Analysts at 10x Research expect a six-figure Bitcoin exchange rate in early 2025. What are their arguments?

There is not much left until the start of 2025, and in the next two months Bitcoin is quite capable of overcoming the cut-off of several tens of thousands of dollars – so believe the analysts of 10x Research. In their opinion, by January, the cost of BTC will jump all the way to the 100 thousand level, which is a long-awaited for many fans of decentralisation. The main drivers of the uptrend will be the interest in digital assets among institutional investors, the general acceptance of the coin market and the growing dominance of Bitcoin.

Recently, many analysts have been sharing their own expectations for the current bullrun. For example, Bitwise Investment Director Matt Hogan believes that Bitcoin will be able to be valued at $200,000 and without major economic problems.

Bitwise platform investment director Matt Hogan

First of all, this will not require the collapse of the US currency, the analyst is confident. You can read more about his point of view here.

When Bitcoin will start to grow

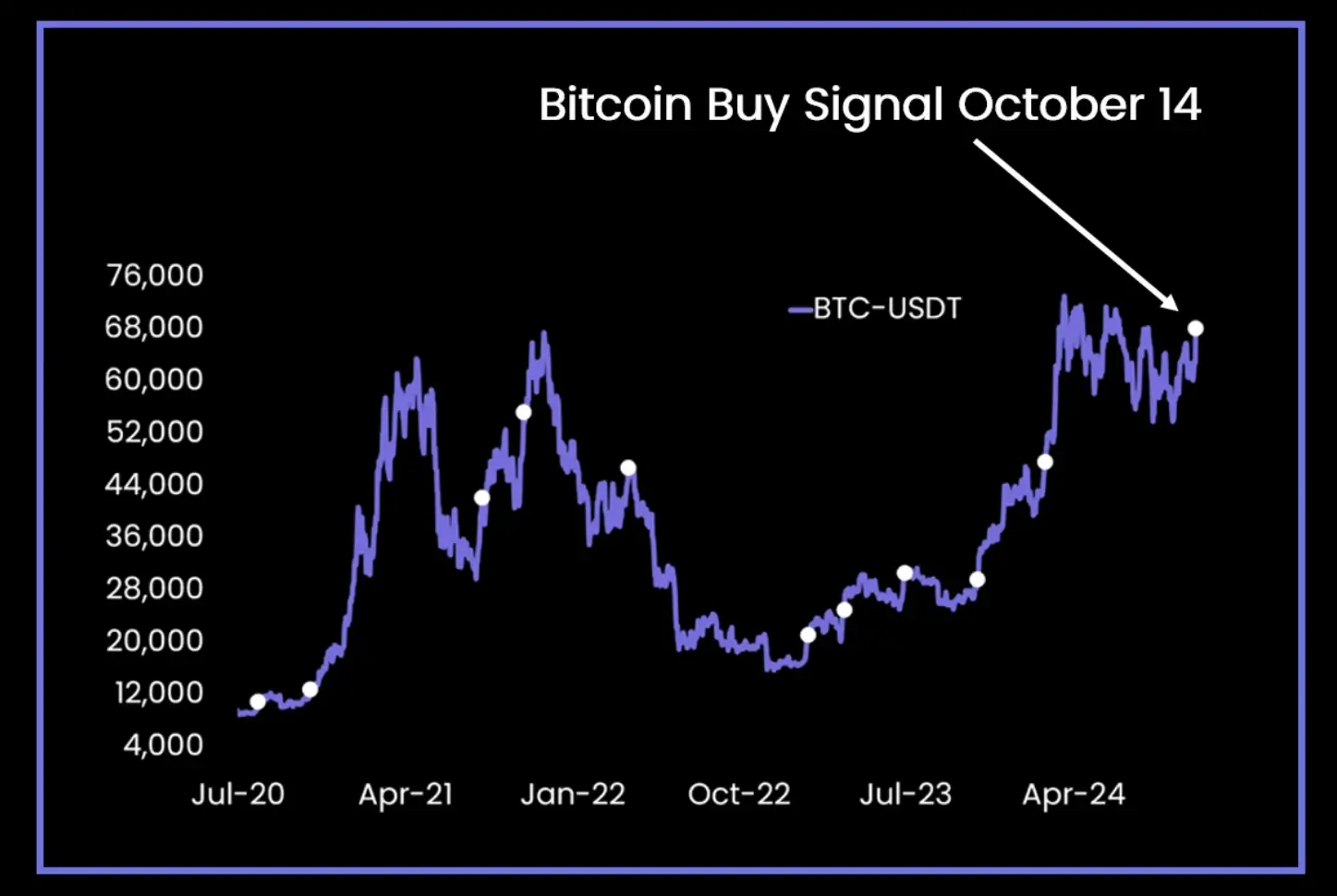

The 10x Research forecast is based on a model that provided two BTC buy signals the day before, the last of which appeared on 14 October. That is, it analyses a huge number of factors and variables, after which it shares a verdict on the situation on the coin market and the necessary actions of investors.

According to analysts, the accuracy of this prediction model is 86.7 percent based on the last fifteen signals. The experts explained their optimistic forecast on Bitcoin as follows.

When Bitcoin sets a new high for the first time in the last six months, as it did recently, we usually see a median return of 40 per cent over the next three months.

BTC buy signal from the 10x Research analyst model

With these calculations in mind, a 40 percent jump from the current price in would lift BTC above $101,000 by January 27, 2025. That’s why analysts are betting on a similar outcome very early next year.

It is important to realise that data from the past does not guarantee a certain outcome in the future. Therefore, the forecast of representatives of 10x Research should be treated only as a possible variant of the development of events, and not a clearly defined scenario.

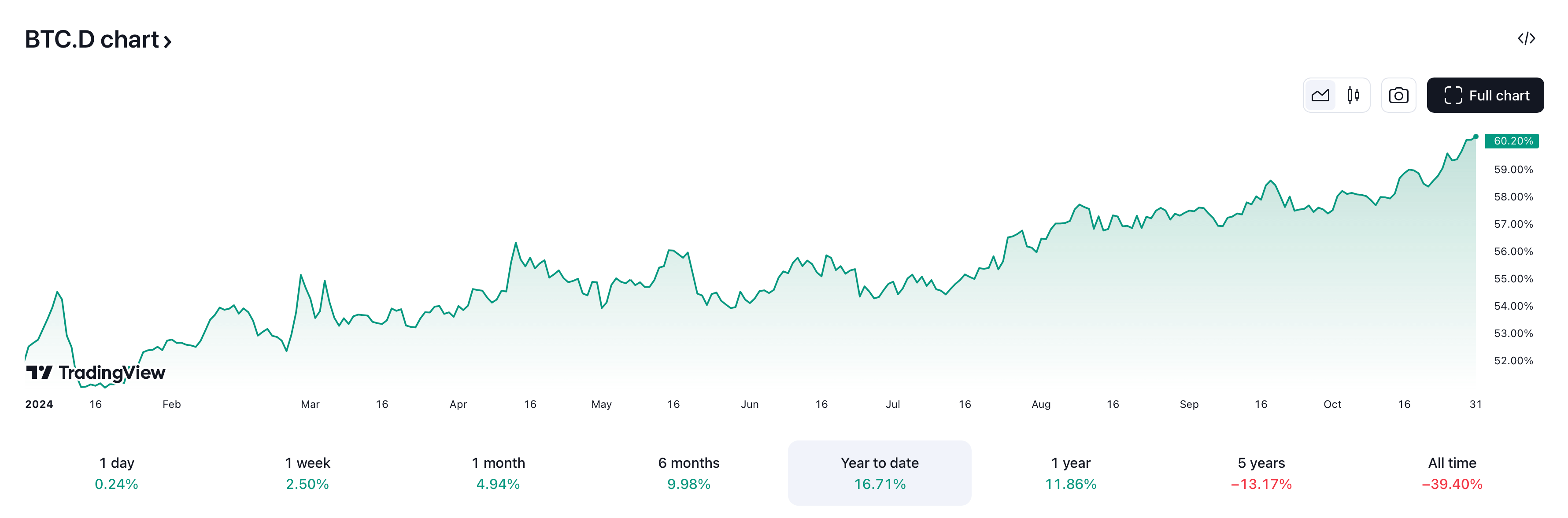

Another factor in the forecast is the “Bitcoin black hole effect”. In other words, the growing market share of BTC is drawing capital from altcoin investors. This effect suggests that as Bitcoin funds and investors become increasingly concentrated in Bitcoin, the value and attention of altcoins declines.

As a result, Bitcoin’s dominance grows while altcoins’ share of total market capitalisation decreases. Essentially this means that Bitcoin is becoming more and more attractive at a higher price, well capital is being withdrawn from altcoins.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Signs of such a thing are noticeable already now. In particular, the day before, the indicator of Bitcoin’s dominance in the total capitalisation of the cryptocurrency market exceeded the mark of 60 percent, that is, this is the share of BTC compared to all coins. Since the beginning of the year, the indicator has increased by 16 per cent – the trend here is obvious.

Change in Bitcoin’s dominance in 2024

As analysts have noted, institutional investors like BlackRock now see BTC as a long-term stable asset and “digital gold.” Here’s a rejoinder on the subject.

Gold has always been seen as a safe haven for capital, so if Bitcoin is “digital gold,” it makes sense that institutional investors are so interested in it.

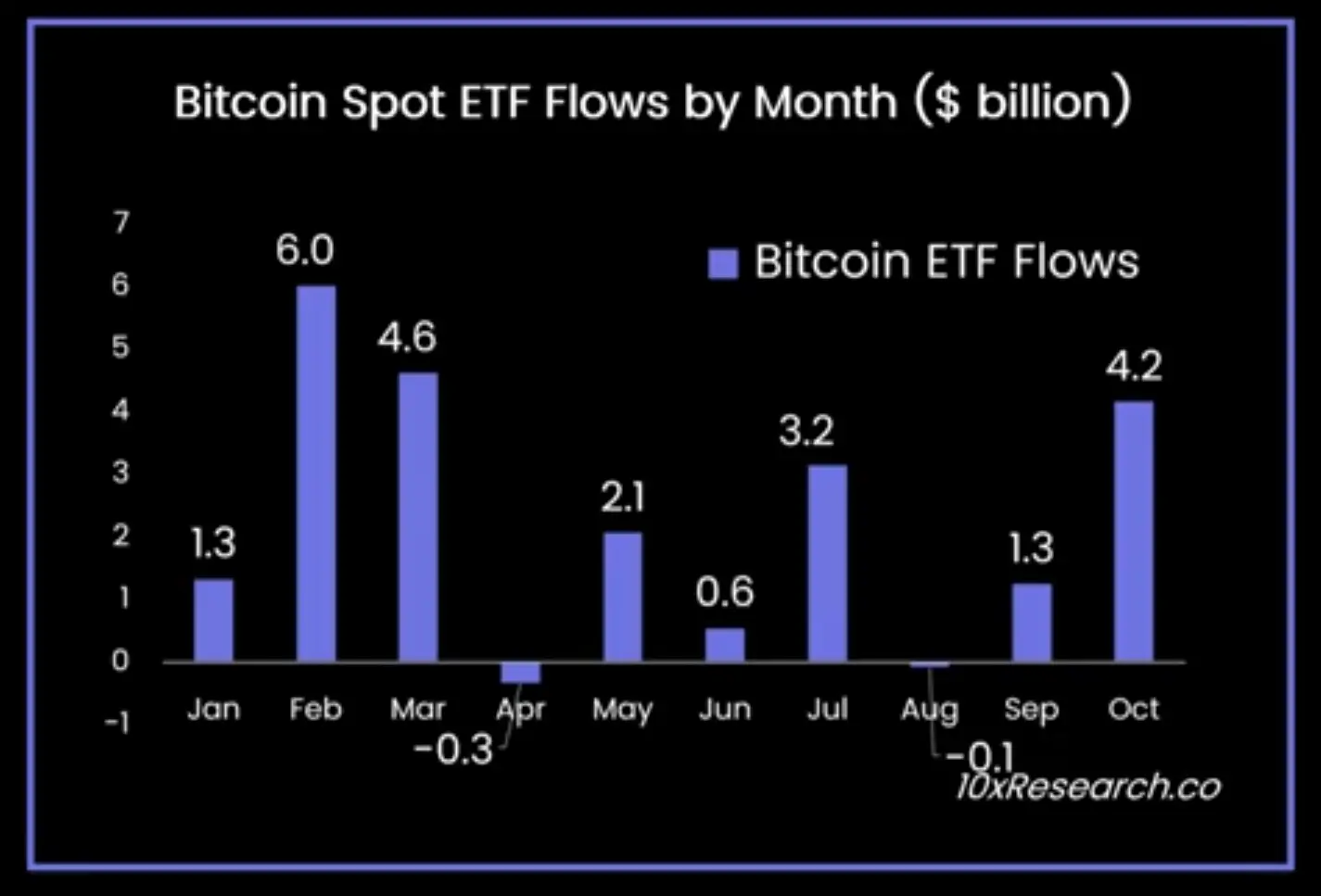

According to Cointelegraph’s sources, spot Bitcoin-ETFs raised $4.1 billion in October alone. Crypto investors in general also see value in holding BTC long-term.

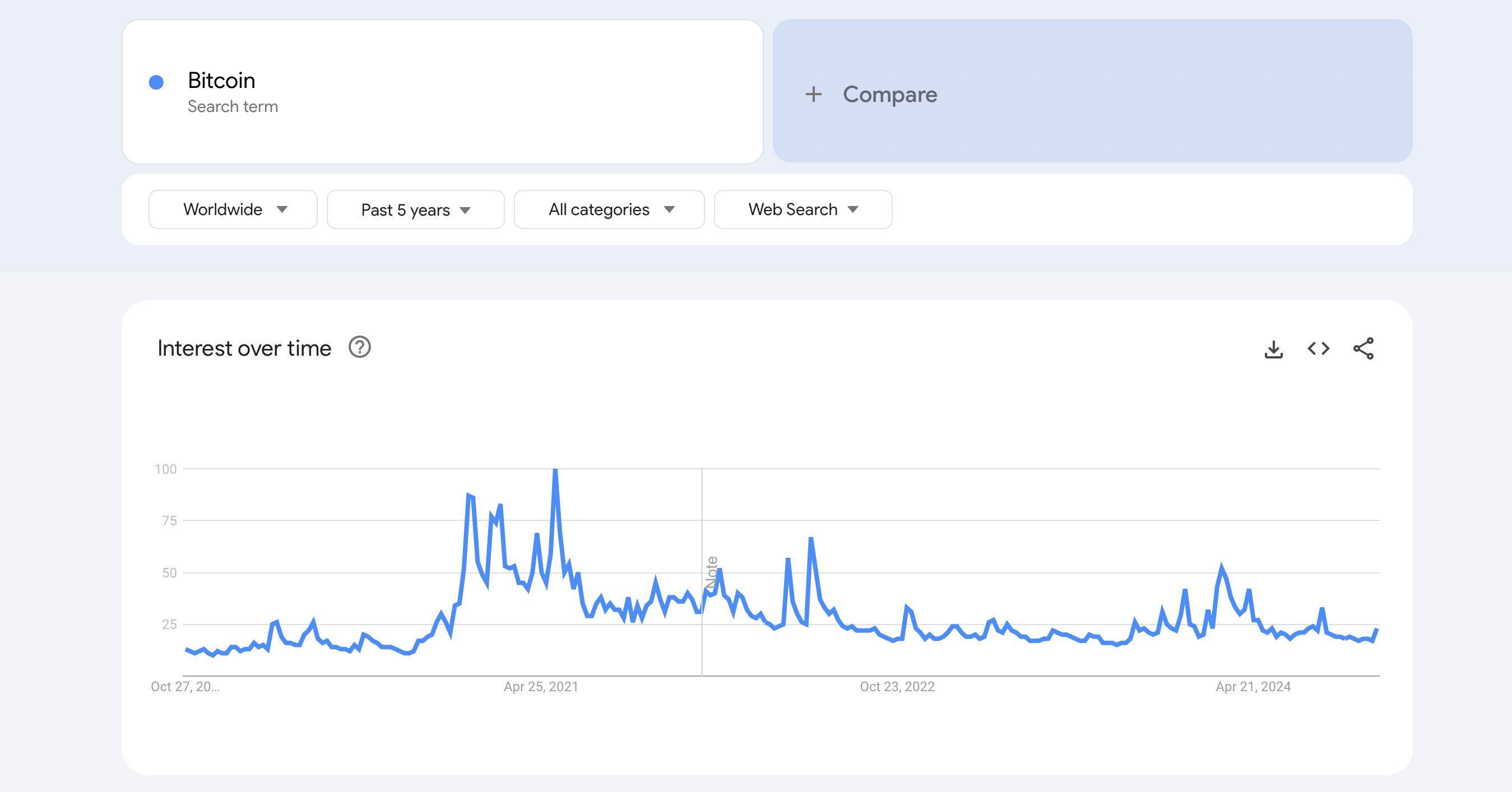

What’s funny is that despite Bitcoin’s surge in recent days, the cryptocurrency’s popularity on Google’s search engine has fallen well short of its all-time high of May 2021. The figure is now at least four times lower than the record. Accordingly, the so-called retail or ordinary retail investors may not yet come to the market and ignore this area.

Popularity of queries about Bitcoin on Google

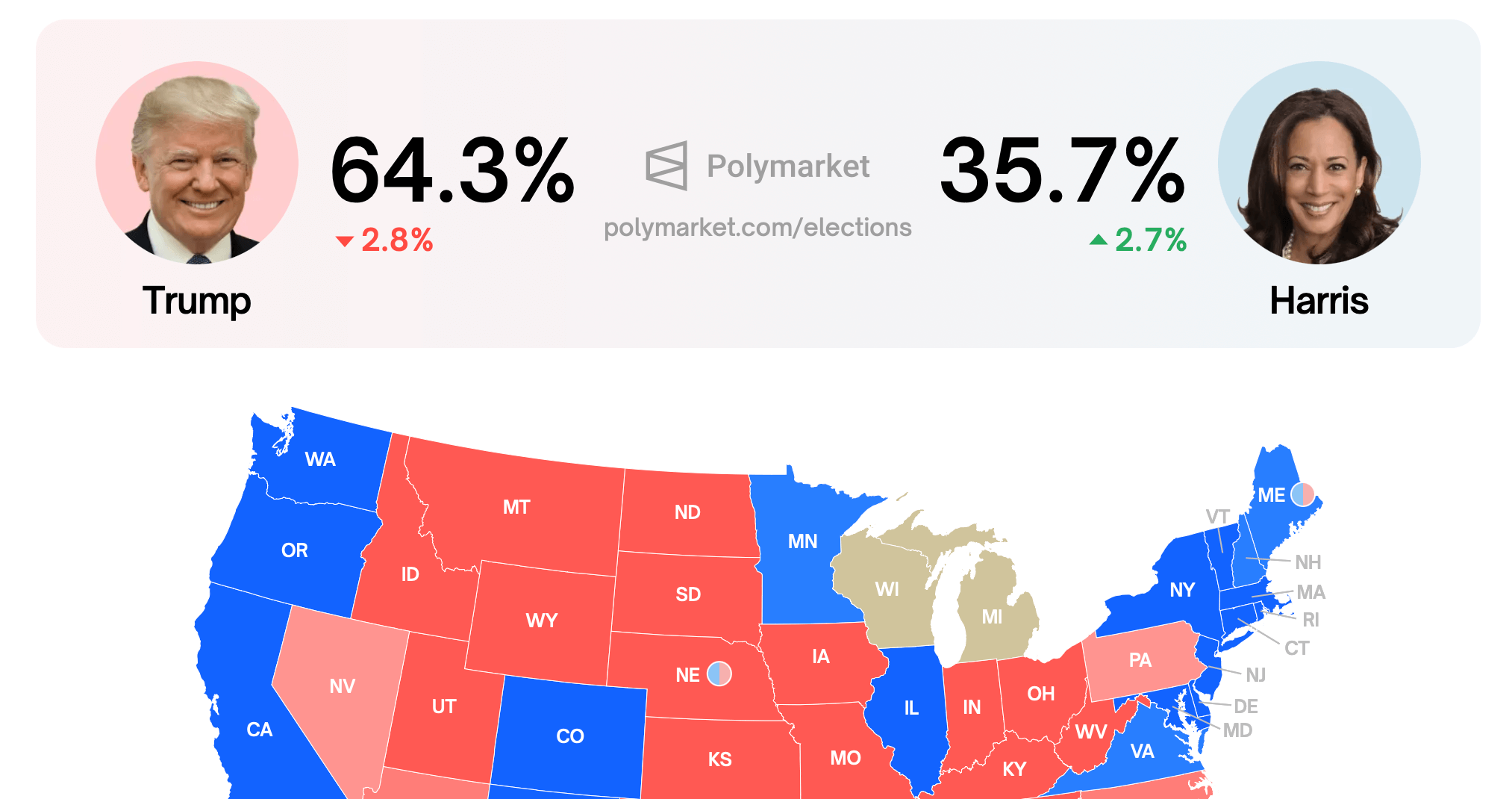

Another 10x Research is betting on Donald Trump’s victory in the US presidential election, but things are a bit more complicated at this point than they seem at first glance.

Flows of funds into spot Bitcoin-ETFs

Trump has supported the coin industry since the beginning of 2024, so many cryptocurrency users are counting on a long-term bullrun if he is re-elected. Pav Hundal, lead analyst at Swyftx, disagrees with this statement. According to him, Trump’s victory will be more like a “dopamine injection”, meaning its long-term effect is unpredictable.

Derive founder Nick Forster said that “traders should approach things with caution” as the market moves into a phase of rising volatility. He warned that “while there may be upside, the risks are also significant”. Forster, citing options data, noted that traders are preparing for significant price swings in the run-up to the election.

Public opinion ahead of the election according to decentralised betting platform Polymarket

However, Hundal does not see the election results as “a deciding factor for Bitcoin to reach the $100,000 mark.” He echoed the sentiments of 10T Holdings founder Dan Tapiero, who believes the asset will reach the six-figure mark regardless of the outcome of next week’s upcoming vote.

The current global environment for cryptocurrencies seems to be the right one. First of all, the central banks of many countries have moved to loosen restrictions in the economy, thanks to which people will connect more actively with investments. Plus, the US presidential election is approaching, with one of the candidates in office supporting the digital asset industry. So now betting on coins seems pretty logical.

For more interesting stuff, check out our crypto chat. Be sure to stop by so you don’t miss the continuation of the current bullrun.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO STAY UP TO DATE.