Bitcoin is set to return to growth before the end of 2024. What factors point to such a prospect?

Bitcoin is entering a positive period in terms of seasonality, as the main cryptocurrency usually grows most actively in the fourth quarter. However, even despite this feature, the coin market will still need a good level of investor demand. This conclusion was reached by analysts of the platform CryptoQuant, who published the next issue of the weekly report on the situation in the niche of coins. They recall that in previous Bitcoin halving years in 2012, 2016 and 2020, the value of BTC grew by 9, 59 and 171 per cent respectively, meaning the situation is clearly worthy of attention.

When the cryptocurrency will start to rise

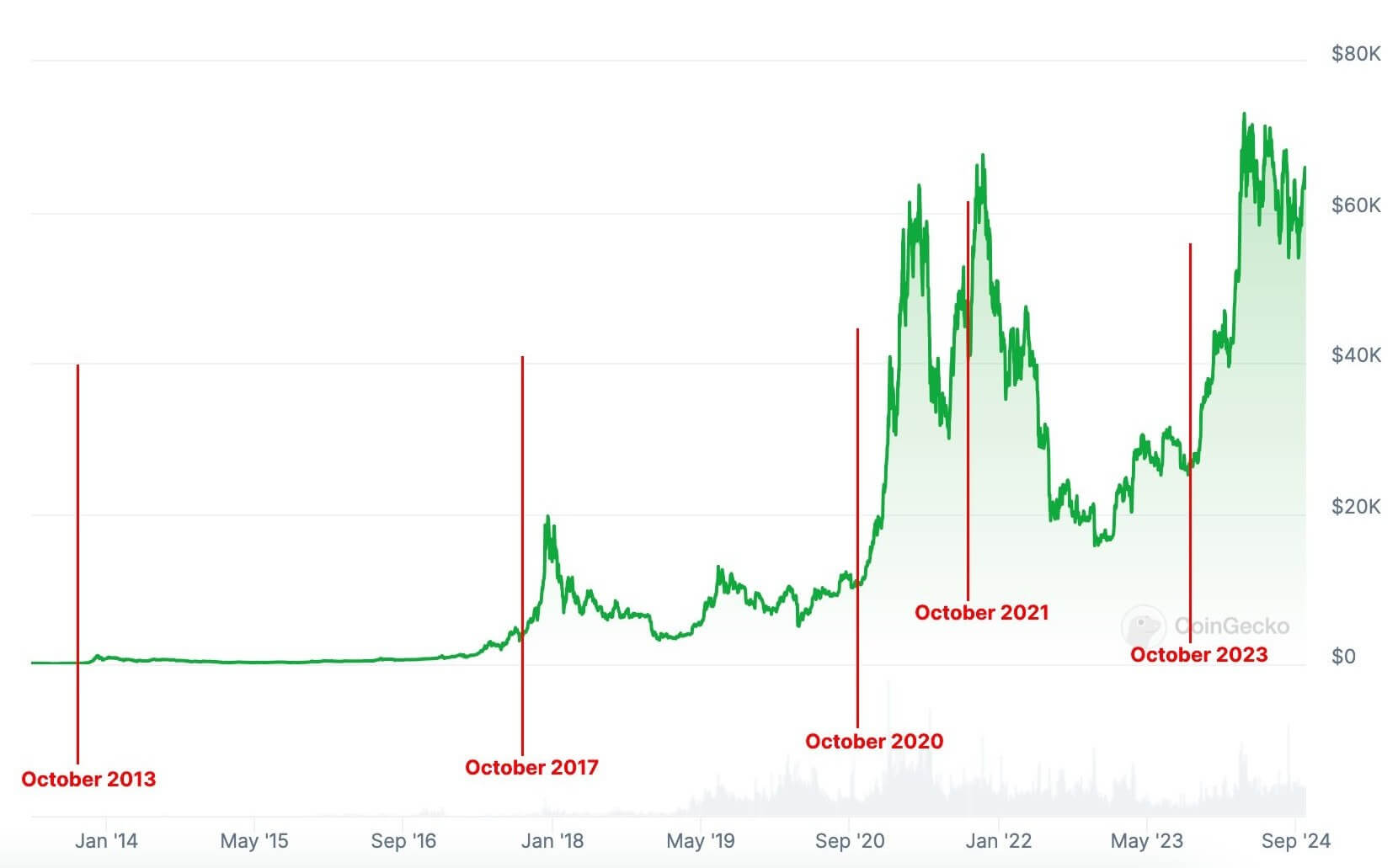

Bitcoin usually performs well in terms of returns in October – and especially when it is in a bullish trend. That said, as Lookonchain analysts reminded us the day before, the previous five bullruns in the crypto industry started just this month. So investors remain positive about the prospects for the coming weeks in the market.

The start of the previous bullruns in the cryptocurrency industry that fell in October

This period of good seasonality on average persists throughout the fourth quarter of the year, which is proving to be positive for long position holders, analysts said. Here is their commentary on the matter.

So far, Bitcoin’s performance in 2024 has been similar to 2016 and 2020 through September.

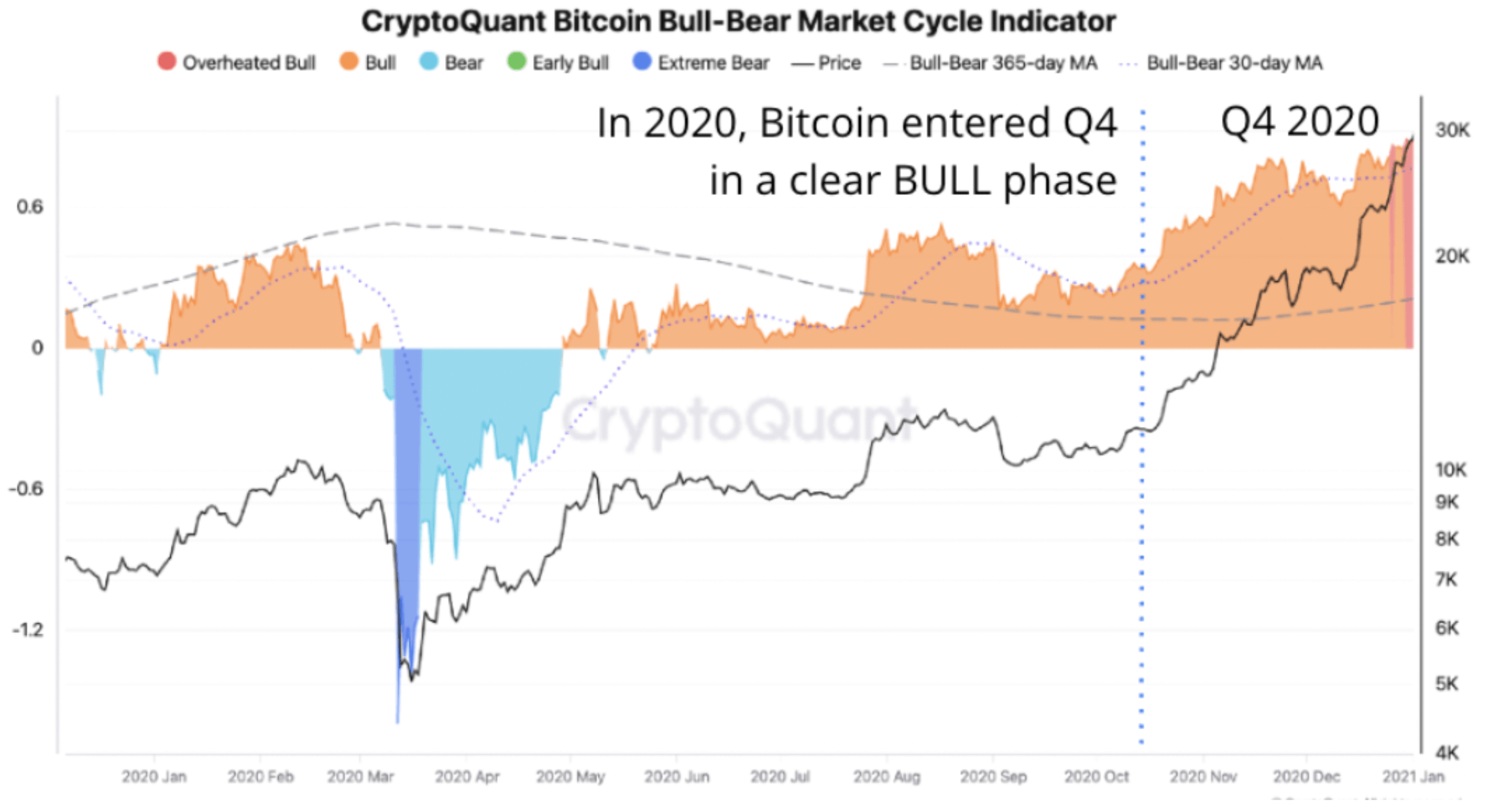

Market phases at the end of 2020

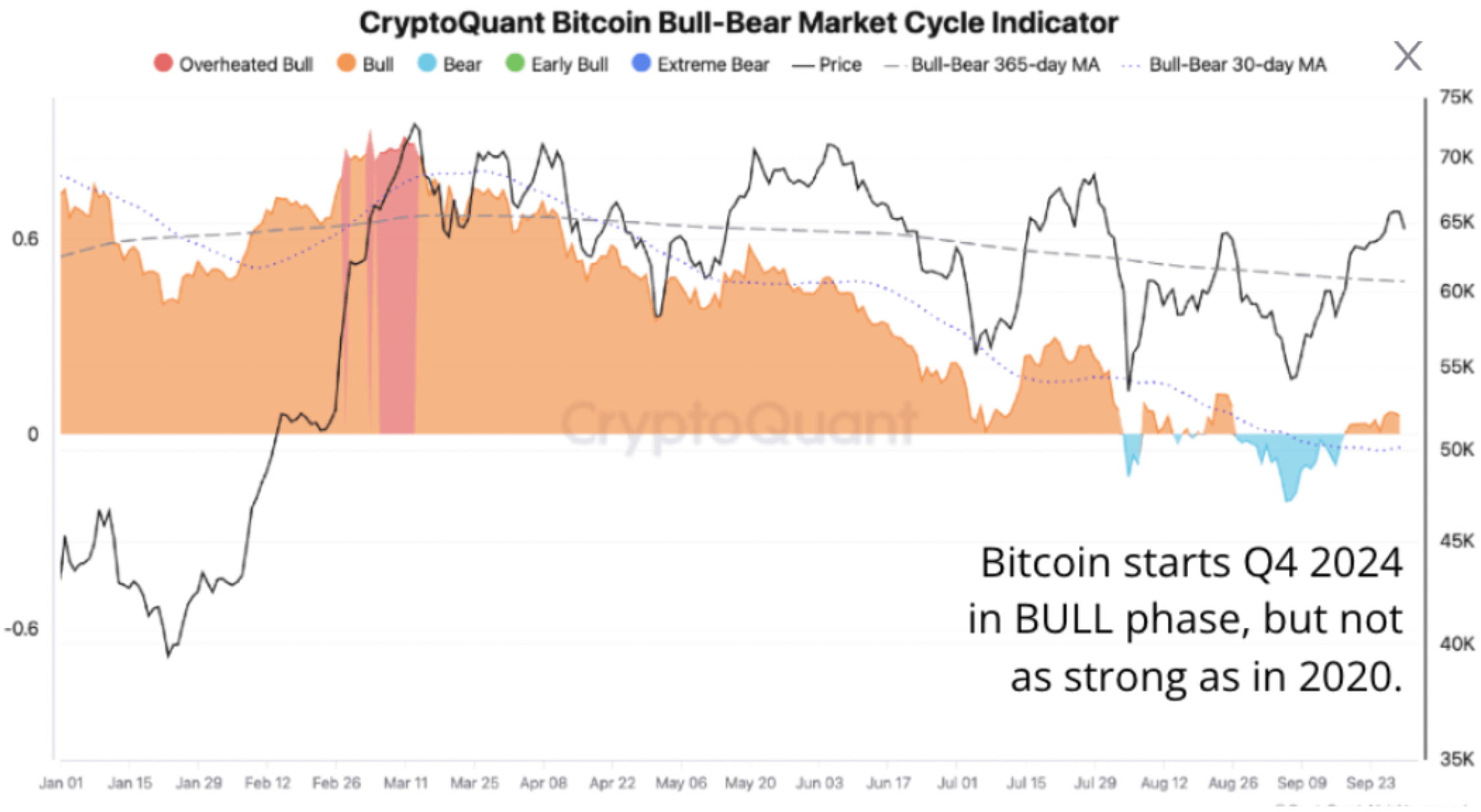

CryptoQuant’s so-called Bull-Bear Market Cycle Indicator shows that Bitcoin remained in a bullish phase between March and August 2024, which is indicated by the orange area.

However, the chart below shows that the price traded in a bearish phase for three weeks between August and September and is now entering the final quarter sandwiched “between bull and bear phases.”

Market phases at the end of 2024

By comparison, Bitcoin entered the fourth quarter of 2020 in an obvious bullish phase, making the entry into the final quarter of this year relatively weak.

The report also emphasises that demand for Bitcoin has tentatively stopped declining, although it needs to grow faster to sustain growth in the fourth quarter. The chart below shows that BTC’s growth in popularity among investors has stalled since July, when the digital asset inflow figure settled between -23 thousand and +69 thousand BTC on a monthly basis.

By comparison, in April, when the price held at $70 thousand, the demand for Bitcoin increased by as much as 496 thousand BTC. Which means investors were actively stocking up on the digital asset. CryptoQuant employees continue.

It looks like demand has room to grow in the fourth quarter.

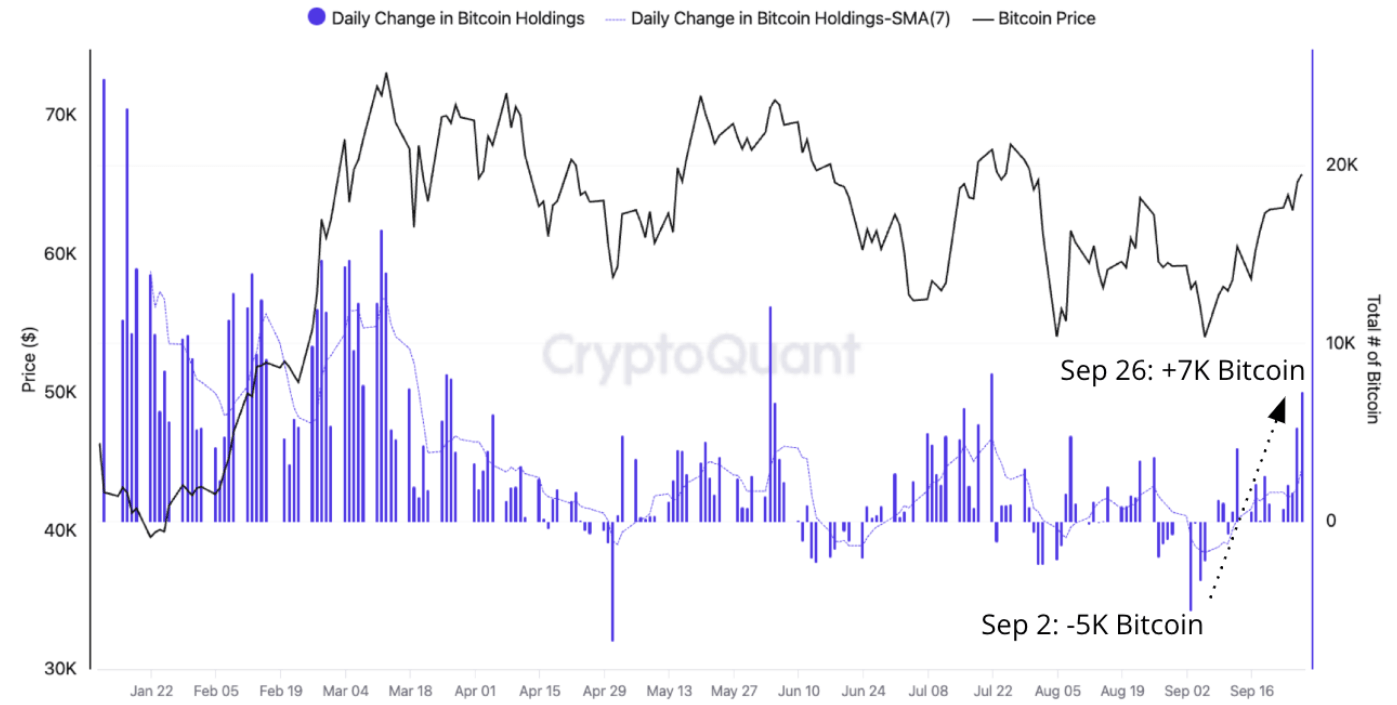

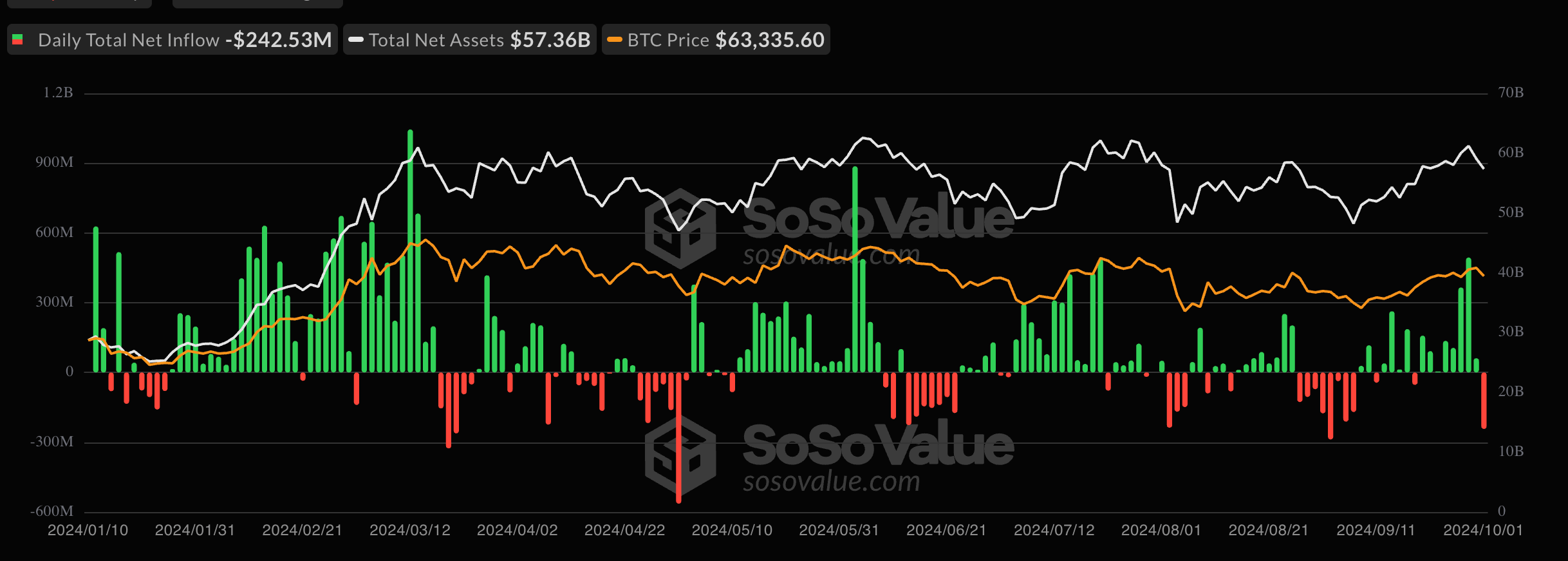

According to Cointelegraph’s sources, institutional demand via US Bitcoin-ETFs is a key factor for the BTC price to continue to rise. Between 2 and 30 September, the outflow from these investment products was 5 thousand BTC, while the inflow was 7 thousand BTC.

Accordingly, the balance on the previous day was positive, although not with too serious advantage.

Changes in the balance of BTC Bitcoin-ETFs

According to SoSoValue, $1.8 billion was invested in spot Bitcoin-ETFs between 13 and 30 September, indicating an increase in institutional demand for these investment products in anticipation of BTC price growth in the fourth quarter.

Inflows and outflows of funds from spot Bitcoin-ETFs in the United States

All these conditions are enough for Bitcoin to reach the $85-100 thousand mark by the end of December. Also, the last key seasonality factor of the year – Christmas holidays – may play its role in this context.

Usually, this period is associated with a large-scale bullrun, and not only in crypto. Still, in such periods of time investors want to get additional profit, which is never too much on the eve of the holidays.

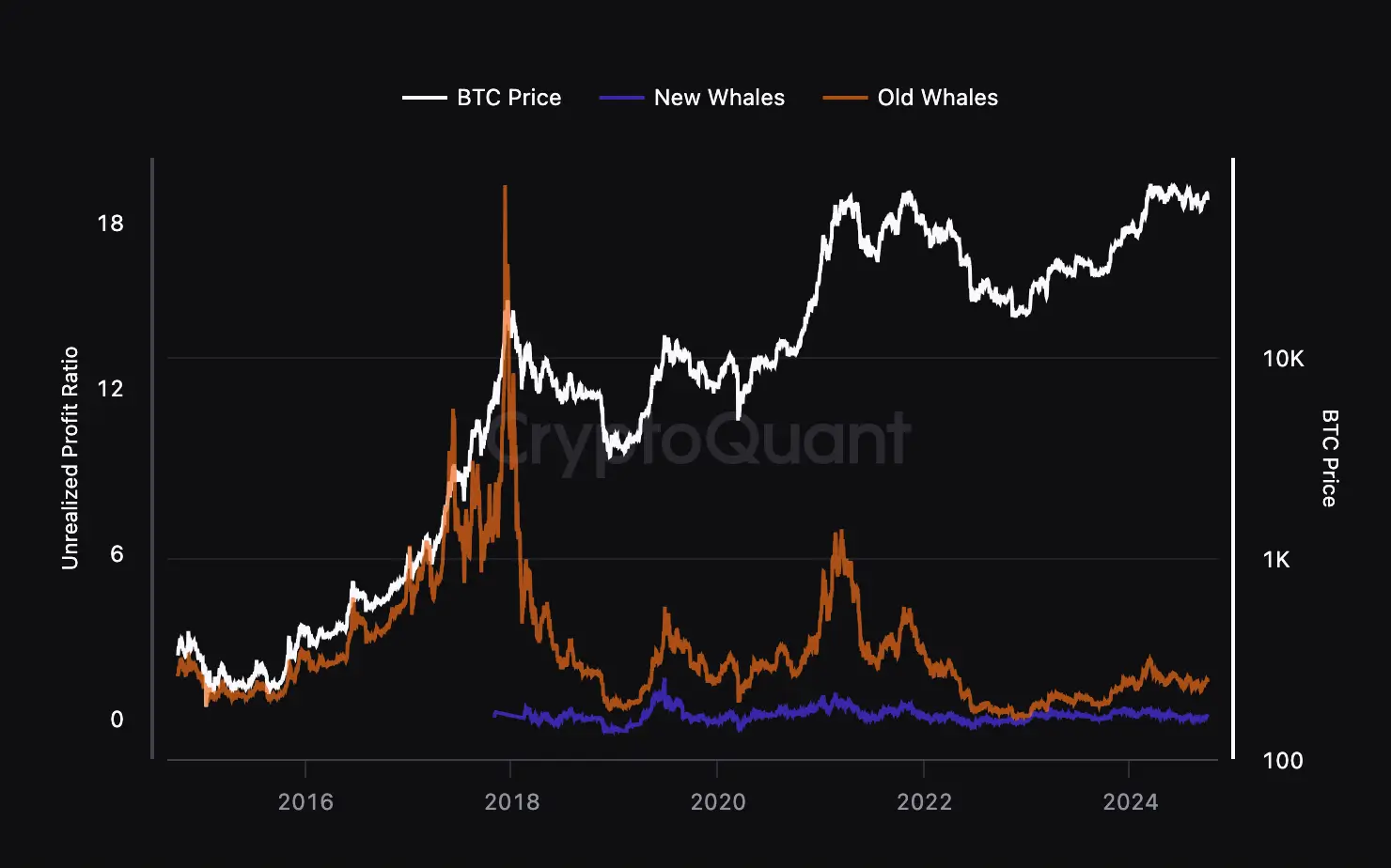

Market conditions also suggest that the unfixed profits of large investors are still too small for them to start selling coins en masse. This was stated by CryptoQuant founder Ki Ën Joo.

According to the expert, new whales who hold a certain asset for five months or less will get only 1 per cent profit from their investment if they sell BTC at the current price. Thus, they have no reason to conduct large transactions and thus influence the market.

Unfixed profit for different categories of whales

Older whales are doing better. Their unrealised profit ratio reached about 1.27 points as of September 30, while new whales are at 0.01 points. However, Zhu noted that the older whales “have not seen particularly high returns” during the current cycle.

Given the above, the CryptoQuant chief concluded that whales are unlikely to dump their positions into the market until liquidity from retail investors becomes available. This will push up cryptocurrency prices and at the same time give large holders the opportunity to exit the market if they wish. They are doing just such a thing as the industry’s bullruns develop.

As a result, experts are banking on the seasonality of the digital asset market, which often shows strength near the end of the year. The industry situation actually looked good until Iran attacked Israel on Tuesday night. And this traditionally leads to increased caution of investors, who prefer to close positions in such conditions.