Bitcoin has taken the $66,000 level. What does the current events in China have to do with the growth of cryptocurrency?

Over the past 24 hours, the cost of Bitcoin rose by 6.2 percent, with the first cryptocurrency also reaching the $66,000 line. The beginning of the week in the niche is forming for the market on a positive note, and experts already have the first guesses as to the reason for the upward trend. It turns out that the BTC jump is related to financial stimuli for the Chinese economy announced by the country’s government. Well, this affects the mood of investors in other parts of the world.

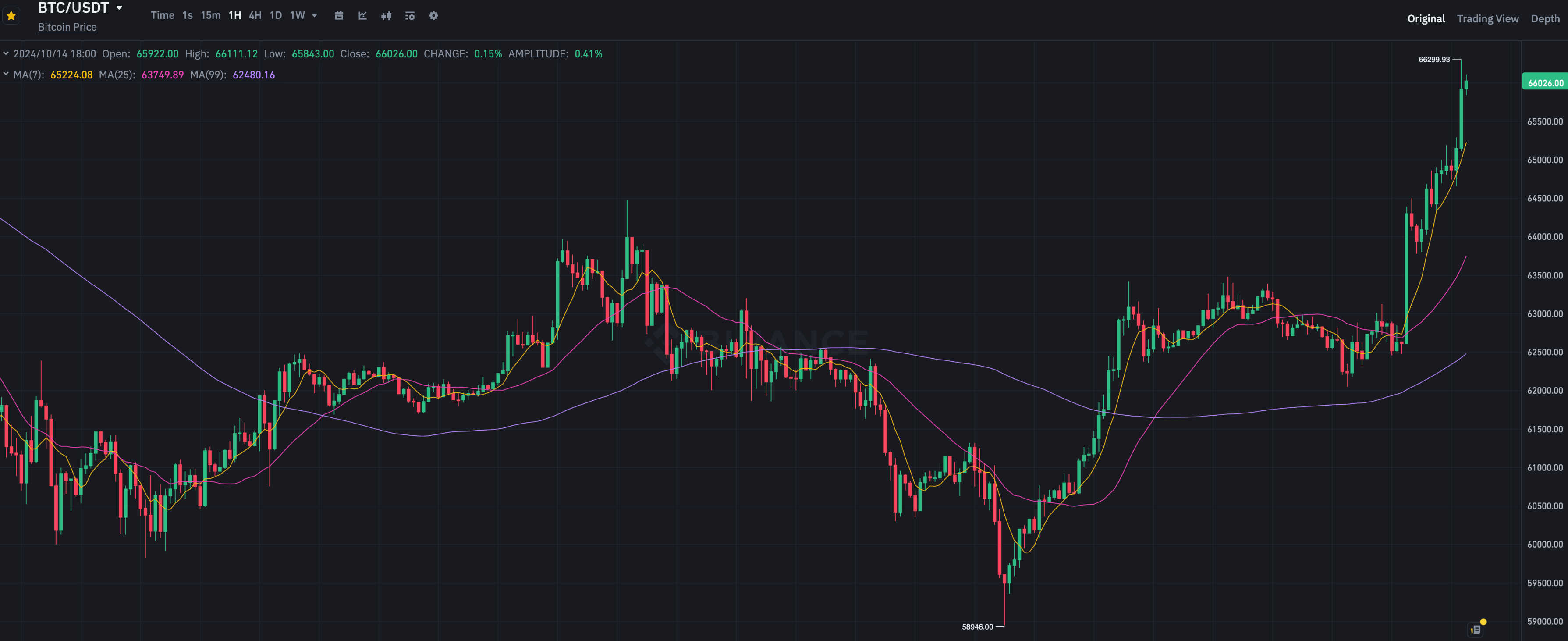

Today, Bitcoin rose above $66,000 in the evening. The local peak here turned out to be the level of $66,299.

15-minute chart of the Bitcoin exchange rate on the Binance exchange

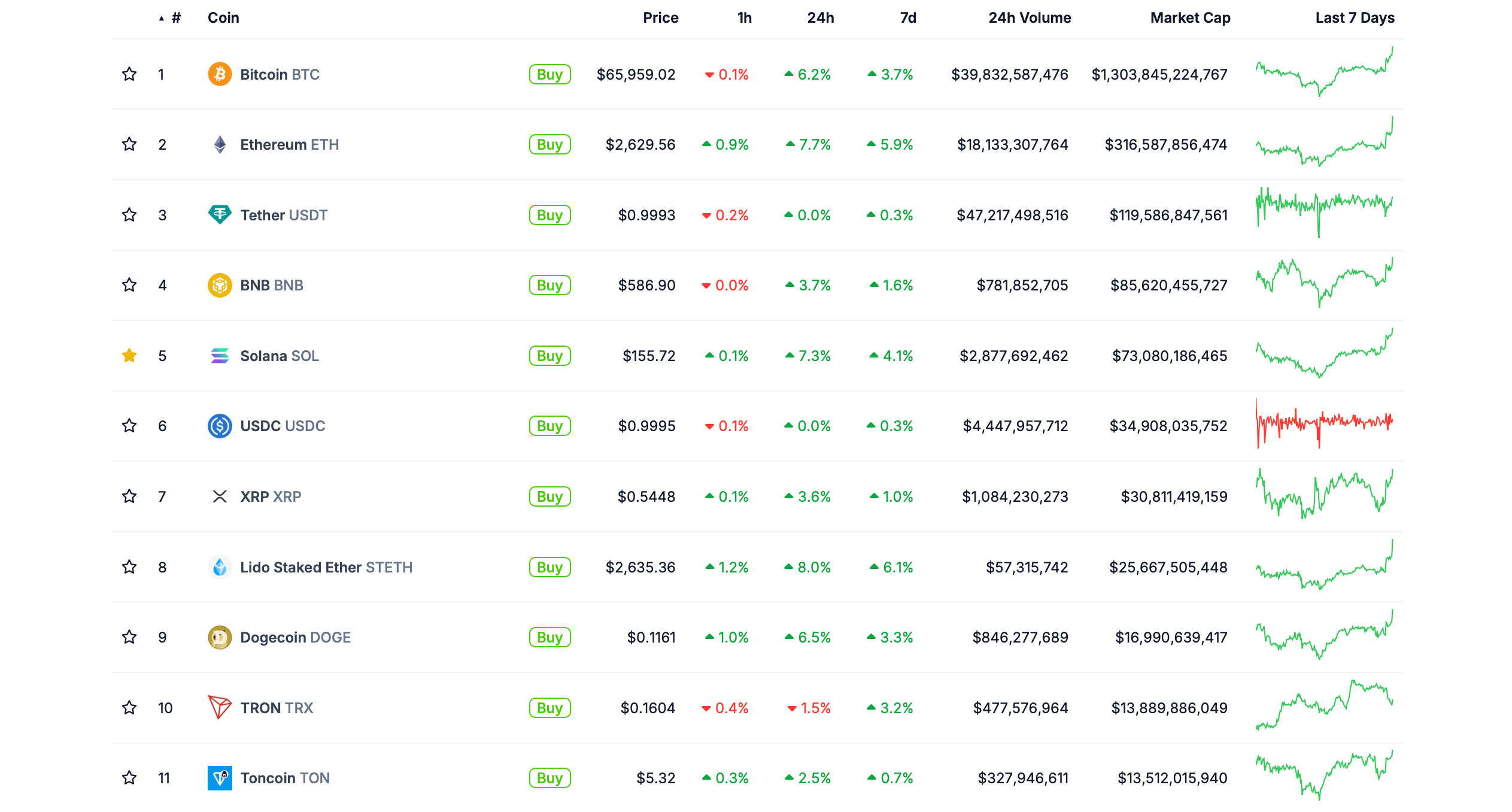

The overall ranking of the largest coins by market capitalisation looks like this. The best results for the day were given by Efirium and Solana with 7.7 and 7.3 per cent growth respectively, although Bitcoin’s result lags behind quite a bit.

The largest cryptocurrencies by market capitalisation as of today

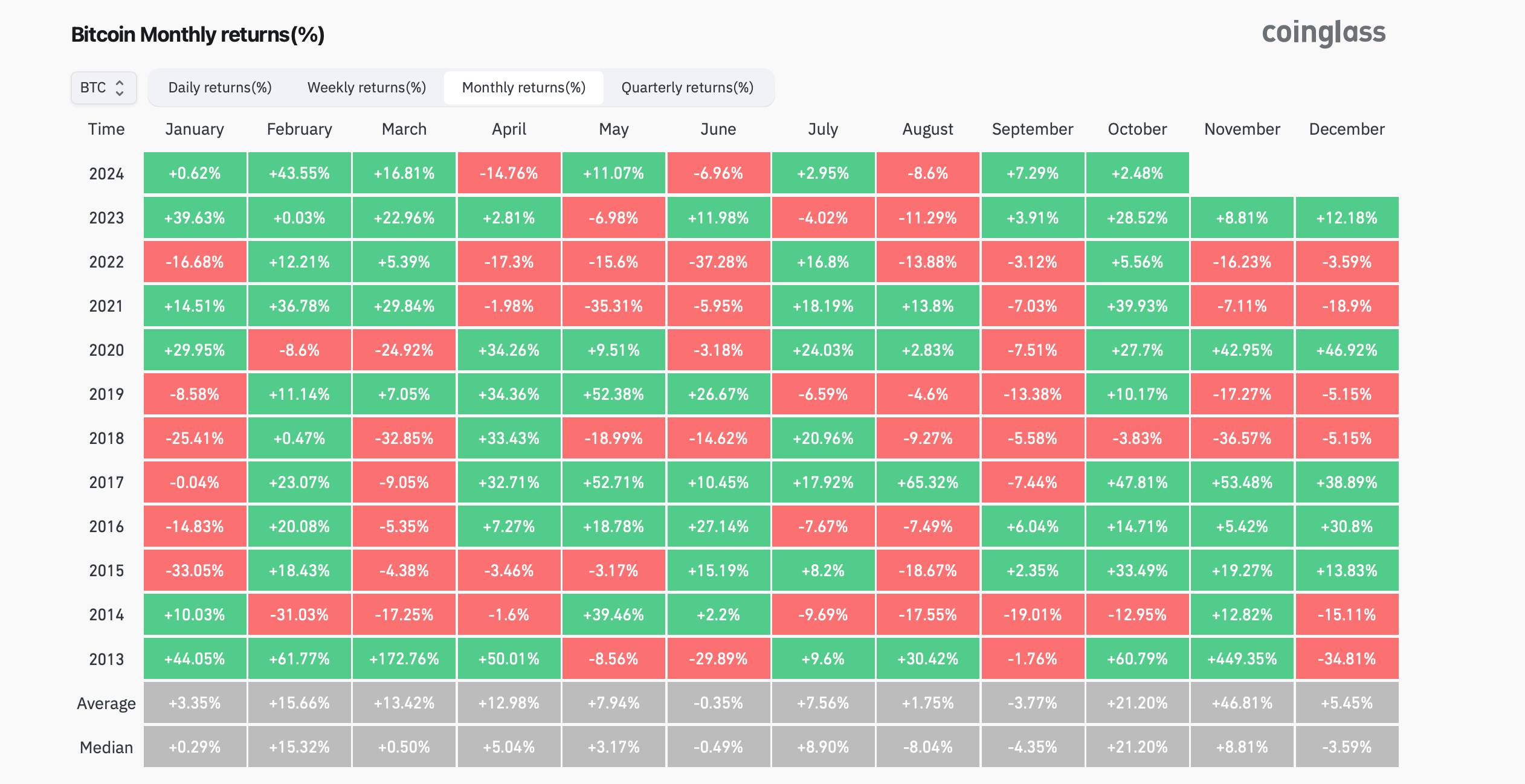

Overall, investors’ expectations for the cryptocurrency market in October were serious, as this month is one of the best for Bitcoin. On average, the cryptocurrency is up 21.2 percent, which is second only to November’s 46.8 percent.

Bitcoin rate changes by month

However, so far, BTC frankly does not please with the behaviour in the context of the month. Still, it is now up only 2.4 percent compared to the first number.

Why Bitcoin is growing now

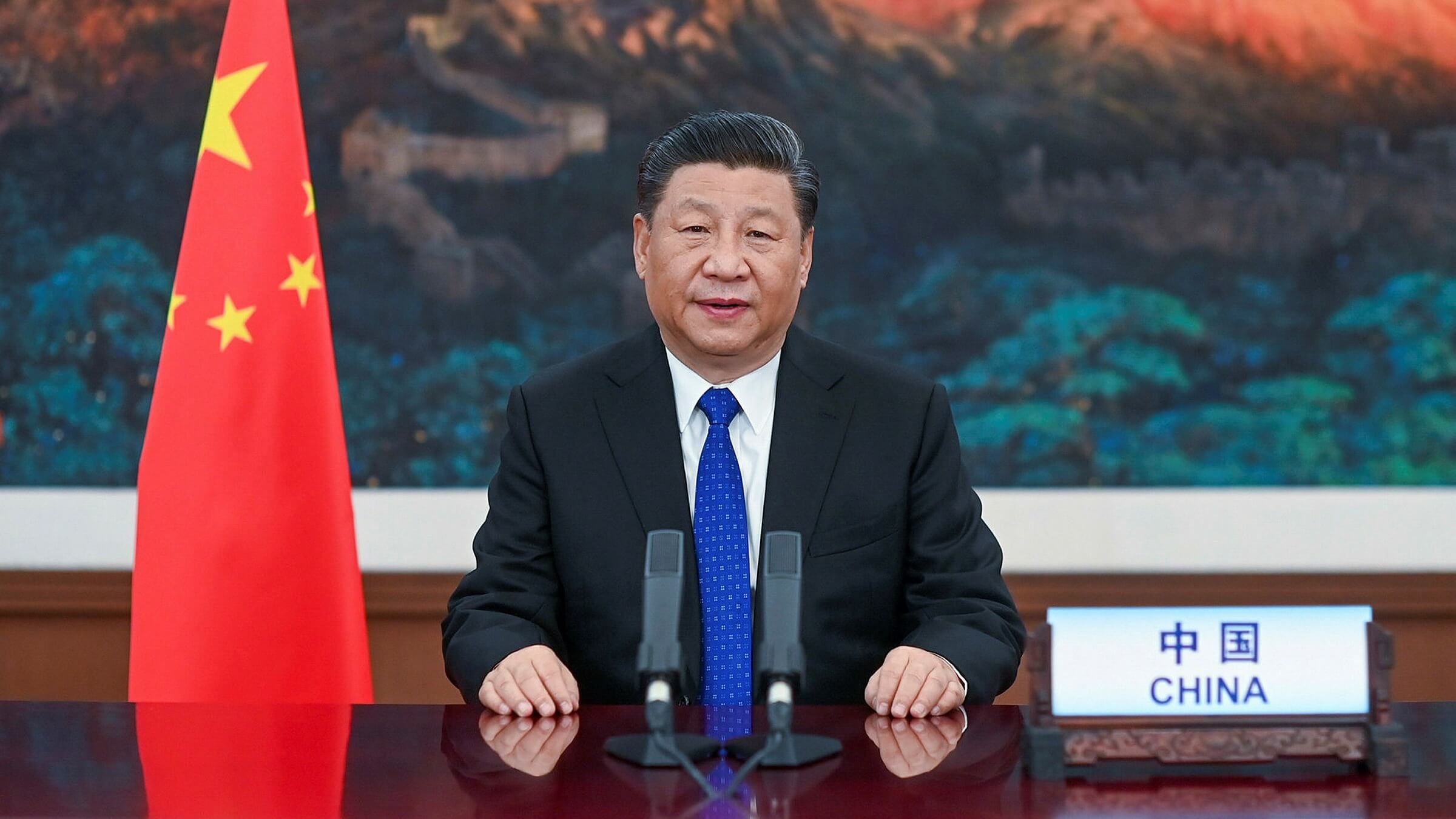

In a nutshell, China is moving to the stage of economic growth. First of all, this is fuelled by aggressive cuts in the benchmark interest rate, which determines the cost of financial loans and their availability. The lower the interest rate, the more favourable it is to borrow, which directly affects the activity of economic agents.

In addition, as the rate falls, the yield of traditional instruments, such as treasury bills, also falls. And this is an additional reason for investors to look for new options for investing funds. Of course, cryptocurrencies, which have come a long way towards popularisation in recent years, are also on their radar. Particularly significant here was the launch of spot Bitcoin-ETFs in the US in January 2024, which have already attracted more than $18 billion in net inflows.

Officials are also looking at the prospect of various initiatives to directly stimulate the economy. For example, these include issuing monthly cheques to certain citizens, something that previously happened during the pandemic in early 2020.

Chinese President Xi Jinping

Overall, China is facing a host of challenges, which include a crisis in the property sector, record youth unemployment, export difficulties and an overall ageing population. The current trend shift in the economy will definitely not solve all of these difficulties in the short term, but it will still have an impact on markets and investors’ willingness to invest.

Presto Research analyst Min Jun noted the importance of the Chinese government’s decisions. Here is his rejoinder.

China’s recent stimulus package seems to be a significant factor supporting momentum in the market.

Handing out money to various states due to the pandemic

According to The Block’s sources, Chinese Finance Minister Lan Fuan unveiled a plan to stimulate the economy, but did not name specific amounts.

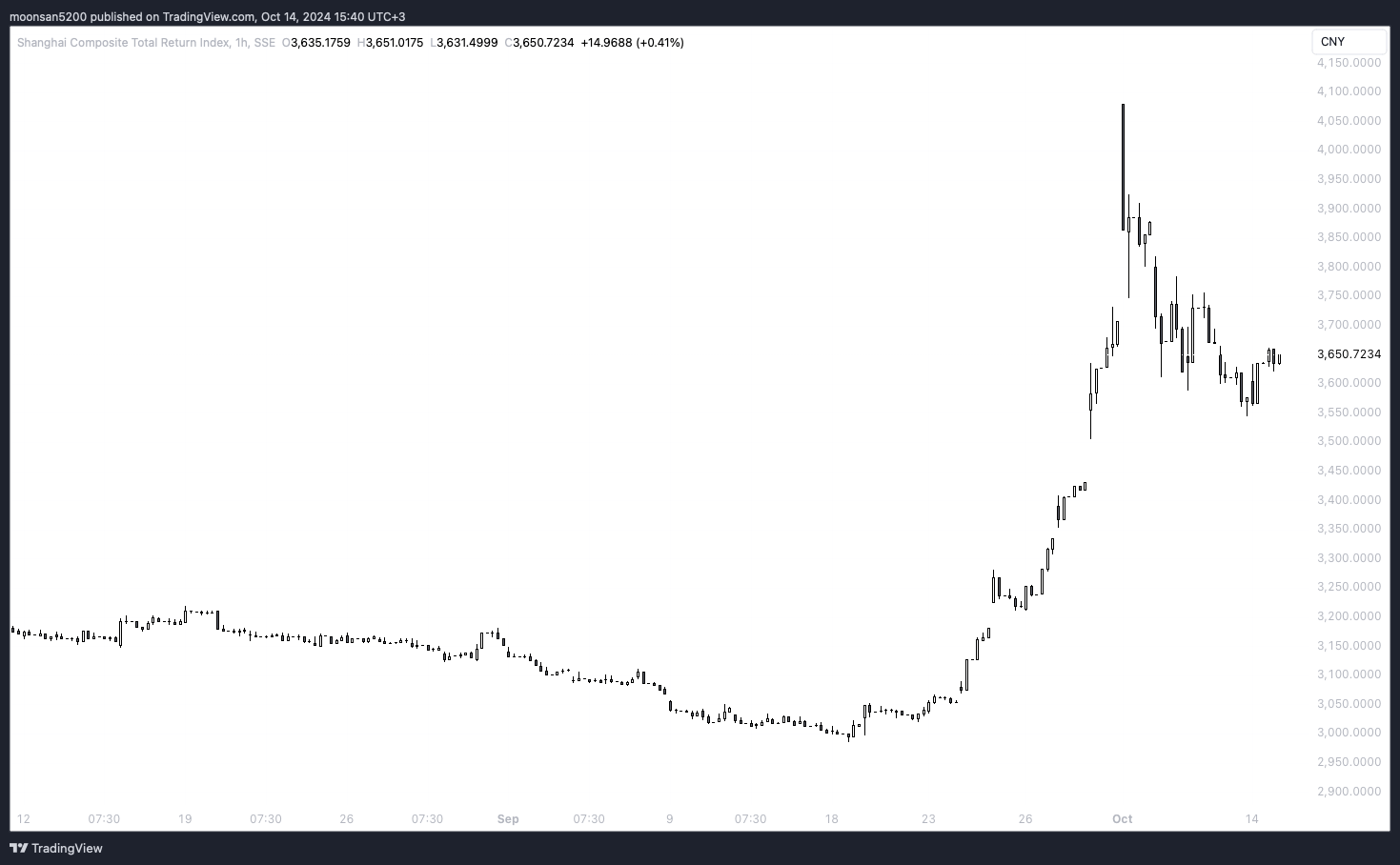

Meanwhile, the Shanghai Composite Index rose 2.12 percent for the day on the back of the announcement. Augustine Fan of SOFA.org also supported the theory of China’s big role in the recent market fluctuations.

Bitcoin’s price rose above $64,000 thanks to gains in Chinese stocks after the weekend’s disappointments.

Shanghai Composite Index performance

Bitcoin was trading in the $62,000-$63,000 range, having fallen to as low as $58,946 last week due to the release of US inflation reports. However, Fan noted that overall market players remained calm despite the rise in inflation.

Ming Jun pointed to the impact of China’s GDP data release and US bank reports on the market this week. Despite Bitcoin’s traditional strength in October, there are still geopolitical risks in the Middle East and political uncertainty ahead of the US election on 5 November that will weigh heavily on the coin market as it approaches.

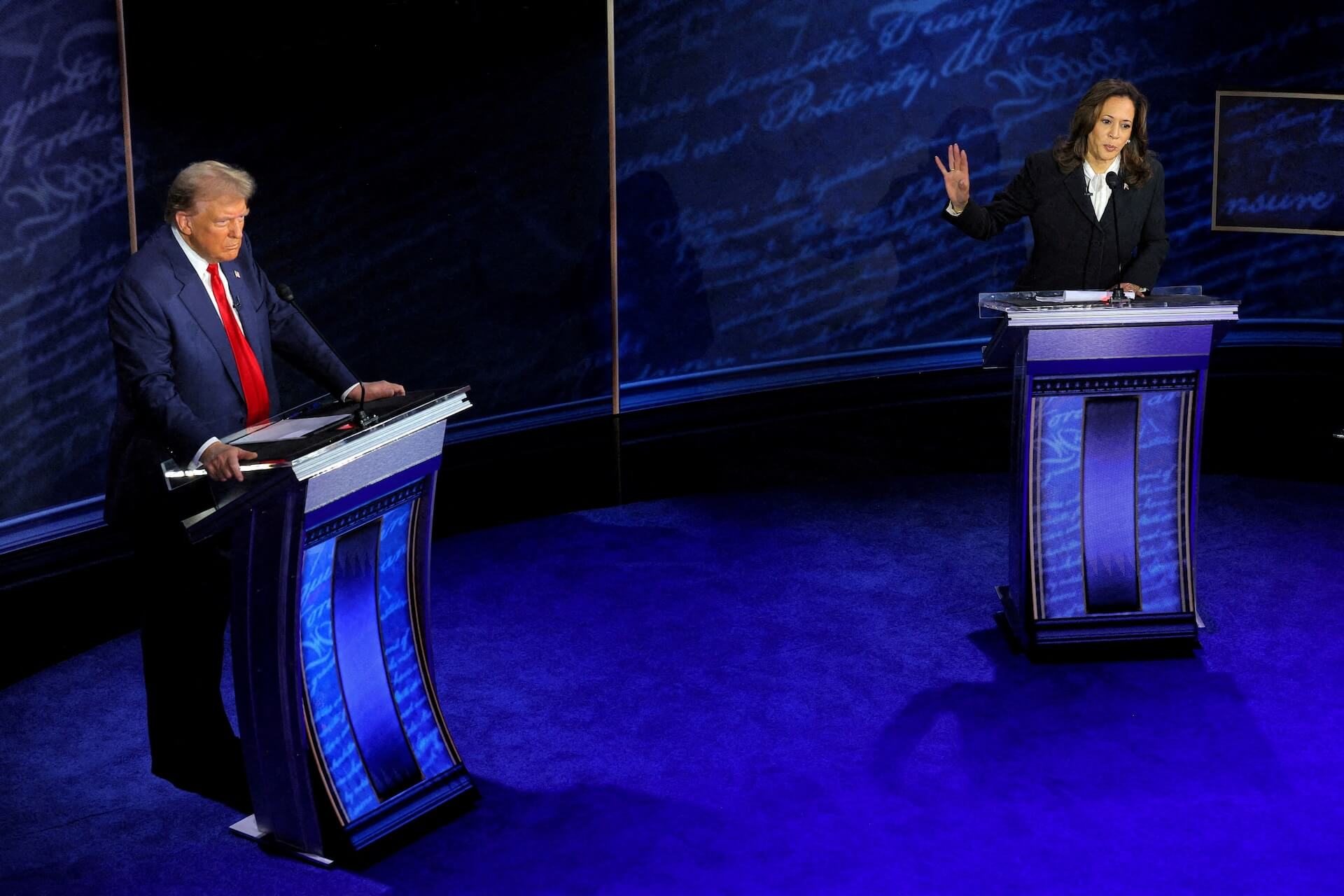

Donald Trump and Kamala Harris Debate

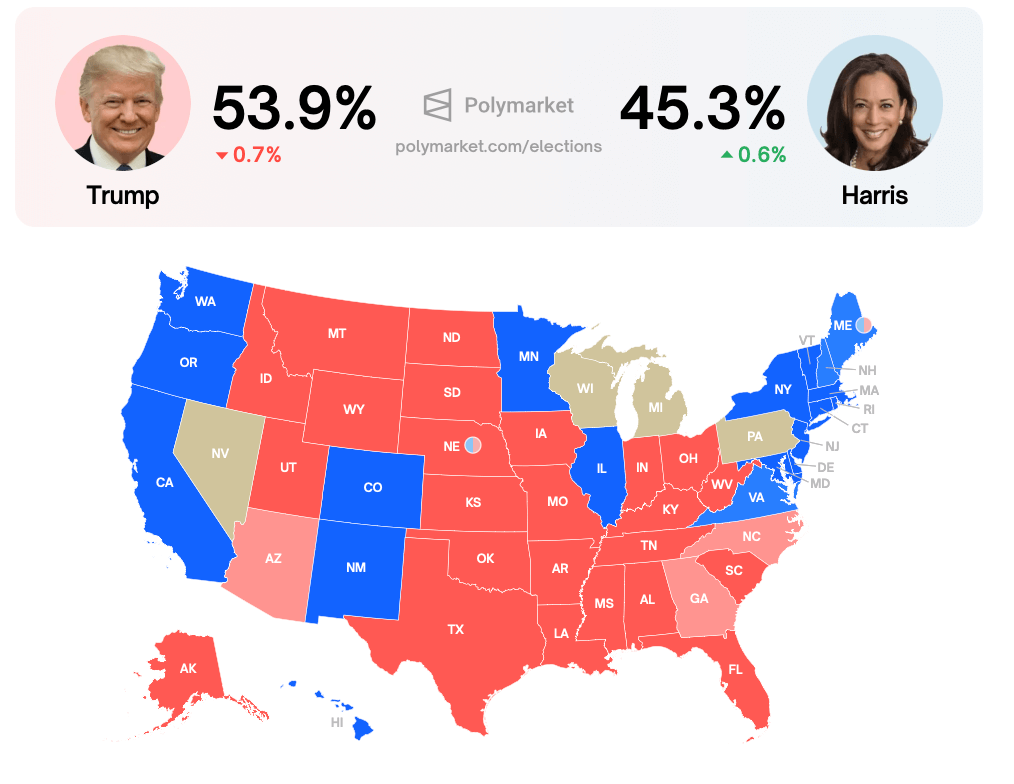

It is important to keep an eye on the candidates’ actions and rhetoric regarding cryptocurrencies and regulation. If Donald Trump as a crypto-friendly candidate continues to gain popularity, it could have a positive impact on crypto investor sentiment and activity.

At the same time, Democratic candidate Kamala Harris continues to be perceived by coin enthusiasts as the worst option for the future of the industry. Still, she has no comment on what’s happening in the niche, and tentatively plans to nominate the current SEC chairwoman as Treasury Secretary. That being said, Gary Gensler openly dislikes and fights digital assets, which could turn out to be a serious problem for them.

The chances of candidates to win the US presidential election according to the odds on Polymarket

As a result, cryptocurrency investors are now focused on the situation in the economies of world leaders. So far, everything hints that things will improve over the next few months, as central banks are gradually lowering the base interest rate. Well, this traditionally creates conditions for an influx of liquidity and growth of various assets, which crypto represents as well.