A representative of the Bitwise investment platform explained at which Bitcoin rate the cryptocurrency will be considered mature

Bitcoin’s price has risen by almost 20 per cent since Donald Trump won the US presidential election. Previously, the Republican candidate made a huge number of promises about the industry during the election campaign, so such a reaction of BTC and other coins seems logical. However, what is happening now is just the beginning of the global growth of niche coins. This is the opinion shared by Bitwise investment director Matt Hogan.

To what level Bitcoin will grow

In his fresh address to the company’s clients, Hogan stated that in the long term, the value of Bitcoin may well rise to the level of $500,000. Moreover, Trump’s victory will be a major factor in this process.

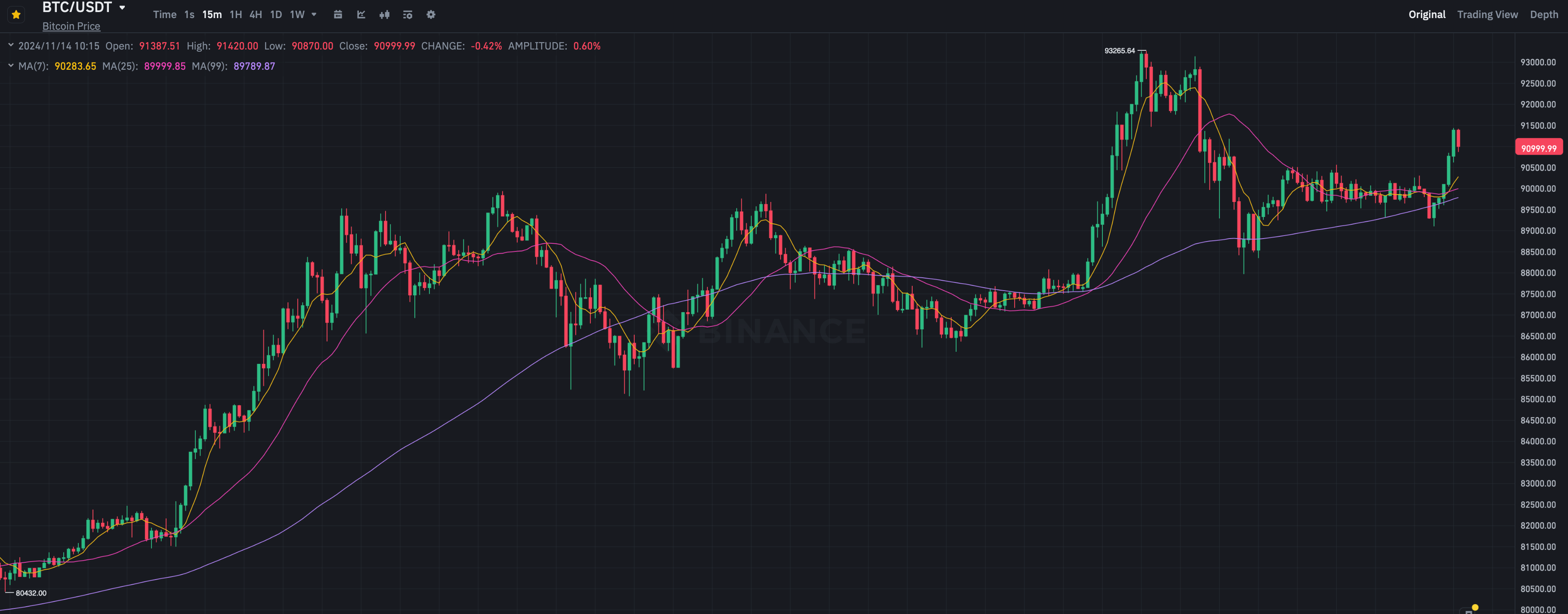

Yesterday, the price of the main cryptocurrency for the first time in history overcame the line of 90 thousand dollars, well, over the past two weeks, the rate of BTC increased by 26 per cent according to the crypto tracker Coingecko.

The actual maximum of the cost of the first cryptocurrency is the mark of 93 265 dollars on the exchange Binance, which was recorded last night.

15-minute chart of the Bitcoin BTC rate on the Binance exchange

According to The Block’s sources, in his address, Hogan urged not to panic over the short-term movements of the asset and focus on the larger scale of what is happening. Here’s his rejoinder.

The market could still pull back given how far things have come. However, the $100,000 level is just around the corner. Yes, we’re no longer in the first round of the game, however, until Bitcoin hits $500,000, investors can still be considered early investors.

According to the analyst, it is at this mark that the cryptocurrency can be considered mature. Well, until that happens, the digital asset industry continues to be something niche and small - of course, if you consider its possible future prospects.

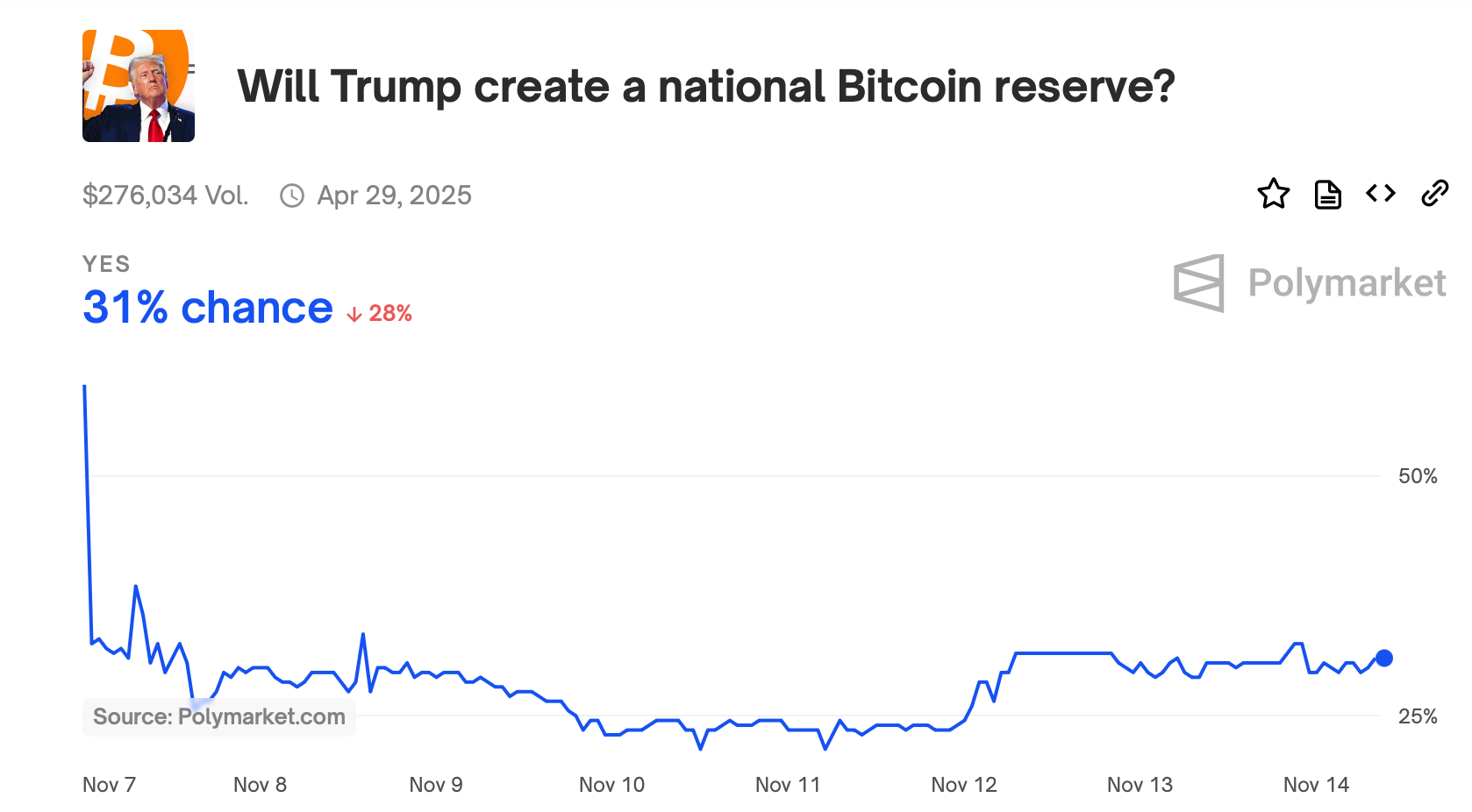

Still today there is a possibility that Donald Trump, after assuming the office of the US President, will promote the approval of BTC as a strategic asset for the whole state. According to users of the decentralised platform Polymarket, the chance of this happening at the moment is 31 percent.

Polymarket users’ bets on whether Bitcoin will become a strategic asset in the US

Hogan admitted that there is no guarantee Bitcoin will rise all the way to $500,000 – especially because of its volatility and uncertain outlook.

However, this level on the chart is the right distinction between the “early and late” periods in the market’s history. And just the transition from one position to the other will mark the point at which Bitcoin becomes a “mature” asset.

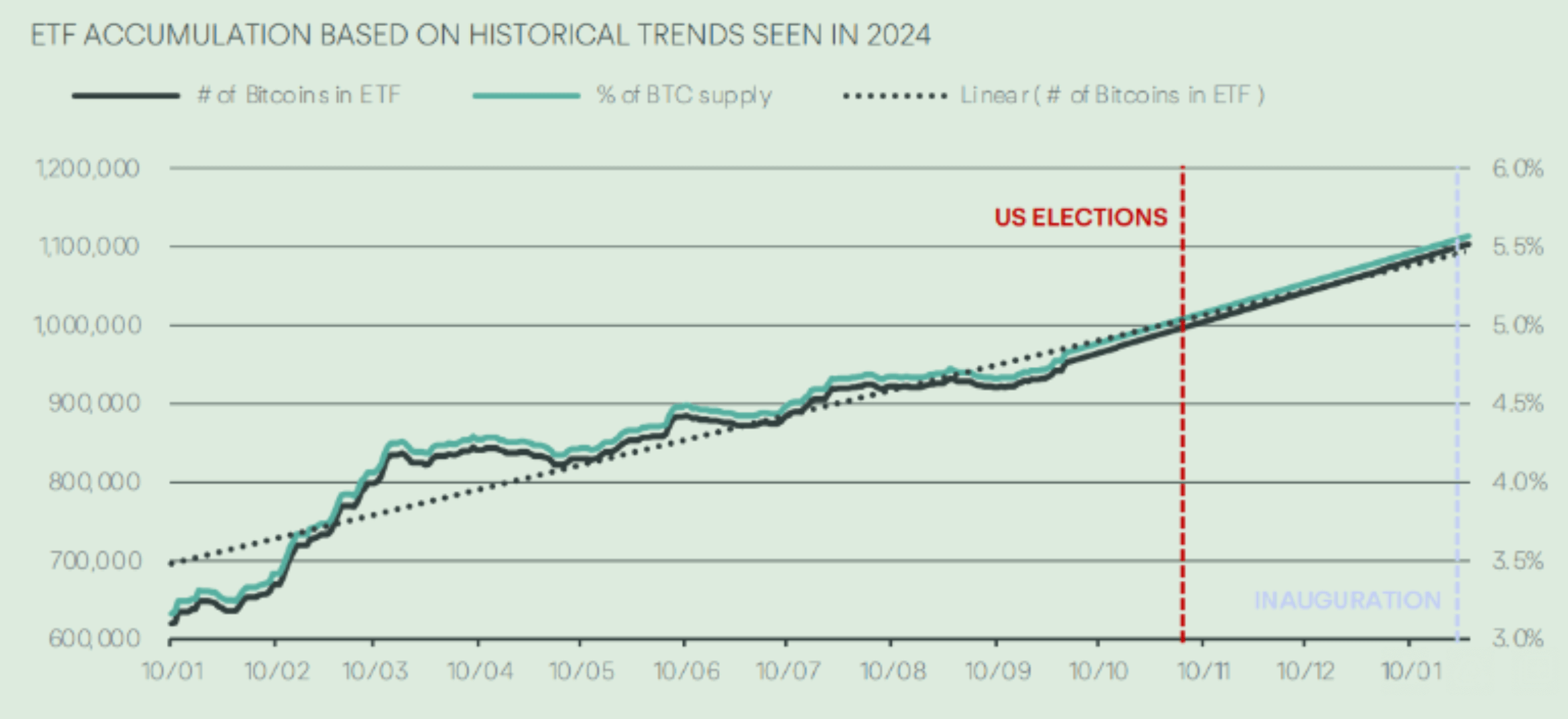

One of the key moments in this process in 2024 was the launch of spot ETFs based on the first cryptocurrency in the US. Thanks to their release, any large investors can now get in touch with cryptocurrency instruments and capitalise on the market's growth.

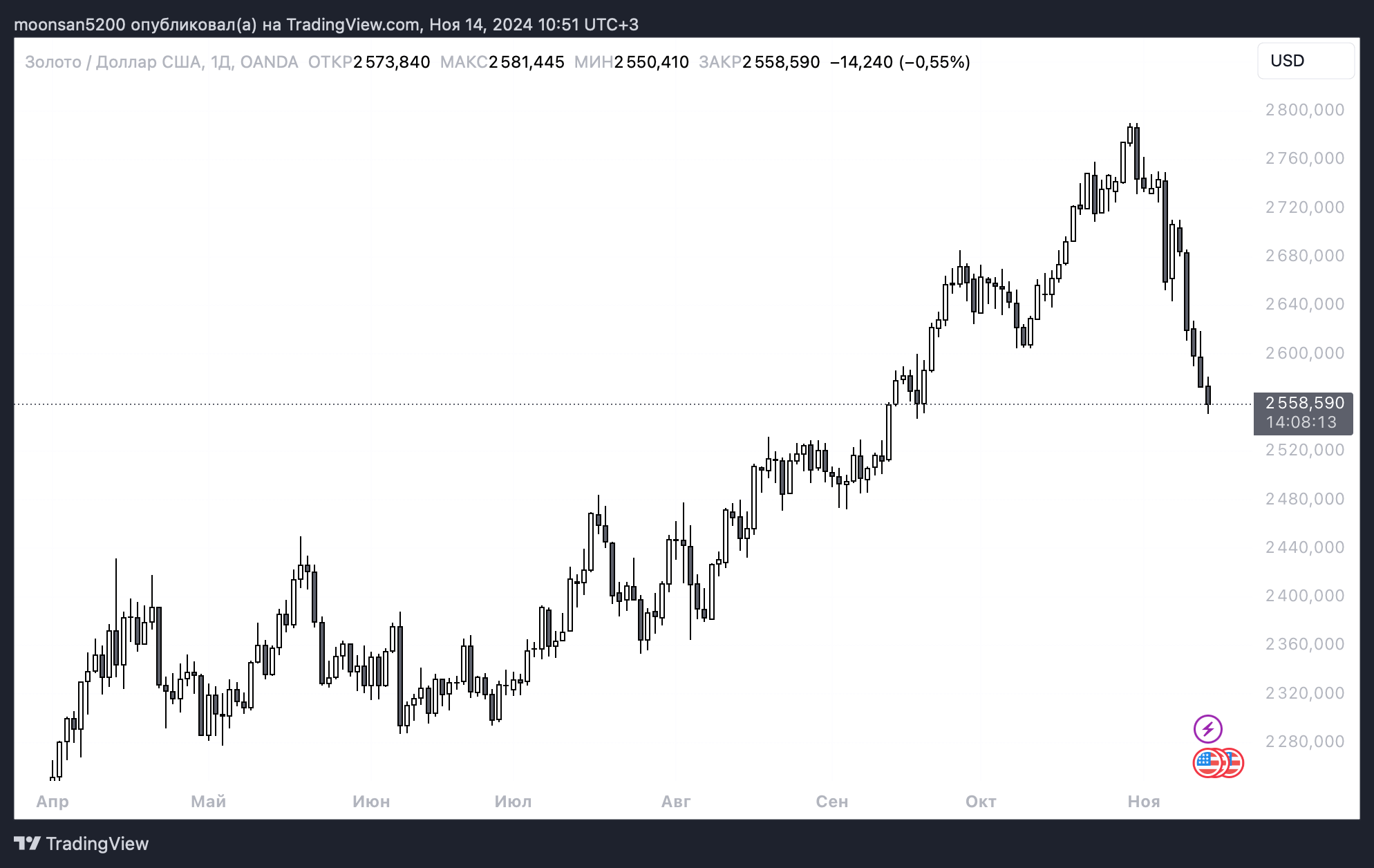

According to the executive, demand for assets in the form of gold and Bitcoin will increase as governments take on debt and devalue their own fiat currencies. While the precious metal has long established status among investors of all classes, Bitcoin has yet to gain global popularity.

Bitwise Investment Director Matt Hogan

Right now, the big news is still seeing pension funds making investments in BTC, and the cryptocurrency itself is slowly making its way into the policies of government bodies in various countries. Hogan continues.

The market has come a long way thanks to the massive success of Bitcoin-based derivatives and the emergence of politicians who support cryptocurrencies. But until BTC becomes as boring as gold, that is, until it is held by central banks and most institutionalisers, cryptocurrency is still in its early stages of development.

Changes in the value of gold on a 1-day chart scale

Specifically, the $500,000 figure is due to the sums of gold and Bitcoin capitalisations, which reaches the $20 trillion level. According to Hogan, a “mature” BTC will hold at least an equal share of this market, and reaching the 50 per cent milestone will require a price at around $500,000 per coin.

Reaching that level would require the same investor groups that are now actively investing in gold to also move money into BTC in equal proportion. The biggest missing link in this chain right now is central banks. However, for them to start investing in Bitcoin in a big way would require the approval of most of the world’s governments. And for now, that seems like an unrealistic scenario.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

Of course, the first achievable six-figure mark on Bitcoin’s chart would be the $100,000 level. Donald Trump’s election victory should push the cryptocurrency in the direction of a new record before the beginning of 2025, that is, already in the coming weeks.

Such an opinion was shared by the head of the research department of Copper.co Fadi Abualfa. His statement leads Cointelegraph.

Although the growth of the dollar has historically not been a good sign for cryptocurrencies, this is clearly not the case now. The clarity of the election results has given a sense of stability in the near term, which is sure to please market participants.

Accumulation of funds under Bitcoin ETF management

According to the expert’s version, BTC-based ETFs can play a key role in fuelling the cryptocurrency’s price growth. Back in October, Abualfa suggested that by the US election, there could be around one million BTC under management in exchange-traded funds, which would reflect a huge influx of institutional demand.

The prediction is based on “back-testing the trend of ETFs accumulating in potential price ranges,” backed by Trump’s promises to combat “excessive strengthening of the U.S. dollar while maintaining its status as the world’s reserve.”

Matt Hogan's version seems curious. Still, and although Bitcoin has been around for almost 16 years, full-fledged spot ETFs based on it weren't launched until early 2024. From there, cryptocurrencies could be accepted on many different levels, from paying taxes in coins to being invested by large pension funds. Of course, with such a future, the current state of the crypto market could indeed be considered immature.

Look for more interesting stuff in our crypto chat of future millionaires. We look forward to seeing you there and soon, because the bullrun in the digital asset industry will definitely not last forever.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.