Bitcoin on its way to $100,000: why does Trump’s victory offer new prospects for the cryptocurrency market?

A six-figure sum in Bitcoin’s value is an achievable goal by the end of this year. Now that Donald Trump has won the US presidential election and the Congress will be dominated by Republicans, the crypto market has turned out to have much more positive incentives for growth. One of them is the prospects of creating a national crypto reserve in BTC. Earlier, the new president also talked about developing adequate rules to regulate the digital asset market.

Ryan Lee, chief analyst at Bitget Research, believes that Bitcoin should grow above the $100,000 level by the end of 2024. Still, Trump’s victory eliminated the main danger – the election of his opponent Kamala Harris and, as a consequence, the continuation of crypto-unfriendly policies of the Biden administration and Democrats in general.

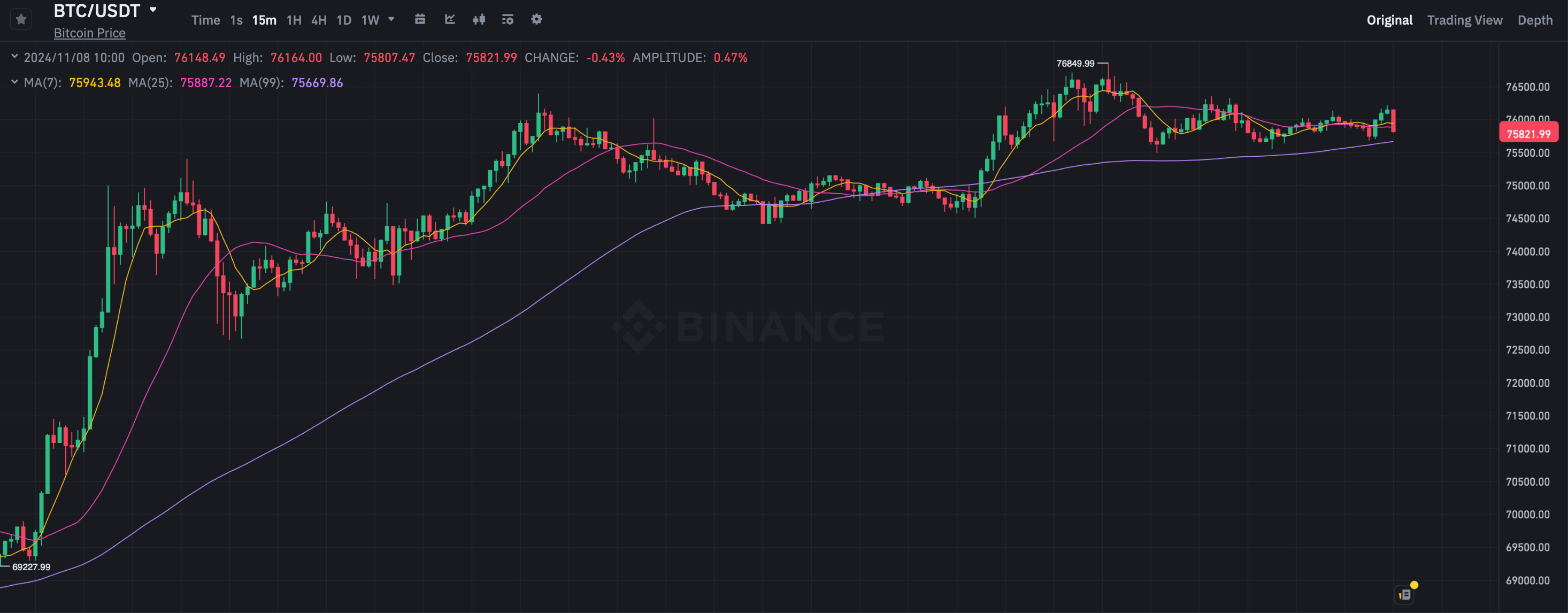

Against this backdrop, Bitcoin set another all-time high in the exchange rate late last night. The price reached $76,849.

15-minute chart of the Bitcoin exchange rate

How much will Bitcoin be worth in 2025

In an interview with Cointelegraph, Ryan Lee stated that there are clear signs of traders preparing for a spike in volatility in the market.

In other words, they are preparing for a sudden change in the price of Bitcoin. Here’s a comment to that effect.

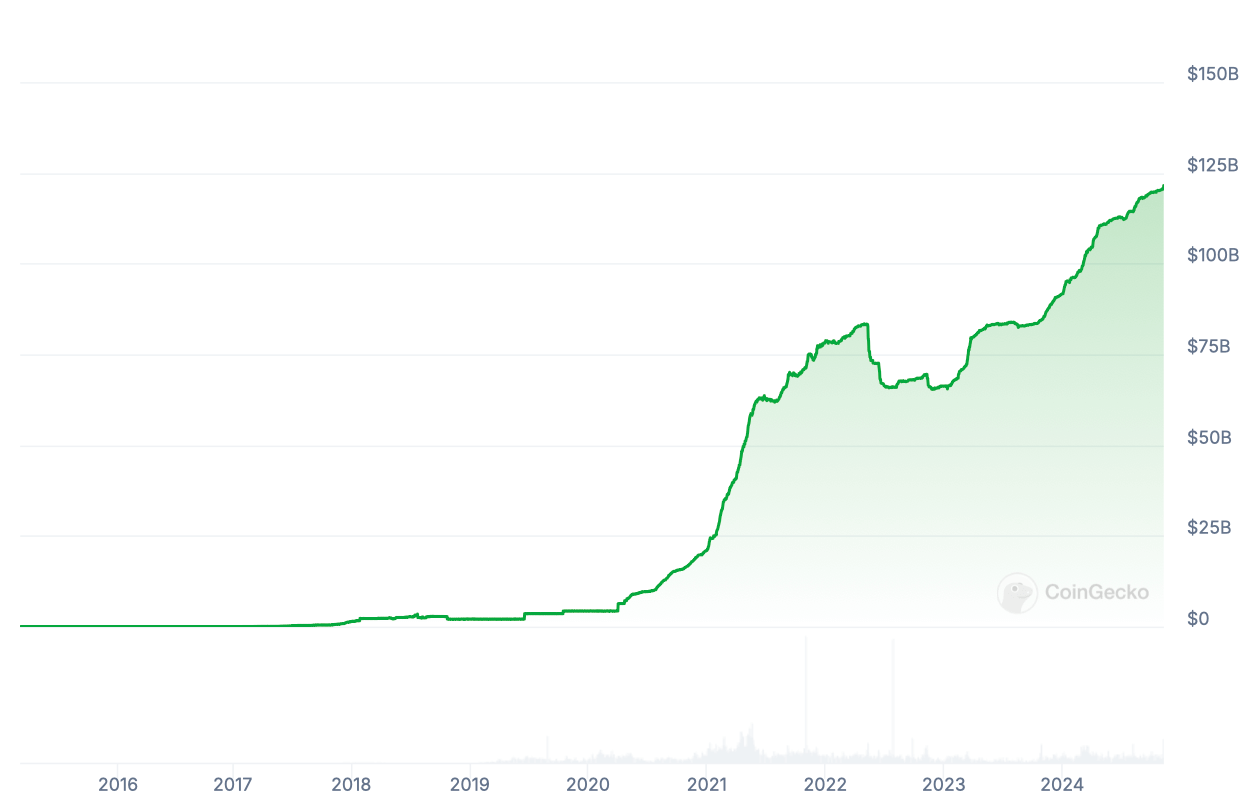

In addition, as the market capitalisation of stablecoins has reached a new high and is hovering around $160 billion, there is room for significant leverage in the market. This has the potential to push BTC to reach the $100,000 level within the next three months.

Leverage or leverage is the ability of market players to borrow capital to execute trades. Trading with leverage allows you to multiply the potential profit, but the potential loss in case of a failed trade also increases.

In this case, the key importance of such trades lies in utilising the facilities of the trading platforms. In this way, the mass of trading operations becomes larger, which proportionally affects the market of digital assets and coin rates.

Capitalisation of the largest stablecoin USDT

As we have already noted, along with the election of Trump, the Republican party gained a majority in Congress. Lee expects this condition to lead to more business and innovation-friendly regulations. The expert continues.

Thanks to the Republicans in Congress, there could be favourable regulatory changes for the crypto market, which will be positive for the industry in the long run.

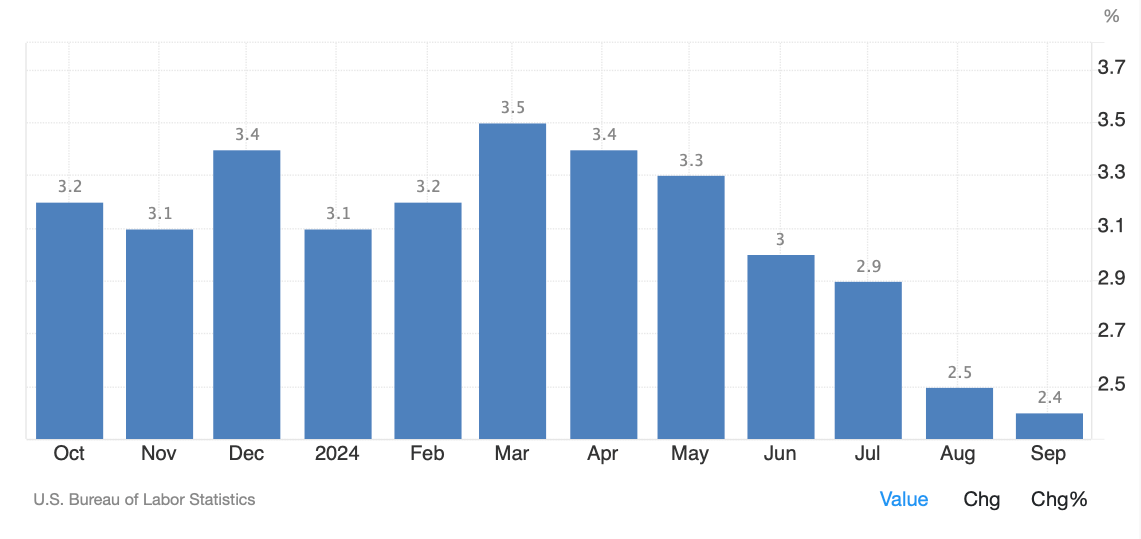

Nevertheless, the analyst still fears high inflation in the US economy. Trump’s policies threaten to keep the rate above the 3.5 per cent level for a long time. The Federal Reserve may have to resort to drastic changes in the base lending rate again in the coming years.

However, last night the US Federal Reserve’s leadership lowered the benchmark interest rate by 25 basis points. The cuts are the second time in a row. Before that, bankers reduced it by 50 basis points in September, which happened for the first time in four years. As a result, this should gradually ease the pressure on the economy and bring the situation in it back to normal.

US inflation

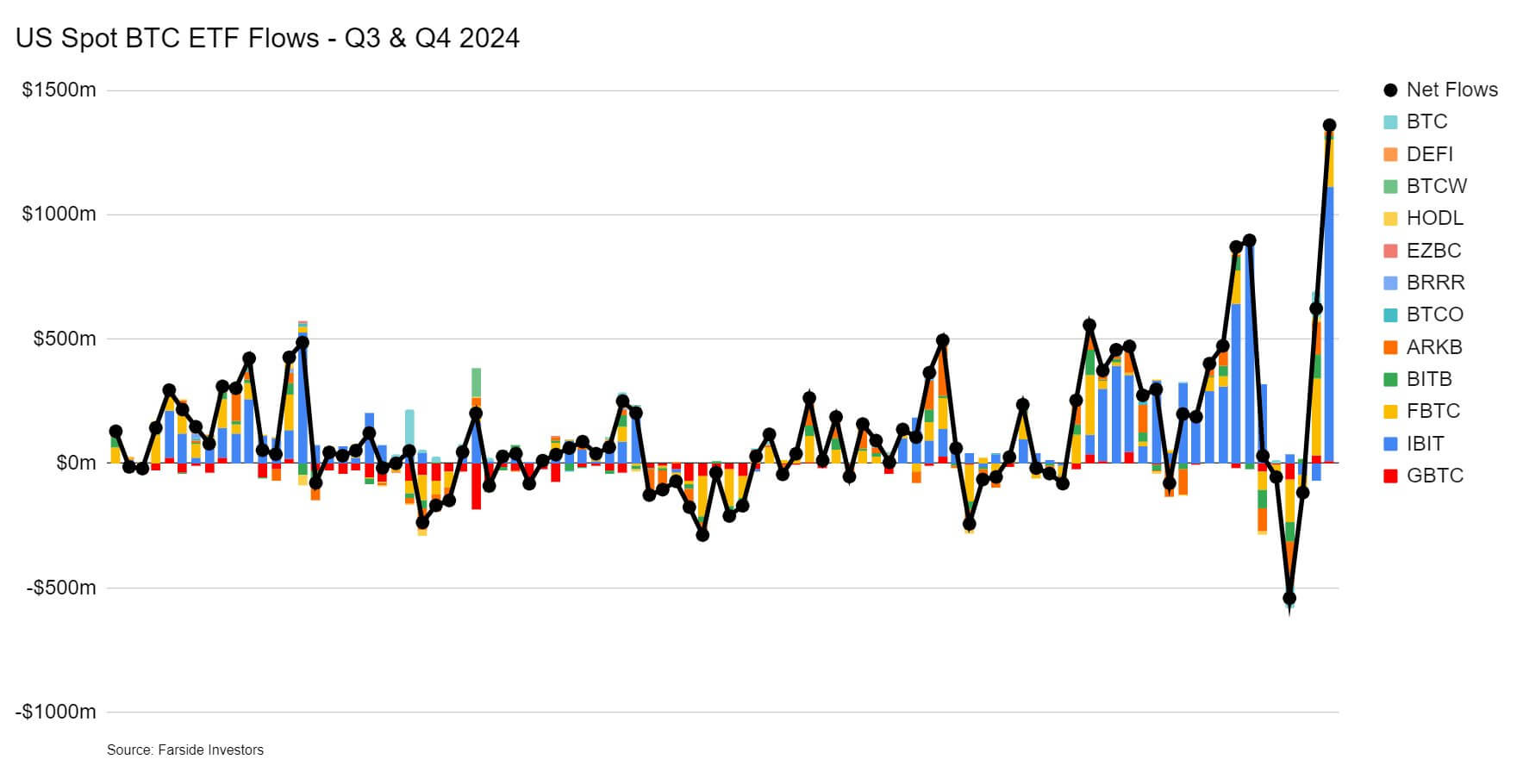

Following Trump’s victory, US spot Bitcoin-ETFs are once again recording notably high net inflows. For example, on the day after the election on 6 November, this figure reached the line of $621 million, which was the tenth largest capital inflow per trading day since the listing of exchange-traded funds in January.

Well, and for the last day exchange-traded funds have attracted $1.37 billion. This is a record for investment instruments since their launch in January 2024.

Inflow and outflow of funds from spot Bitcoin-ETFs

According to Lee, such data shows the growing confidence of Wall Street sharks in the prospects of the crypto market.

Bitcoin-ETFs may see net inflows in the coming days as Wall Street institutionalists are optimistic about the market’s prospects. The ratio of long to short positions in the futures market is below 1, indicating a strong desire among institutional investors to buy such instruments.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

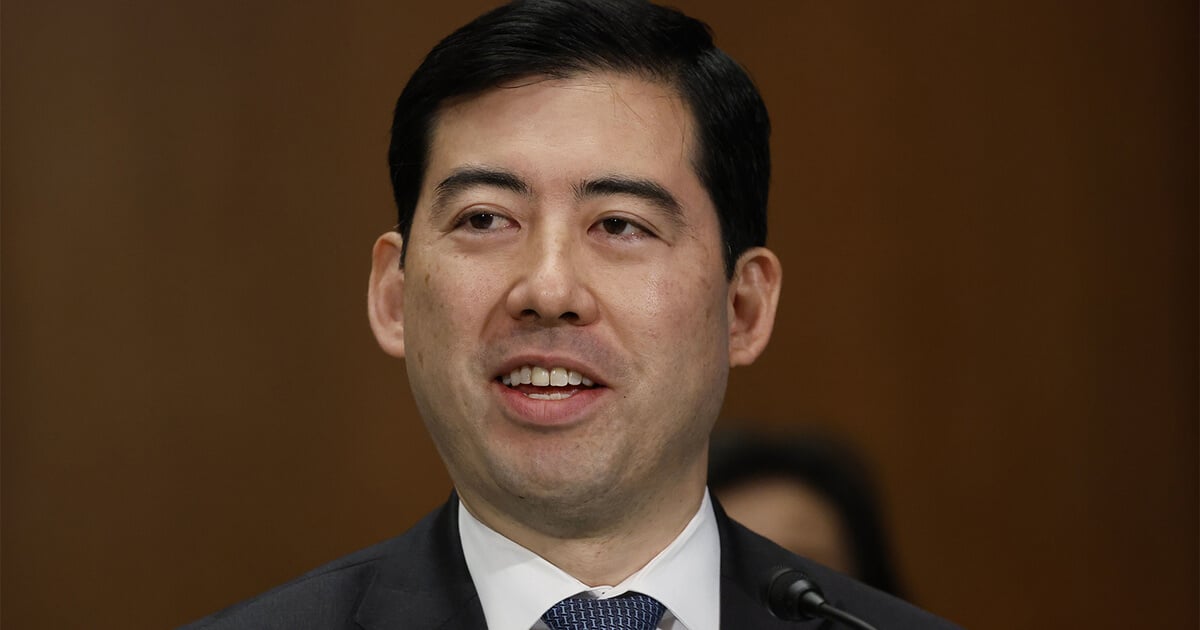

One of Trump’s campaign promises is to oust the current leadership of the Securities and Exchange Commission (SEC), represented by its chairman Gary Gensler. Trump will be inaugurated in January, and until then he must formally introduce Gensler’s successor. According to lawyer Jake Czerwinski, SEC Commissioner Mark Ueda could be considered as such.

Commissioner Ueda is known for criticising Gensler’s approach to regulating cryptocurrencies. Since taking office on 30 June 2022, he has opposed the regular harassment of blockchain companies with lawsuits, a tactic that Gary Gensler has used almost all of the time since his appointment.

SEC Commissioner Mark Ueda

For a long time, the crypto community had its own presumptive nominee – Hester Pearce, another crypto-friendly commissioner. However, the chances of Pearce taking the helm are “very slim,” according to Czerwinski.

Being chairman is a pretty tough, thankless and miserable job, frankly. Some commissioners may want Weda’s appointment, but others may feel they’ve done their time and are ready to move on to quieter areas of expertise.

According to Czerwinski, Trump is also capable of picking someone else. He continues.

I believe Trump may prefer to appoint someone new of his own.

In addition, the lawyer emphasised that Trump’s top policy priority should be to stop trying to “destroy the industry through coercive regulation”. This means abandoning the SEC’s unwarranted enforcement actions against large crypto firms, as well as the Justice Department’s prosecutions.

Analysts are almost unanimously confident that the financial markets and digital asset industry will benefit amid Trump's rise to power. Even if the politician at least ensures the adoption of an adequate crypto regulatory framework in the US, it will already be a huge step for the industry and its popularisation.

Join our millionaire crypto chatroom where current market forecasts and trends are discussed! Get insights from leading analysts and stay up to date with all the changes in the world of cryptocurrencies.

SUBSCRIBE TO OUR CHANNEL IN TELEGRAM TO KEEP UP TO DATE.