Analysts at Bernstein have called the forecast for Bitcoin to grow to 200k in 2025 conservative. Why?

Analysts at brokerage firm Bernstein have once again confirmed their medium-term forecast for the value of Bitcoin. They expect that by the end of 2025 the price of the main cryptocurrency will rise to 200 thousand dollars. Moreover, in the current conditions in the world, such a forecast they called “conservative”. The main reason for the continuation of the global growth of BTC is the limited maximum supply of coins against the background of record US government debt.

When will Bitcoin grow

In a fresh appeal to clients, Bernstein experts stated the following.

If you’re sceptical about Bitcoin, perhaps the limited supply of the digital asset and its main feature as a store of value aren’t such bad things in a world where US debt is breaking new records above $35 trillion and the threat of inflation still looms. If you like gold, you should like Bitcoin even more.

For investors who aren’t interested in buying Bitcoin outright, experts suggested investing in shares of MicroStrategy, the world’s largest holder of the first publicly traded cryptocurrency.

The change in MicroStrategy’s share price in 2024

A similar option is the shares of the trading platform Robinhood, which is capturing an increasing share of the crypto market. The securities of these companies show a clear correlation with the value of Bitcoin and can be considered a kind of “crypto-index”. Therefore, they clearly deserve the attention of capital holders.

Robinhood strengthens its own positions in the industry. For example, in early October it became known that the company added support for cryptocurrency transactions for European users. Customers can now conduct deposits and withdrawals of more than twenty coins. Well, the management of the giant explained the decision by the high demand from users.

Change in Robinhood’s share price

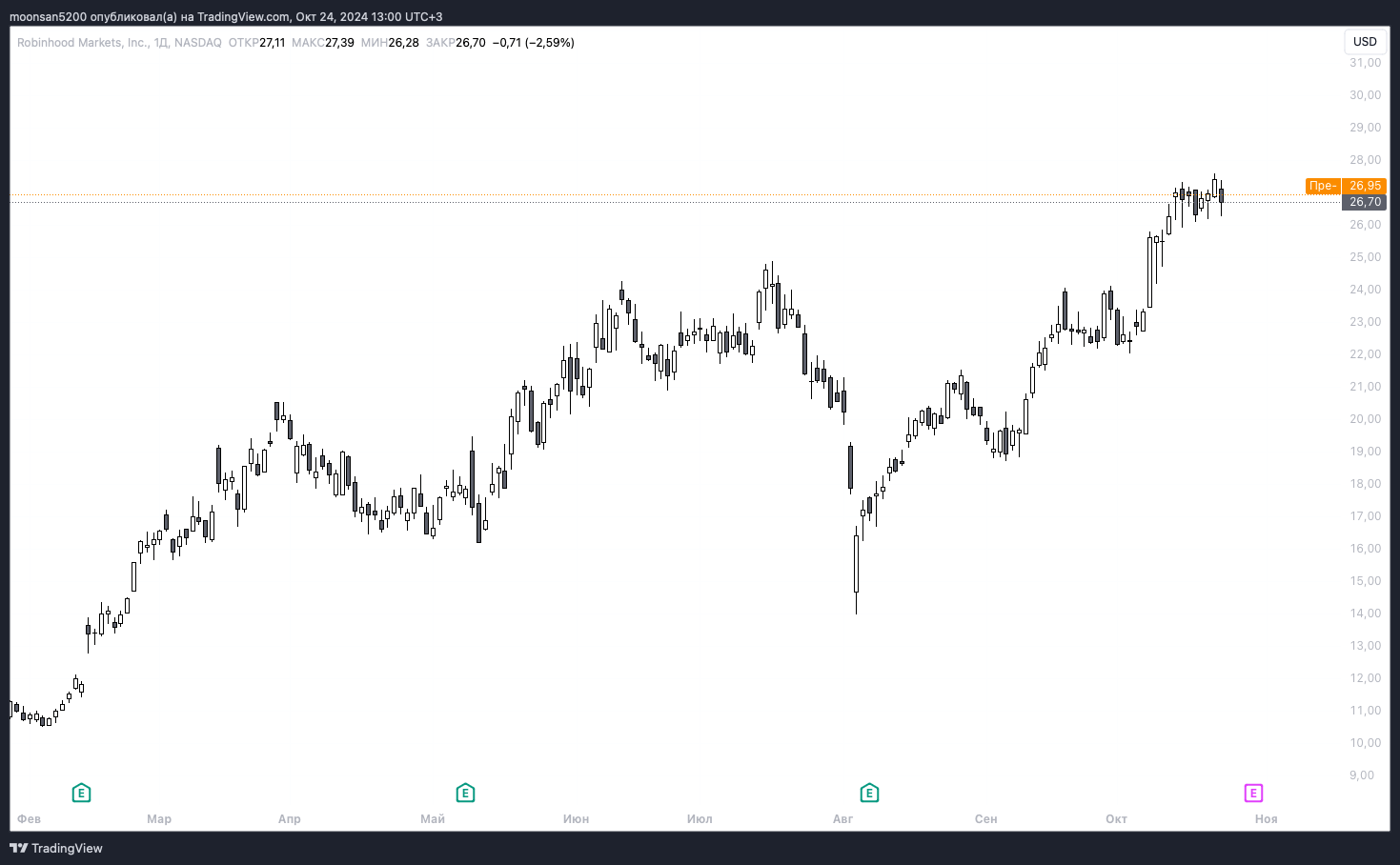

Another factor that will help BTC get to $200,000 is the constant scaling of operations of cryptocurrency miners, who are finding ways to reduce energy costs for their own operations.

For example, large companies like Riot Platforms and Cleanspark are registered in the US and are already becoming a prominent part of the energy and data centre market.

This is confirmed by the change in Bitcoin’s hashrate, which is the total computing power of the network. On Monday, this figure rose above 900 hashes per second for the first time.

Bitcoin network hashrate changes

According to The Block’s sources, another important player in the market in the form of Core Scientific remains underappreciated. On Tuesday, it was announced that it has extended its hosting deal with AI Hyperscaler CoreWeave for another $2 billion.

CoreWeave exercised its option to add about 120 MW to its existing AI data centre hosting agreement with the mining company. This will bring the total capacity of the operations to about 500 MW.

And that’s the equivalent of Core Scientific’s total high-performance computing capacity. The value of the contract will eventually reach $8.7 billion over twelve years.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

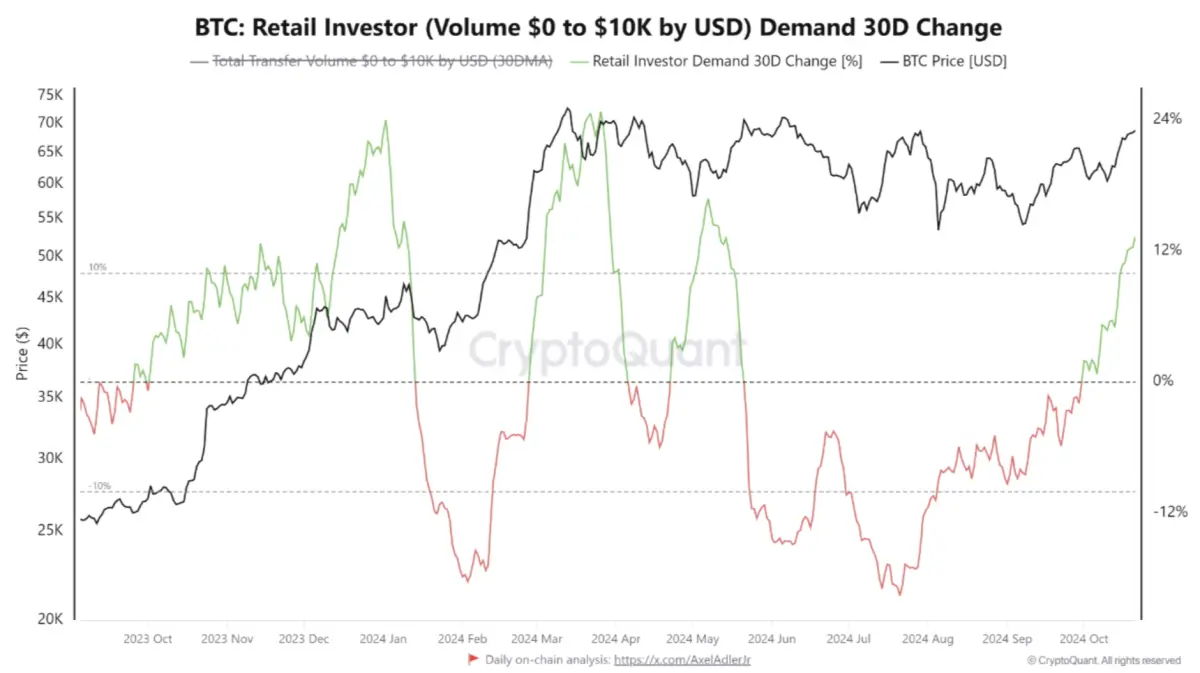

Individual investors will play a tangible role in the new wave of bullrun – in October, their activity just approached an all-time high. The last time something similar was recorded in March 2024, when the price of BTC also approached its peak.

The details of market observations were shared by CryptoQuant analysts in a recent report. Here’s their quote.

Over the past 30 days, demand from retail investors has increased by about 13 per cent. This indicates a scenario along the lines of March, when we were close to the last all-time high.

Demand from individual investors

According to Julio Moreno, head of research at CryptoQuant, the increase in demand for BTC is occurring in parallel with the growing interest from institutional investors.

He noted that while retail investors are returning to the market, institutional players have steadily increased their stake in BTC throughout the year. Here’s what he said here.

This is in contrast to what happened in the first quarter of 2024, when demand was driven mostly by large investors.

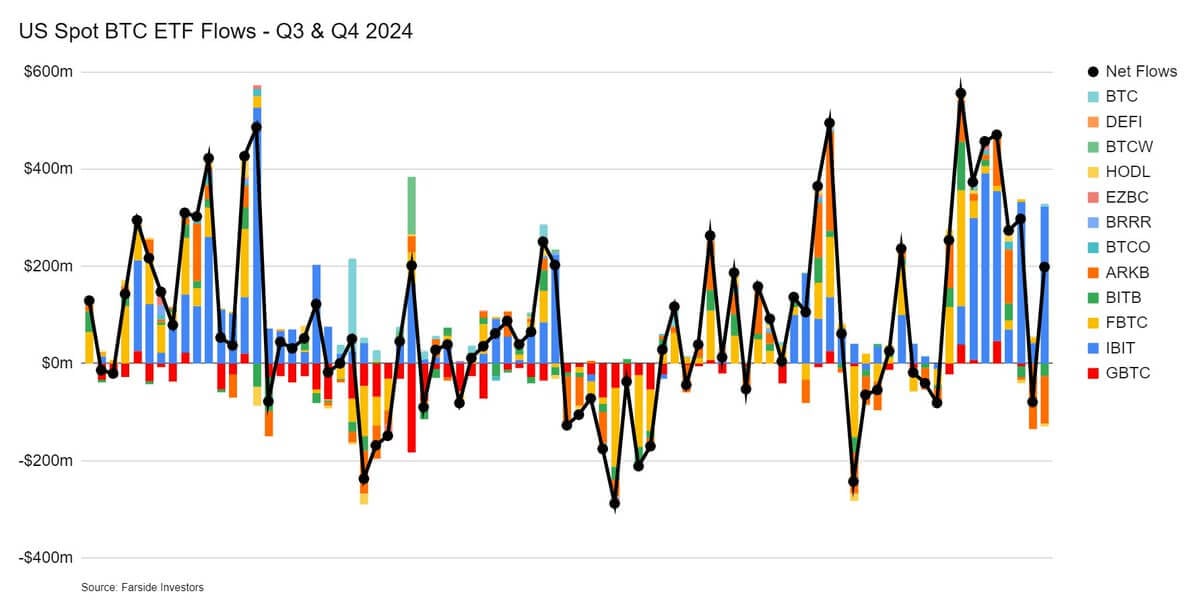

Now, players of all sizes are getting involved with Bitcoin, and in recent days this has been particularly active through spot ETFs on the cryptocurrency. For example, Wednesday's result was a net inflow of $198.5 million.

Inflows and outflows from spot Bitcoin ETFs in the U.S.

Moreno added that the current retail and institutional demand dynamics are similar to what happened in previous bull cycles. The expert continues.

In 2017, individual investors actively accumulated Bitcoin after its price surpassed its previous all-time high. They continued to buy when BTC pulled up to the $20,000 level.

Cryptocurrency market growth

CryptoQuant uses several key metrics to measure demand from different categories of market players. One of them is tracking the total number of coins stored in wallets with a balance of less than 1 BTC.

According to Moreno, this amount has grown from 1.734 million BTC in mid-March to 1.752 million coins currently, an increase of 18,000 bitcoins. Another metric is the volume of transactions on a blockchain valued at less than $10,000, which reflects the activity of small investors and gives an indication of market sentiment.

Of course, the confidence of Bernstein's representatives does not mean that Bitcoin will actually take the $200,000 line within the specified timeframe. However, such statements shape investors' expectations of the cryptocurrency's behaviour and their respective actions. Therefore, voicing them is crucial - especially as the bullrun in the coin niche continues.

For more interesting stuff, check out our Future Rich cryptocurrency chat. Be sure to stop by to keep up with what’s happening inside the crypto and blockchain niche.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.