How will the US presidential election results actually affect the crypto industry? Possible scenarios

As the US presidential election approaches in November, blockchain industry players are keeping a close eye on how the campaigns of Donald Trump or Kamala Harris may affect the market. Ahead of the 5 November vote, both candidates have in fact taken opposing positions on cryptocurrencies, raising questions about the future of the industry under each candidate’s leadership. Here’s an expert’s perspective on what could happen to the niche going forward.

Donald Trump this year began openly supporting Bitcoin and other cryptocurrencies, meaning he has generally presented himself as a supporter of digital assets.

In particular, he accepts cryptocurrencies as campaign donations and has outlined a policy to make the US the “world leader” of mining. Donald also supports the appointment of a new head of the SEC and plans to work on creating a national strategic bitcoin reserve.

Former US President Donald Trump at the Bitcoin 2024 cryptocurrency conference

Most importantly, Trump also managed to become the first U.S. president to conduct a transaction in the Bitcoin network. He did so at PubKey Bitcoin in New York, where he used the cryptocurrency to pay a bill. We wrote about it in a separate article.

At the same time, Harris has not mentioned crypto in her speeches or political statements until recently. Only at The Economic Club event in late September did the current vice president say she would support cryptocurrencies along with other advanced technologies like artificial intelligence.

However, her position didn’t sound convincing. Firstly, Harris limited herself to one sentence in her mention of coins and did not provide any specifics. Secondly, during her tenure as U.S. Vice President, Kamala did not support digital assets and, in addition, did not in any way prevent the SEC from fighting it. Therefore, crypto enthusiasts consider her an enemy to the industry.

U.S. Vice President Kamala Harris

But what would be the real consequences for crypto-niche if any of the favourites wins?

What will happen to cryptocurrency because of the election?

Asset managers have expressed different views on the impact of the election outcome on the industry. However, they generally expect crypto to thrive regardless of who ends up in the White House.

This is a view shared by Bitwise’s Chief Investment Officer Matt Hogan. Here’s his quote from an interview with The Block.

I’m more and more inclined to think that overall crypto is going to win regardless of the outcome of the election in November.

Former U.S. President Donald Trump

Hogan believes that Washington’s “hostile attitude” towards cryptocurrencies is no longer relevant, as indicated by positive comments from both sides of Congress and the recent easing of crypto asset storage restrictions for banks.

Be that as it may, the voting process remains important on a larger scale. The analyst continues.

Nevertheless, the election still matters. There is a lot of uncertainty about what a Harris administration will mean for cryptocurrencies, and markets don’t like uncertainty. I believe investors will want to see changes in the leadership of key regulators under the Kamala administration before drawing conclusions. Additional uncertainty could weaken the market until it is resolved.

Eliezer Ndinga, head of digital asset strategy and business development at 21Shares, agreed with this position. He believes that innovation will continue to grow regardless of the political situation.

Matthew Siegel, head of digital asset research at VanEck, shares a similar view. Here’s his comment.

Regardless of who wins the election, expect downgrades in US debt ratings and greater scrutiny from bond buyers on the sustainability of fiscal plans. We believe Bitcoin is a winner in such an environment.

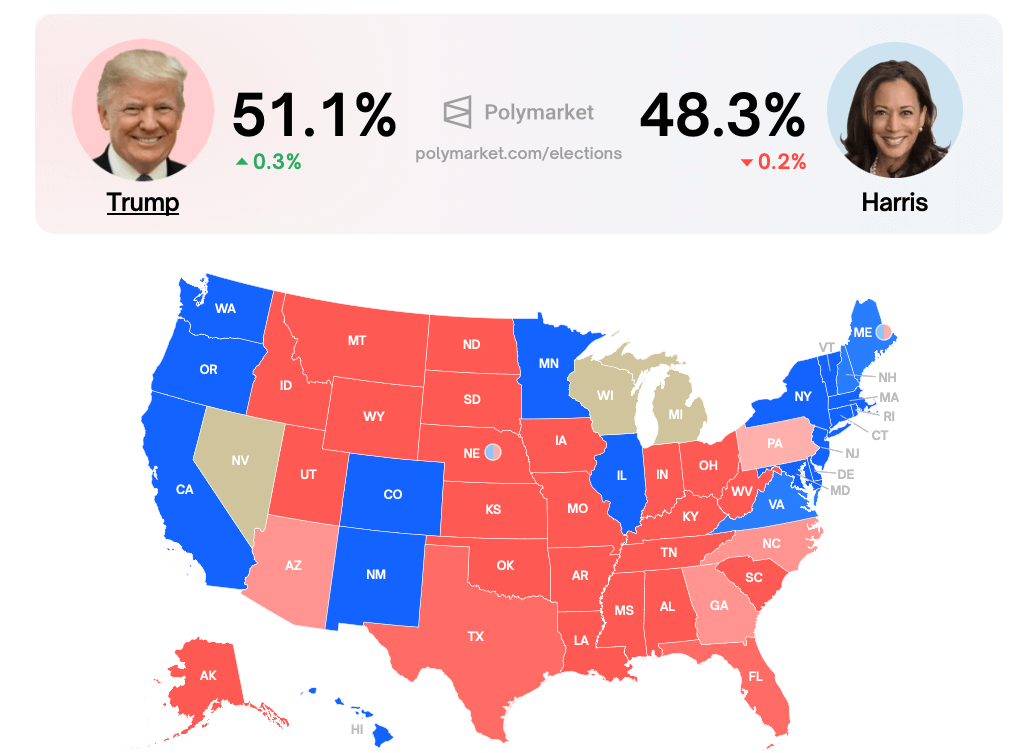

Actual odds of candidates winning the US presidential election according to decentralised marketplace Polymarket

In the event of a possible second term for President Trump, protectionist measures and inflationary trade policies could weaken the US dollar, potentially benefiting Bitcoin as a hedge against currency devaluation.

This is the view of James Butterfill, head of research at CoinShares. In his opinion, Trump’s support for the crypto is also able to create a more favourable regulatory environment for the industry.

Well, Harris’ unclear stance on cryptocurrencies has the potential to lead to a less favourable environment for digital assets. This scenario will probably benefit Bitcoin more compared to altcoins, which may suffer due to the actions of regulators.

Overall, the upcoming US presidential election will be remembered as the first to be influenced by cryptocurrency voters. As a group, they are becoming increasingly active and organised. That is, as digital assets grow in popularity, many cryptocurrency owners are seeking to support candidates who promise favourable conditions for the development of the industry.

The growth of the cryptocurrency market

Such voters have the potential to play a crucial role in a number of key swing states where cryptocurrency support can influence the outcome of an election.

In addition, candidates seeking their support are increasingly emphasising the creation of crypto-friendly policies, reinforcing the role of this group of voters in the political agenda.

As the election approaches, Donald Trump seems unequivocally the better candidate for the US presidency. He has previously promised to implement simple but important initiatives like approving a modern coin regulatory framework and firing SEC Chairman Gary Gensler. This will already be enough to improve the situation in the digital asset niche.

More interesting stuff is in our crypto chat. Be sure to stop by to get a proper understanding of what is happening in the world of coins. This way, it will be possible to benefit more from the ongoing bullrun.