Bitcoin is looking more and more attractive against gold, and investors are choosing the cryptocurrency. Why?

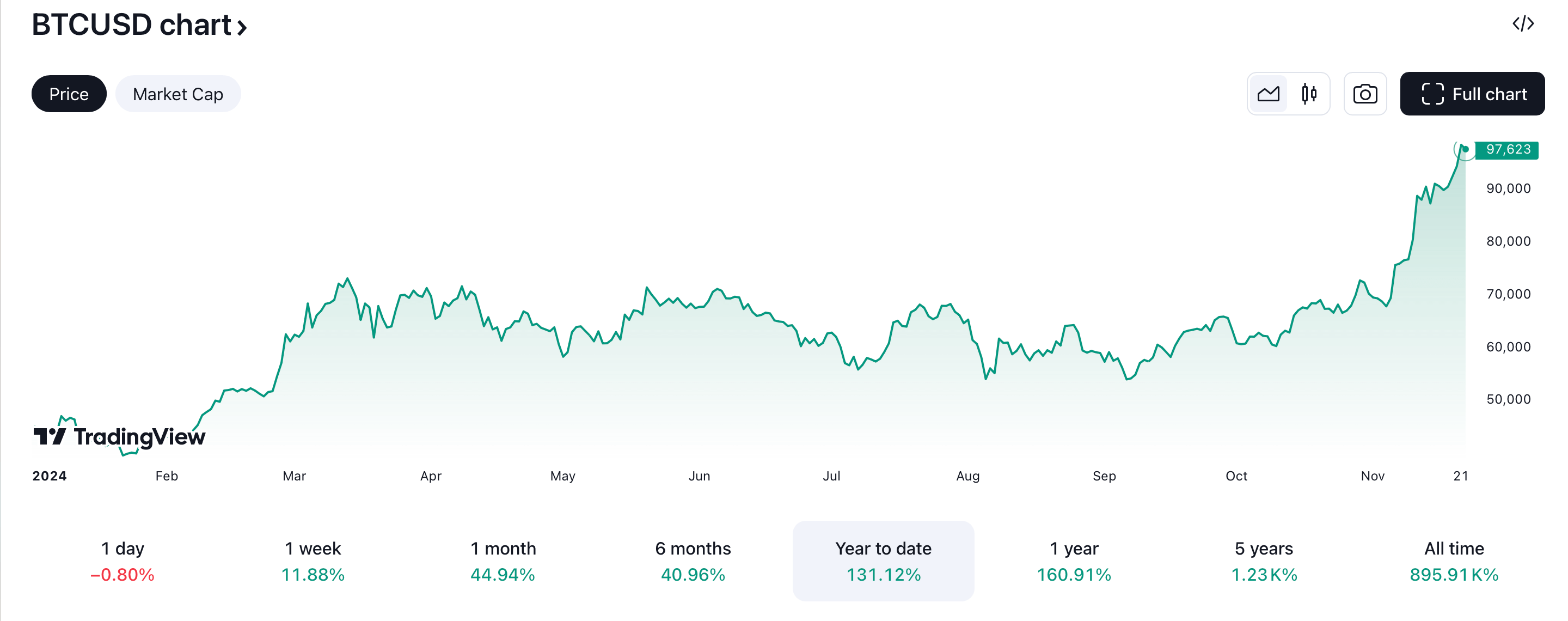

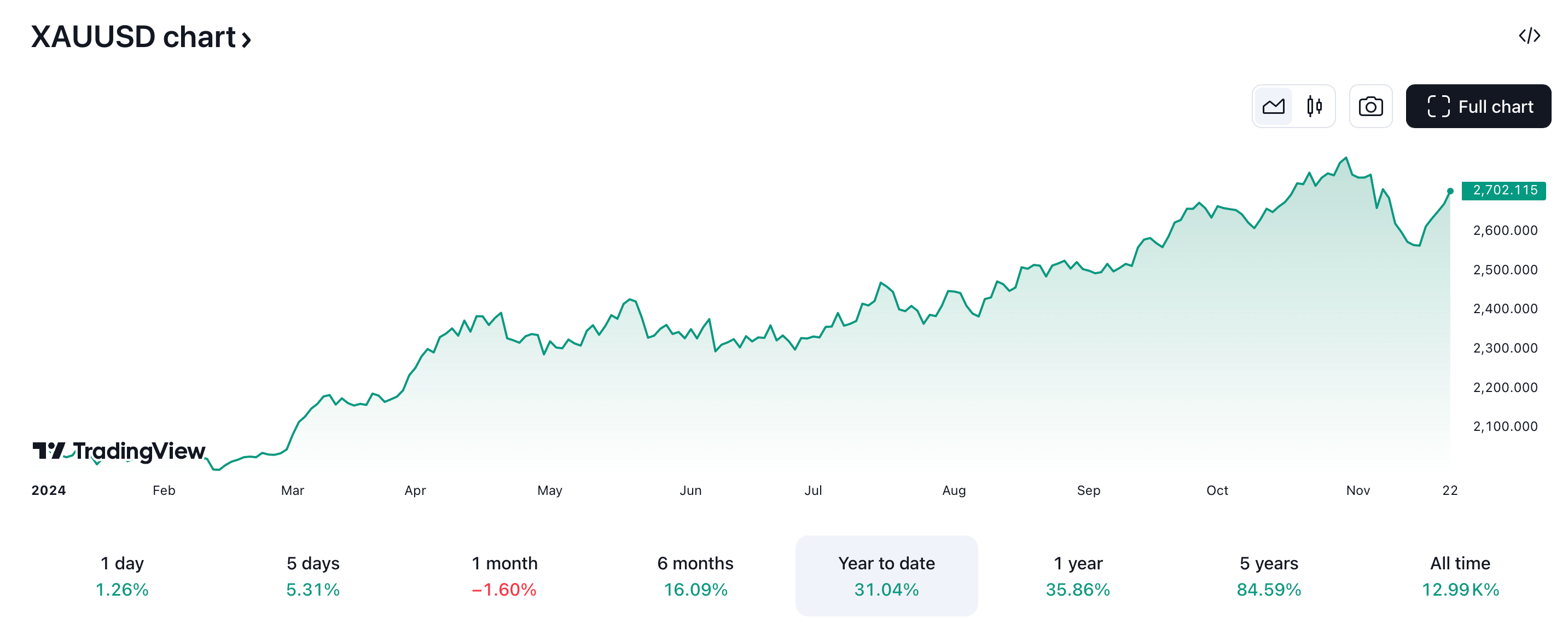

Bitcoin has significantly outperformed gold in terms of returns over the past month. In particular, the cryptocurrency rose in value by 49 per cent, while the precious metal fell by 1.5 per cent over the same period. This divergence emphasises the shift in the mood of large investors, who are now paying more and more attention directly to cryptocurrencies. According to analysts, Bitcoin is thus asserting its status as a reliable asset in the global economy.

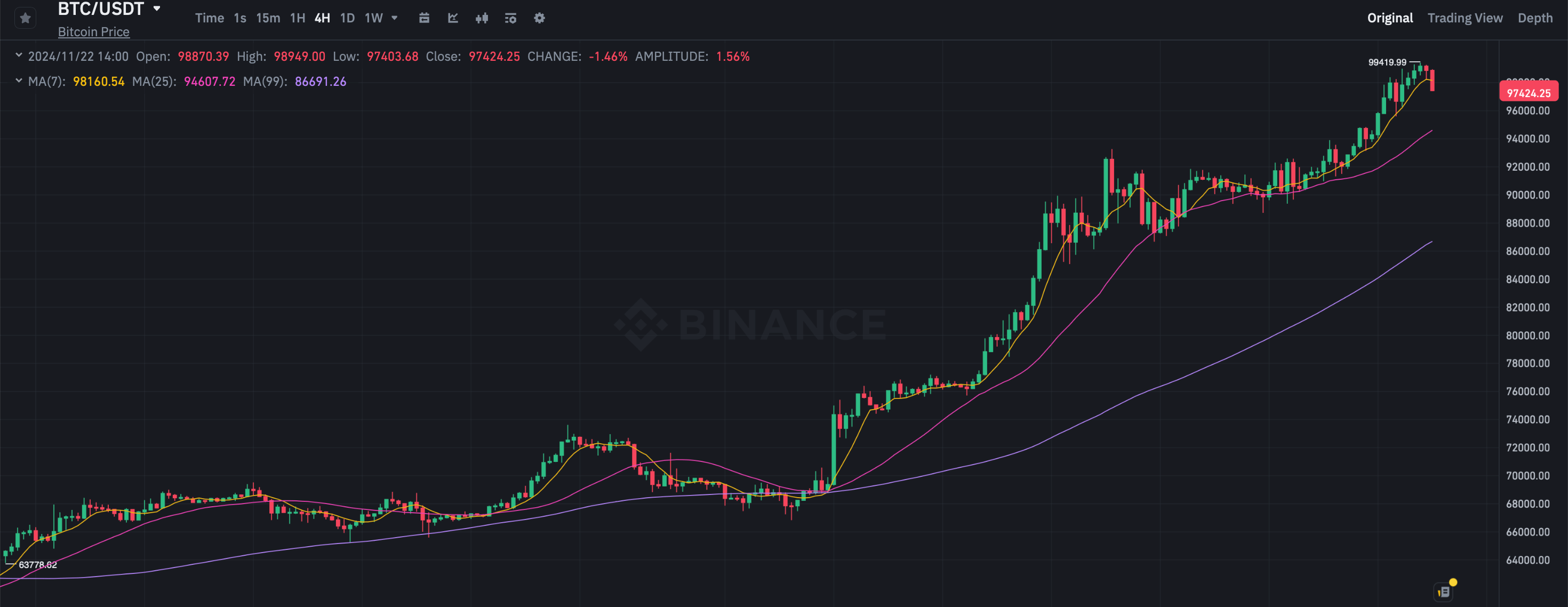

Today Bitcoin has set another historical maximum price. The rate of cryptocurrency reached a mark of 99,419 dollars, that is, to the long-awaited level of 100 thousand was not enough just a little bit.

Four-hour chart of the Bitcoin rate on the Binance exchange

Thus, since the beginning of 2024, the first cryptocurrency has risen in price by 131 per cent.

Bitcoin value growth in 2024

Who is buying Bitcoin now

Deenar co-founder Maruf Yusupov said that Bitcoin’s rapid rise after Donald Trump’s victory in the US election could change traditional views on capital hedging during times of high inflation.

In other words, the digital asset could become a much more popular tool to protect against the risks of rising prices. Here is a commentary on the matter, as cited by The Block.

Trump’s focus on tax cuts, tariffs and cryptocurrencies is fuelling interest in Bitcoin as a modern alternative to gold. As BTC adoption grows among institutional players, we could see a significant shift of capital from gold to digital assets.

Note that major players are indeed paying more and more attention to crypto. In particular, the new head of investment company Charles Schwab has stated that the giant wants to give its clients the opportunity to purchase coins on spot. Plus, he expressed regret over his reluctance to get involved with coins in the past.

Cryptocurrency market growth

Nigel Green, CEO of deVere Group, shared a similar view of what is happening.

Bitcoin is increasingly seen as a hedge against inflation and a portfolio diversification tool. Interest in it from large professional investors is at an all-time high, while the infrastructure to support mass adoption of cryptocurrency continues to expand.

Changes in the value of gold in 2024

Meanwhile, Fadi Abualfa, head of research at copper.co, pointed out the growing similarities in price movements between gold and Bitcoin-based ETF shares.

Current trends indicate that Bitcoin and gold ETFs are following a similar pattern of price dynamics. Both are characterised by growing assets under management that differ only slightly in scale. This speaks not only to the overall market drivers, but also to Bitcoin’s ability to consolidate its own position as a new asset for capital preservation.

That is, BTC is becoming something of a “digital alternative” to gold – a status that has long been attributed to cryptocurrency within the industry. Now many participants in financial markets outside of crypto are beginning to truly realise this.

On top of that, a recent statement from US Federal Reserve Chairman Jerome Powell has put additional pressure on the price of gold. Powell sent a clear signal that the Fed would prefer not to rush to lower the benchmark lending rate.

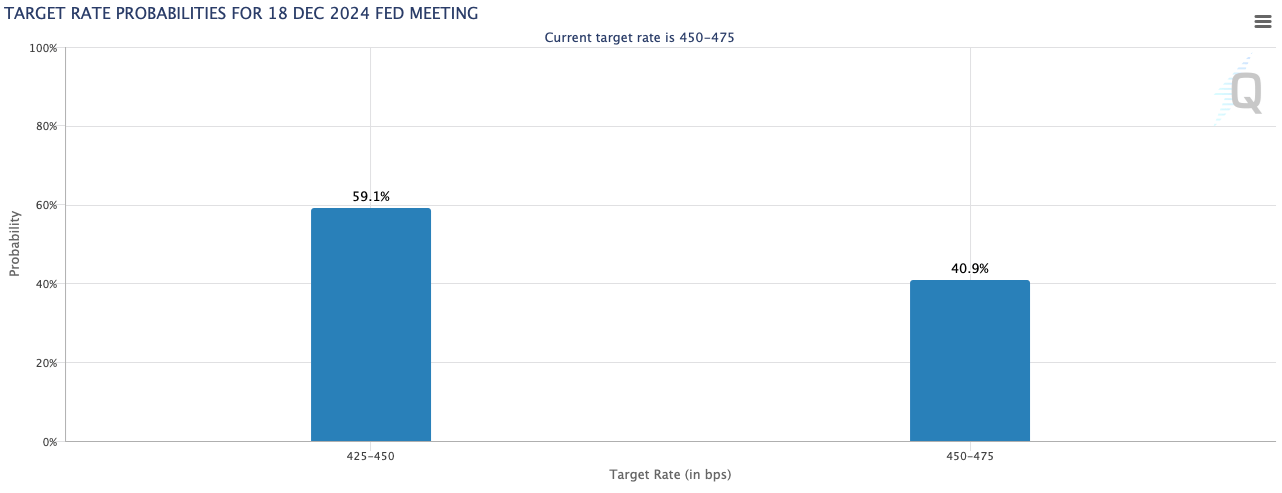

Probabilities of a base interest rate cut and a pause in the process

According to the FedWatch tool, traders estimate the probability of a pause in rate changes at the next meeting of the Federal Open Market Committee of the US Federal Reserve on 18 December at 41 per cent. Meanwhile, back at the beginning of the month, a rate cut was predicted with an 80 per cent probability.

😈 MORE INTERESTING CAN BE FOUND IN OUR YANDEX.ZEN!

On the other hand, things are shaping up for crypto in a better way. Earlier, the official resignation date of Securities and Exchange Commission (SEC) Chairman Gary Gensler became known – he will step down on 20 January, the day of Donald Trump’s inauguration.

According to Pantera’s general counsel Katrina Paglia, the event will mark the end of the regulator’s pressure on the industry. It was observed over the past few years, and the initiator of such actions was directly Gensler.

Paglia’s remarks are quoted by Cointelegraph.

I think we will see settlements of some of the lawsuits. Although the SEC could really just go ahead and file a motion to dismiss and withdraw all of its lawsuits. I don’t think that’s going to happen.

She said it’s more likely that some of these lawsuits will just use new vague language to de facto drop the prosecution of crypto companies.

They will quietly withdraw from the case.

Paglia added that the regulator will have to “make some sort of statement” and get something in return for the time and resources the government has spent on the Commission’s enforcement campaigns. Either way, this is good news for the sector’s fundamentals, as now innovation among US entrepreneurs will not be stymied for fear of being fined by the country’s key regulator.

Analysts recognise that at the moment Bitcoin is proving increasingly attractive against the main precious metal. This is easy to understand given the active growth of the cryptocurrency's rate. This means that BTC itself is getting more and more chances to become a key instrument for hedging risks due to inflation.

Look for more interesting things in our crypto chat. There we will discuss other important news that affects what is happening in the digital asset industry.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.