An SEC spokesman criticised the regulator’s actions. What is the problem with its approach to cryptocurrencies?

Not only cryptocurrency owners are criticising the activities of the Securities and Exchange Commission (SEC). It turns out that there is serious opposition to what is happening with the regulator even within it. This was stated by SEC Commissioner Mark Uyeda on FOX Business: according to him, the Commission’s approach to controlling the crypto market “has been a real disaster”. That is, the industry has suffered tangibly because of the regulator’s tough actions, and the SEC itself needs a key reform of its strategies.

Such a case among SEC officials is not the first time. For example, in late September, SEC official Hester Pierce bluntly stated that the regulator should have long ago called digital assets as such, which do not belong to the category of securities.

SEC Commissioner Hester Pierce

Thus, the Commission would no longer claim to regulate this area. However, SEC Chairman Gary Gensler is hardly satisfied with this, as his statements are aimed at making the regulator a de facto key player for the coin industry.

The SEC and cryptocurrencies are the problem

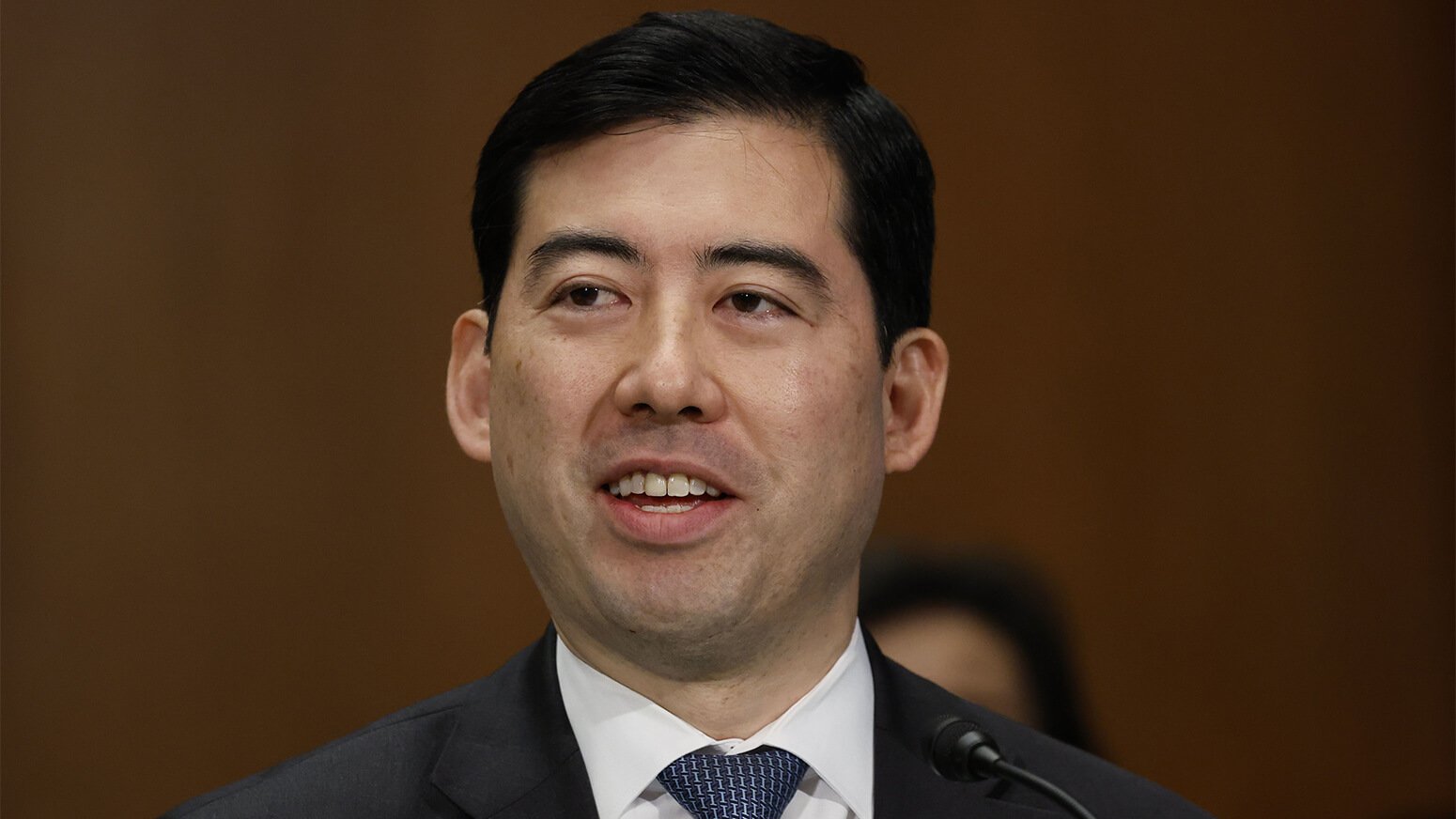

Republican and SEC Commissioner Mark Uyeda was an on-air guest on the Mornings with Maria show on FOX Business. During the conversation, he spoke about his agency’s misguided approach to controlling cryptocurrencies, which he acknowledges. Here’s the relevant line from the regulator’s spokesperson.

I think our policy and approach over the last few years has been a real disaster for the entire industry. We’ve pushed regulation through enforcement without providing any guidance, and as a result everything has been decided in the courts. And different courts have made different judgements.

SEC Commissioner Mark Uyeda

According to The Block’s sources, Uyeda spoke on the show the day after the Crypto.com exchange filed a lawsuit against the SEC after receiving Wells’ notice.

Recall, the latter is a formal warning of an imminent lawsuit and investigation into what's going on with the platform. That is, the management of the trading platform decided to be proactive, and during the proceedings the exchange hopes to achieve greater clarity on the regulation of crypto.

Crypto.com’s lawyers said the SEC overstepped its authority and challenged the regulator’s assertion that most cryptocurrencies are securities.

The SEC has long been in litigation with Coinbase and Ripple. And in the case of the latter, the Commission has never managed to prove that absolutely all transactions with the native token XRP were transactions with securities. Only sales of XRP to institutional investors who purchased the crypto-asset directly from Ripple fell under this category.

In early October, the Securities Commission filed an appeal in this proceeding with Ripple. Thus, the regulator wants to challenge the decision of Analisa Torres, which in July 2023 recognised XRP as an asset that does not belong to securities. According to experts, because of this, the final consideration of this case may last until 2026.

Ripple CEO Brad Garlinghouse

SEC Chairman Gary Gensler has been heavily criticised by crypto industry leaders for his stance on digital assets. He insists that most cryptocurrencies should be classified as securities, and has called for crypto platforms to register with the agency.

However, complying with SEC registration is impractical under current rules because the regulatory structure is ill-suited for digital assets. Uyeda acknowledged that.

The problem is that we haven’t provided clear explanations of what you can and can’t do, and if you’re participating in any securities offering, how to register, how to be regulated as a broker-dealer, and how to register as an exchange.

Securities Commission Chairman Gary Gensler

The list of the regulator’s friction with the industry doesn’t end there. Cryptocurrency exchange Bitnomial has also filed a lawsuit against the SEC, accusing the agency of “exceeding its authority over digital assets” because of its continued claim that XRP is a security.

In a 10 October lawsuit in an Illinois federal court, Bitnomial’s lawyers argue that XRP is already regulated as a commodity, Cointelegraph reported. The SEC is “claiming jurisdiction over a product that is already regulated and under the exclusive jurisdiction of the Commodity Futures Trading Commission (CFTC).”

As a reminder, Bitnomial is an exchange that received approval from the CFTC in 2020 to trade cryptocurrency futures. In August, it applied for certification to the CFTC to list XRP futures contracts.

Commodity Futures Trading Commission (CFTC) Chairman Rostin Benham said

Exchange officials said the SEC contacted it and declared XRP futures as securities. That is, they are allegedly requiring Bitnomial to register as a securities exchange before listing instruments.

All of this increases the burden on the company in terms of legal costs. Again, earlier the SEC failed to prove the fact that XRP belongs to securities in a separate proceeding with Ripple.

Such remarks by SEC officials are sure to bring Gary Gensler's dismissal as SEC chairman closer. Such a scenario will be realised if Donald Trump wins the US presidential election. Earlier he had already promised to get rid of Gary on the first day of assuming new powers.