How is the USDT stablecoin being used outside the cryptocurrency market as well? Interview with the head of Tether

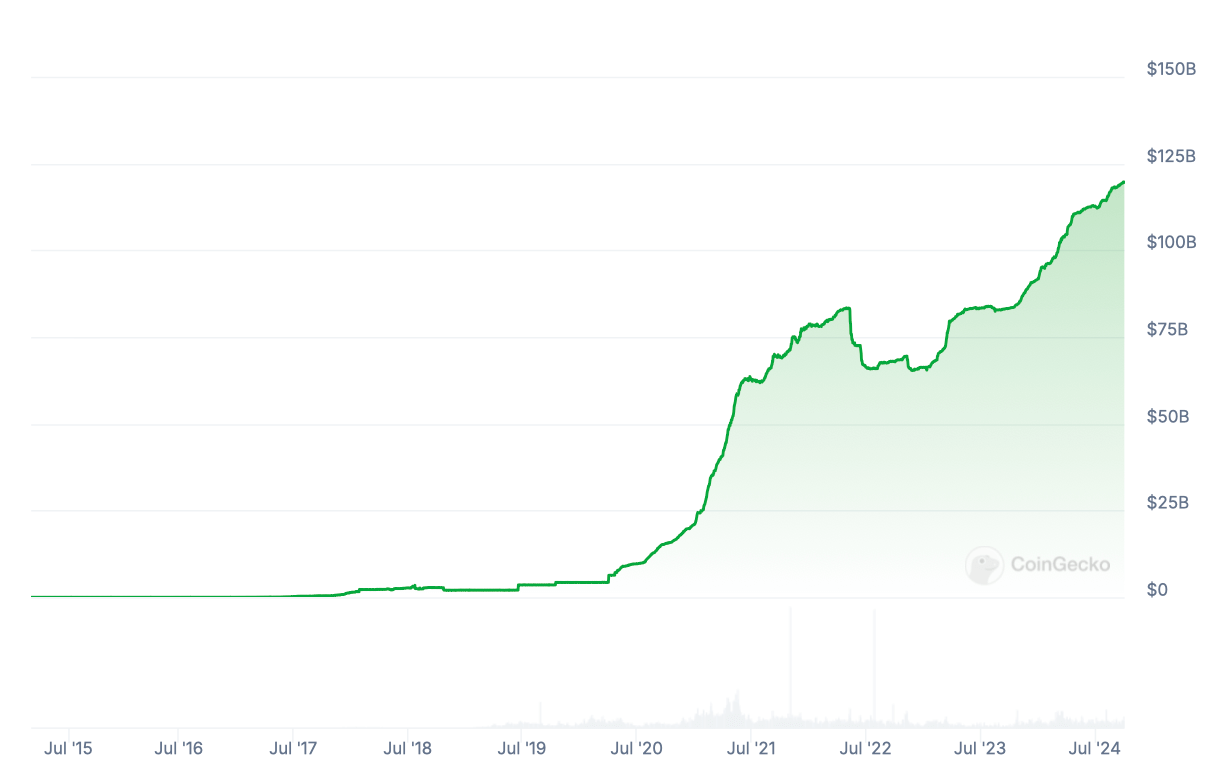

The history of USDT began with the creation of an ordinary token, but eventually, over the years of its existence, the main project of the company Tether became the key stablecoin of the crypto market with a capitalisation of $119 billion. USDT is gradually gaining utility even outside the industry. This was stated by Tether CEO Paolo Ardoino in an interview with Bullish platform manager Tom Farley. Here are the key points from the conversation with the executive.

Stablecoins are tokens whose value is tied to some real asset, most commonly the US dollar. They form the basis of cryptocurrency trading. Also, these coins allow you to store capital without worrying about fluctuations in the rates of other cryptocurrencies like Bitcoin and Etherium. In general, USDT is the main bridge between the world of fiat money and digital assets, as well as an indispensable tool for the development of the cryptocurrency niche.

The struggle of USDT and Bitcoin

On the eve of many large companies announced the desire to launch their own stablecoins. In particular, it became known about such plans of Robinhood, Robinhood and Ripple.

Experts assume that the giants are primarily attracted by the profitability of this sphere. Still, Tether earned $6.2 billion in 2023.

How USDT stablecoin is used

According to Ardoino, USDT is not only about crypto. Still, in countries like Argentina and Turkey, the stablecoin serves as a lifeline as an alternative to unstable national currencies.

Before the widespread use of the token, residents of inflation-stricken countries had to resort to the black market to get dollars. Now the situation is quite different.

Here’s Ardoino’s commentary on the matter, which CoinDesk cites.

USDT works much better outside of the US. There are 15 different transport levels for USDT in the US. There are banks, credit cards, debit cards. Venmo, PayPal, Cash App, and many other services also help. But who needs the dollar itself?

Change in capitalisation of the largest stablecoin USDT

As of today, USDT is not only the largest stablecoin, but also the third most capitalised cryptocurrency in the industry. It is second only to Bitcoin and Efirium.

In addition, USDT is more than three times larger than its closest competitor USDC from Circle with a capitalisation of $35.9 billion. Accordingly, the Tether product, at least for the moment, is in much greater demand.

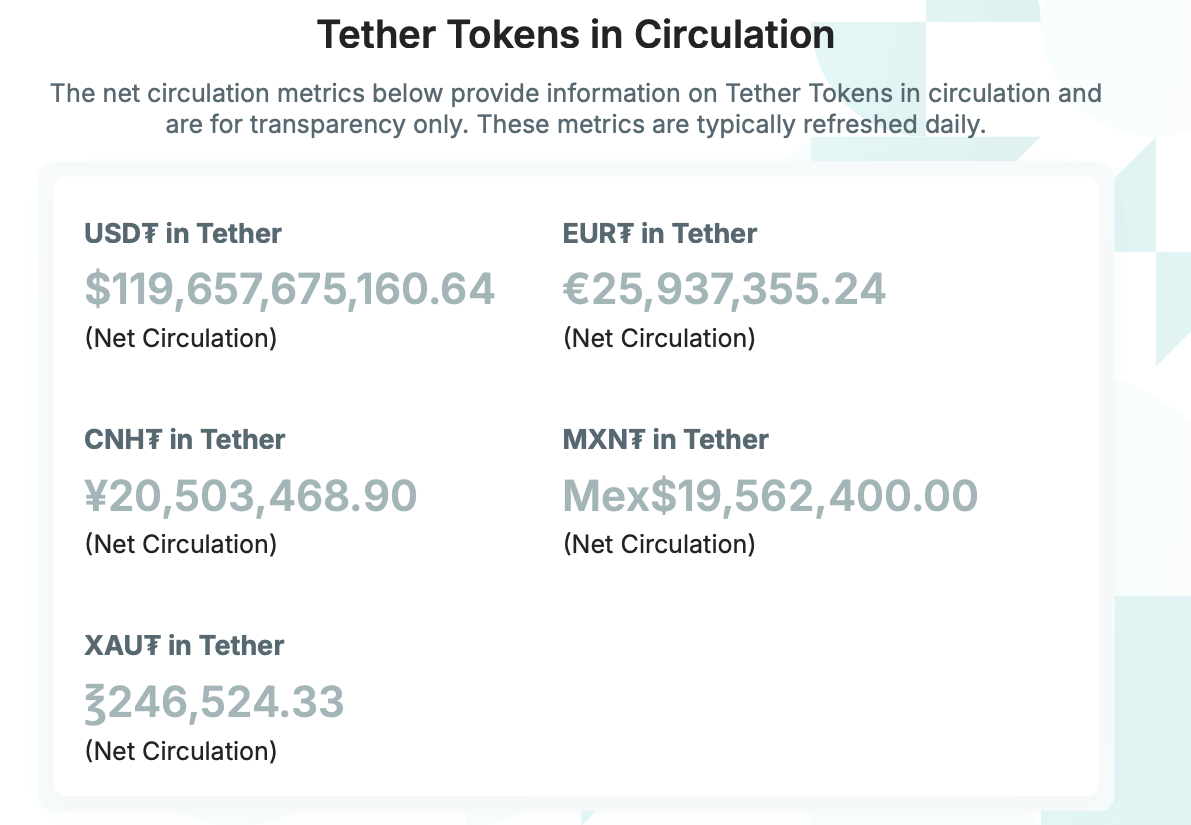

Information about USDT and other Tether steiblcoins in circulation

More than half of USDT worth $61 billion is issued on the Tron blockchain, while $54.3 billion is accounted for by Efirium.

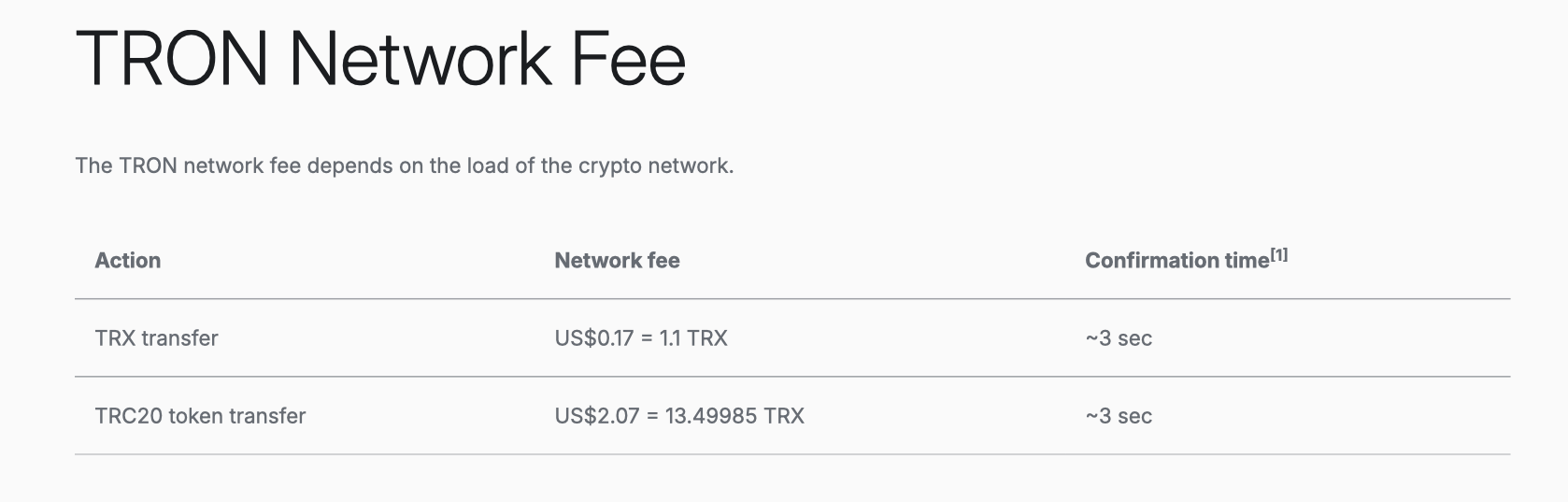

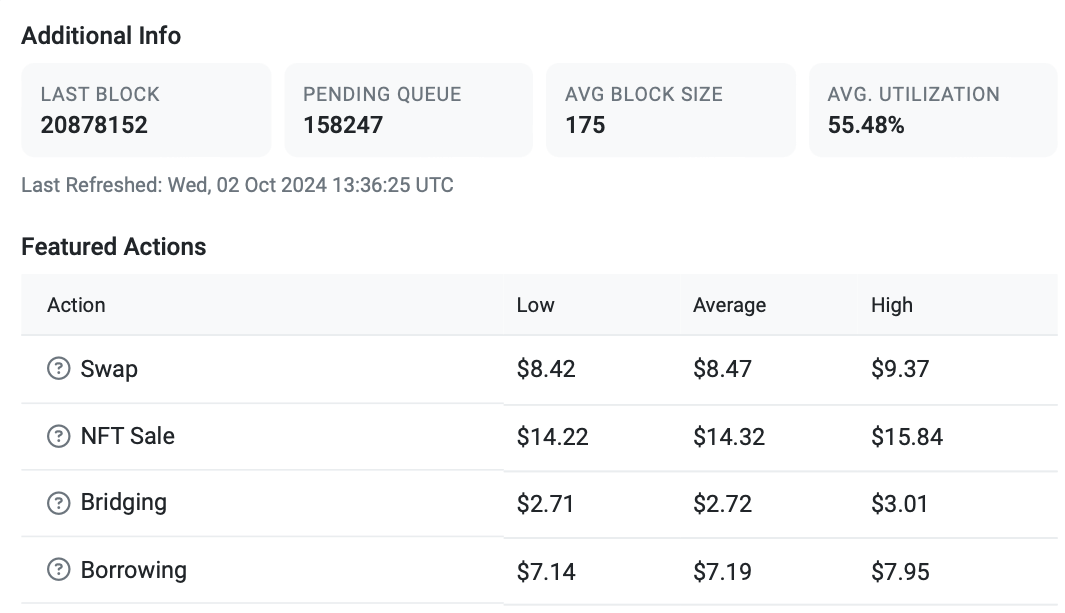

According to Ardoino, this is because it is much cheaper to conduct transactions on the Tron network. The difference between the cost of transfers in Eth and Tron reaches several times, with fees in Etherium creeping up again the day before as activity on the blockchain increased. Ardoino continues.

Imagine a man living in Haiti who makes $1.34 a day. How can he pay $5 for commissions? These markets can’t afford to pay five or six dollars per transaction on the Etherium network or other blockchain.

Commissions on the Tron network

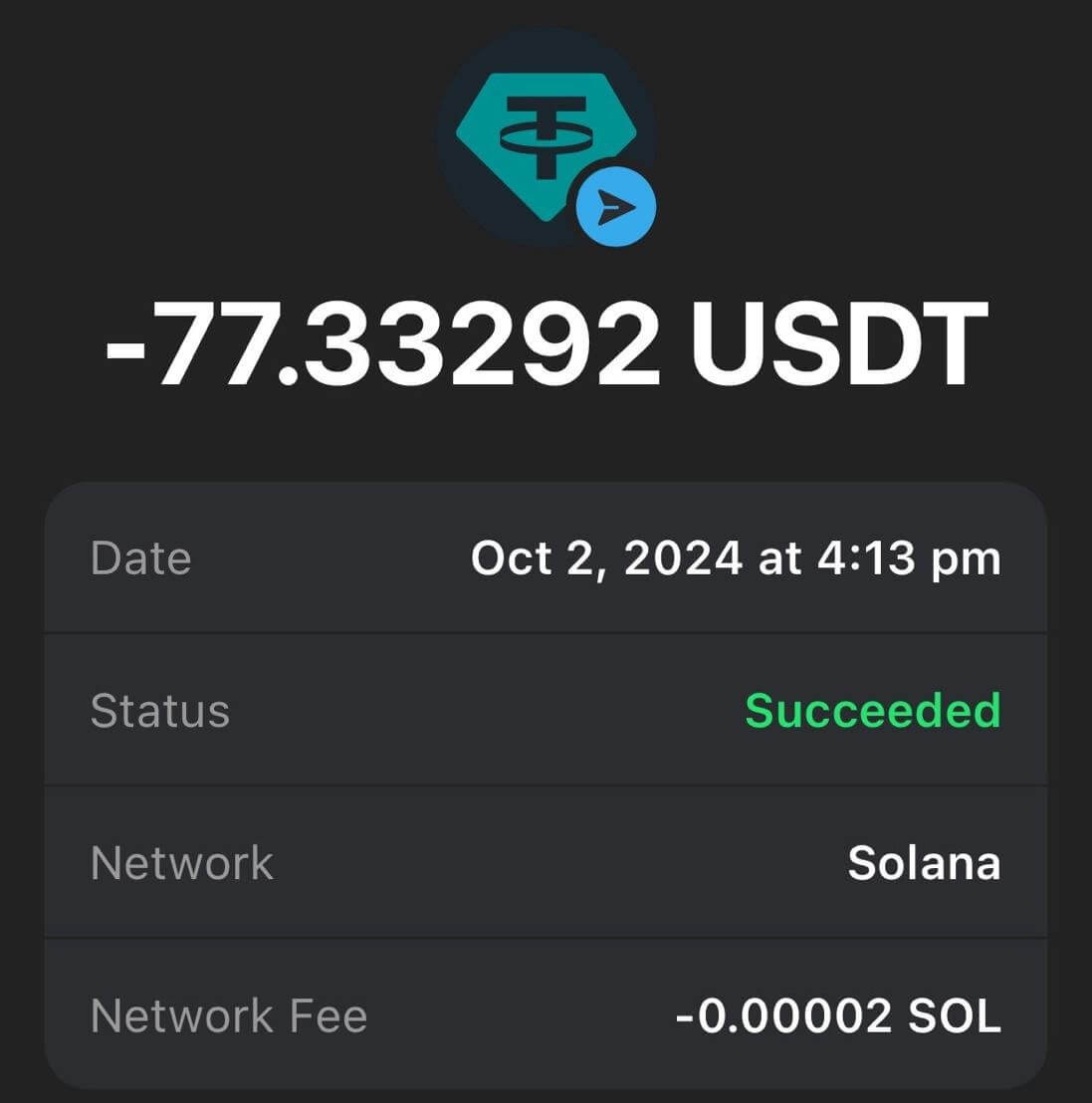

A more affordable popular alternative is Solana. Specifically, today we conducted several transactions with USDT, sending them to centralised exchanges. The transfer fee was 0.00002 SOL, which translates to 0.29 cents at today's exchange rate. That is, for 1 cent in Solana you can conduct at least three transactions.

The cost of a USDT transfer on the Solana network that we conducted today

Ardoino also mentioned another aspect where stablecoins and geopolitics intersect – treasury bills.

Still, the debentures provide support for the cryptocurrency and can be easily exchanged for dollars if USDT holders want to cash out. Meanwhile, interest payments are flowing into Tether’s coffers.

Transaction fees on the Etherium network as of today

Meanwhile, China – the second-largest holder of U.S. government debt – continues to reduce its own holdings of U.S. Treasury bills.

Issuers of popular stablecoins like Tether have pounced on them with a “huge appetite,” buying up just over $100 billion worth of them while the People’s Bank of China gets rid of them, Ardoino noted.

If Tether were a country, the data suggests its debt holdings would be equivalent to Germany’s corresponding figure.

We added resilience to the ownership of the US dollar, so now you don’t have a single country, a single decision maker who can sell hundreds of billions of notes at once. USDT and Tether are best friends to the US dollar.

Tether CEO Paolo Ardoino is the head of Tether

However, for most of its history, the state of Tether’s reserves has remained in great question, and for good reason. Still, in the early years of its existence, the company was repeatedly faced with broken relationships from banks. As a result, it was forced to open and close accounts all over the world, from Qatar to China, Taiwan, and Canada.

When the details of USDT’s collateral were unclear, the media reported on a fight to make public the full details of Tether’s banking relationships involving the New York State Attorney General, who obtained it through an investigation.

Now the situation has changed and the relationship with regulators has become more straightforward. Most of the money is managed by Cantor Fitzgerald, with CEO Howard Lutnick regularly vouching for the issuer of the steblecoins and in addition backing Bitcoin.

USDT and other stablecoins are an important component of the blockchain industry and one of the most popular uses for digital assets. Still, such assets allow residents of countries with troubled economies to protect the value of their money. At the same time, citizens earning a living in other countries can easily support their families through token transfers. So as the crypto niche becomes more popular, such tokens will also become more common.