How Donald Trump’s victory in the US presidential election could affect Bitcoin: JPMorgan’s version of the story

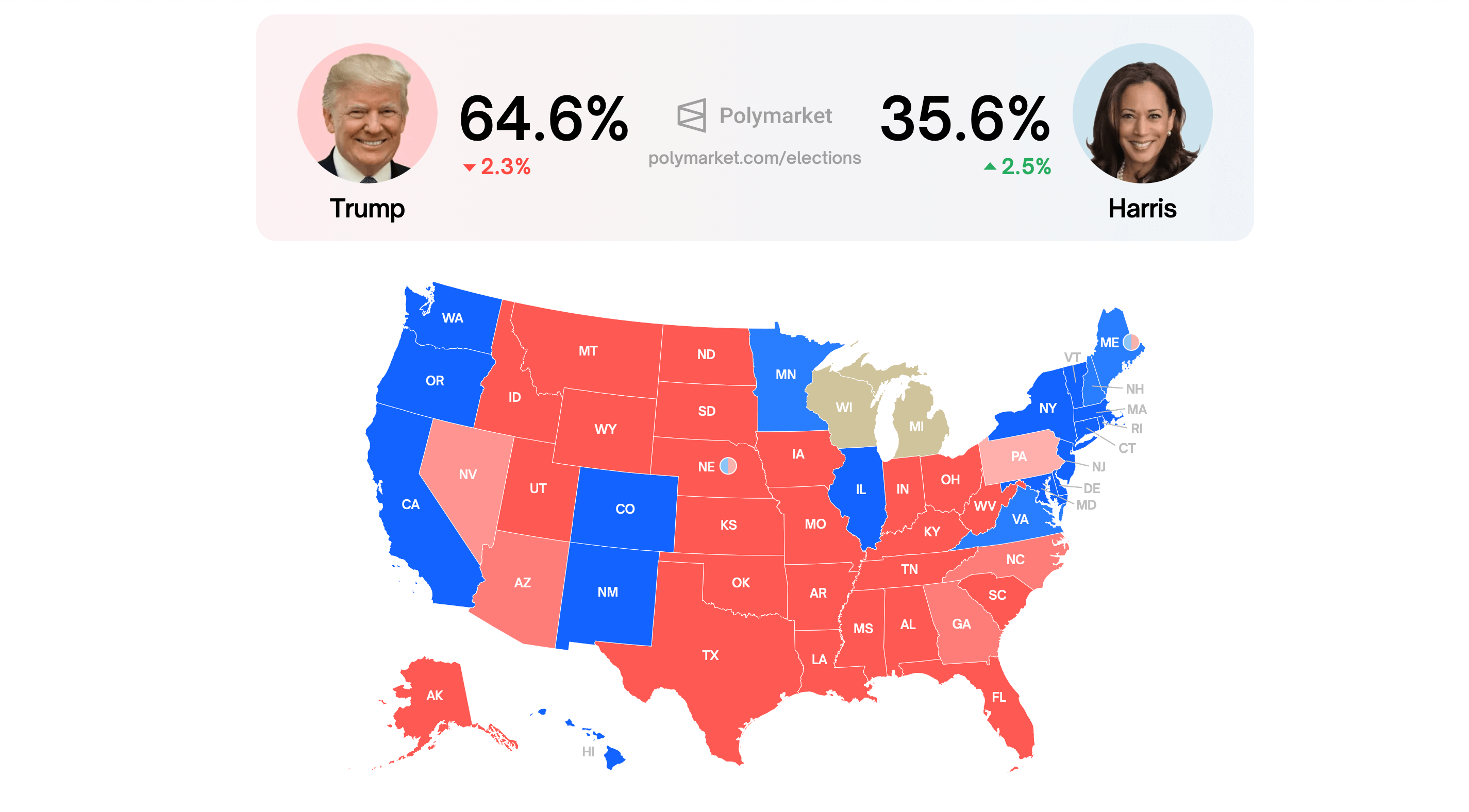

The US presidential election will be held next Tuesday, where Americans will vote for one of two candidates – Kamala Harris or Donald Trump. According to analysts at banking giant JPMorgan, the possible re-election of the latter looks like the best-case scenario for the cryptocurrency market. According to them, Trump’s victory will give momentum to Bitcoin’s growth and in addition make it a truly standalone asset.

When Bitcoin will start to grow

Here is one of the quotes in the report that the analysts published, led by Nikolaos Panigirtzoglou. The replica is cited by The Block.

Retail investors seem to be even more strongly anticipating a “separation deal,” buying Bitcoin and gold ETFs. The momentum of their activity is also seen in meme tokens and the artificial intelligence sector.

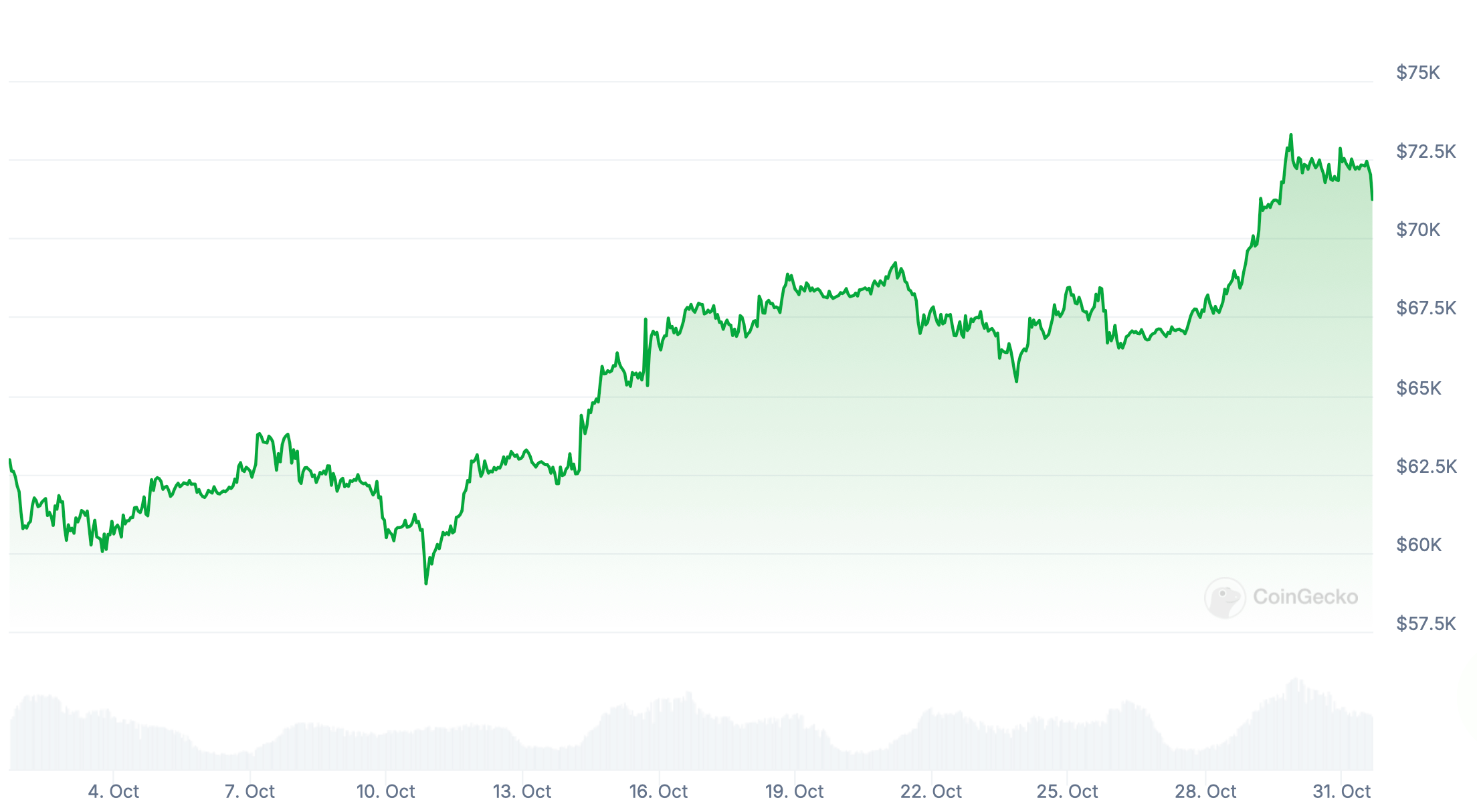

Analysts mean that some investors are linking up with digital assets out of fear of devaluation of local fiat currency, i.e. its depreciation. As of today, Bitcoin has risen in value by 67 per cent since January 1, 2024. Accordingly, even choosing the most conservative coin in the digital asset market is proving to be a more logical option than ignoring crypto.

Cryptocurrency market growth

At the same time, institutional investors have mostly reduced their activity in Bitcoin futures trading in recent weeks. Analysts continue.

Bitcoin futures have become quite overbought, which creates a certain vulnerability going forward.

Changes in the value of Bitcoin BTC over the past month

According to analysts, gold-based ETFs have also seen steady inflows, likely predominantly driven by retail investors. Overall, if Trump’s victory inspires market players to not only buy risky assets but also further strategy to change the country’s leadership’s policies on the economy, Bitcoin’s growth could continue, analysts said.

Donald Trump’s chances of winning the election depend on multiple factors. Despite the criminal charges, he retains a significant support base among Americans. However, winning the general election will depend on his ability to expand this support beyond his core audience and gain the trust of independent and moderate voters – primarily in so-called swing states.

Current odds of winning the US presidential election according to Polymarket

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Analysts believe that the possible victory of Donald Trump will lead to the creation of an adequate regulatory framework for digital assets, as previously mentioned by the politician.

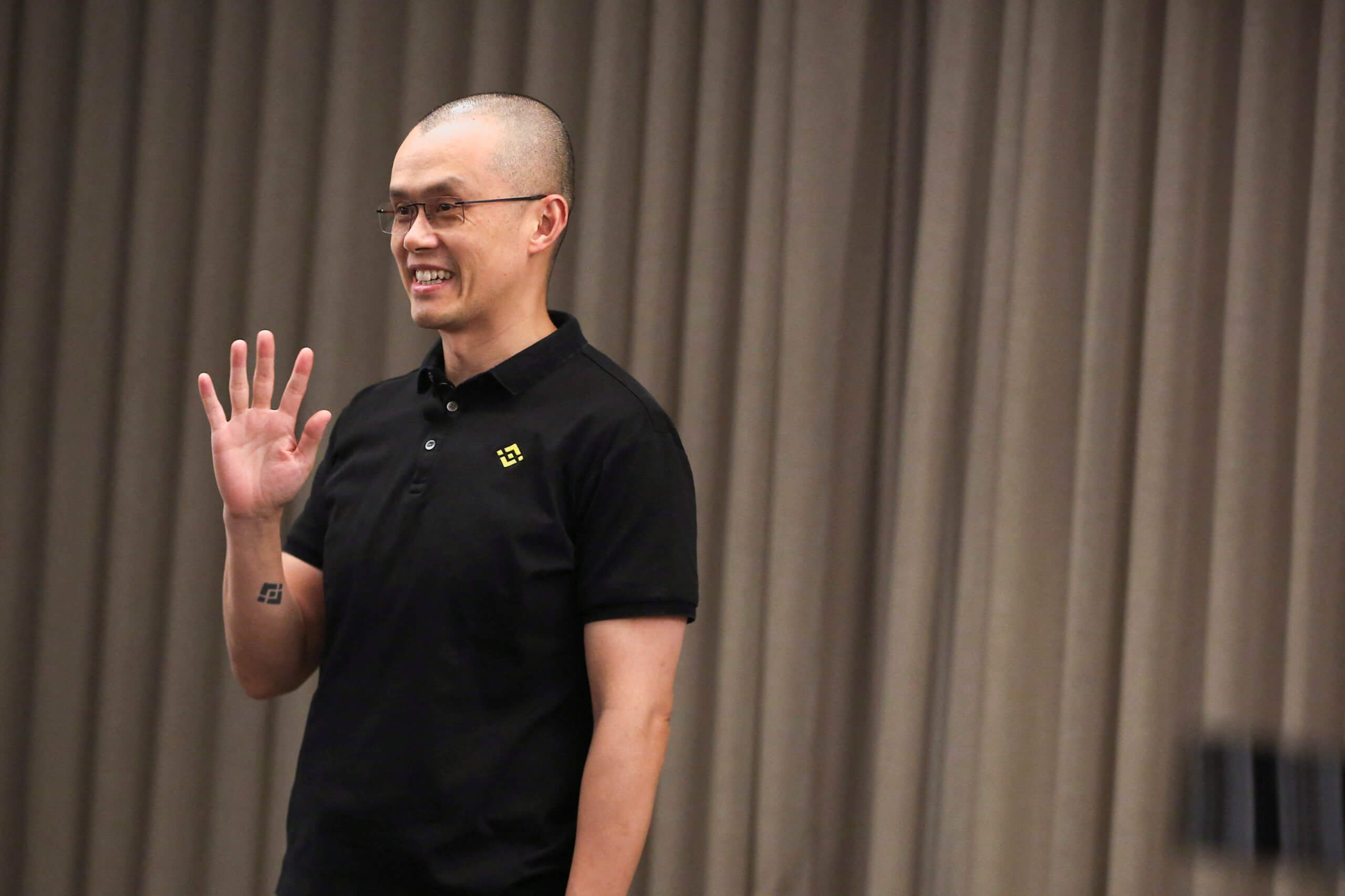

However, the former head of crypto exchange Binance, Changpeng Zhao, is already noticing improvements in the global regulation of crypto. He revealed this during today’s Binance Blockchain Week conference in Dubai, which was his first cryptocurrency event after four months in jail.

Here’s his line.

Overall, cryptocurrency regulation is moving in a positive direction. By June, Donald Trump supports crypto, by the end of June, both parties are on its side. And I’m still sitting in jail thinking: what the hell is even going on here?

Changpeng Zhao is the former head of crypto exchange Binance

Zhao said the changes in the perception of cryptocurrencies show a growing public interest in digital assets. At the same time, the former head of the world’s largest crypto exchange refused to speculate on the possible outcome of the US presidential election.

Changpeng also noted that some guards in prison asked him which cryptocurrency was better to invest in.

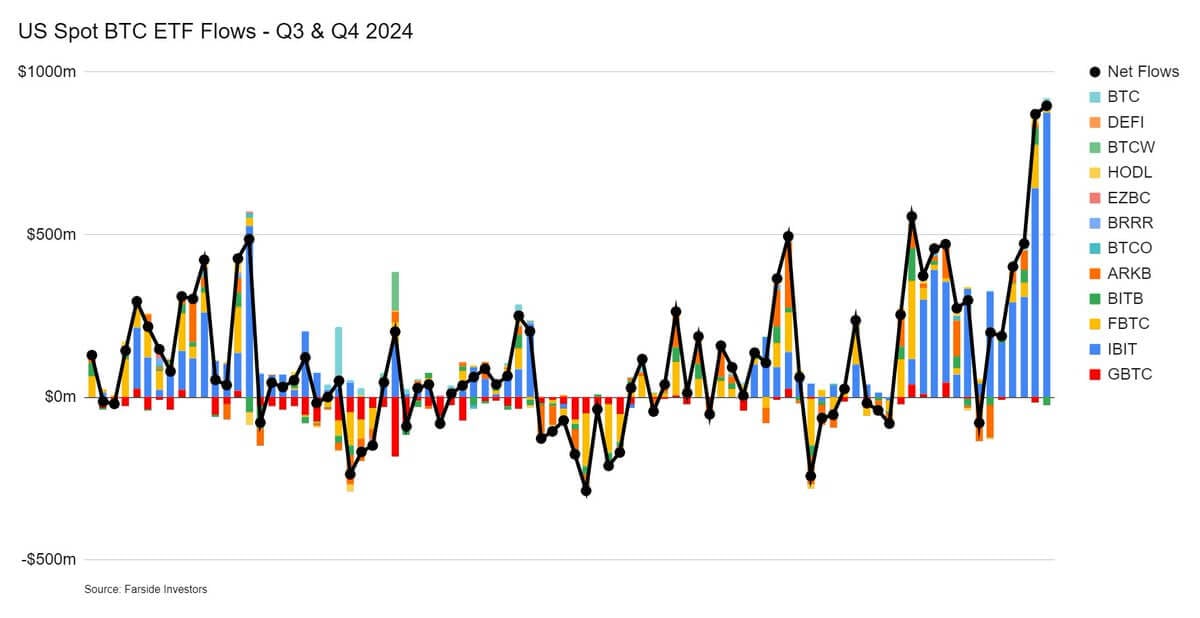

Today, Bitcoin’s value is balancing below $71,000. The market’s respite after a sharp rise earlier in the week came amid a second consecutive day of strong inflows into spot Bitcoin-ETFs in the United States, Coindesk noted.

For example, BTC-based exchange-traded funds recorded $893 million in inflows on Wednesday, up from $870 million on Tuesday.

The total net inflow of funds since the listing of investment instruments in January amounted to $24.2 billion. And this amount takes into account the huge outflow of 20 billion dollars from GBTC instrument from Grayscale, which stands out from its competitors with very high commissions.

Capital inflows and outflows from spot Bitcoin-ETFs in the US

Most of the inflows on Wednesday came from BlackRock’s iShares Bitcoin Trust (IBIT). Specifically, the instrument attracted $872 million, which was an all-time record for the fund.

Capital inflows into other ETFs totalled less than $12 million, while Bitwise’s BITB was the only instrument with net outflows. Its minus is $23.9 million in 24 hours.

The opinion of many analysts is that Bitcoin and the cryptocurrency market in general will continue its development and growth regardless of the outcome of the US presidential election. However, Donald Trump is still a more suitable candidate for the coin industry given his previous promises. Therefore, the expectations of crypto users here are obvious.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there as soon as possible so that you don’t miss the bullrun development in the coin industry.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.