The head of cryptocurrency exchange Coinbase is expecting an apology from the new SEC chairman. Why?

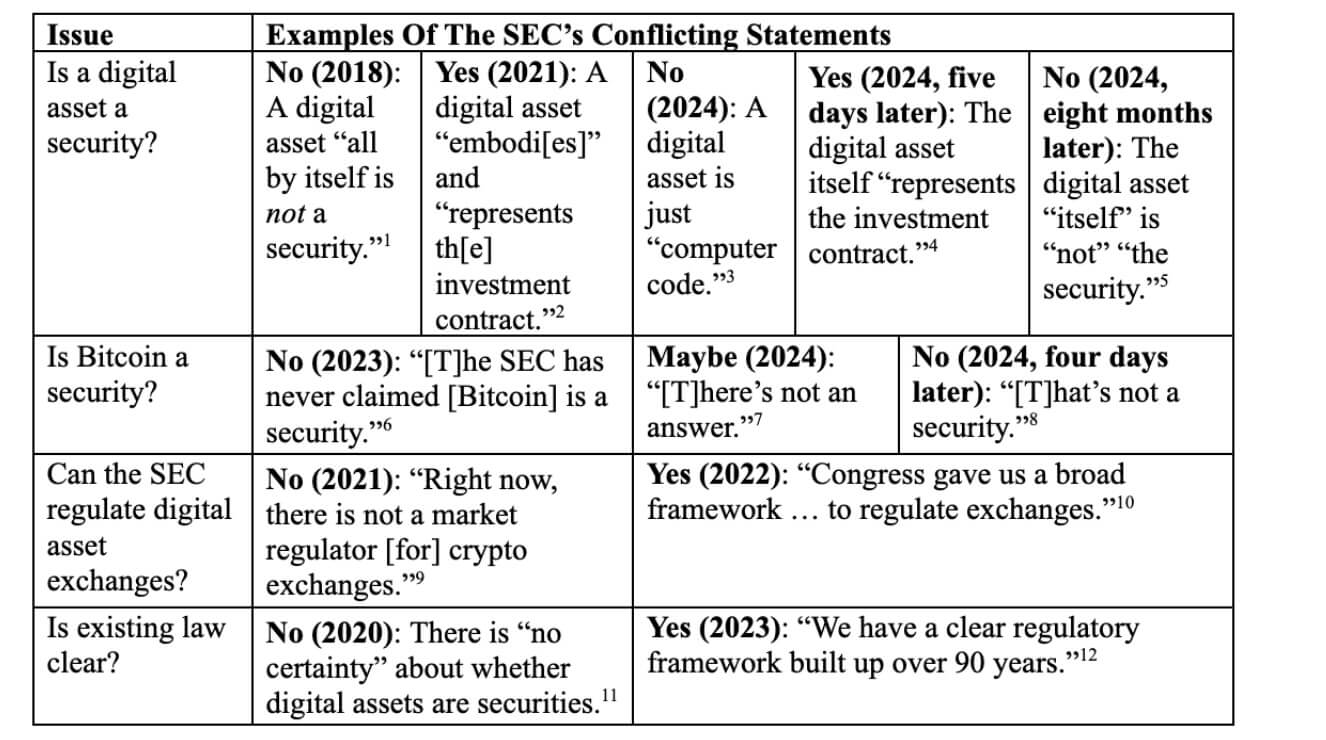

The next chairman of the US Securities and Exchange Commission (SEC) should publicly apologise to Americans for the damage his agency has done to the digital asset sphere. This statement was made by Brian Armstrong, CEO of the largest US crypto exchange, on his Twitter. He also published a series of mutually exclusive statements from the SEC leadership regarding digital assets. In general, Armstrong claims that during all this time, the regulator has made no attempt to create a clear algorithm to control the industry.

The main problem at the SEC is its current chairman, Gary Gensler. He was appointed to the post by President Joe Biden and has taken an aggressive stance towards the cryptocurrency industry.

Gensler’s activities boil down to filing lawsuits against cryptocurrency companies and regulation through coercion. In addition, he openly refers to all cryptocurrencies except Bitcoin as unregistered securities.

Securities Commission Chairman Gary Gensler

Actually, this is the basis for the litigation. Although previously the regulator was unable to prove that the cryptocurrency XRP belongs to this category.

What will happen to cryptocurrencies in the United States

First of all, Armstrong posted a screenshot of several statements from the SEC in different years. In them, the regulator gave official answers to questions about whether cryptocurrencies are securities, as well as the general way the Commission regulates digital assets.

Conflicting statements from the SEC about cryptocurrencies

According to the Coinbase executive, the next SEC chairman should apologise to the American people and withdraw all “frivolous lawsuits against cryptocurrency companies”. While this would not undo the damage done, it would restore trust in government agencies.

Lawyer John Deaton previously noted that the damage to the cryptocurrency industry due to the SEC's actions can be estimated at $15 billion. How exactly he came to this mark is unknown, but the scale of the problems of representatives of the blockchain niche is really huge.

Here, first of all, the situation with the trading platform Kraken comes to mind. In February 2023, the exchange closed the option of steaking cryptocurrencies for US residents paid a fine of $30 million. However, already in autumn, the Commission again filed a lawsuit against the exchange because of the "serious risk" to the industry from the platform. As a result, Kraken's co-founder characterised the SEC's strategy as extortion.

Coinbase cryptocurrency exchange chief Brian Armstrong

According to Cointelegraph’s sources, Armstrong has endorsed Senate candidates in favour of proper regulation of crypto ahead of the US presidential election. That list includes former Bridgewater Associates CEO David McCormick and lawyer John Deaton.

If former President Donald Trump wins the upcoming election, he will almost certainly appoint a more cryptocurrency-friendly person as SEC chairman. Still, earlier during the Bitcoin 2024 cryptocurrency conference in Nashville on 27 July, Trump promised to fire current SEC Chairman Gary Gensler on day one if he is re-elected.

Former US President Donald Trump at the Bitcoin 2024 cryptocurrency conference

Additionally, Trump may consider former SEC General Counsel Robert Stebbins, SEC Commissioner Hester Pearce, or Chris Giancarlo, who is a commissioner and former chairman of the Commodity Futures Trading Commission (CFTC). The listed candidates seem to be more suitable personalities for the position and are surely able to ensure adequate development of the coin sphere.

For example, Hester Pearce stated during a hearing in late September that the Commission should have long ago recognised cryptocurrencies as assets that do not qualify as securities. Accordingly, all the regulator’s attacks on the sphere have not brought any positive result and in fact have only made things worse – including the local economy.

Earlier, Pearce also spoke out against the SEC's decision to ban sending the ethers that underpin spot Efirium-ETFs in the US into staking. According to her, it will eventually be reviewed, well, and investors will have the opportunity to earn additional returns on their investments.

High-profile cases in the crypto industry continue to be relevant. In particular, on 28 October, the US Department of Justice brought charges against 53-year-old Maximiliano Pilipis, who is the operator of the AurumXchange exchange.

Cryptocurrency fraudsters

He allegedly funnelled more than $30 million in 100,000 transactions through the platform, some of which came from wallets linked to the now-closed Silk Road darknet platform.

Pilipis ran his exchange without a licence from 2009 to 2013 – the same year the FBI shut down Silk Road. He received millions of dollars in fees for laundering funds from Silk Road, including 10,000 BTC worth about $1.2 million at the time, sources noted.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

One of Maximiliano Pilipis’ properties

Authorities also accused the suspect of flouting federal crypto exchange registration and reporting requirements, failing to comply with anti-money laundering regulations and fraud. After AurumXchange was shut down, Pilipis split and transferred BTC and other assets, laundering them through real estate.

The SEC's current policy towards cryptocurrencies is an unequivocal failure. Still, the regulator essentially only attacks the representatives of the niche and does not try to provide conditions for its development. We can only hope that the upcoming elections in the U.S. will help to change the situation for the better.

Look for more interesting things in our crypto chat. We are definitely waiting for you there if you don’t want to miss the progress of the current bullrun in the coin industry.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.