Microsoft shareholders will vote on a possible investment in Bitcoin. How will this affect the crypto market?

At the end of last week, it became known that Microsoft shareholders will hold a vote on whether the company should invest in Bitcoin. Judging by the documents filed with the SEC, the procedure itself will take place on 10 December 2024. In general, this is a routine process that happens every year. But now, in addition to a number of questions regarding the business itself, shareholders will be able to share their attitudes towards the world of digital assets. Well, this is able to affect the entire coin industry and the attractiveness of the latter in the eyes of investors.

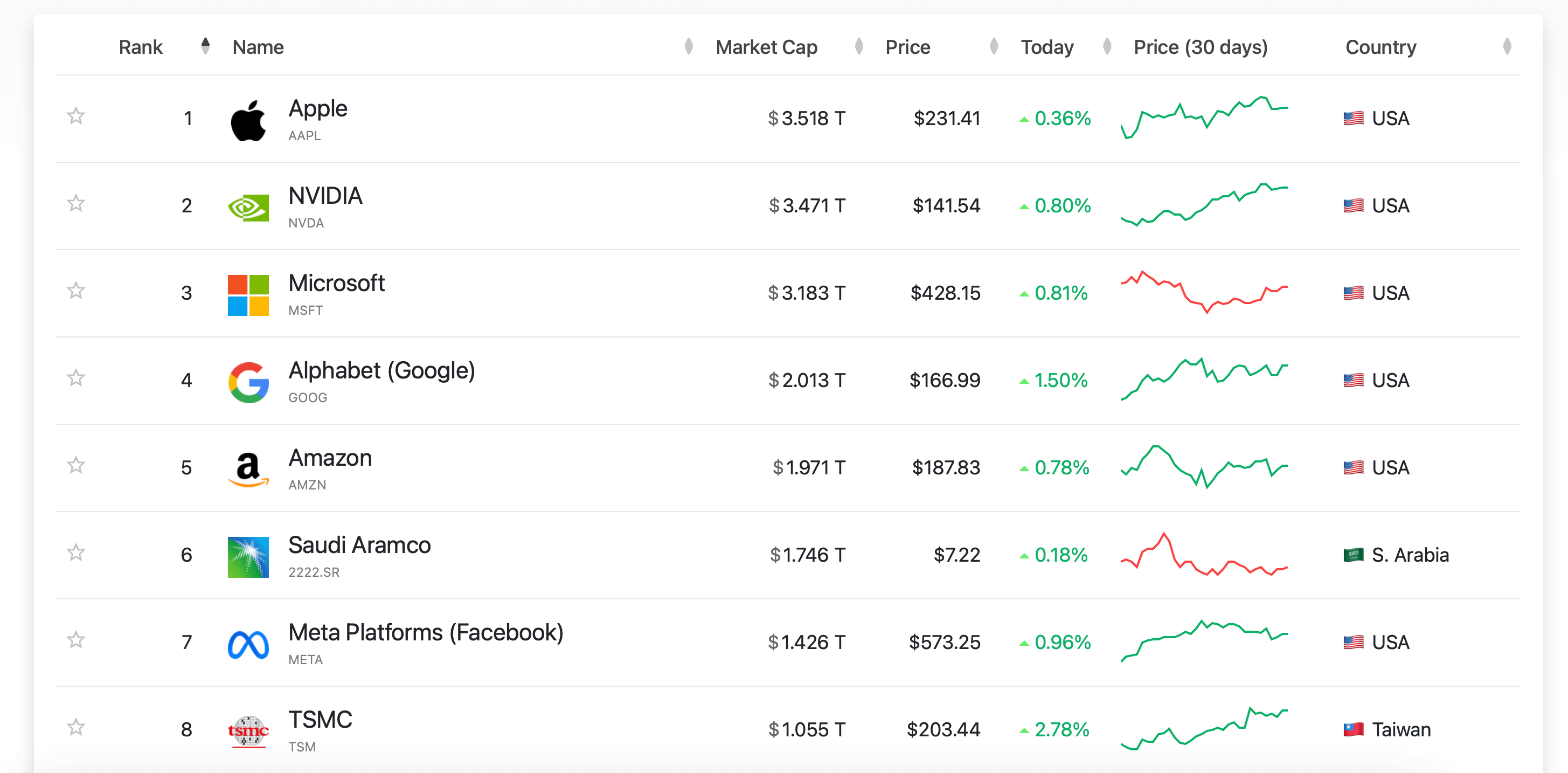

Microsoft is the third largest company in the world with a market capitalisation of $3.1 trillion.

It is second only to Apple with a capitalisation of 3.51 trillion and Nvidia, whose figure reaches 3.47 trillion. It is important to note that the gap with Google in the fourth position is quite large, because the market capitalisation of this technological giant is equal to $2 trillion.

The largest companies in the world by market capitalisation

Does Microsoft have bitcoins?

If the company’s management does decide to acquire BTC, such an event will affect the crypto market as a whole. However, how serious will be the impact of the event on the industry? Cointelegraph journalists tried to give an answer here.

According to the financial report for the second quarter of 2024, Microsoft had $76 billion in cash and cash equivalents. If shareholders voted to allocate at least 10 percent of that amount to BTC investments, the company would end up with $7.6 billion invested in the cryptocurrency.

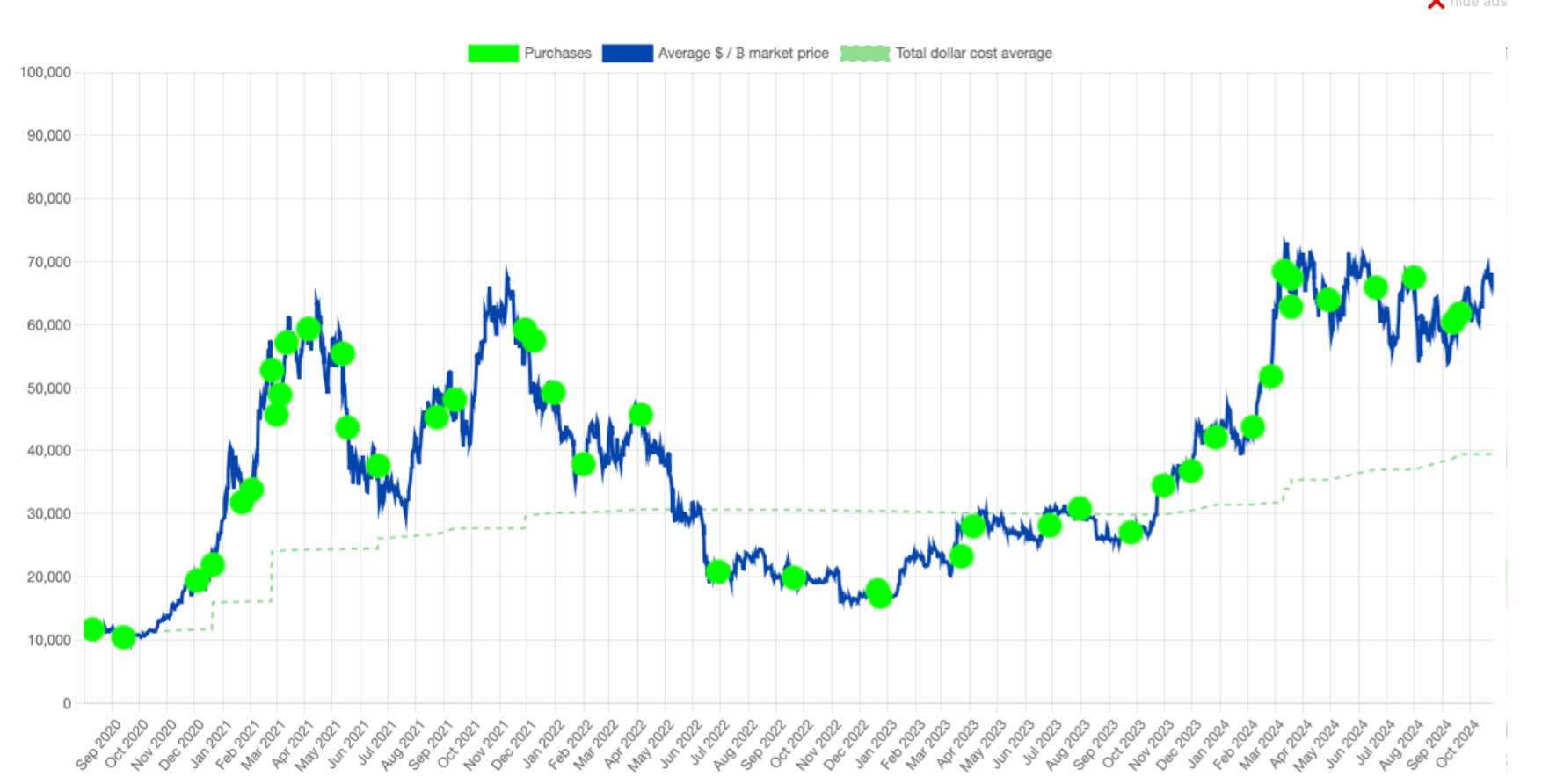

With Bitcoin’s notional average price at $73,000 per coin, this would mean an acquisition of 104,109 BTC. While this figure seems huge, it’s still more than half the volume of bitcoins accumulated to date by MicroStrategy. The giant has been acquiring coins since August 2020, bringing the cryptocurrency’s total balance to 252,220 BTC.

Rounds of bitcoin purchases by MicroStrategy

But that’s not what’s important: in the context of a constantly shrinking supply of BTC and falling crypto reserves of exchanges, the purchase of cryptocurrency by Microsoft representatives of this scale is able to cause a supply shock.

That is, a new large buyer will appear on the market, which will further increase the bias in favour of demand. And this can already lead to a rapid rise in the value of Bitcoin, because the number of those who want to get in touch with the crypto because of the corresponding decision of the giant will also grow.

Will this scenario become a reality? Everything will depend on the decision of shareholders, although even the very possibility of realising the strategy of a large acquisition of BTC by a technology giant has sparked lively discussions in the corporate world.

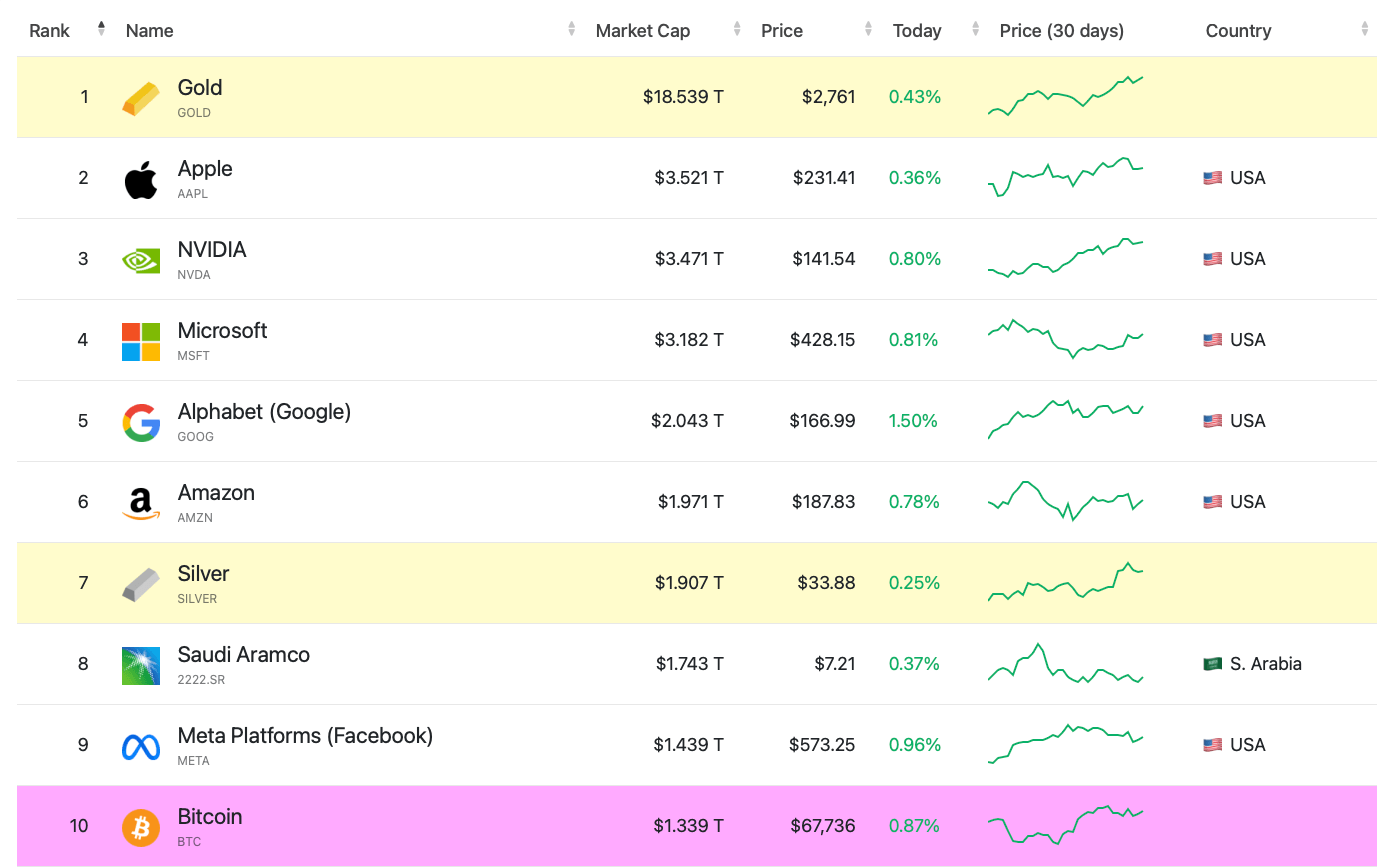

Ranking of companies and assets by market capitalisation

In U.S. publicly traded companies like Microsoft, shareholders vote on major decisions at annual meetings. Voting on special proposals is usually non-binding, but it serves as an indicator of shareholder sentiment and can compel management to act accordingly.

A large shareholder is able to force a company to consult with all shareholders on certain issues, as required by the Securities Commission’s rules for public companies.

However, the board recommended voting against the Bitcoin investment proposal, suggesting caution amid volatility in digital assets and regulatory uncertainty. Nevertheless, the growing demand for BTC from institutional investors cannot be ignored.

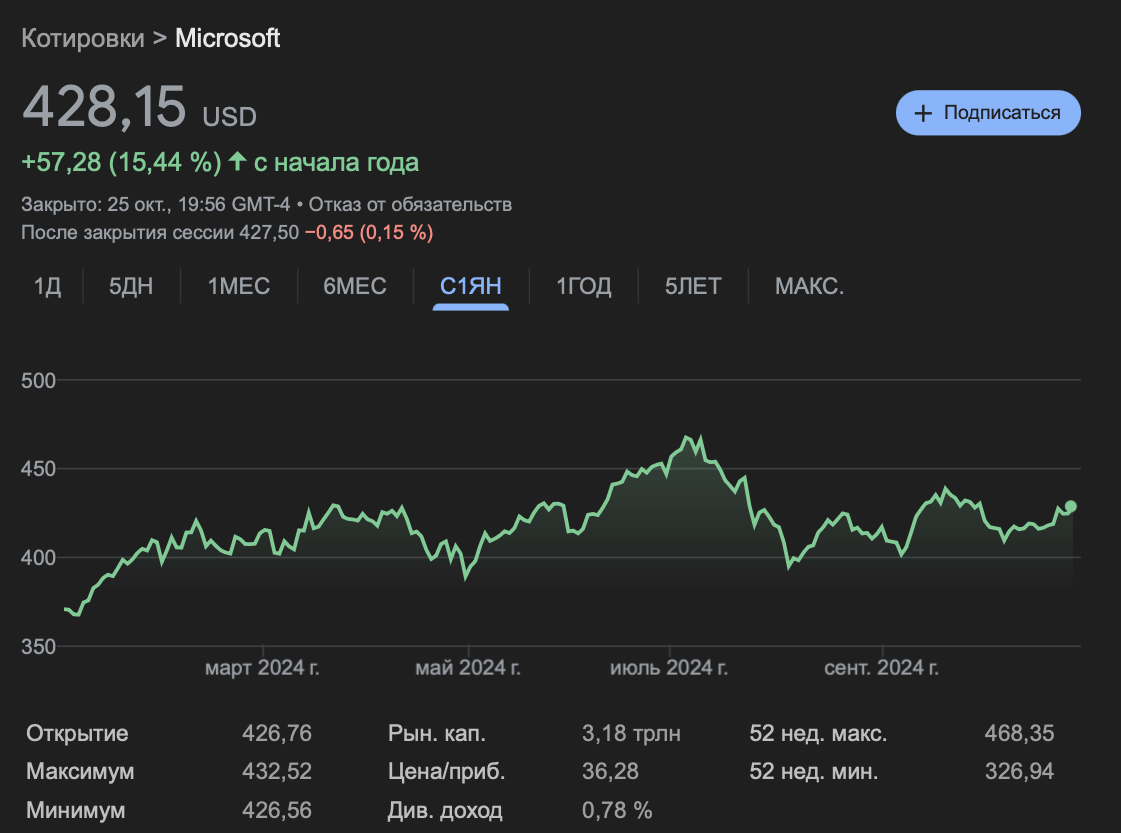

Microsoft’s stock price changes

LinkedIn founder and Microsoft board member Reid Hoffman expressed a favourable opinion of Bitcoin in an interview with Yahoo Finance. The expert called it a digital means of preserving value and emphasised the coin’s role in changing the future of financial systems. Hoffman himself is also known for being one of the first investors in the popular cryptocurrency company Xapo.

If Microsoft does decide to invest in Bitcoin, there are several ways to do so. First of all, the company can directly buy coins on exchanges through their employees. Another option is to buy shares of spot Bitcoin-ETFs, which allow it to indirectly earn on fluctuations in the value of the first cryptocurrency at the heart of the instrument.

Microsoft may also consider leverage – including options-like derivatives. However, there’s still a long way to go before methods are discussed, and we first need to see shareholder sentiment at the December vote.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

The idea of a tech giant acquiring bitcoins fits in with a new forecast by Maty Greenspan, founder of the Quantum Economics platform.

Cryptocurrency investors during the bullrun

He stated that it will be BTC that will be the main narrative of the next round of the bullrun. Here’s the comment.

The general consensus is that the next leg of the bull trend will be related to Bitcoin and second-tier solutions based on it.

The expert noted that over the past year “a whole new opportunity has opened up for the field of decentralised finance and NFT on the Bitcoin blockchain”.

With this in mind, Greenspan believes that BTC at $100,000 in 2024 is “definitely a real opportunity.” It will be especially relevant if a crypto-supportive candidate is elected to the presidency in November.

For now, we’re just waiting for Trump’s victory to be confirmed and then move into the growth phase.

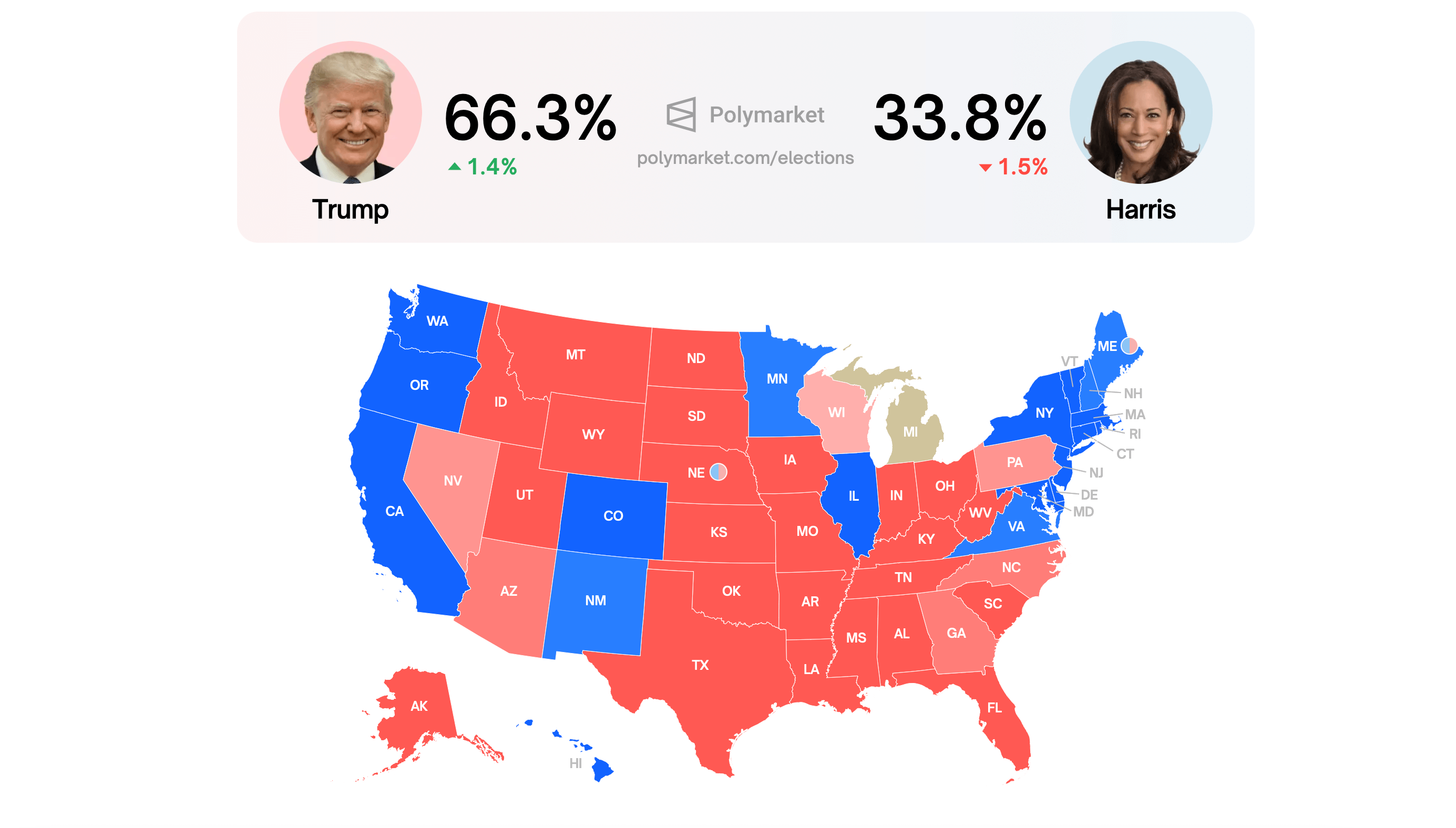

Actual odds of victory of the US presidential candidates according to Polymarket data

As a reminder, the US presidential election will take place next week – on the 5th of November. Now, according to the data of the Polymarket betting platform, Republican Donald Trump is leading with a noticeable advantage. He began to actively promote a position of support for crypto back in March this year, which has seriously influenced fans of digital assets.

The likelihood of Microsoft buying bitcoins is still extremely low, as shareholders have already been advised to vote negatively on this item. However, considering the very prospect of one of the largest companies in the world allocating funds for BTC is already a serious achievement. So sooner or later the giants will start buying crypto for their own balance sheets.

Want to stay up to date with other interesting news? Join our crypto chat, where we discuss all sorts of interesting topics from the world of digital assets.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.