Bankrupt cryptocurrency exchange Mt.Gox’s user compensation plan extended for a year. Why is this necessary?

The rehabilitation process of Mt.Gox has been extended again, with the new date for the repayment of debts to former users of the bankrupt cryptocurrency exchange set for 31 October 2025. This is not the first extension, as the original deadline for the payments was set for 31 October 2023. The reasons for the current delay are technical and administrative problems faced by creditors when filing for compensation. Trustee Nobuaki Kobayashi explained that extending the deadline gives creditors more time to complete the necessary procedures and also limits the overall impact of what is happening on the market.

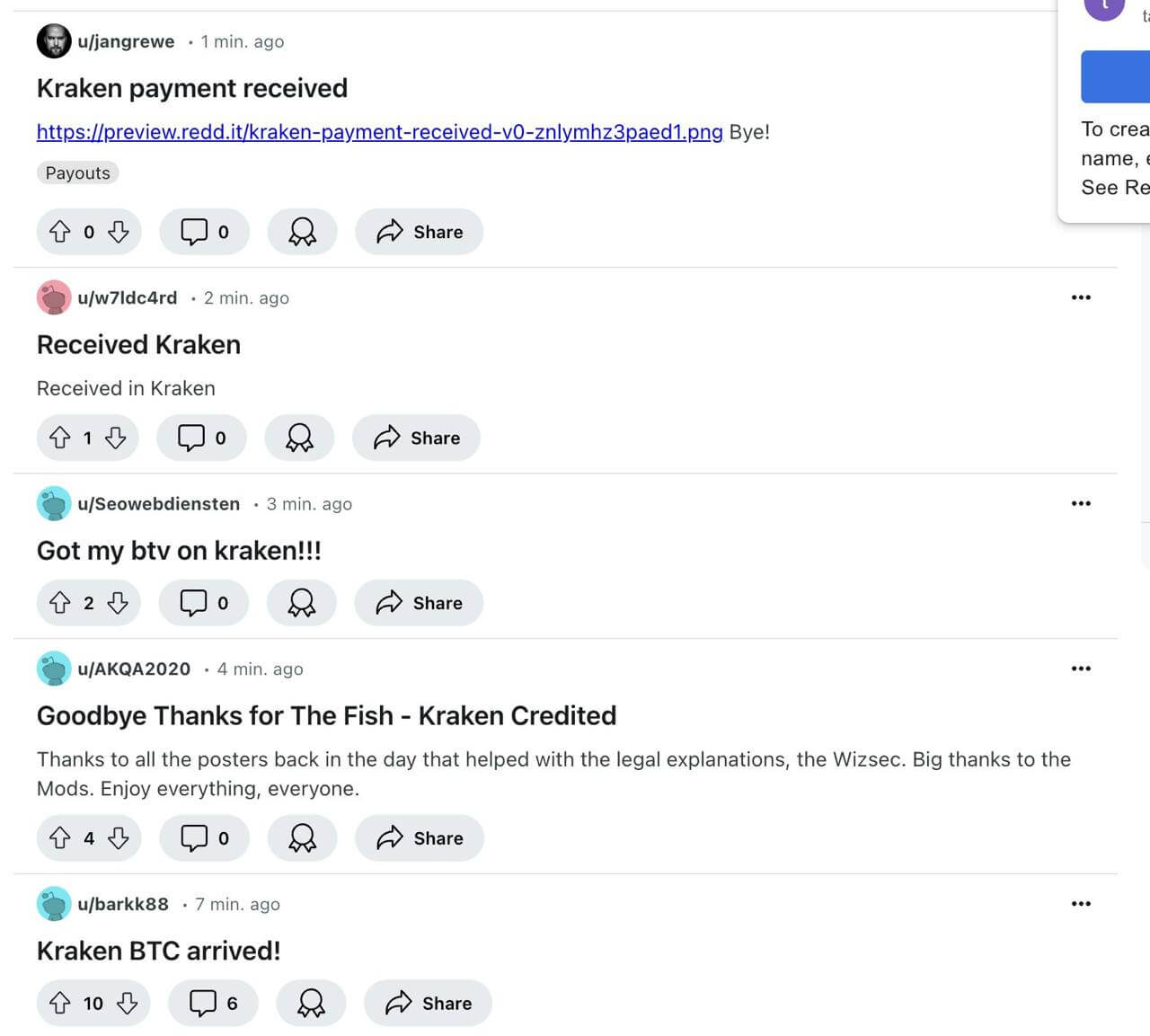

The actual process of distributing bitcoins to former users of the Mt.Gox cryptocurrency exchange began in July 2024. For example, on the 23rd, users of the Kraken trading platform reported receiving coins – here are the relevant publications.

Kraken crypto exchange users reported receiving coins as part of the compensation from Mt.Gox

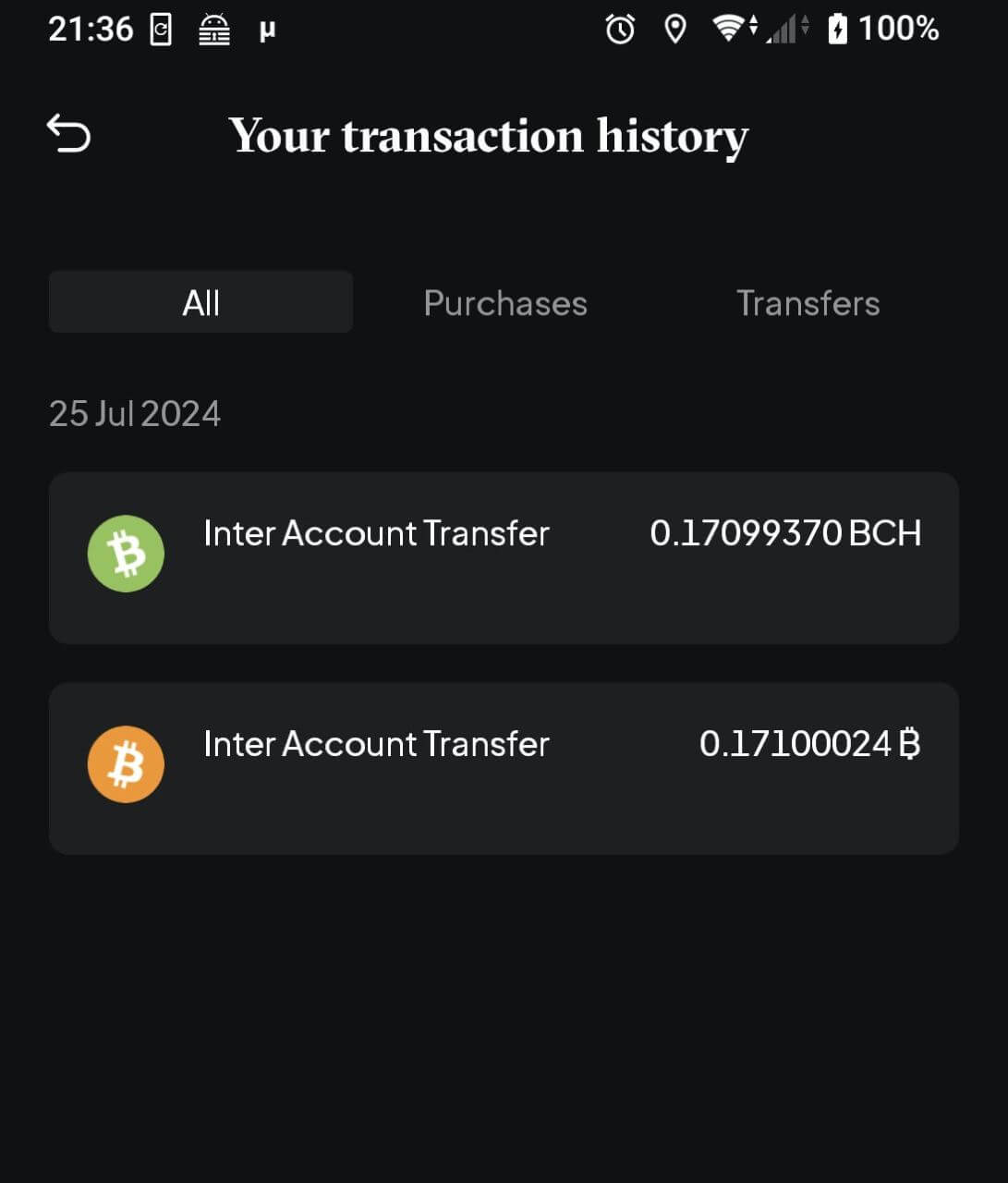

Two days later, similar screenshots were published by users of the Bitstamp trading platform.

Receipt of coins as part of compensation from Mt.Gox by users of Bitstamp exchange

It is important to note that users received both bitcoins and Bitcoin Cash. However, BCH is a fork of the original BTC, so its accruals were once received by all bitcoin holders on non-custodial wallets. That is, the creation of this coin essentially helped to increase the amount for further distribution among former users.

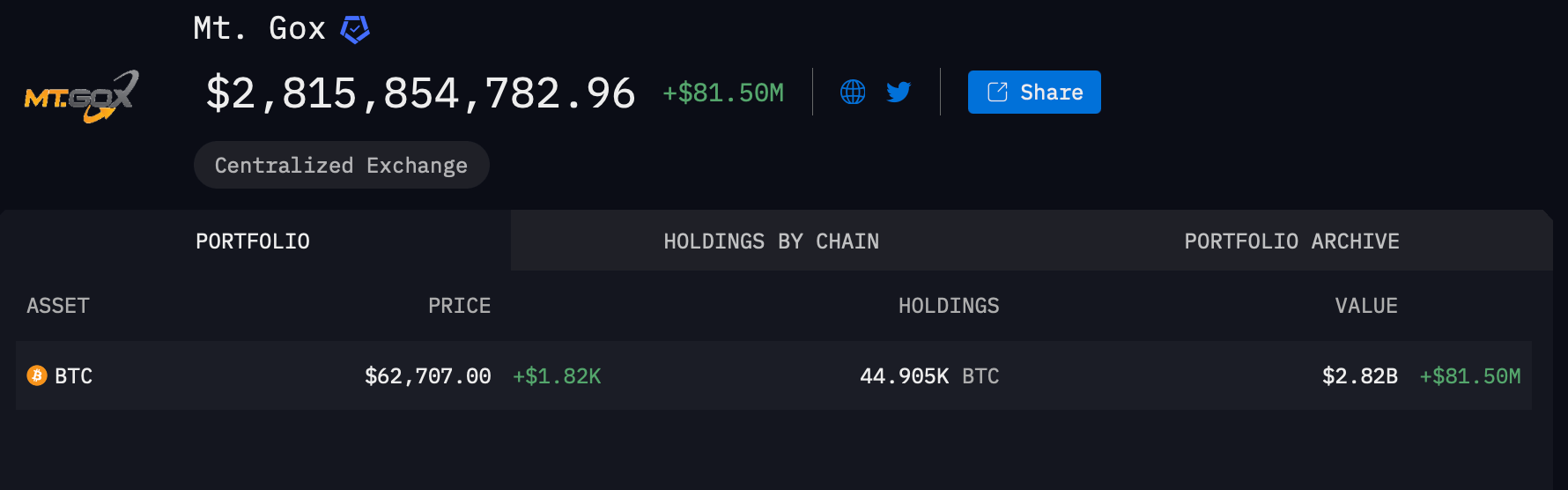

As of today, the content of the Mt.Gox wallet looks as follows.

The wallet of the bankrupt cryptocurrency exchange Mt.Gox with coins to be distributed to former customers

It holds 44,905 bitcoins with a total value of $2.8 billion. It is this amount of cryptocurrency that is to be distributed to former users of the trading platform.

When will the distribution of crypto from Mt.Gox end?

According to The Block’s sources, the new transfer is able to positively affect the volatility of the crypto market, because the full distribution of the exchange’s assets is again postponed. At the same time, analysts continue to monitor how this event will affect crypto trading volumes and prices in the near future.

Here’s a rejoinder from the related news in the press release.

As it is desirable to make distributions to such creditors to the extent reasonably practicable, the Rehabilitation Trustee, with court approval, has changed the deadline for distributions from 31 October 2024 Japanese Standard Time to 31 October 2025.

This means that the final distribution of digital assets will not take place until next autumn. This can hardly be called good news. Still, the story with Mt.Gox after the exchange hack has been going on for more than a decade, and this year it should have ended, thereby ceasing to affect the mood of investors, who traditionally panicked after the movement of large amounts of coins from the wallets of the platform. However, in the end, it turned out that we will have to wait for the end of the story until the end of next year.

Trustee of the bankrupt cryptocurrency exchange Mt.Gox Nobuaki Kobayashi

The price of Bitcoin earlier this year reacted negatively to the news about the upcoming distribution of Mt.Gox’s assets and the exchange’s transaction. At the time, fears grew among market participants about how much of these coins the lenders would sell on the market after waiting a decade for their funds to be returned.

The postponement of the repayment deadline for another year is able to alleviate these concerns. However, if the digital asset market experiences a bullrun peak over the next year, such a distribution could create additional selling pressure and new problems as the industry moves into a bearish trend.

As a reminder, the Mt.Gox exchange was founded in 2010 by Jed McCaleb as a play card exchange platform, but soon became one of the first and largest cryptocurrency exchanges.

In 2011, McCaleb sold the platform to Mark Karpeles, who made it a dominant player in the market, handling up to 70 per cent of all Bitcoin transactions in the niche. However, Mt.Gox has faced numerous problems, including cyberattacks and data breaches, Coindesk reported.

A claim for damages from a former customer of cryptocurrency exchange Mt.Gox

In 2014, the exchange filed for bankruptcy after around 850,000 BTC was stolen from its wallets. The event shocked the market and raised questions about the security of crypto platforms.

Investigations showed that the exchange was not managed in the best way, while some of the losses could be attributed to internal problems and security flaws.

Cryptocurrency hacking

The process of rehabilitating Mt.Gox has been ongoing for over a decade now, and creditors are still waiting for their funds to be returned. At the moment, court and legal procedures are underway to recover assets, which has an impact on the market, as possible massive sales traditionally lead to unnecessary volatility.

The continued compensation of Mt.Gox users is not good news. Still, ideally, the distribution of crypto until the end of October this year would allow to forget about this story, which actively influenced the market sentiment over the past years. Now we should expect the end of payments only in a year. This means that the prospect of crypto volatility due to the platform's wallet operations will remain.