Bitcoin’s corrections in this cycle coincide with previous cryptocurrency market bullruns. What does that mean?

Recently, Bitcoin has shown remarkable resilience despite periods of price volatility. Glassnode analysts drew attention to this in their latest report. According to them, corrections in the current bull cycle remain relatively shallow and continue to follow the scale observed in previous uptrends. That is, the overall market structure is consistent, which in turn reflects both the resilience of demand and the limited scale of the recent collapses. In other words, previous bullruns can still serve as a benchmark for new benchmarks.

What will happen to cryptocurrency in the future?

Glassnode’s report emphasises that the major cryptocurrency’s corrections remain not as critical as in past cycles. Here’s the relevant rejoinder from experts on what’s going on.

The maximum drawdown is a little less significant than is usually seen in previous bullish trends.

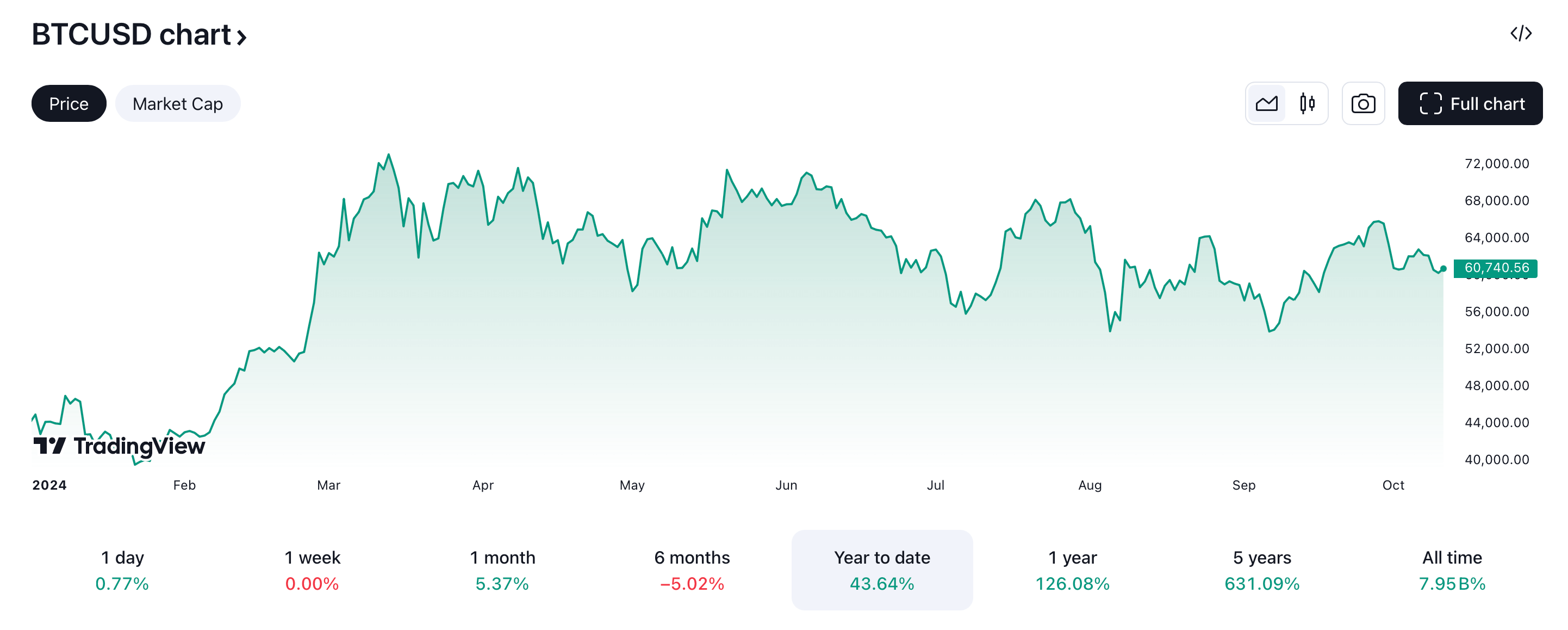

Bitcoin exchange rate changes in 2024

Two key metrics that experts look at are True-Market Mean and Active Investor Price, which help estimate the average value of Bitcoin to investors in the current market cycle.

True-Market Mean reflects the average price at which BTC has been purchased by all market participants over time. Meanwhile, the Active Investor Price focuses on the average cost of entry for investors who have actively traded in recent months.

Since the beginning of 2024, the spot price has largely remained above both metrics with rare exceptions. According to The Block’s sources, this indicates a strong support base that helps stabilise the market during price dips.

Recent market movements show that investor behaviour remains resilient and strong demand mitigates the impact of corrections.

Bitcoin and other cryptocurrencies are on the rise

Of particular note is the group of short-term holders of BTC who have purchased it in the last one to three months. Glassnode notes that the recent price of Bitcoin has once again exceeded the critical underlying value for this group, which means their sentiment towards the future of the market should be positive.

The experts continue.

This is an encouraging sign of strength. However, if the market doesn’t hold above this level, recent buyers will find themselves under increasing pressure – especially given the difficult conditions of recent months.

MVRV indicator

Meanwhile, the MVRV indicator, which measures the ratio of market value to realised value for new investors, has risen from the lows of early August. This is another good sign for the bulls in the current cycle, analysts said.

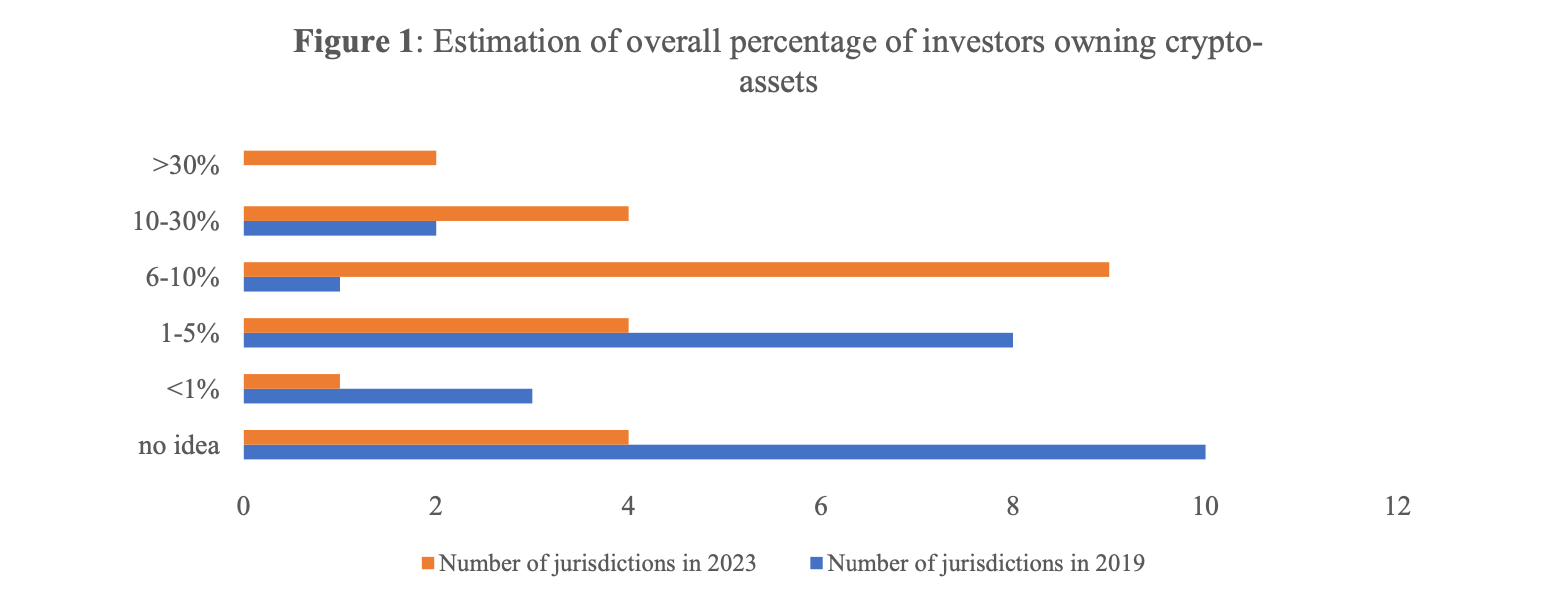

The good news also includes the fact that individual investors are actively buying crypto. According to the International Organisation of Securities Commissions Council (IOSCO), cryptocurrency ownership among retail investors has increased significantly since 2020, which calls for more attention to educational measures in this area.

Cryptocurrency ownership rate

According to the IOSCO report, in 15 of the 24 jurisdictions surveyed, up to 10 per cent or more of retail investors owned cryptocurrency in the past year, while in six regions this figure reached 30 per cent or more.

That’s a marked increase from 2020, when the figures did not exceed the 5 per cent level. Here’s a quote from the publication on the situation, as cited by Cointelegraph.

Despite market volatility, which manifested itself in the form of a major downturn in 2022 during the Cryptozyme, retail investors in both developed economies and emerging markets continue to invest in crypto assets.

IOSCO experts noted that there are risks and concerns in the niche due to the volatility of the crypto market, lack of investor understanding, lack of regulation, and fraud and scams. These problems are similar to those identified in the 2020 report, i.e. the situation has not improved in this respect.

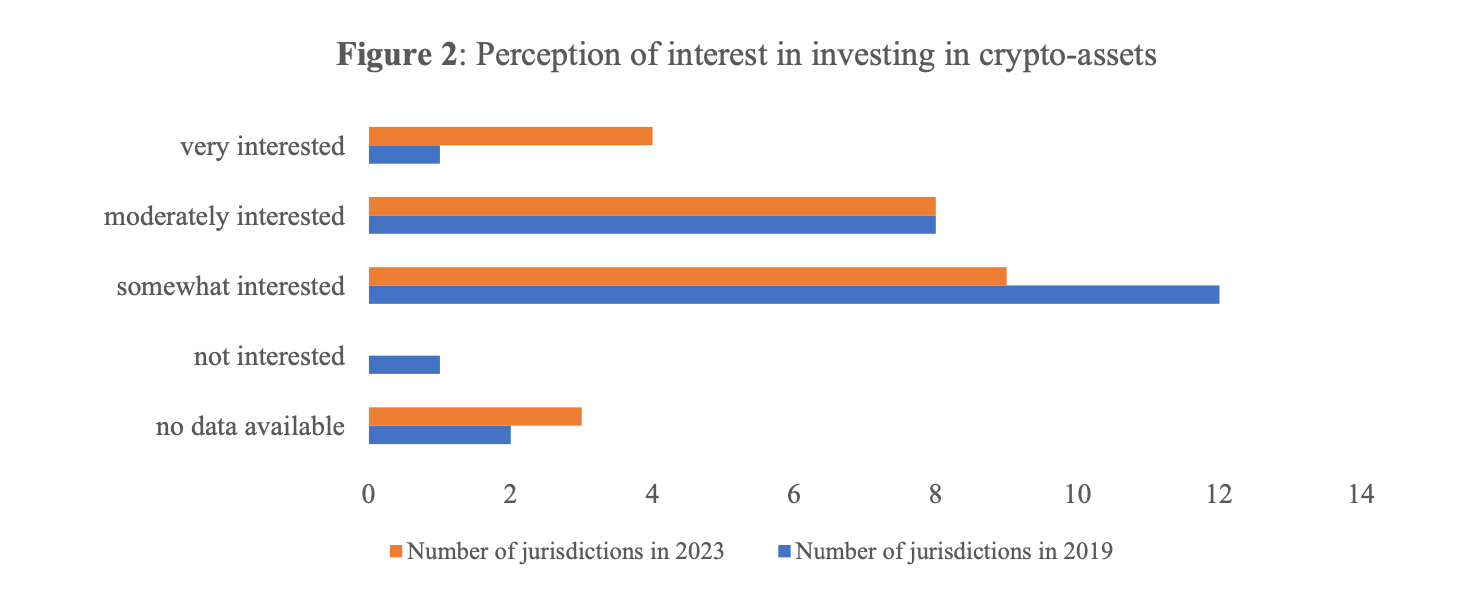

Level of interest in crypto

Overall, the risks and challenges have multiplied since 2020, emphasising the need for more robust investor protection and education measures. The past four years have seen several high-profile bankruptcies and platform collapses, a prolonged bear trend, an increase in fraud, hacking and investor losses, and increased regulation and enforcement in the crypto space.

Despite this, retail investors continue to show interest in crypto. Which means they expect the niche to grow.

Over the past four years, numerous surveys, studies and reports have pointed to growing investor interest – and especially new investors – in crypto assets.

The report also notes that retail investors buying cryptocurrency tend to be younger – typically men under 40. Thus, the movement of the crypto market depends largely on the actions of the younger generation.

It can also have a significant impact on the U.S. presidential election, as a significant percentage of Americans own cryptocurrencies.

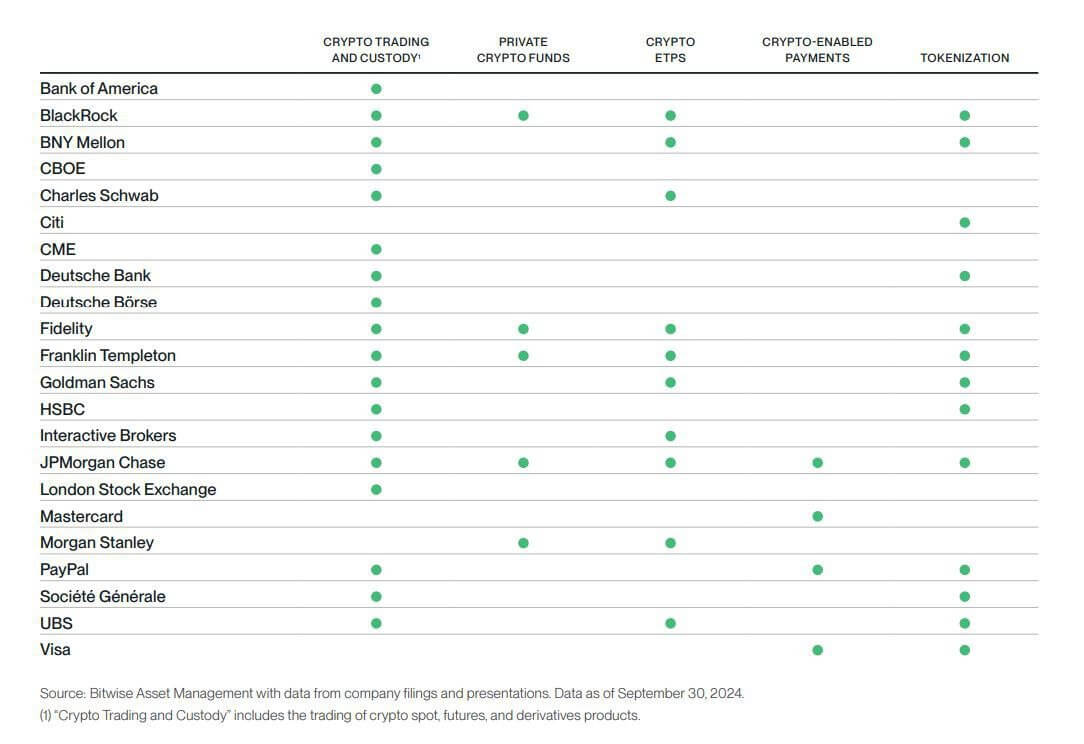

The growth of acceptance of digital assets is also noticeable in the situation with major representatives of the world of finance. It was analysed by employees of the investment platform Bitwise, comparing several indicators. In particular, we are talking about crypto trading and custodial services, the availability of private crypto funds, ETFs and payments in digital assets, as well as support for tokenisation.

The latter term means moving traditional assets to blockchain for faster and more efficient interactions with them. Here is the result of that comparison.

Comparison of cryptocurrency and blockchain popularisation among traditional finance companies

Leading the ranking was JPMorgan Bank, which received points in every metric. It is worth noting that the banking giant, among other things, uses its own blockchain platform called Onyx, which means that it is really ahead of the competition in terms of capabilities.

The verdict of analysts is clear: the current stage of growth in the coin market fits into the norms of previous bullruns. Many experts probably no longer believe in such a prospect, because the industry has been in the so-called sideways for quite a long time without a clear advantage of buyers or sellers. However, if we focus on the time after the halving in April 2024, there is still time for growth to continue.