Florida officials want to add Bitcoin to pension plans. What does this mean for the popularisation of cryptocurrencies?

Florida finance chief Jimmy Patronis is pushing for a major step towards Bitcoin adoption. He previously asked Florida State Board of Administration (SBA) Executive Director Chris Spencer to include the first cryptocurrency in the state’s pension plans. He said adding BTC would help create additional inflation protection and benefit local residents.

The issue of investing in Bitcoin will soon be considered by Microsoft shareholders as well. The relevant vote will take place on 10 December 2024, and the company’s board of directors has recommended voting against the proposal.

Although the chances of success here are minimal, the very fact that representatives of the third largest company in the world are paying attention to the topic of cryptocurrencies already speaks volumes.

Cryptocurrency investors during the bullrun

How bitcoins are made

There is a separate quote in the letter to Spencer in which the official describes the need for Bitcoin integration at the state level. Here it is.

Bitcoin is often referred to as “digital gold,” it is able to help diversify a state’s portfolio and provide a reliable hedge against the volatility of other major asset classes.

Bitcoin is indeed often referred to as digital gold because of the similarities in its properties to precious metal. First of all, the maximum supply of BTC is limited to 21 million coins, plus the digital asset is not managed by any country or government.

However, Bitcoin has certain advantages as well. It can be sent to anyone anywhere in the world in a matter of minutes, the rate of issuance of new BTC halves approximately every four years, in addition, the transparent blockchain allows you to specify the current supply of cryptocurrency at any time, which is not the case with gold.

.

Letter from Jimmy Patronis asking for the use of Bitcoin in retirement plans

In the letter, Patronis calls on the Florida Board of Administration to “report on the feasibility, risks, and potential benefits” of directing a portion of the state’s pension system funds into digital asset classes. This must be done before the next legislative session, scheduled for 4 March 2025.

According to Cointelegraph sources, Florida’s SBA manages more than 30 funds.

They include the state’s pension trust fund, which had about $205 billion in assets as of 30 September. In the letter, Patronis suggested testing Bitcoin integration as part of a pilot project at the expense of the Florida Growth Fund. He continues.

When managing public pensions for firefighters, teachers and police officers, it is also important to prioritise and ensure the best return on investment for Florida residents. This is where the potential of investing in a Bitcoin-like cryptocurrency becomes particularly compelling.

Florida’s chief financial officer, Jimmy Patronis, said

The executive also said that such a move would be coordinated with Florida Governor Ron DeSantis. The latter is actively in favour of blocking the development of central bank digital currencies (CBDCs) and also supports the development of the crypto industry.

If Florida decides to invest in cryptocurrencies, it will become at least the third state, after Wisconsin and Michigan, to add crypto assets to its public pension funds.

In May, for example, the State of Wisconsin Investment Board (SWIB) said it invested $164 million in spot Bitcoin-ETFs, with cryptocurrencies accounting for about 0.1 percent of total assets under management.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

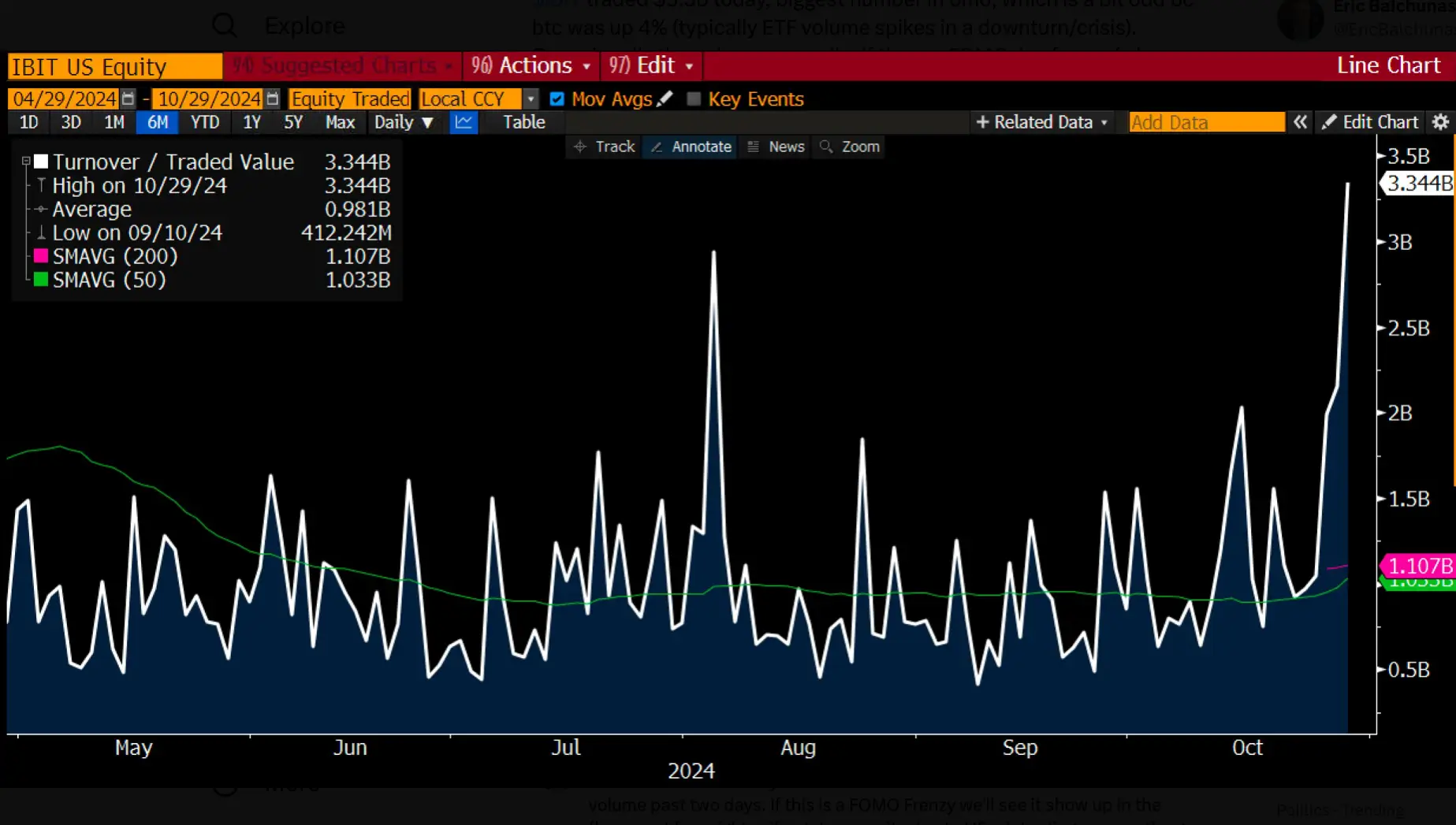

Meanwhile, daily transaction volume for BlackRock’s iShares Bitcoin Trust (IBIT) spot exchange-traded fund reached $3.35 billion for 29 October. This is a record high for the index in the last six months.

According to analyst Eric Balchunas, the increase in transaction volume was driven by Bitcoin’s rise above the $72,000 level. Balchunas believes investors are “afraid of missing out on potential profits” as BTC approaches its all-time high.

If it’s hype, we’ll see it in the ETF inflows statistics over the next few days. If not, then it’s due to high-frequency arbitrage trading or something similar.

Trading volumes in IBIT

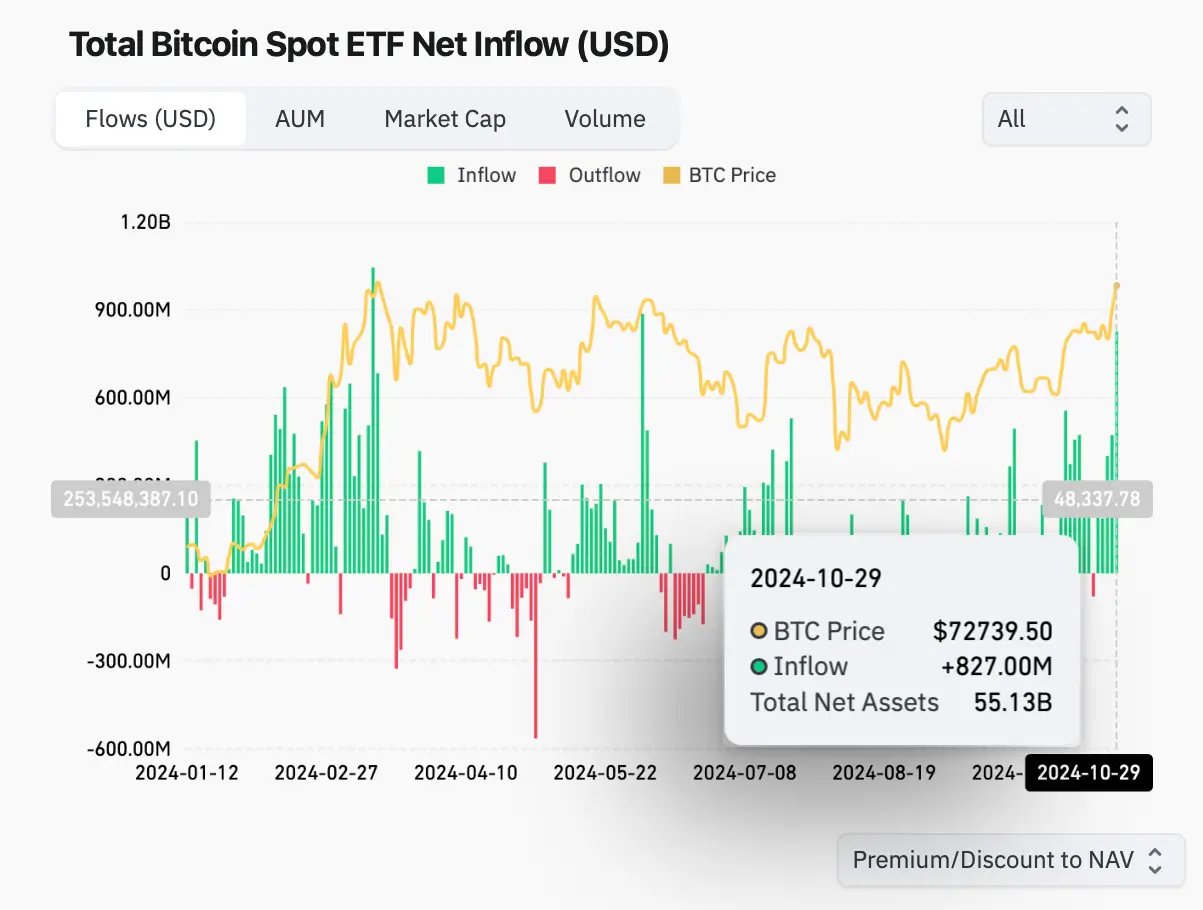

Total inflows into eleven spot Bitcoin ETFs in the US totalled $827 million yesterday, a record high for the past six months.

Balchunas added that with the exception of iShares Bitcoin Trust, other exchange-traded funds also registered increased activity figures for market players, indicating that their interest in what’s going on is growing. Here’s his rejoinder.

IBIT is not alone as all ETFs have recorded increased transaction volume in the last two days.

Galaxy Digital’s head of research Alex Thorne noted that 29 October was “the third day with the highest Bitcoin-ETF trading volume since 1 April 2024”.

Inflows and outflows of funds from Bitcoin-ETFs

Most likely, the short-term effect on the situation with exchange-traded funds is caused by the approaching US presidential elections. They will be held as early as next Tuesday, 5 November, when Americans will choose between incumbent Vice President Kamala Harris and former President Donald Trump.

What's happening is yet again a reminder of how serious the cryptocurrency industry has come in recent years. And if Bitcoin does become a part of citizens' retirement plans, the popularity of BTC as a full-fledged investment among many people will seriously increase. And so far, that's exactly where things are headed.

Look for more interesting information in our crypto chat room. We look forward to seeing you there to capitalise as much as possible on the current bullrun.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.