Binance has taken to delisting tokens and Kraken has closed its trading platform for NFT. What is the reason for this?

The largest crypto exchange Binance announced the delisting of five tokens from its platform, with the procedure to be completed by December. The official announcement about the removal of trading pairs caused a natural fall in the value of assets. We are talking about altcoins called Gifto (GFT), IRISnet (IRIS), SelfKey (KEY), OAX (OAX) and Ren (REN). According to Binance officials, these assets allegedly failed to meet industry standards regarding regulatory compliance, but the exact reasons for getting rid of the coins were not given.

The former head of Binance crypto exchange Changpeng Zhao made it clear the day before that he does not approve of the massive hype surrounding meme tokens. Although the latter do allow investors to have fun, the market certainly doesn’t need thousands of new projects every day.

Changpeng Zhao is the former head of crypto exchange Binance

Here is Zhao’s retort to the situation, which he posted on Twitter.

I’m not against memes, however meme coins are getting “a little” weird right now.

Let’s create real blockchain-based applications.

New delisting on the Binance exchange

According to Cointelegraph’s sources, arbitrage strategies, credit transactions and futures positions on the listed tokens will be closed on 3 December 2024. Well, isolated and cross-marginal positions on the tokens will be suspended today – 27 November.

The announcement caused a significant drawdown in the price of the above-mentioned assets. Their value fell by an average of 40 per cent.

This is how investors react to negative news. Still, the listing of the crypto asset on Binance gives it access to a huge number of traders, well, and the growth of transaction volumes allows the rate to increase. And when the coin is deprived of these advantages, it may well lead to the disappearance of players' interest in the project and even its subsequent death.

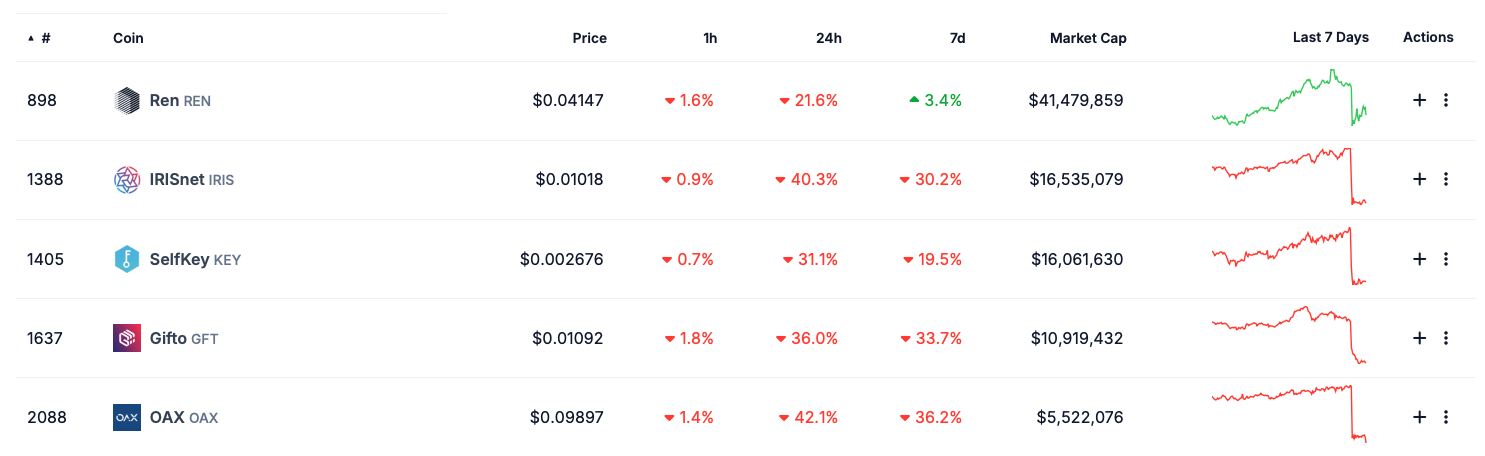

Tokens that will be removed from Binance

Recall that Binance is the largest cryptocurrency exchange in terms of trading activity. Currently, 386 tokens and 1,275 trading pairs are registered on its platform. At the end of November 26, trading volume on the exchange was $44 billion – almost 20 percent more than in the previous 24 hours.

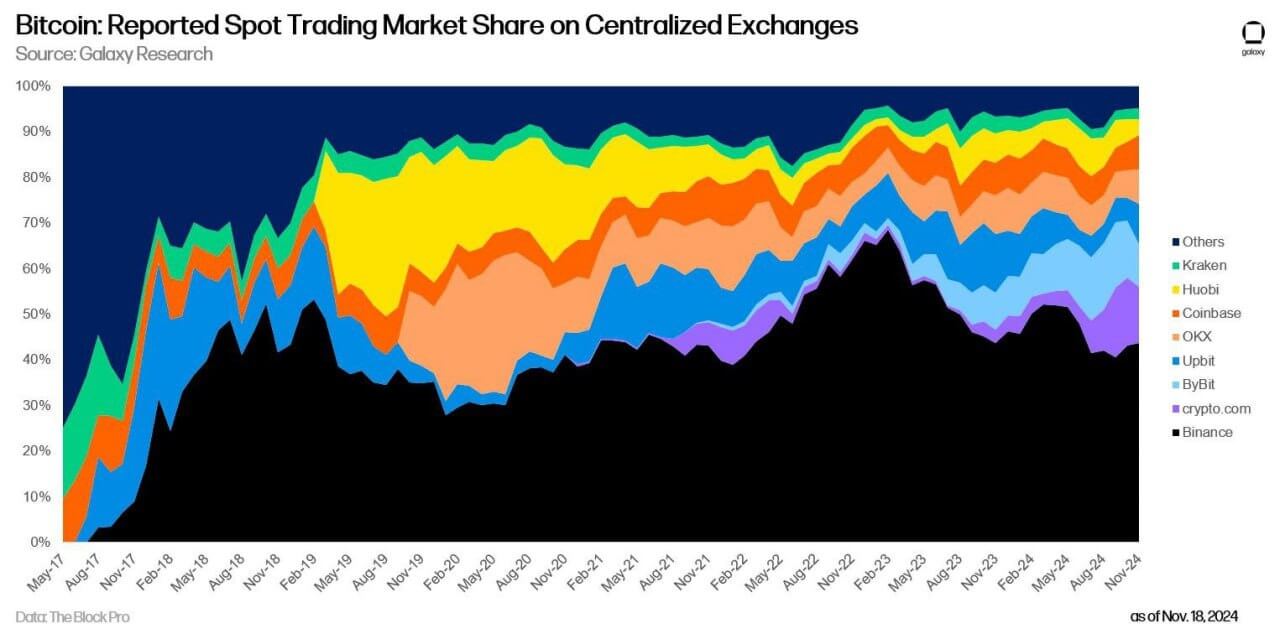

As of summer 2020, Binance accounts for at least 40 percent of total trading volumes with coins on spot among all centralised exchanges. In the chart from Galaxy Research, its figure is marked in black, and the closest competitor to Binance in this context is Crypto-com.

Shares of centralised cryptocurrency exchanges in trading coins on the spot

At the same time, the exchange did not disclose exactly what requirements do not meet the above-mentioned tokens. The announcement only lists the key factors on the basis of which the assets added to trading are regularly evaluated. These are the commitment of the project team, quality of development, trading volume and liquidity. In addition, the stability of the respective network and security against attacks are also taken into account.

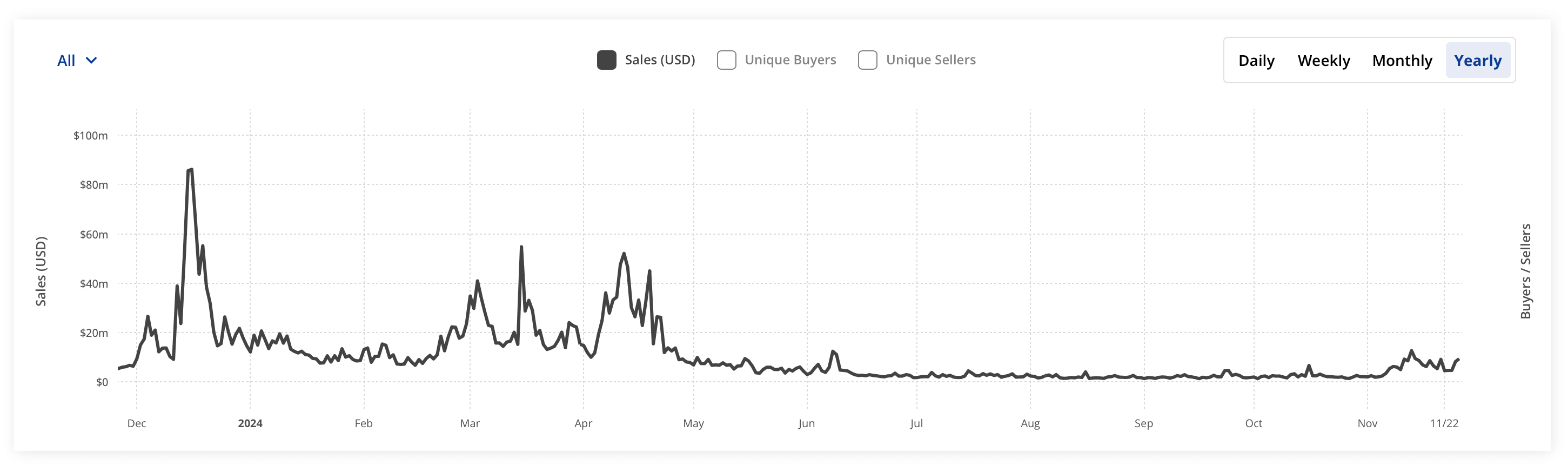

Tokens from different areas of the industry – from gift cards to decentralised exchange assets – have been delisted. Over the past few months, trading volumes for most of these tokens have declined.

For example, the amount of transactions for REN fell from $34 million in March to nearly $6 million in early November. A similar figure for OAX dropped from a peak of $101 million in March to $468,000 in October.

The volume of open positions on Binance over the year

Low trading volume is often a red flag for both projects and token holders, as it indicates low liquidity and a lack of crypto-asset adoption. In other words, regular traders are not showing interest in what’s happening with the coins. And since the exchange charges trading commissions, falling trading volumes mean a sag in the platform’s revenue for the asset.

Binance has warned users that deposits of these tokens will not be credited after 11 December and withdrawals will not be supported after 12 December. The tokens can be converted to stablecoins after 13 December.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

Another piece of discontinuation news concerns the Kraken exchange. It will close its NFT platform and redirect resources for other more promising projects. As a result, after 27 November 2024, users will no longer be able to sell or buy unique tokens on the platform, i.e. only withdrawal of assets will be available. The platform will close completely on 27 February 2025.

The news was commented on by Kraken representatives. The relevant quote is given by The Block.

We made the decision to close our NFT platform in order to devote more resources to new projects and services, including unannounced initiatives in development. Customers have been informed of the changes and our team will support them while they migrate their NFTs to a Kraken wallet or self-storage wallet.

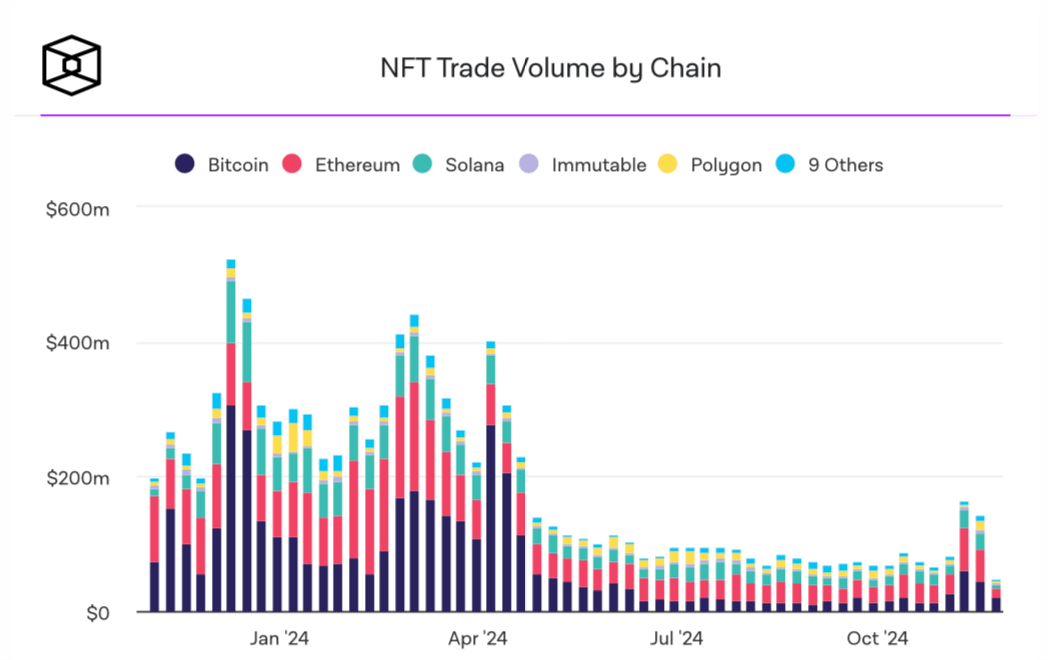

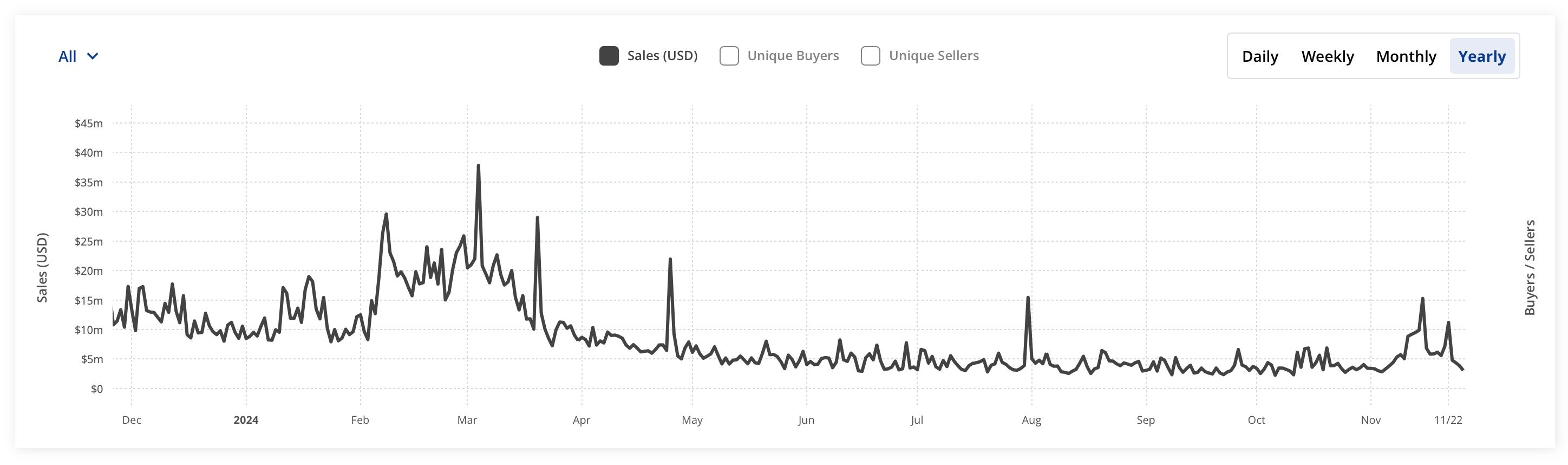

NFT token transaction volumes

Kraken first announced the launch of its own NFT platform in December 2021. Its beta version was launched by November 2022.

However, NFT sales have been at a consistently low level since the spring of this year. That is, the drop in activity has made this division of Kraken inefficient and, in theory, unprofitable. And so the prospect of closing the platform was predictable.

For example, this is what the chart of trading volumes from NFT in the Efirium network over the last year looks like. If at the end of last year the figure was in the $17-18 million zone, now it has slipped into the $3-4 million zone.

Change in trading volumes with NFT in the Etherium network over the last year

A similar situation is observed in the Bitcoin network, which surprised the crypto community with the success of so-called Ordinals. Although the total trading volume with NFT in BTC totalled $9 million yesterday, the figure was many times higher at the end of 2023. This is also noticeable in the chart.

Change in trading volumes with NFTs in the Bitcoin network over the last year

The situation with the trading exchanges Binance and Kraken reflects the changing trends in cryptocurrencies. NFTs were almost the key topic in 2021-2022, but now investors' attention is mostly focused on meme tokens. Obviously, the change of traders' interests will continue.

Look for more interesting things in our crypto chat. There, we’ll talk about other important topics that are shaping the current bullrun in the digital asset industry.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.