Analysts recalled Bitcoin’s biggest collapses during the growth phases of the cryptocurrency market. What were they like?

There have been dozens of major corrections in Bitcoin’s history, with market collapses often leading to a sense of complete industry collapse. Be that as it may, each time the BTC rate recovered and went to new highs, thanks to which the holders of the first cryptocurrency for at least four years in the end necessarily came out in the plus. So, in general, we can now also expect a major correction of the digital asset in the context of historical bull cycles. How high is the probability of such an event?

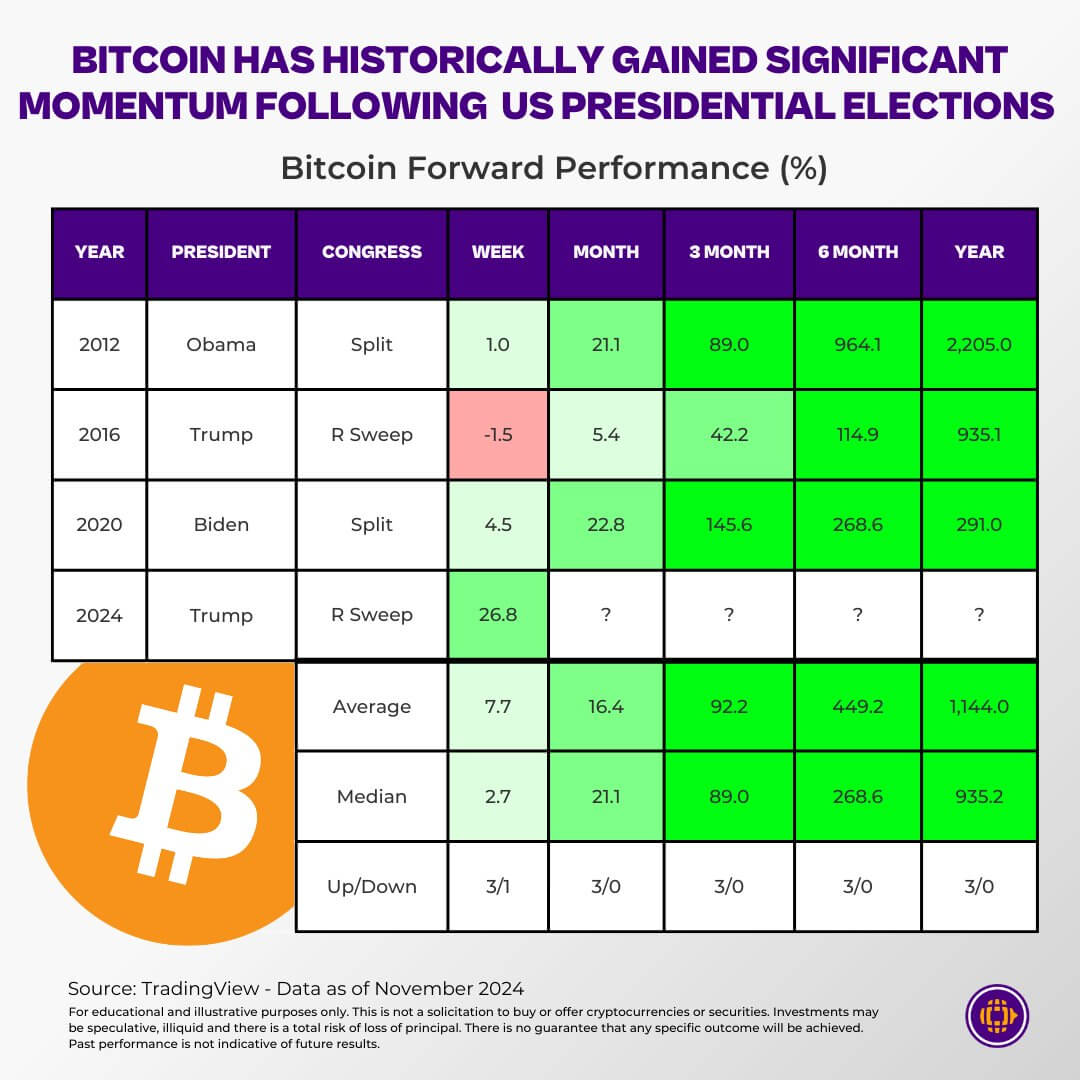

It is important to note that in November 2024, the US presidential election will take place, and this event traditionally affects the Bitcoin exchange rate. In particular, BTC on average appreciates by 449 per cent over six months and 1,144 per cent over a year.

Bitcoin exchange rate behaviour after the US presidential election

A week after Trump’s recent victory, the first cryptocurrency jumped 26 per cent, the best result in this timeframe compared to the previous election.

Bitcoin’s biggest price drops

A brief overview of previous bullruns in digital assets was published by Blockworks journalists. They noted that Bitcoin fell about 80 per cent from the peak of the bull cycle to the low of the “cryptozyme”. This has happened in every cycle since the first major rally in 2011.

However, it is the corrections that formed right during the rapid rise of BTC that are discussed in this article. This is roughly the stage the market is at right now.

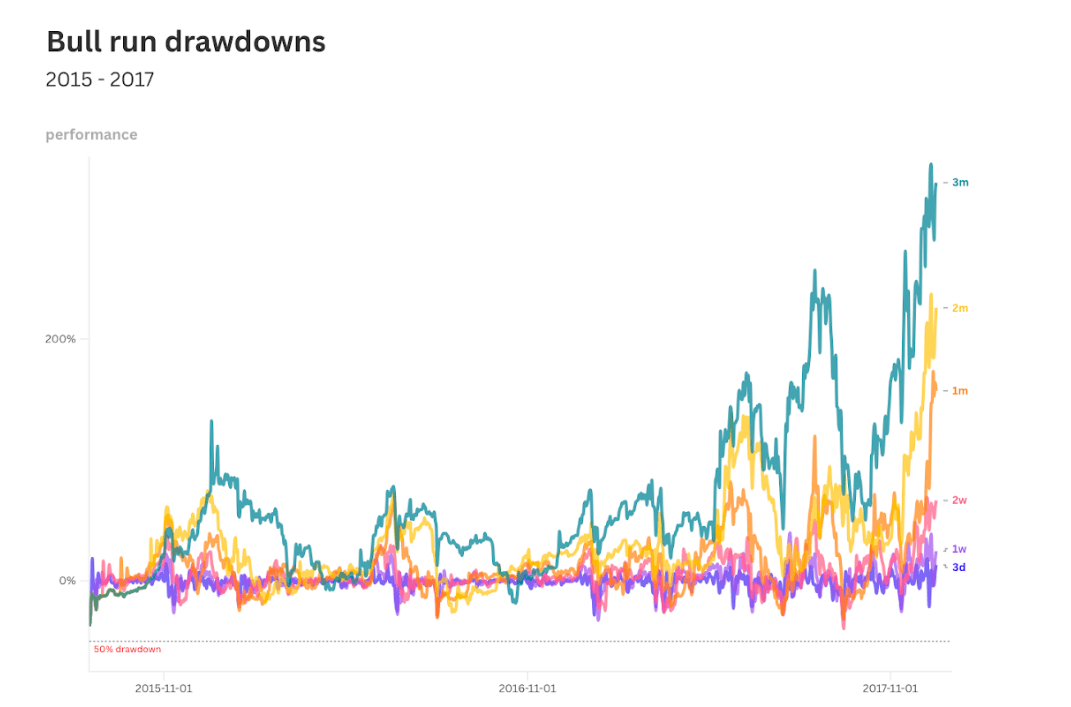

The charts below show the dynamics of Bitcoin price on six different time intervals – from three days to three months. The charts start at the beginning of the cycle and continue all the way up to the all-time high.

Bitcoin’s corrections during the 2015-2017 bull run

Each line shows a different timeframe. For example, the dark purple line shows the percentage difference between each daily low and the open three days earlier. The green line shows the same, but over three months.

The dotted line at the bottom indicates the price drawdown level of 50 per cent. As you can see, during the bull cycle from August 2015 to December 2017, there were no drawdowns of such a large magnitude. During this bullrun, the largest was a 40 per cent pullback for a fortnight at the end of September 2017.

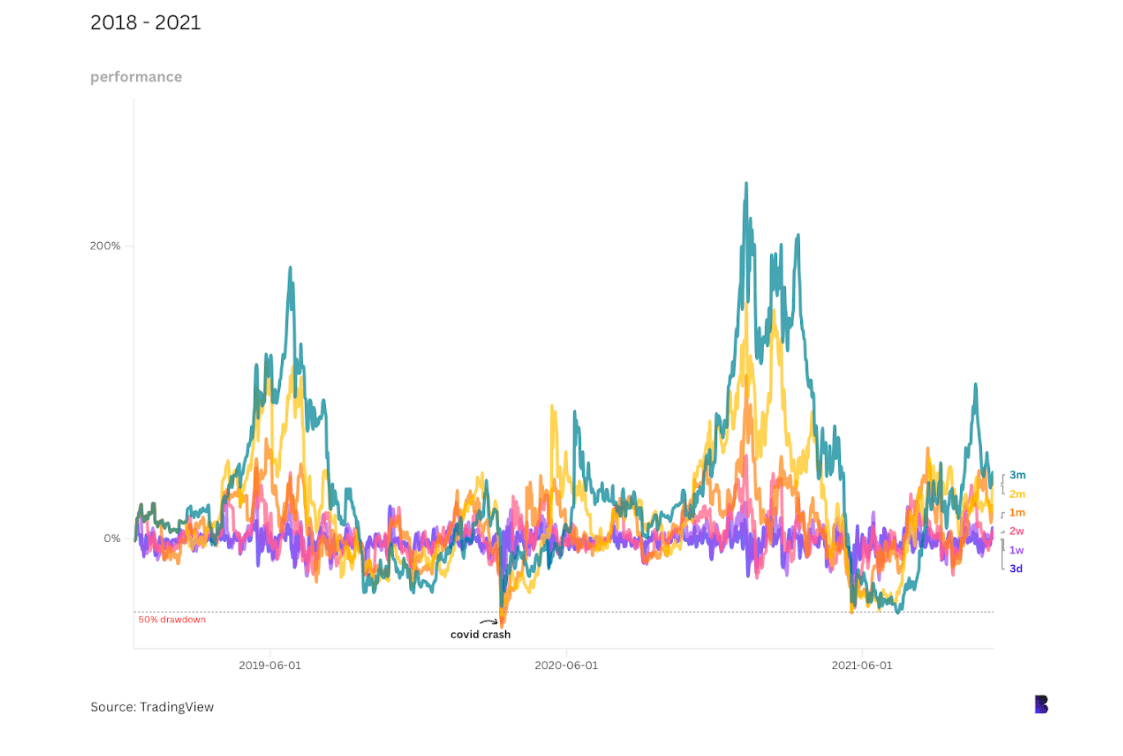

However, already during the next cycle from 2018 to 2021, three corrections occurred that crossed the aforementioned level. One of them was the market crash in March 2020 amid the announcement of the COVID-19 pandemic and massive global restrictions. The event also coincided with a similar major drawdown in stock markets.

Bitcoin corrections in the 2018-2021 bullrun period

BTC fell by half or more on all time frames except the three-month chart, when the drop was only about 47 per cent. Other major drawdowns occurred in May and July 2021, when Bitcoin collapsed from a then-record $60,000 to $30,000. Then over the next four months, it rose again to nearly $69,000.

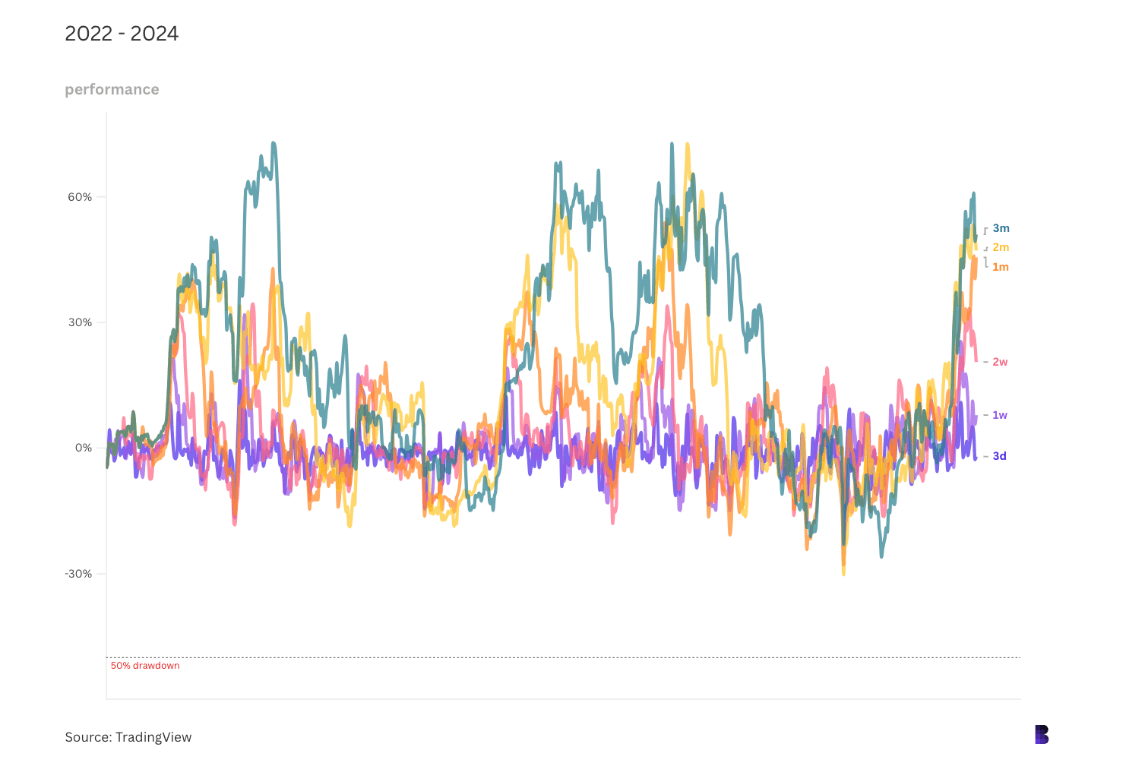

This time around, the bullrun is much more stable when you compare it in terms of the magnitude of the drawdowns to past cycles. So far, the strongest correction came in the first week of August, when the main cryptocurrency fell in price by just over 30 per cent.

The current growth phase is also marked by Bitcoin's behaviour. In particular, this time the first cryptocurrency for the first time beat its own price maximum at the level of 69 thousand dollars before halving, that is, reducing the reward for mining a block in the network by 50 per cent.

As analysts believe, such was the consequence of the launch of spot ETFs in the U.S. based on BTC. Still, thanks to them large investors, whose activity affected the market, were able to get in touch with the coin industry.

Bitcoin corrections during the 2022-2024 bullrun period

But all this does not mean that Bitcoin has lost its volatility, that is, the threat of the largest drawdown on the chart still remains. Judging by statistics, the biggest correction in terms of scale happens near the end of a bullish trend. That is, the longer there is no collapse, the more difficult the market situation becomes to predict.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

Slow down the growth of Bitcoin’s price are able to hit the reputation of the asset. They’re being inflicted by scammers like Khalid Parekh, the Texas-based owner and manager of the firm Fair Invest. The day before, he was accused by the Securities and Exchange Commission (SEC) of illegally investing his clients’ funds in cryptocurrencies without their knowledge, according to DL News.

From August 2021 to August 2022, Parekh raised $18.5 million from 373 investors in 40 states. In radio programmes, podcasts, interviews and other media, he reached out to members of the US Muslim community and claimed that his fund complied with Islamic law. He promised investors returns of 4 per cent per year.

Charged with digital asset fraud Khalid Parekhh

According to Parekh himself, he was earning the promised returns by investing in conventional assets like stocks and funds. However, the accused was instead making money by placing clients’ money on two lending platforms in the cryptosphere.

After an SEC investigation and allegations against him, the investment manager agreed to a $100,000 fine for misleading his clients. Overall, the story ended well: the money didn’t go anywhere, and Parekh even returned it to his clients with the promised interest. He also revoked his registration with the SEC as an investment adviser.

As a result, experts reminded about an important feature of the cryptocurrency market - namely the ability to collapse sharply in price during bullruns. Therefore, beginners should be ready for such a thing. And as experience shows, in most cases such events turn out to be a great opportunity to increase their own savings in coins.

.

Look for more interesting things in our crypto chat of millionaires. There we will discuss other important topics related to the blockchain and decentralised platforms industry, as well as the progress of the current bullrun.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM TO STAY UP TO DATE.