Tesla has moved $750 million worth of bitcoins. What could this mean for the cryptocurrency market?

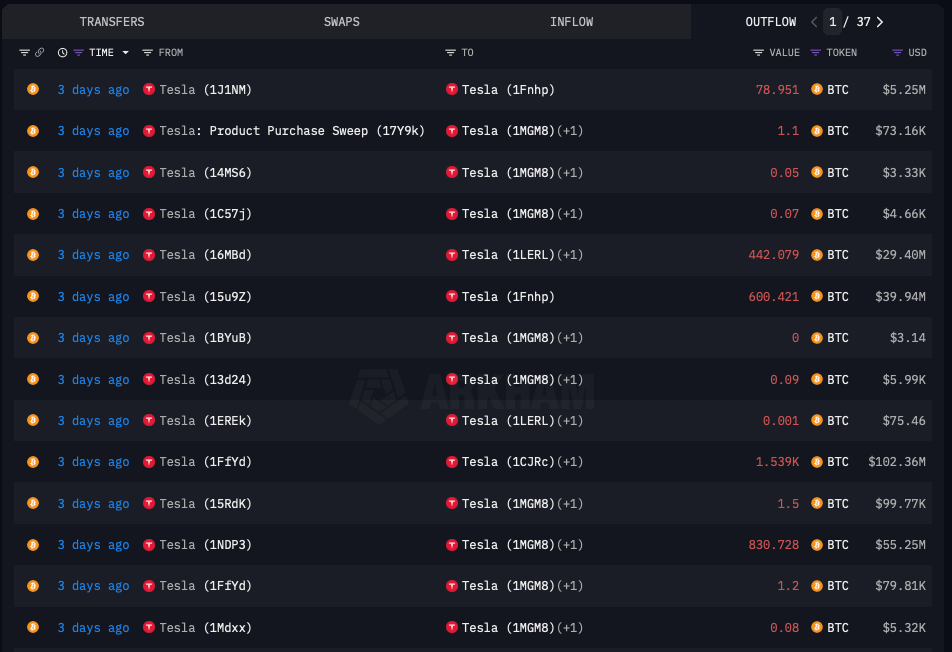

In the middle of the week, bitcoins owned by Tesla became the centre of attention among crypto investors. As it turned out, the company for the first time in two years conducted a transaction with BTC worth more than $750 million, sending coins to new wallets. However, none of the transfers went to exchanges, and in addition, the coins were not converted into stablecoins. So what then is the reason for these transactions?

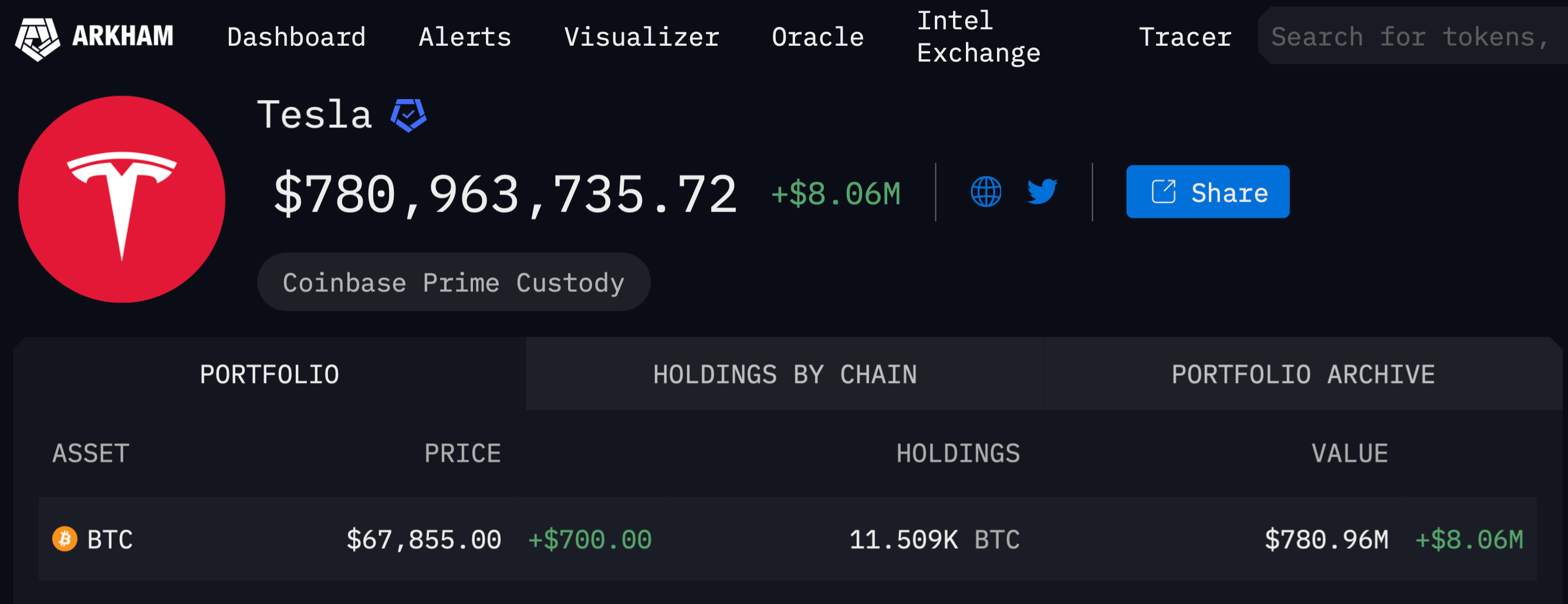

Today, Tesla’s Bitcoin wallet balance is the equivalent of $780 million. Arkham platform analysts report that the giant has 11,509 BTC.

Tesla’s Bitcoin wallet balance

How many bitcoins does Tesla have

The electric car manufacturer announced the purchase of the first $1.5 billion worth of bitcoins back in early 2021, that is, during the active bullrun in the coin market. Then Tesla CEO Ilon Musk took to PR of the first cryptocurrency and digital assets on his Twitter, emphasising on a meme-coin called Dogecoin.

Such publications quite predictably led to an explosive growth in the value of the main cryptocurrency and an increase in the capitalisation of the entire market. In addition, in March 2021, Tesla started accepting bitcoins as a means of paying for cars, but this initiative was soon cancelled.

Tesla CEO Ilon Musk and Dogecoin

The car manufacturer’s sales of digital assets followed. In particular, in April 2021, the company got rid of 10 per cent of its own bitcoins. As the giant’s representatives noted at the time, this operation was required to test the liquidity of the first cryptocurrency, that is, the market’s ability to handle a large sale of coins.

Tesla then sold 29,160 BTC or 75 per cent of its cryptocurrency portfolio in the second quarter of 2022, missing out on a significant profit on its investments as a result.

According to platform Arkham Intelligence, this time the BTCs were transferred to new wallets rather than exchanges, dispelling early fears of a major sell-off of digital assets.

Representatives for Tesla and Musk have yet to comment on what has happened. More details are sure to emerge early next week when the company reports its earnings results for the third quarter of 2024.

Tesla’s latest bitcoin transfers

A CryptoQuant analyst under the pseudonym Maartunn told CoinDesk about the potential reasons for the transactions in an interview.

The first of these is a possible audit. In other words, Tesla may be transferring bitcoins to fulfil accounting or legal obligations related to financial statements or internal audits.

Selling Tesla cars for bitcoins

The second reason is trivial wallet management. Tesla probably uses multiple wallets for operational purposes.

The third reason is a complete restructuring of the portfolio. This could indicate the expectation of future sales or loans, similar to what happened with the bankrupt trading platform Mt.Gox. However, such assumptions should be refrained from until there is evidence of a sale along the lines of the transfer of digital assets to Coinbase, which is currently unavailable.

A fourth possible reason for the social media hype could be the consolidation of UTXOs or unspent transaction outputs, which is the process of combining multiple UTXOs into one. UTXOs can be thought of as individual unspent token amounts in their respective blockchains, waiting to be used in future transactions.

Each UTXO used in a transaction increases the size of the transaction, which can lead to higher transfer fees, as the latter is determined by the size of the transaction data, not the value of the transfer.

The struggle of the dollar and Bitcoin

Consolidation results in less raw data for future transactions, potentially reducing the value of a large transaction in the future. Doing something like this is advantageous when there is low load on the digital asset’s network.

It looks like Tesla isn’t the only one reluctant to get rid of its bitcoins right now. The cryptocurrency’s reserves on centralised exchanges have fallen to their lowest since December 2021. This is about the point at which CryptoQuant analysts began tracking this figure, The Block reports.

More than 51 thousand BTC has been withdrawn from trading platforms over the past month. This trend leads to a reduction in Bitcoin’s liquid supply and suggests that investors are withdrawing their coins for a long-term digital asset storage strategy

In general, the outflow of coins from exchanges is a multi-year trend. According to experts, it may be caused by the growth of the price of cryptocurrency, that is, the banal expectation of investors to increase the value of their investment. However, statistics show that any previous investment of capital in BTC for more than four years ended in profit for the holder of the position.

Dynamics of Bitcoin reserves of centralised cryptocurrency exchanges

In October 2021, Bitcoin exchange reserves were near the mark of 3.2 million coins. During this time, the indicator decreased by 590 thousand BTC.

The relevant information was commented on by Julio Moreno, head of research at CryptoQuant. Here is his quote.

BTC reserves on exchanges declined this year due to Mt.Gox payments to creditors, as our total exchange reserves data included Mt.Gox funds.

By the way, last week Mt.Gox’s rehabilitation plan was extended for one year, i.e. until 31 October 2025. On the whole, this is not bad news, as an increase in the duration of the compensation procedure will reduce the pressure from sellers on the industry.

Demand for indemnity payment from a former customer of crypto exchange Mt.Gox

As a result, we can assume that the purpose of conducting Bitcoin transactions by Tesla representatives is not to sell cryptocurrency. It will most likely be possible to find out the real motives after the publication of the next financial statements. After all, in them public companies tell in detail about the state of their assets - and coins, among others.