MicroStrategy wants to raise $42 billion to buy bitcoins (BTC). How will this happen?

MicroStrategy will continue to increase the number of BTC on its own balance sheet. Tonight, the company announced an initiative to raise $42 billion over the next three years to buy cryptocurrencies. The plan is dubbed 21/21, as the funds raised will be split up into $21 billion in equity and fixed income securities. Currently, $42 billion can be spent to buy more than 578,000 BTC or 2.7 percent of the total coins in circulation, so the plan is massive.

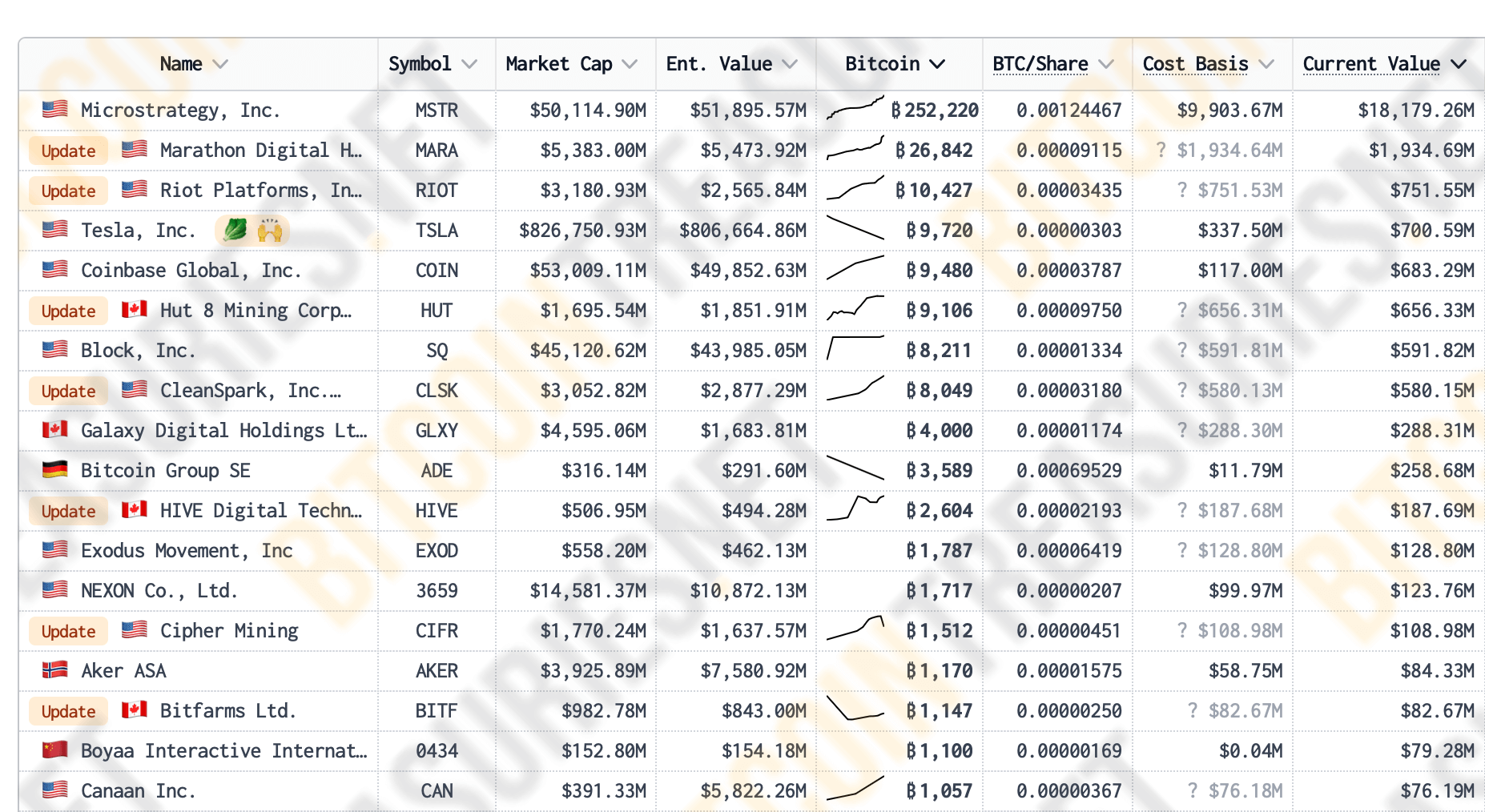

MicroStrategy is still the leader in terms of accumulated bitcoins among publicly traded companies. Today, the giant owns 252,220 BTC worth $18.1 billion, with $9.9 billion invested.

Ranking of public companies by number of bitcoins in circulation

This amount translates to 1.2 percent of all bitcoins in circulation, meaning the company’s efforts are indeed commendable.

At the same time, experts are confident that Bitcoin will continue its growth in the current bullrun. As Bitwise Investment Director Matt Hogan noted the day before on Yahoo Finance, the cryptocurrency will set price highs regardless of the outcome of the upcoming US presidential election. Here’s his line.

Regardless of Donald Trump or Kamala Harris winning, the Bitcoin regulatory situation is getting better. I think this is what is reflected in the price of the cryptocurrency.

However, Trump’s success will still benefit the market in the short term, the expert said.

When MicroStrategy will buy bitcoins

MicroStrategy President and CEO Phong Le said that such a move would increase the company’s revenue from bitcoin ownership. Here is a comment on the matter, as quoted by Cointelegraph.

Today we are announcing an ambitious goal of raising $42 billion in capital over the next three years. This amount includes $21 billion in equity capital and $21 billion in debt securities, which we call our “21/21 plan.”

As a BTC custodial company, we plan to use the additional capital to purchase more bitcoins as a reserve asset, allowing us to achieve greater returns on the cryptocurrency.

MicroStrategy Executive Chairman Michael Saylor

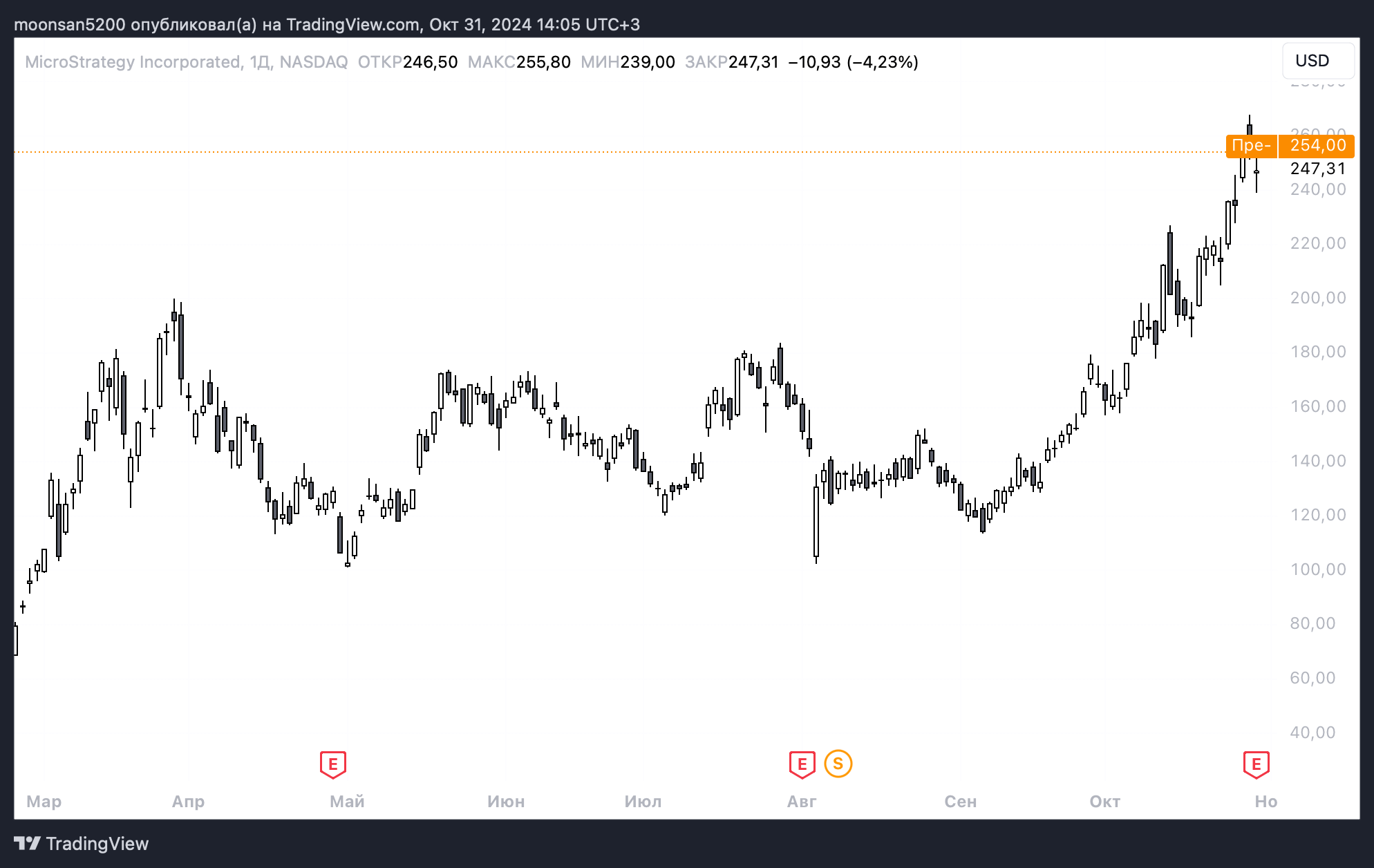

MicroStrategy has a total market capitalisation of $50.1 billion today. The company reported that BTC’s year-to-date return was 17.8 percent, a figure used specifically by MicroStrategy analysts to evaluate the performance of crypto investments.

According to The Block’s sources, MicroStrategy raised $2.1 billion in the third quarter through equity and debt capital.

The company also increased the amount of crypto under management by 11 percent and cut annual expenses by $24 million.The crypto giant’s total revenue was $116.1 million, down $8 million from experts’ forecasts and 10.3 percent from a year ago.

Changes in MicroStrategy MSTR stock price

Operating expenses for the quarter reached $514.3 million, which was mainly due to a $412.1 million impairment loss on digital assets. Net loss for the quarter was 340.2 million or $1.72 per share.

Information about the new strategy was also revealed on Twitter by MicroStrategy executive chairman Michael Saylor

The news of MicroStrategy’s new investment plan was received with great optimism by the investor community. For example, a user under the pseudonym BitcoinMiningStockGuy on Twitter noted one interesting detail: only half of the funds in MicroStrategy’s investment plan is almost equal to the capitalisation of all mining companies whose shares are traded on the stock exchange.

Michael Saylor at the MicroStrategy presentation

That is, MicroStrategy will, through its actions, create a stable source of demand for Bitcoin for the next three years. This should have a positive effect on the value of the main cryptocurrency in the long term, as it will get a large buyer who is interested in accumulating as much Bitcoin as possible.

😈 MORE INTERESTING STUFF CAN BE FOUND AT US AT YANDEX.ZEN!

Meanwhile, Reddit, the company behind the social platform of the same name, has decided to get rid of most of its crypto in the third quarter of 2024. However, on the scale of the overall balance sheet, this deal turned out to be insignificant. Here’s a commentary on the situation.

During the three months to 30 September 2024, we sold the majority of our crypto portfolio, which consisted primarily of Bitcoin and Etherium. The net carrying value of our cryptocurrencies as well as the gain realised on the sale was immaterial for the periods presented.

According to Reddit’s filing with the SEC, cryptocurrency sales revenue for the three months totalled 6.869 million.

Reddit platform logo

That said, the company had previously invested some of its excess cash reserves in BTC and ETH. It also acquired a minor amount of MATIC tokens, which carries the ticker POL after rebranding.

Reddit has been using its excess cash reserves to invest in crypto since 2022. In a previous initial public offering (IPO) filing, the company praised cryptocurrencies and blockchain as having “significant investment potential.”

According to Reddit’s policy, investments in digital assets for custodial purposes are limited to BTC, ETH and any other cryptocurrencies that U.S. regulators have defined as “likely not securities.”

As we've already noted, the current number of bitcoins in MicroStrategy's possession is estimated at $18 billion, which means the company wants to at least triple its holdings. However, the money will be raised over the course of three years, so the BTC rate will obviously vary. Be that as it may, there is definitely no limit to the giant's management's faith in the potential of cryptocurrencies.

Look for more interesting stuff in our crypto chat. Come in quickly so you don’t miss the development of the current bullrun in the coin market.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.