Microsoft will consider the prospect of direct investment in Bitcoin. What condition is needed to buy BTC?

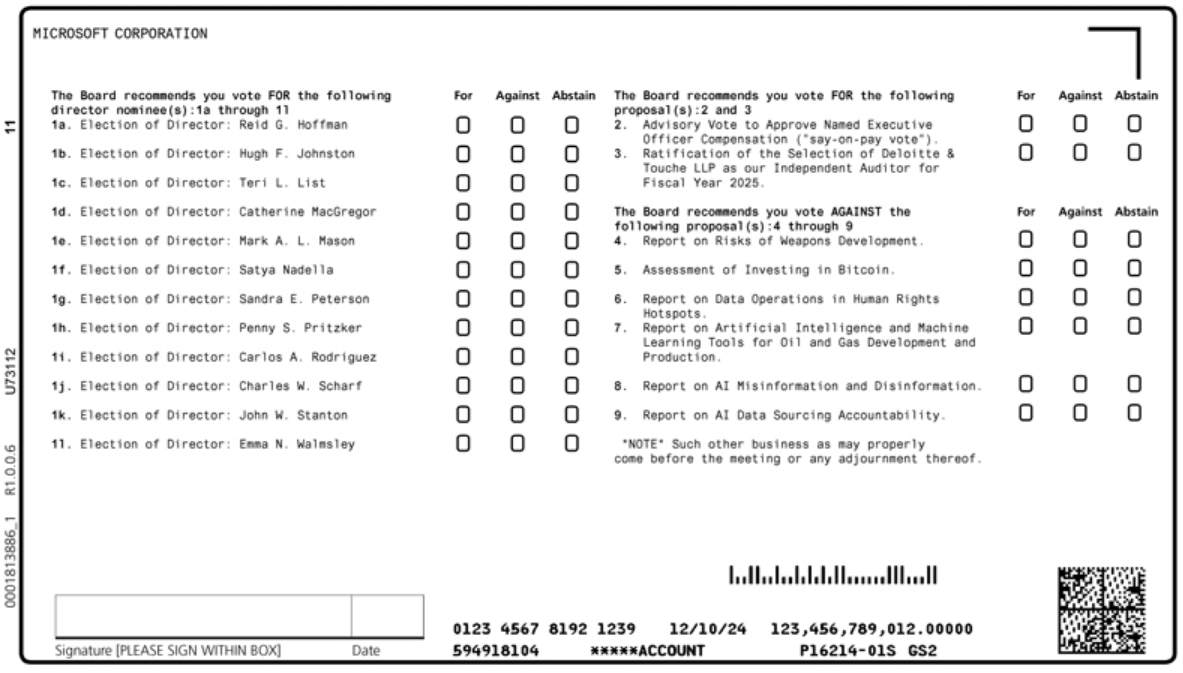

Microsoft may be in for some serious changes. On 10 December, the tech giant’s shareholders will hold a vote to decide whether to consider Bitcoin as a suitable investment and add the cryptocurrency to its balance sheet. In a fresh filing with the Securities and Exchange Commission (SEC), Microsoft officials reported a proposed “Bitcoin Investment Appraisal” from some shareholders. MicroStrategy comes to mind as an example of a successful investment in BTC.

Recall, MicroStrategy and its co-founder Michael Saylor are remembered in the crypto industry with criticism this week. Still, he unexpectedly recommended that lovers of digital assets send them to large companies for storage, i.e. use custodial services.

On top of that, Saylor for some reason called fans of independent storage of cryptocurrencies “paranoid cryptoanarchists”, which caused misunderstanding of blockchain fans.

MicroStrategy co-founder Michael Saylor

However, the criticism paid off. As a result, Michael published the following post on Twitter.

I support self-storage of cryptocurrencies for anyone willing and able to do so, and the freedom to choose the form of storage and custodian for people and organisations around the world. Bitcoin benefits from all forms of investment by all participants and should be open to all.

That line didn’t convince everyone, though. Some Sailor readers suggested that the businessman did reveal his real attitude towards the coin market.

Will Microsoft buy bitcoins?

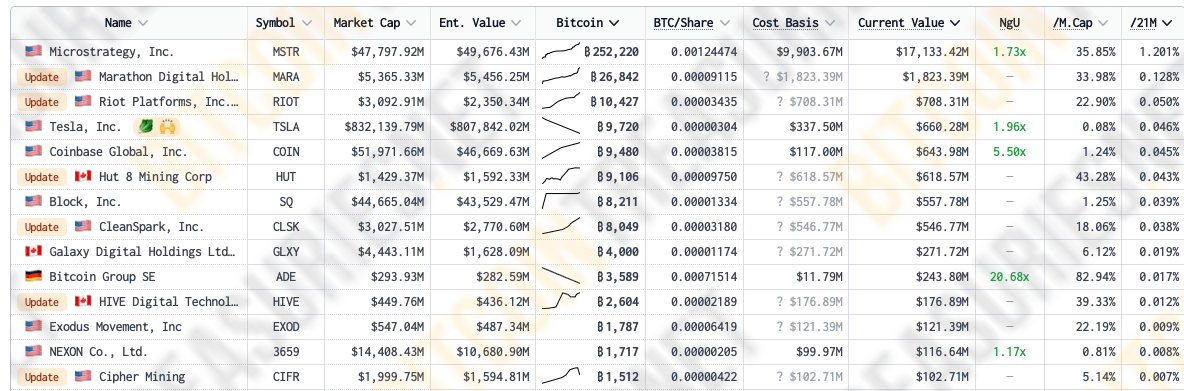

According to Cointelegraph’s sources, the relevant proposal was initially submitted by experts from the National Centre for Public Policy Research (NCPPR). As we noted, they cited MicroStrategy Investment Strategy, which is the largest holder of BTC among publicly traded companies, as an example.

Under securities laws, eligible shareholders holding a certain number of shares may propose matters to be voted on at a shareholder meeting, including changes to the corporation's operations or policies and other corporate actions. The final decision on such proposals is generally made by a majority vote of the shareholders, rather than by the board of directors.

Representatives of the organisation believe that the Bitcoin acquisition has helped MSTR stock outperform Microsoft securities by 300 per cent. This is partly true: MicroStrategy shares have become a kind of index of the crypto market, and since the beginning of 2024, the value of securities under the ticker MSTR has increased by 248 per cent.

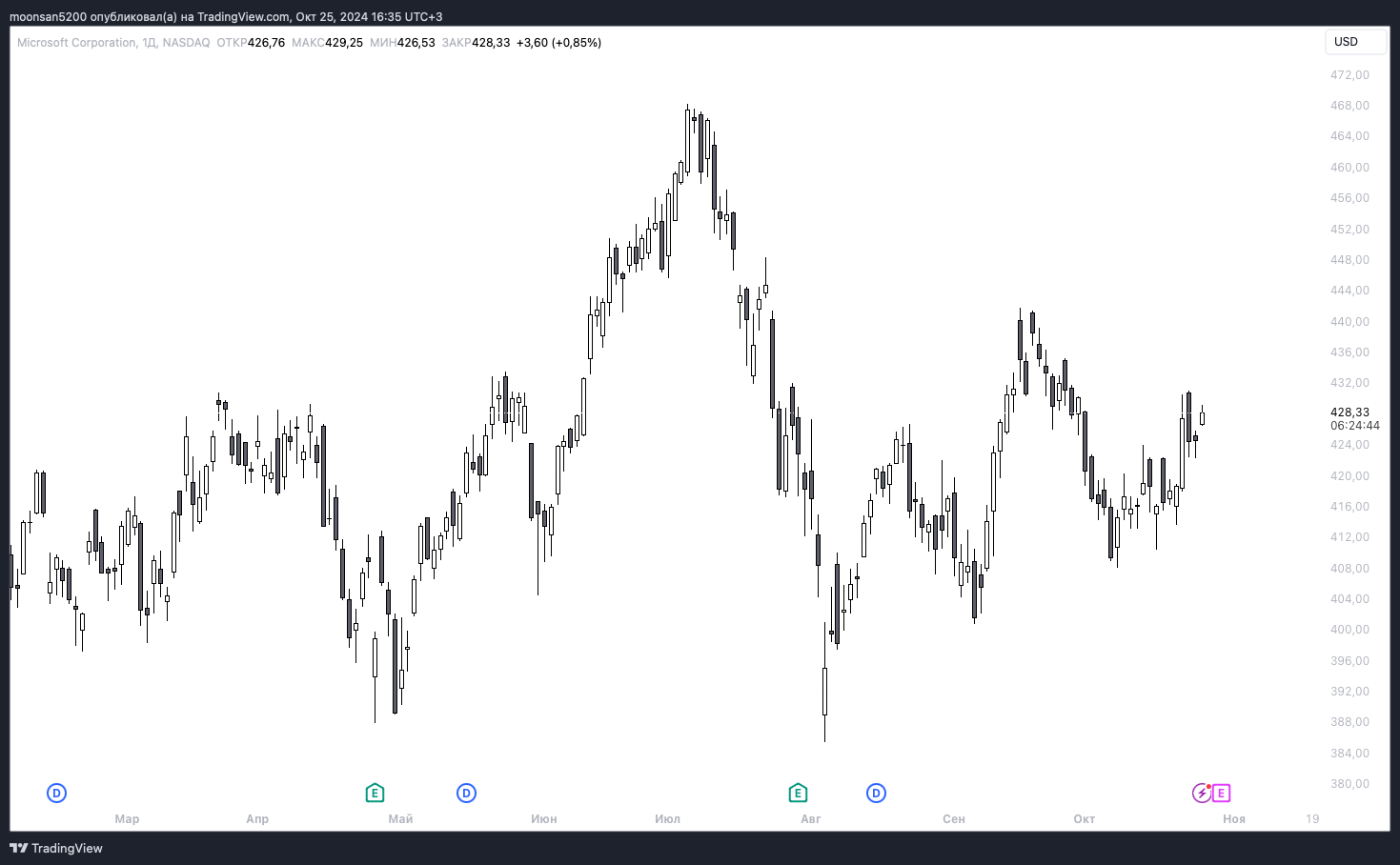

Changes in the value of Microsoft shares

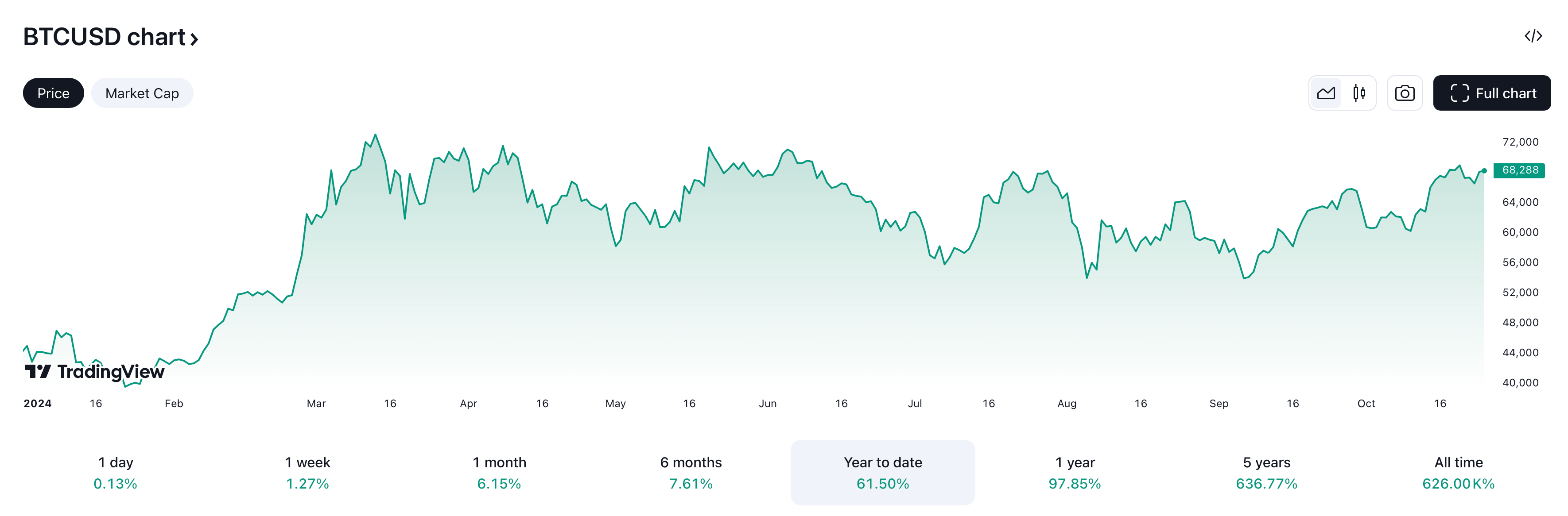

At the same time, Bitcoin rose 61 per cent on January 1. Accordingly, MicroStrategy also managed to outperform the index of the first cryptocurrency, despite its use as the main investment.

Changes in the value of Bitcoin BTC in 2024

Nevertheless, the board is still recommending that shareholders vote against the corresponding proposal at the meeting on 10 December. The reason here is that they are supposedly already “considering a wide range of assets for investment.”

There are reports that this list may include Bitcoin. Here is the relevant rejoinder to the situation, as cited by The Block.

Microsoft is evaluating a wide range of investable assets to fund the company’s ongoing operations, including assets that are expected to provide diversification and inflation protection, as well as mitigate the risk of significant economic losses from rising interest rates.

Recommendation of the board of directors to vote “no”

More specifically – the option to invest in Bitcoin has been considered at least several times by management at previous meetings. However, it’s not certain that this time around, the cryptocurrency will get the necessary approval from the higher echelons of Microsoft.

Most likely, executives will prefer to follow the results of the US presidential election and what policies the new president’s administration will promote.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

The company also noted that volatility “is a factor to consider when evaluating crypto investments.” Accordingly, the company’s representatives may not be satisfied with the fact that Bitcoin is able to fall and rise in price by a notional 10 per cent per day. However, nowadays this is also true for ordinary stocks, so this argument does not seem convincing.

Microsoft is the third largest technology company in the US with a market capitalisation of $3.157 trillion. If the idea is approved and implemented, the giant could end up being the largest holder of BTC in the world. However, the company is unlikely to surpass MicroStrategy in terms of bitcoins: still, Michael Saylor’s organisation has managed to acquire more than a quarter of a million coins.

Top BTC holders among institutional holders

Michael Saylor also reacted to a similar prospect. He addressed Microsoft CEO Satya Nadella on Twitter with the following rejoinder.

Satya, if you want the next trillion dollars for MSFT shareholders, dial me up.

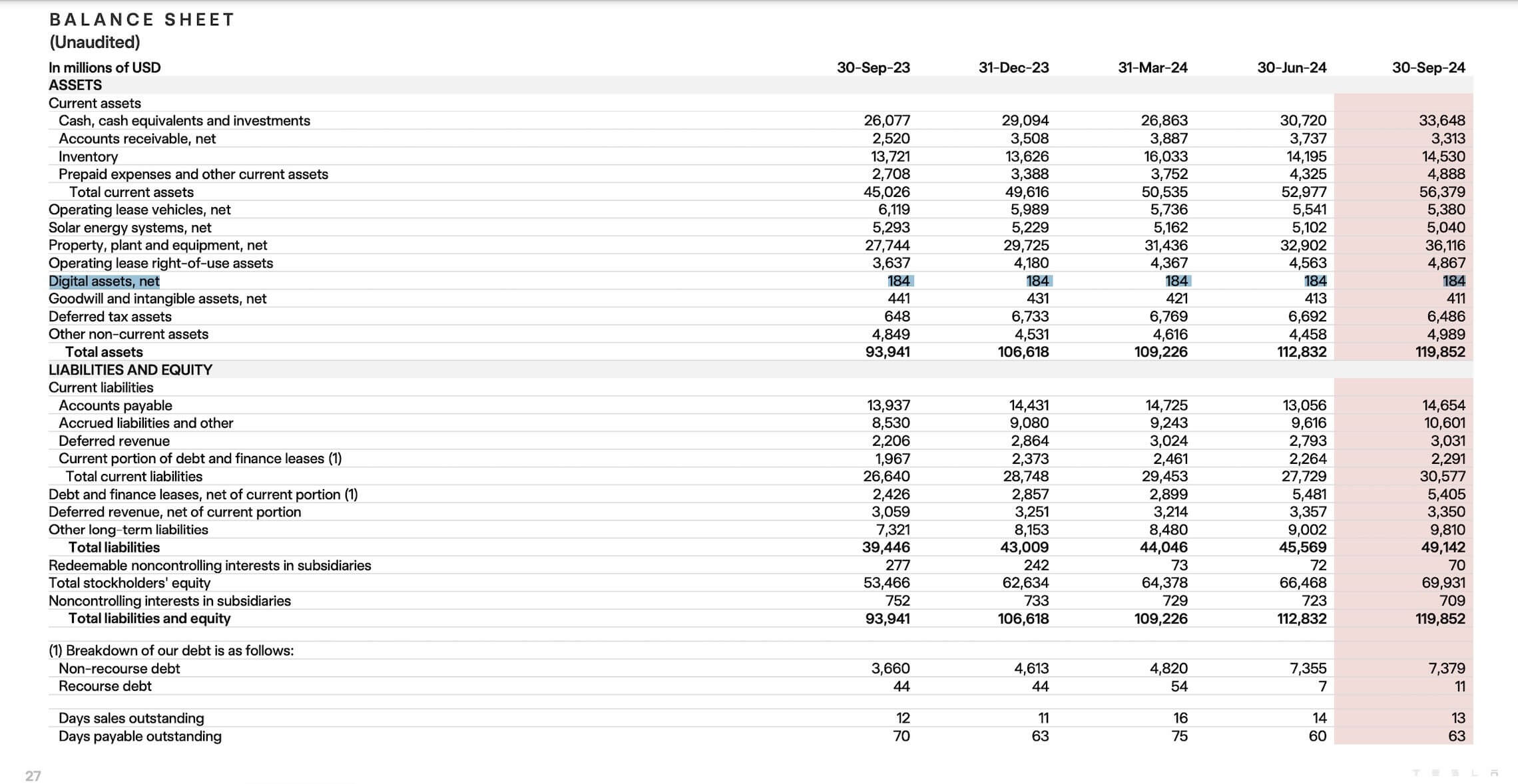

Meanwhile, Tesla continues to be among the bitcoin holders. As revealed last night thanks to the release of its Q3 2024 financial report, the giant has once again not conducted any transactions with the coin. Moreover, the absence of any sales and purchases has been observed for five consecutive quarters.

Tesla’s financial report for the third quarter of 2024

Apparently, the Microsoft Board of Directors meeting on 10 December will end with a failure on the Bitcoin vote. However, the emergence of such an idea indicates investors' interest in cryptocurrency and recognition of this asset category. Therefore, the demand for the coins among major players will surely increase in the future.

Want to stay up to date with other interesting news? Join our crypto chat. We look forward to seeing you there so that you don’t miss the development of the current bullrun in the blockchain and decentralised platform industry.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO KEEP UP TO DATE.