The US presidential election could lead to an explosive rise in the Bitcoin exchange rate. What will this period be like for cryptocurrencies?

According to ZX Squared Capital Chief Investment Officer C.K. Zheng, Bitcoin investors will benefit significantly from the upcoming U.S. presidential election, regardless of the winner of the election. Still, historically, Bitcoin’s halving, which happened this time in April, leads to good numbers for BTC returns in the fourth quarter of the same year. Well, Zheng said that both the US presidential candidates failed to properly address an important issue, which can also play into the hands of the major cryptocurrency.

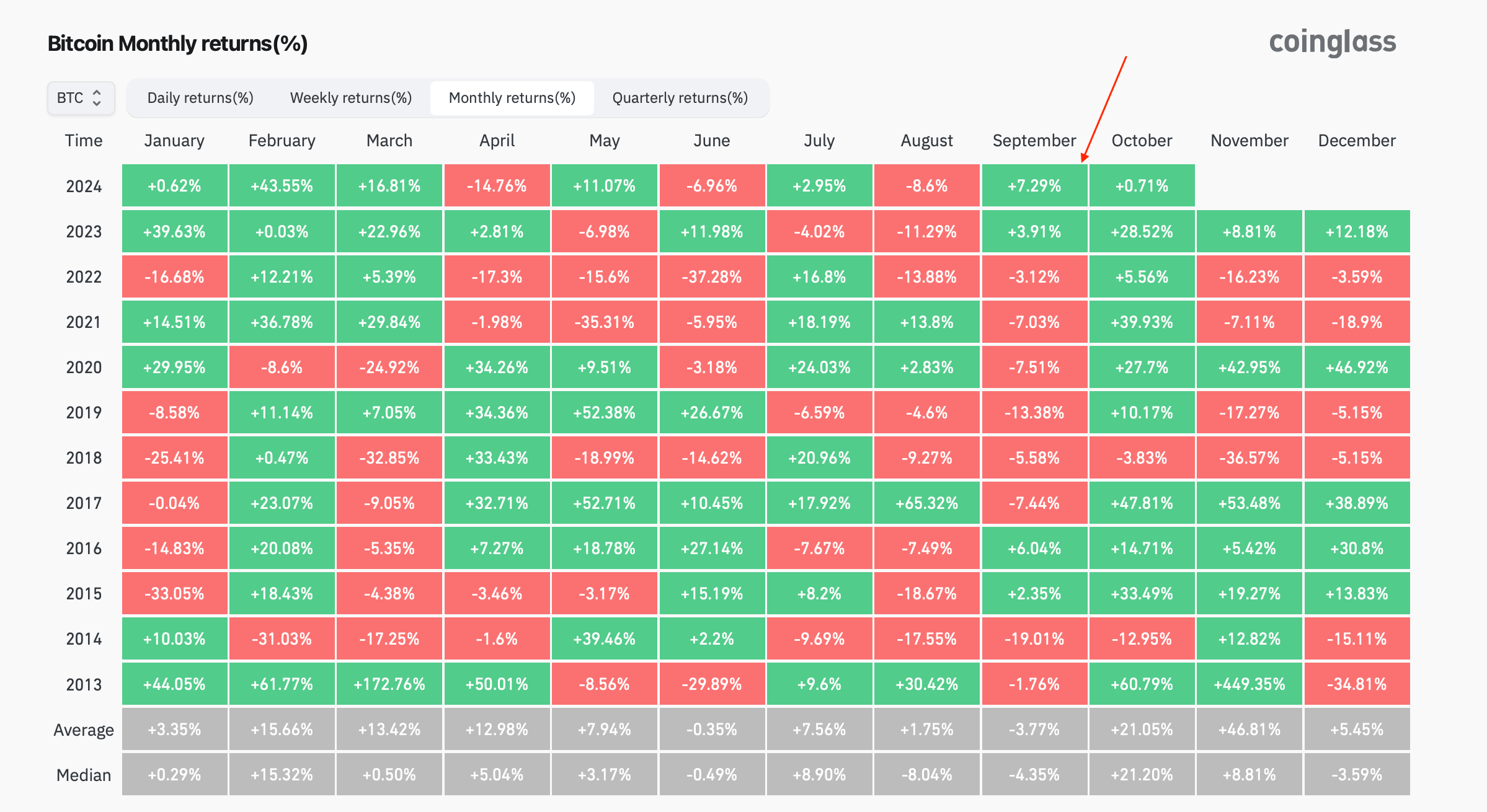

Right now, the cryptocurrency industry is seeing more and more positivity. For example, Bitcoin rose by 7.2 percent at the end of September, making it the best such month since at least 2013. Here’s the relevant table.

Bitcoin exchange rate changes by month

That said, Bernstein experts previously disagreed that a win for both candidates would be positive for the digital asset industry. The reason is that Donald Trump has been supporting the coin niche since at least the spring and has already managed to become the first US president to conduct a transaction on the Bitcoin network.

That said, Kamala Harris is the current Vice President of the US and has done nothing to help the crypto niche in 3.5 years. So it can be assumed that she is happy with the fight against the industry, which is conducted by Joe Biden’s administration.

That’s why Bernstein experts have previously stated the prospect of Bitcoin rising to the $80-90 thousand dollar range if Trump wins and the cryptocurrency falling to $30-40 thousand if Harris wins. Read more about their version in a separate piece.

When the cryptocurrency will begin to grow

In an interview with Cointelegraph, the expert shared his frustration about the strategy of politicians in solving problems in the macroeconomy. Here is his quote on the matter.

Since neither Republicans nor Democrats are paying proper attention to the growing US debt and deficit in this election, it will be very favourable for Bitcoin – especially after the whole procedure is over.

Meaning that the situation with inflation and government debt in general always remains a hot topic. And this reminds us of the advantages of the limited supply of the first cryptocurrency, whose rate of issuance is in addition reduced by 50 per cent every four years during the so-called halving. Consequently, this argument could make investors get in touch with the coin market.

Additionally, Bitcoin has benefited from uncertainty in previous presidential elections. According to Zheng, no exception to this rule is expected this time.

Cryptocurrency industry growth

Another important factor is the seasonality of the BTC market rate within a year. According to CoinGlass, Bitcoin has historically seen a sharp rise in the fourth quarter, climbing more than 50 per cent six times since 2013.

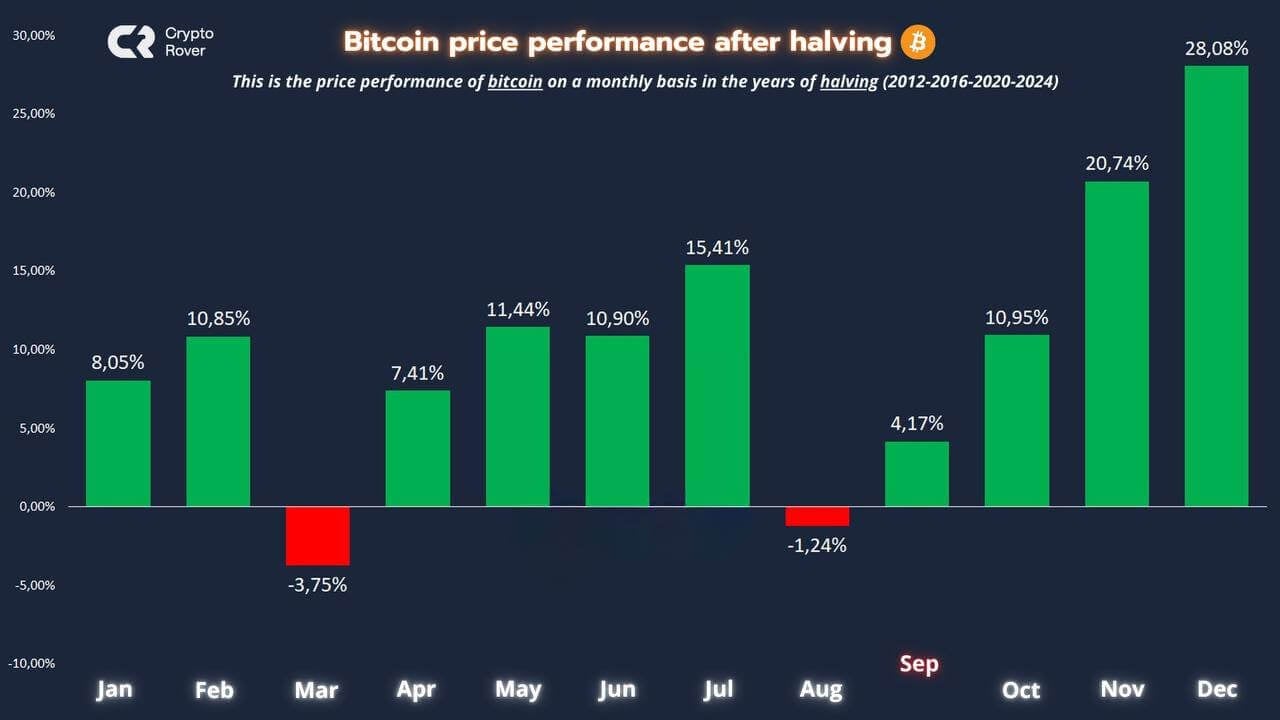

Well halving years have often amplified these results. For example, in 2020, Bitcoin rose 168 per cent in the fourth quarter, and this also coincided with the last US presidential election.

Former US President Donald Trump buys burgers with bitcoins

Seasonality is the tendency of assets to change in a regular and predictable way, repeated over the course of a calendar year. While it may look random, the possible causes turn out to be varied.

For example, it could be profit taking in April and May when tax season arrives, or a bull rally in December in the run-up to the New Year holidays, during which period investors want to make a quick buck on coin connections and withdraw funds.

The following chart shows the changes in the value of BTC after the halving. As can be seen, the end of the year in retrospect does turn out to be the most profitable, as the first cryptocurrency grows by 20 and 28 per cent on average in November and December, respectively.

Bitcoin’s profitability after halwings

The listed conditions put the asset on a firmer footing ahead of October – it acts as the start of an overall bullish period, with some traders targeting gains of up to $70,000 in the coming weeks from current levels. A green September has always led to Bitcoin closing higher in October, November and December, analysts said.

Unlike September, there have only been two October months since 2013 when BTC ended the month in the negative, Coindesk reported. At the same time, it was up as much as 60 per cent, while the average was 22 per cent.

However, Samantha Yap, CEO of PR firm YAP, believes that Bitcoin’s price rise is not the most important thing in this situation. Here’s his comment.

The main thing is the surge of interest in cryptocurrencies among ordinary investors that will follow. Media attention often follows the attention of everyday people. The faith in Web3 and the decentralised finance sphere in these moments is due to the fact that there are more user-friendly and accessible applications ready to be used by newcomers.

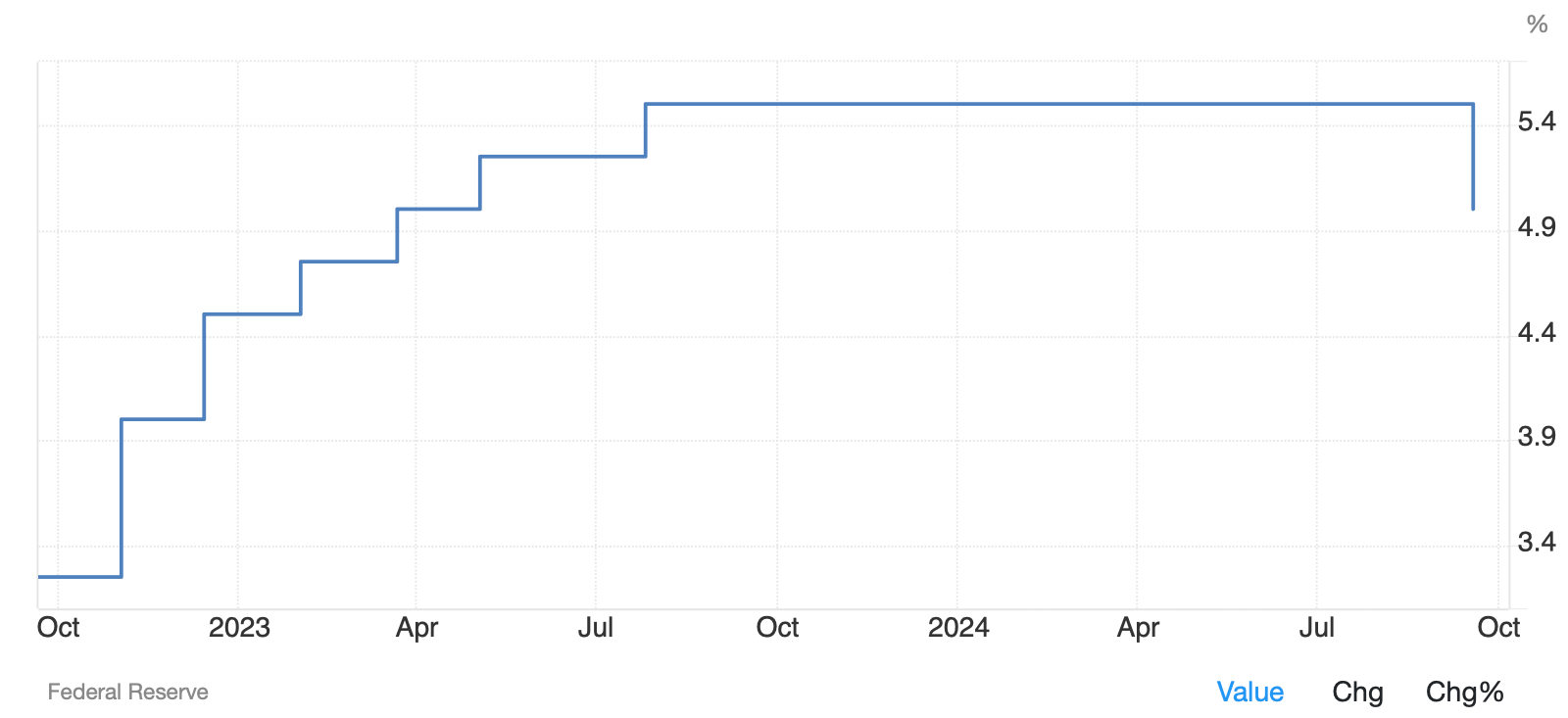

The prime lending rate in the U.S.

And lastly: an aggressive 50 basis point cut in the benchmark lending rate by the US Federal Reserve could be favourable for Bitcoin and other high-risk assets. However, this is only relevant if the US economy can achieve a “soft landing”, i.e. the ability to avoid overheating the economy and inflation while not causing a recession.

Central banks aim for such a scenario by regulating rates, because in this way the consequences for the economy as a whole will be minimal compared to the prospect of a recession. In this case, if the Fed is successful, Zheng counts on a close correlation of the BTC rate with the NASDAQ index.

As a result, analysts are betting on the US presidential election, the possible victory of Donald Trump will definitely have a good impact on crypto, and the seasonality of what is happening in the industry. Although events in the financial markets do not have to repeat themselves, they often resemble each other or "rhyme" due to similar behaviour of novice crypto investors. So there is a chance that it will be the same this time too.