ledger wallet screens are connected to security chips isolated from the internet, they show actual transaction data. In other words, it’s impossible to tamper with device displays and make them show incorrect information online.

Major hacks of exchanges and protocols aren’t the only things that can crash the market. Investors are also keeping a close eye on the movement of bitcoins from the so-called “Satoshi Era.”

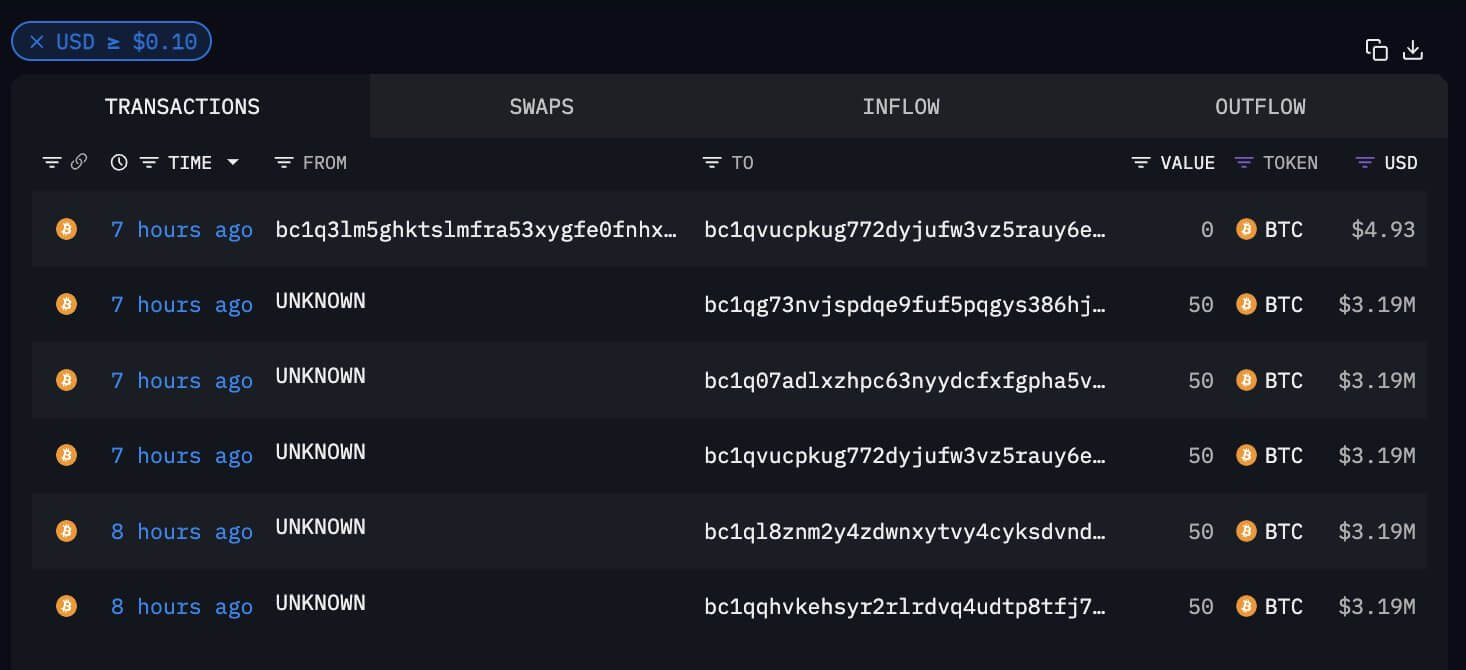

This week alone, transactions worth 250 BTC from that time period were made. As a reminder, the “Satoshi Era” is usually referred to as the period when the anonymous Bitcoin creator under the pseudonym Satoshi Nakamoto was active on online forums from late 2009 to 2011.

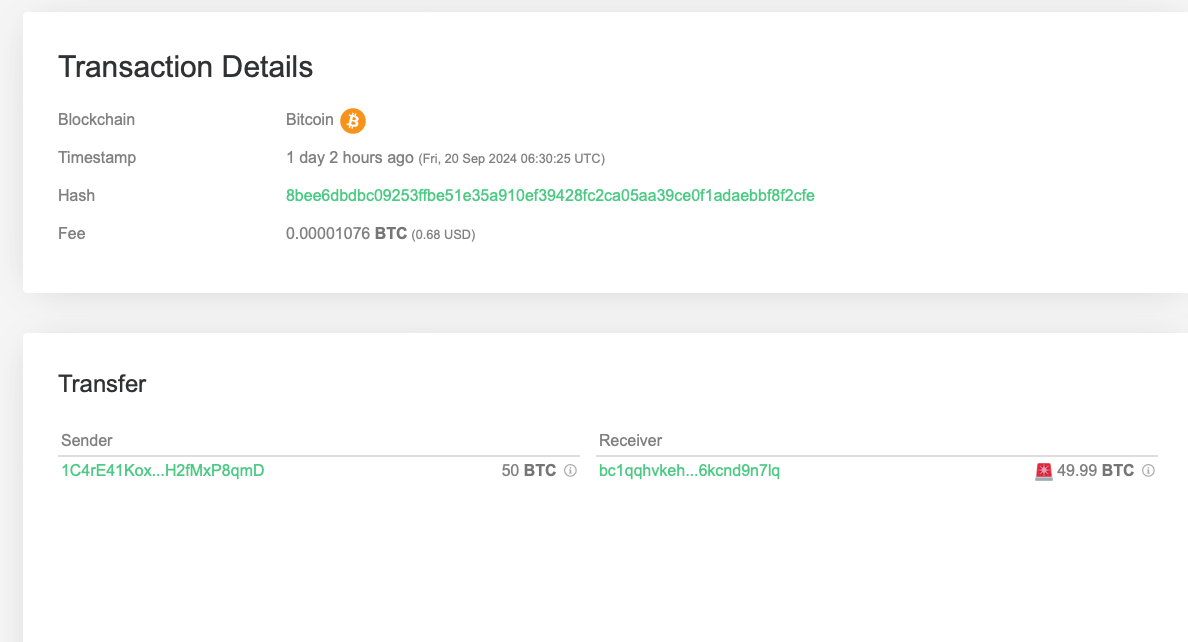

One of the fresh Bitcoin transactions from the “Satoshi Era”

250 BTC equivalent to about $16 million at current prices were moved within an hour on Friday morning. Each transaction was conducted in batches of 50 BTC, and the coins went to new wallets.

It is unclear whether all of these wallets belong to the same person or organisation. As of now, there has been no movement from the new wallets to the cryptocurrency exchanges, Coindesk reported.

Fresh bitcoin transactions that haven’t moved in about 15 years

The blockchain observer shows that these bitcoins were received as a reward for mining in 2009, which is just a few months after the network was launched. Since then, these wallets have shown no activity except for the aforementioned movement of funds the day before.

The Ledger representative's comments seem to be correct. Still, as the final stages of the bullrun unfold, with many coins able to fetch Xs in a matter of days, many investors forget about the security of digital assets. This, in turn, can end up being an irreparable mistake, of which there are more than enough examples in the niche. That is why it is better to think about protecting your coins in advance - and ideally to buy a hardware wallet.