The US election could trigger a bond market crash. What does this mean for cryptocurrencies?

Analysts at trading firm Presto Peter Chang and Ming Yung believe that the US presidential election is a serious risk for investors. Still, they may provoke a fall in the bond market, which will lead to negative consequences for a number of assets – including Bitcoin. If the analysts’ forecast becomes a reality, a so-called “Minsky moment” will occur.

The Minsky moment is a sharp market crash after a long period of speculation and rising asset prices, named after economist Hyman Minsky. His theory states that in times of financial stability, investors begin to take on more and more risk, which in turn leads to instability.

Cryptocurrency market crash

The so-called Minsky moment occurs when borrowers are no longer able to service their debts. This leads to a loss of confidence in what is happening, massive asset sales and further financial crisis.

What will happen to the financial markets?

In a published report, Chang and Jung looked at the risks to the US economy from a curious angle. Here’s the relevant rejoinder, as cited by The Block.

As the US debt-to-GDP ratio has risen from 40 to 100 per cent over the past 25 years and is certain to reach 124 to 200 per cent in the next 10 to 30 years, the US election could trigger a “Minsky moment”. This is when the bond market “realises the problem” and demands much higher compensation for deficit financing, i.e. by collapsing bonds.

In general, the current economic conditions do not seem to be the worst. In September, the US Federal Reserve lowered its benchmark interest rate for the first time in four years, dropping it by 50 basis points. And although the American economy is still not rid of the risk of recession, the actions of bankers hint tentatively at the possibility of getting out of the crisis.

US Fed Chairman Jerome Powell

According to experts, the risk of a bond market collapse is heightened by the candidates’ promises of a new fiscal policy based on rising inflation. In their comments, analysts referred to the recent interview of billionaire Paul Tudor Jones on CNBC.

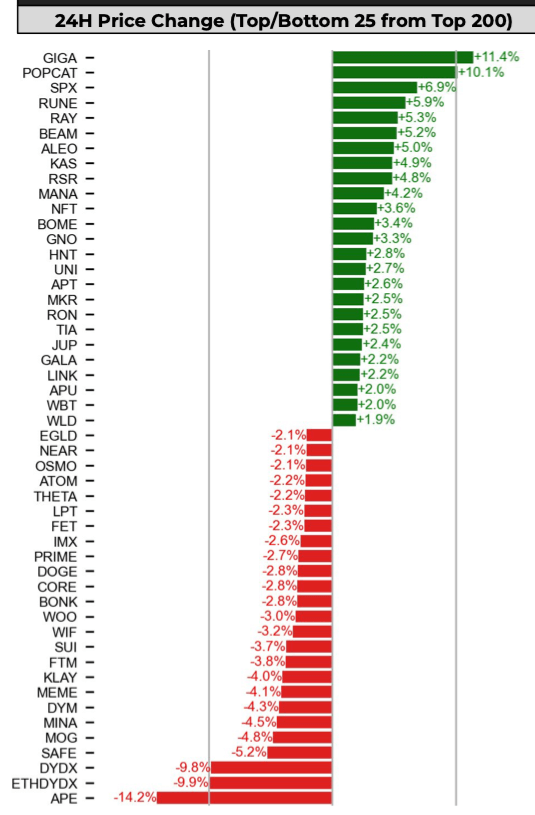

The rise and collapse in the value of the top cryptocurrencies over the past 24 hours

He said he will have “zero fixed income” – meaning no bond-like fixed income securities in his investment portfolio.

Jones believes that policymakers will try to fix the rising debt situation by manipulating the benchmark lending rate and inflation. However, such actions will make government bonds unattractive for investment. Here is his quote.

The strategy to get out of this crisis is to erode debt through inflation. You set interest rates below inflation and nominal growth rates above it, and thus lower the debt-to-GDP ratio. History shows that all civilisations got rid of debt in this way – inflation was their salvation.

Paul Tudor Jones also said that the problems of inflation are bound to come back. Therefore, he is at least at the moment choosing gold and Bitcoin, increasing the volume of such investments.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

However, Jones believes that the US Federal Reserve should continue to lower the benchmark interest rate. The next FOMC meeting, which will decide the fate of the rate, will be held on 7 November. At the moment, traders assume that the bankers will reduce it again – but this time by 25 basis points.

The likelihood of a 25 basis point cut in the benchmark interest rate at the next FOMC meeting

A separate and profitable case for crypto is the victory of Republican Donald Trump in the upcoming US presidential election on 5 November.

This is the opinion of Jeff Park, head of alpha strategies at crypto asset manager Bitwise, whose remarks are cited by Cointelegraph.

Polymarket’s graph of the price of BTC versus Trump’s chances of winning from 15 August to 20 October shows certain wild swings – especially when Harris and Trump were alternately in the lead. Given probability theory, I predict that a Trump victory could push BTC towards the $92,000 line on the chart.

Earlier, many analysts stated the prospect of Bitcoin rising to new all-time highs given the election. For example, Jeff May, a representative of the BTSE exchange, believes that this will happen with any outcome of the vote. Read more about his opinion in a separate article.

Correlation of BTC price with Donald Trump’s chances of winning the US presidential election

In general, crypto has never been so closely linked to the outcome of any political event. The reason for what is happening is that Republican presidential candidate Donald Trump has made a liberal policy towards crypto a key element of his election campaign.

In an attempt to appeal to voters interested solely in cryptocurrencies, Trump has promised to turn the US into the “crypto capital of the world.” In addition, he said he would fire Securities and Exchange Commission (SEC) Chairman Gary Gensler on the first day of his presidency.

Analysts' version is that the upcoming US presidential election will seriously affect all financial markets, including cryptocurrencies. Billionaire Paul Tudor Jones does not expect good results from the economy, in this regard, he bets on Bitcoin and gold. However, there is still a chance for its so-called soft landing.

Look for more interesting stuff in our crypto chat room. We look forward to seeing you there to make the most of the current bullrun.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.