Why MicroStrategy keeps buying more and more bitcoins: a response from co-founder Michael Saylor

MicroStrategy’s capitalisation has grown from $1.5 billion to $40 billion in the last four years alone. The reason for this was, among other things, the extremely risky strategy of its co-founder and executive chairman Michael Saylor. It was under his leadership that the company began actively buying bitcoins in August 2020, and in that time it has almost become a new cryptocurrency fund given the sheer volume of coins under its management. However, as Sailor himself notes, constant rounds of BTC purchases are not the way to “endlessly print money.”

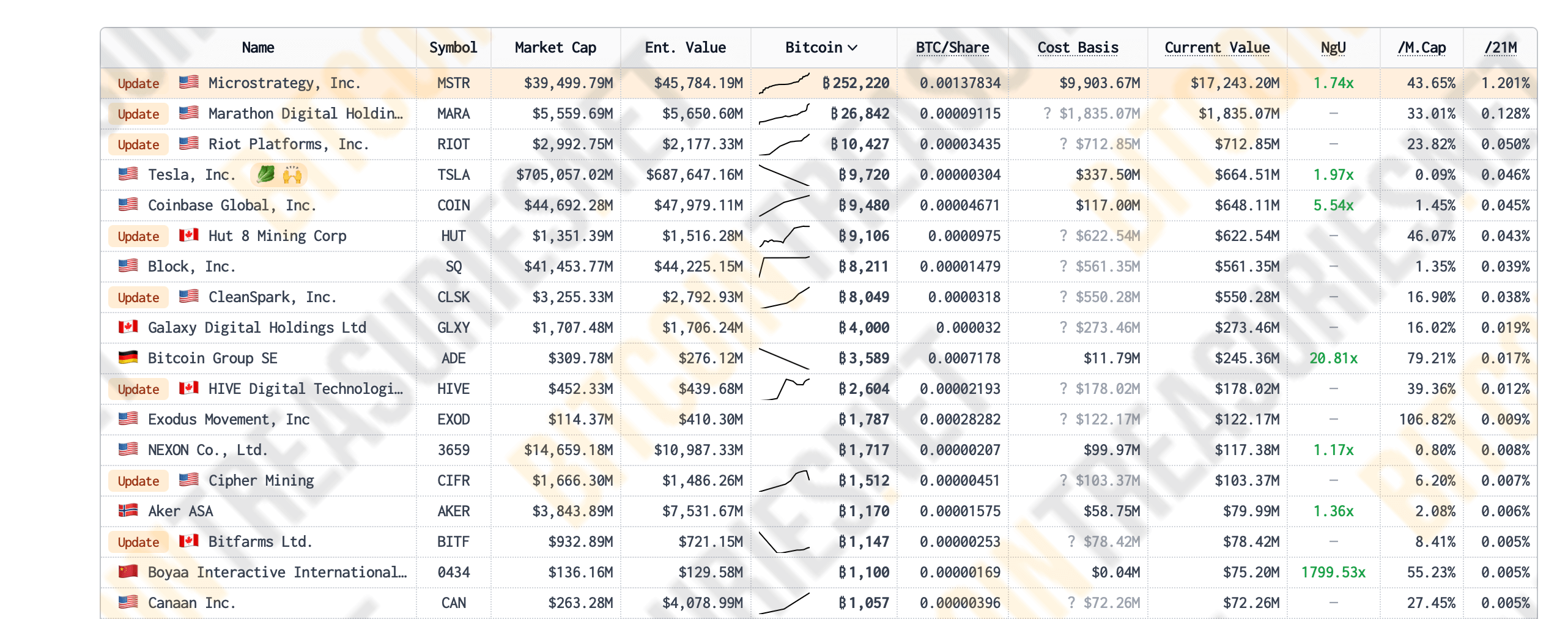

As of today, MicroStrategy continues to be the largest holder of bitcoins among publicly traded companies. The cryptocurrency giant has 252,220 BTC worth $17.2 billion in cryptocurrency accumulations. It is important to note that a total of 9.9 billion was invested in this position, which means that the original amount has grown 1.74 times.

The largest holders of Bitcoin among public companies

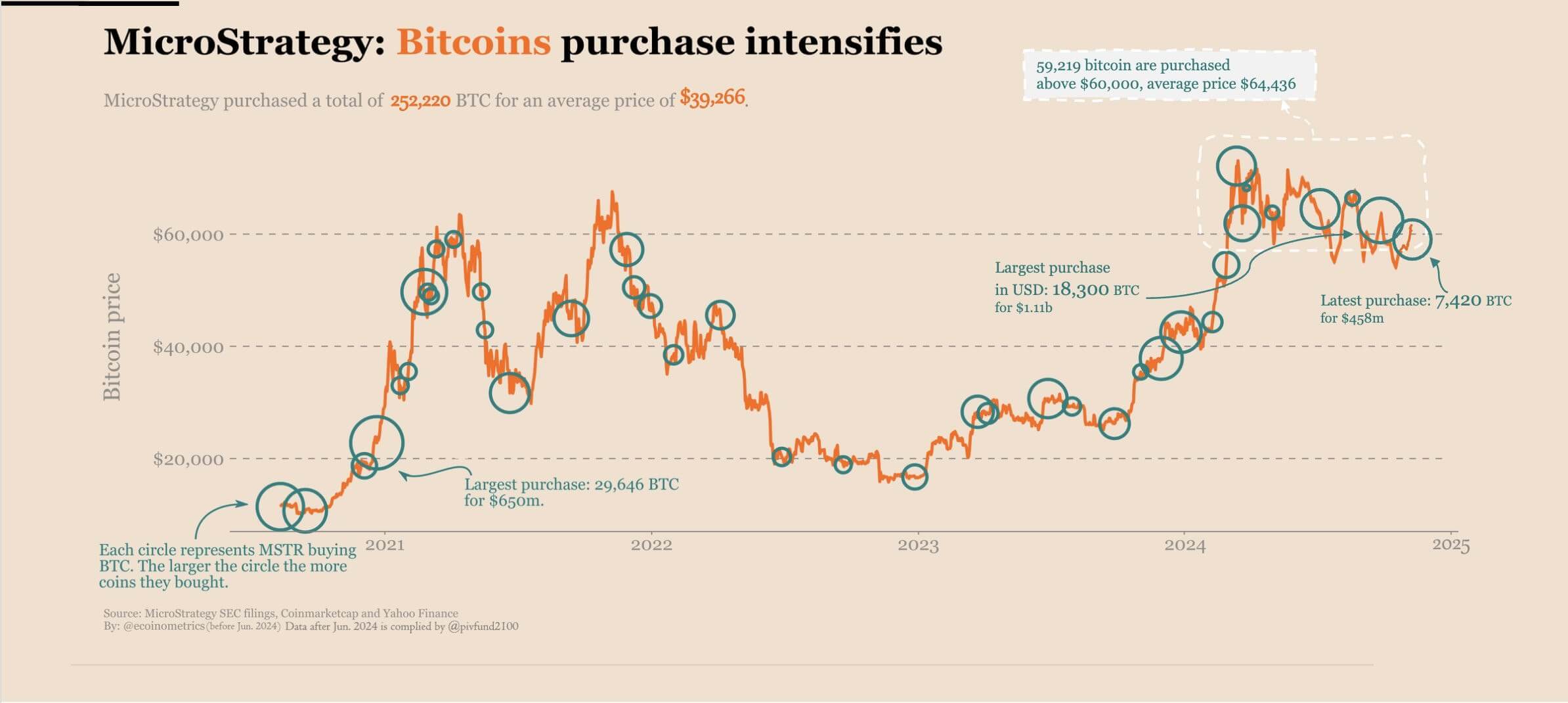

The pace of company purchases of coins in 2024 has increased significantly. In particular, MicroStrategy has recently purchased 59219 Bitcoins at a price above $60,000 per coin.

An analysis of MicroStrategy’s bitcoin purchases

Plus, in mid-September, the giant purchased 18,300 BTC for $1.1 billion, which was its largest transaction in dollar terms. The record for the volume of coins purchased was set at the end of 2020: at that time, the company purchased 29,646 Bitcoins for $650 million.

Meanwhile, Bitcoin-based instruments are attracting more and more interest from investors. For example, at the end of the week, Morgan Stanley bank reported $272.1 million invested in such instruments at the end of the third quarter of 2024. The funds were invested in spot ETFs based on the first cryptocurrency.

Morgan Stanley bank logo

After the end of the second quarter, the organisation reported investments in BTC equivalent to 190 million. Accordingly, the bank has increased the volume of investments, since at the end of June Bitcoin was valued at about 60 thousand dollars, that is, not only the growth of the cryptocurrency’s rate has now played a role.

The number of BTC holders will soon increase among ordinary retail investors as well. This will be facilitated by the fresh integration of the MoonPay service into the Venmo payment platform. Here’s a clip of the corresponding announcement.

Why MicroStrateg needs so many bitcoins

The day before, Michael Saylor gave an interview about his leadership experience as head of the company. Thanks to him, MicroStrategy, which generally deals with enterprise software development, now owns 252,220 BTC. The value of MicroStrategy’s crypto portfolio exceeds the level of $17 billion.

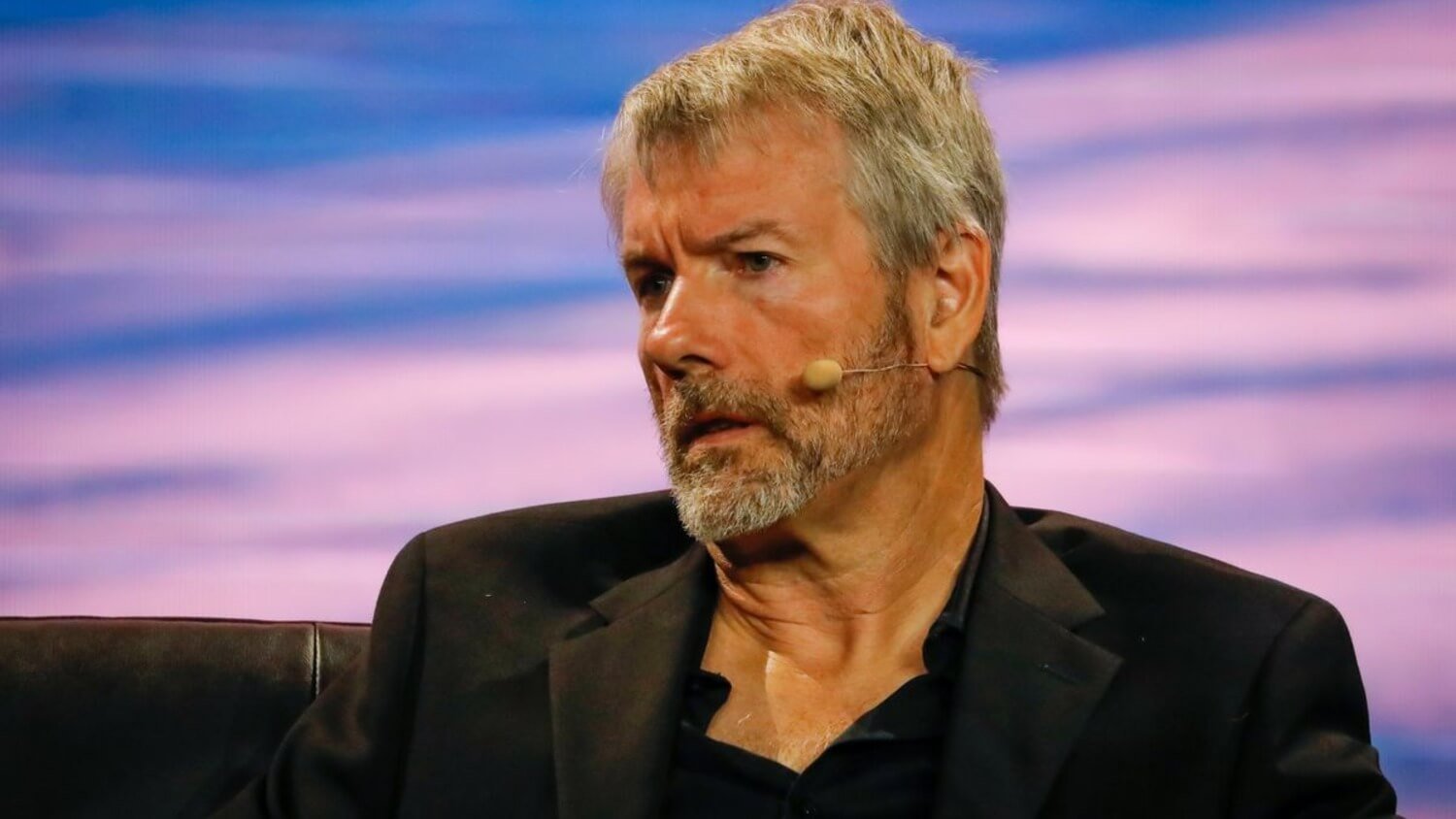

MicroStrategy spokesperson Michael Saylor said

The company has gradually changed its own profile into an institutional that plays a key role in the life of an entire digital asset market. And while some traders are shorting MSTR stock because of the company’s alleged overvaluation, Saylor isn’t worried about his brainchild’s prospects.

Here’s his commentary on what’s going on, as quoted by Decrypt.

When I was younger, I would worry about people shorting my stock. Now I’m not worried, because MicroStrategy is really just providing a set of institutional investments that investors can use to build their portfolio.

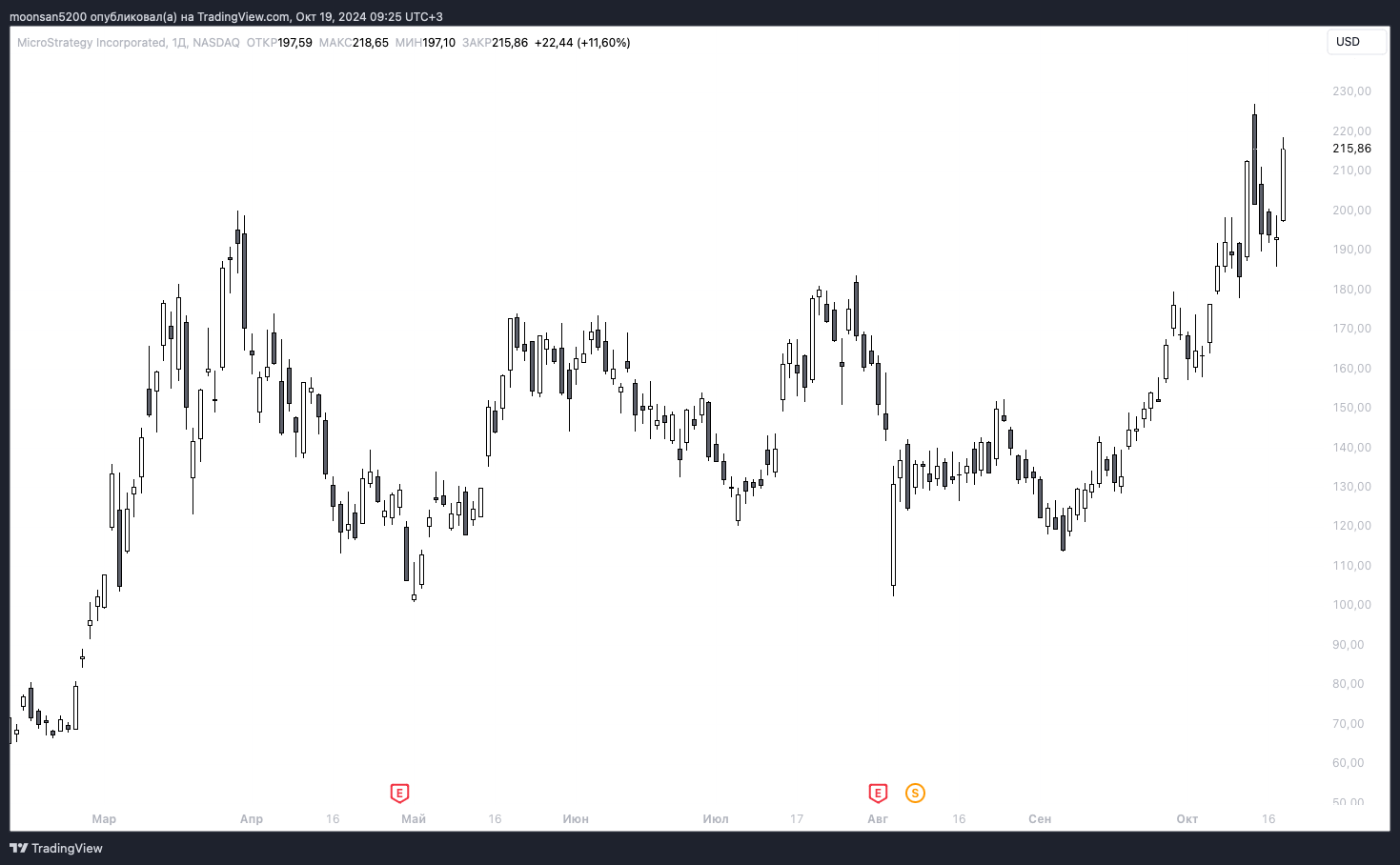

MicroStrategy’s stock price change

Saylor also emphasised the role MicroStrategy plays in bringing the world of traditional finance and crypto together. He continues.

If we didn’t exist, billions and billions of dollars of capital from traditional financial markets would not be invested in Bitcoin.

MicroStrategy Executive Chairman Michael Saylor

In addition, Michael noted that his company’s acquisitions of BTC makes the first cryptocurrency a rarer asset. Still, the number of available coins becomes smaller because of this, and MicroStrategy itself has no plans to get rid of crypto in the foreseeable future. Here’s his comment.

MicroStrategy’s real business is to become a leader in issuing securities for the sake of buying BTC. With each new acquisition, we increase the scarcity of cryptocurrency by increasing its value.

Prior to this, the company issued convertible bonds, using its shares to fund additional bitcoin acquisitions. In theory, with such collateral, MicroStrategy could print money almost indefinitely.

The giant has been frequently criticised for this. However, Michael Saylor does not consider such a strategy to be some sort of shameful manipulation.

It’s not a money glitch, it’s the digital transformation of capital markets.

Former MicroStrategy executive Michael Saylor

Earlier this month, Michael Saylor also stated that MicroStrategy aims to become a “Bitcoin bank” with a potential valuation of a trillion dollars. He explained that the company will be creating BTC-based capital market instruments that will turn out to be offered to investors.

Apparently, MicroStrategy will continue to acquire bitcoins for its own holdings. Overall, the company has already made significant strides in this investment, as it has bought up 1.2 percent of the current supply of the first cryptocurrency at the moment. And so as BTC and other coins become popularised through ETFs and other such instruments, the company's role will also increase - as will its earning potential.

Want to keep up with the latest news? Join our crypto chat. We are waiting for you there now to discuss current events in the world of blockchain assets.