Citi analysts have named the outcome of the US election, which will be the best for the cryptocurrency sphere. What is it?

5 November 2024 is the most important date of this year for the United States and the world as a whole. It is on this day that the election of a new president will take place, as well as the political balance of power in Congress. For cryptocurrency investors and blockchain businesses, it is extremely important that both houses of Congress are occupied by Republicans. This is the conclusion that analysts at Citi Bank came to in their latest report. Along with this, they shared other interesting facts about what is happening in the market.

How the election will affect cryptocurrencies

An unconditional victory of the Republicans is just what the sphere of digital assets needs, experts believe. If the Democrats, led by Kamala Harris, succeed, Congress may be divided between the two forces.

This, in turn, will lead to increased uncertainty and tension, which will negatively affect the digital asset industry. Here’s a comment from bank representatives, led by Peter Christiansen, as quoted by Coindesk.

Trump and Vance have publicly supported digital asset reform, and Republican control of the Senate will be important for the passage of FIT21-type bills along with the confirmation of new agency heads.

As a reminder, FIT21 is the Financial Innovation and Technology for the 21st Century Act, which was passed by the House of Representatives in May 2024 and has proven to be an important step in regulating the crypto industry. The document creates clear rules for the existence of digital assets, while dividing responsibility between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The former will oversee digital commodities, while the latter will focus on assets from the securities category.

FIT21 supports innovation in the digital world and protects consumers. The law requires transparency from developers of digital projects: disclosure of their structure and management, as well as reliable protection of user funds. This not only makes it easier for companies to work with cryptocurrencies, but also gives market participants confidence that the U.S. will be a leader in blockchain innovation.

Republican and US vice-presidential candidate J David Vance

At the same time, Donald Trump is the Republican candidate for US President. Back in July 2024, he submitted the nomination of James David Vance as the new vice-presidential candidate. Both are actively in favour of moderate regulation of the crypto market, while Vance has been storing bitcoins in the equivalent of $100,000 to $250,000 since as early as 2021, i.e. interacting with the industry.

Nevertheless, the victory of Republicans in the Senate and Democrats in the House of Representatives will still be a favourable outcome for the market, experts believe.

Citi noted that there are several Democrats on the existing House Financial Services subcommittee who are strongly opposed to cryptocurrencies. However, “they are likely to be outweighed by a combined contingent of Democrats and Republicans who favour the popularisation and development of digital assets”.

Harris’ victory as the new president and a Republican Congress will be an uncertain outcome for crypto, as Kamala remains undecided on her digital asset policy goals. Additionally, a Democrat administration will likely retain many of the current agency heads who are already remembered for their negative attitudes towards the blockchain and digital asset industry.

U.S. Vice President Kamala Harris

The worst possible outcome according to Citi representatives is a Harris victory and a divided Congress. Such a scenario would create possible confirmation problems in the Senate, while investors would be less hopeful that any potential legislation regarding cryptocurrencies would have sufficient support in the Senate.

However, as Decrypt’s reporters point out, there are other factors outside of the US political arena in the life of the state that are in a position to prevent Bitcoin from reaching new highs in the near future. They were revealed by Yuya Hasegawa, a digital asset market analyst from Bitbank. According to him, rising U.S. bond yields are a threat to the growth of the BTC exchange rate.

When bond yields start to stay high, it makes them more attractive for investors to invest in than high-risk assets like Bitcoin. Thus, capital may start to flow from crypto into securities, which is unlikely to make further BTC appreciation possible.

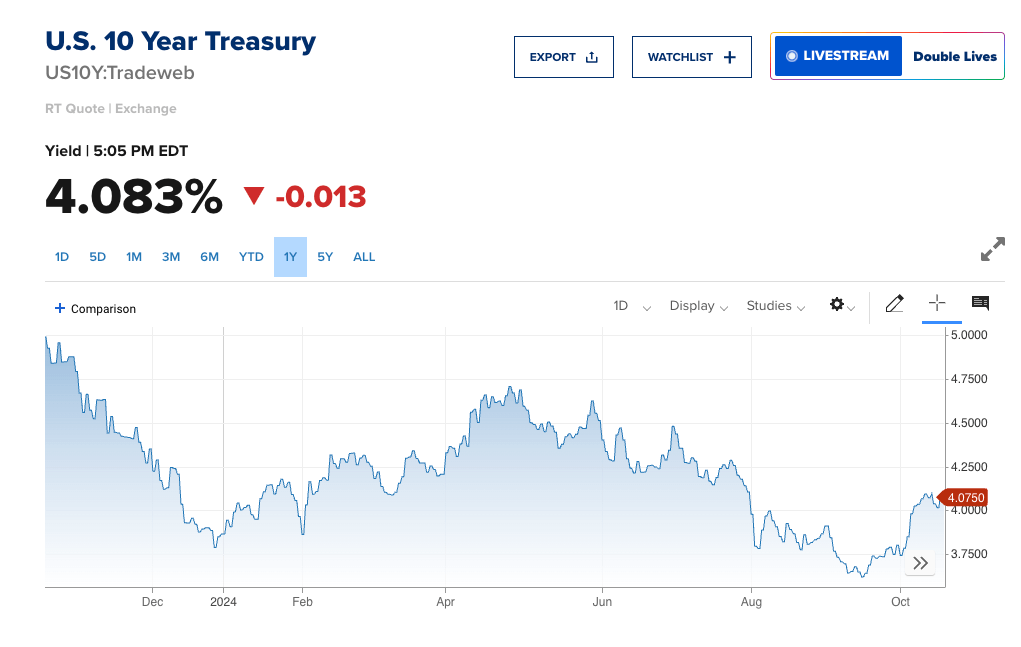

US ten-year bond yields

As of mid-October, the yield on ten-year US Treasury bonds fluctuated between 4.02 and 4.08 per cent. This is slightly lower than in September, when the yield reached 4.3 percent. Still, the figure is still high enough to create an attractive alternative to crypto assets.

And that’s not Hasegawa’s only concern. Here’s a comment on that.

Stronger coin sales by individual investors compared to expectations and lower jobless claims have caused markets to worry that the Fed may not continue to lower the benchmark lending rate as quickly.

The likelihood that the Fed will not cut rates again in November is not an immediate threat. According to a Bitbank analyst, there is still a “reasonable probability” that the Federal Open Market Committee (FOMC) will decide to cut rates by 25 basis points after its meeting in early November.

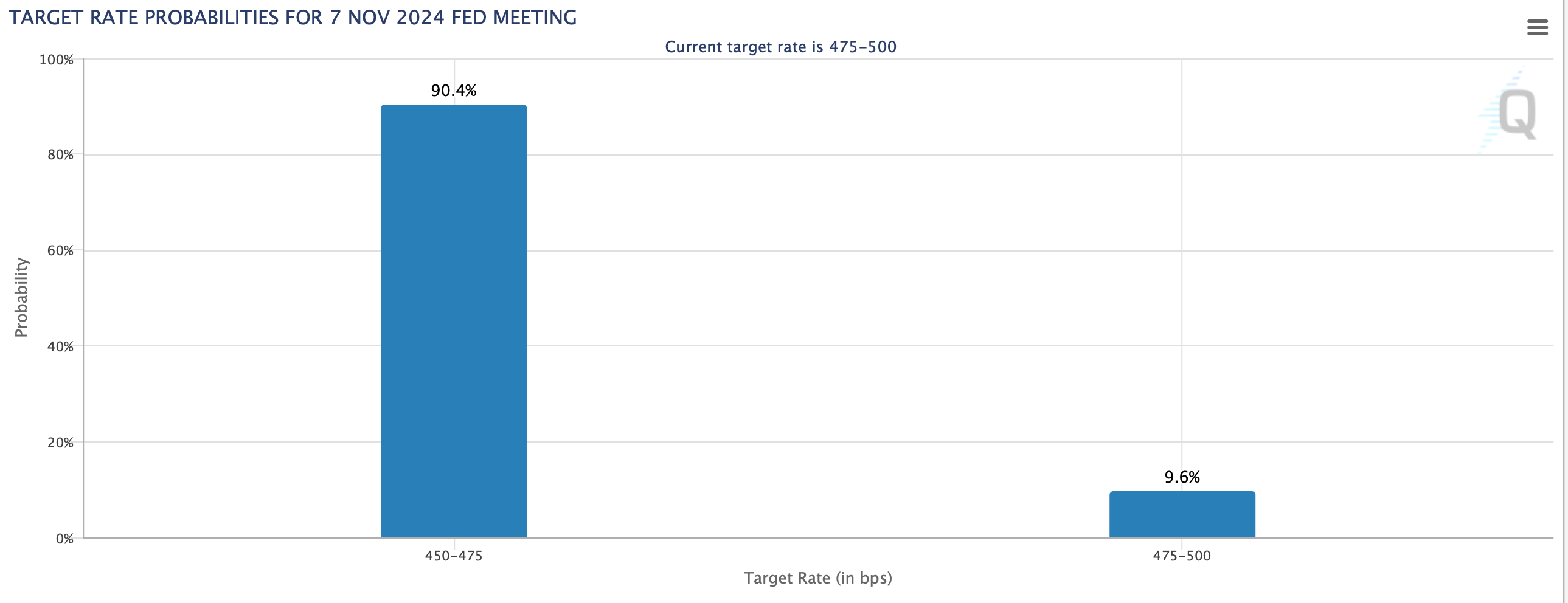

Over the weekend, for example, traders put that probability at 90 per cent, while the remainder of the figure is for the rate at current levels after the meeting on the 7th.

Chances of a 25 basis point cut in the benchmark interest rate at the next FOMC meeting

In general, experts agree that the Republicans will prove to be a better choice for cryptocurrency holders in the United States. Still, judging by the events of recent years, they are more active in favour of normalising what is happening with digital assets. At the same time, many Democrats openly oppose the popularisation of coins.

Want to keep up with the latest news? Subscribe to our cryptochat of future millionaires. We look forward to seeing you there to experience the final stage of this bullrun together.