Bitcoin will become the leader in DeFi in the next three years: the Cardano creator’s version

Bitcoin’s potential in the field of decentralised finance (DeFi) is extremely underestimated. At the same time, within two to three years, the network of the main cryptocurrency may eclipse many other projects in this sector – this opinion was shared by Charles Hoskinson, the founder of Cardano. According to him, decentralised platforms based on BTC are able to seriously compete with centralised exchanges and other similar platforms.

For a long time, the Bitcoin network was used exclusively for the transfer of value, with which it in principle successfully coped. However, in early 2023, the Ordinals standard was launched on the basis of the protocol, which turned out to be an analogue of NFT on the BTC blockchain.

Ordinals platform based on the Bitcoin network

Since then, the network of the first cryptocurrency began to attract the attention of developers. This led to the emergence of new products and rethinking the capabilities of this chain.

How Bitcoin is developing

The day before, Hoskinson published another video on his YouTube channel. In it, the following quote was voiced, as quoted by Cointelegraph.

I was at the origin of the cryptosphere and fell in love with Bitcoin. Bitcoin has been a big part of my life. The only reason I am here today is because of the existence of this cryptocurrency.

Cardano founder Charles Hoskinson

Hoskinson also mentioned the frustration of using BTC in the early days of the project. He continues.

Bitcoin has gone from a sleeping giant that had no way of waking up in an innovation coma to an awakened giant that is four times the size of Solana and Efirium combined. Decentralised finance in the Bitcoin ecosystem will eclipse decentralised finance in all other startups in the industry within 24-36 months – and that’s just because of scale and liquidity.

Note that such a prediction seems slightly unrealistic. Although Bitcoin is indeed in demand among investors, they most often purchase cryptocurrency as digital gold, i.e. to preserve value.

Well, the mentioned Solana is much more convenient for interaction with DeFi, NFT and other popular sectors. After all, transactions in it are instantaneous, not in an average of ten minutes as in the case of Bitcoin. In addition, the commissions for their conduct are estimated in tenths or hundredths of a cent, which is also important for users.

.

Cardano’s creator added that an additional trigger for the mainstream cryptocurrency ecosystem to proliferate will be the massive interest of governments in BTC. Here’s a rejoinder to that.

I believe Bitcoin will hit the $250,000 to $500,000 mark in the next 12-24 months due to the influx of investment and massive interest. Simply put, BTC is a value preservation tool on the internet, and it will remain in that role for the foreseeable future when it has widespread use in DeFi applications.

The amount of funds blocked in the decentralised finance sphere

He said users can “enable DeFi mode” in Bitcoin by transferring BTC across the bridge into wrapped Cardano tokens. This will allow BTC holders to participate in projects from decentralised finance, trade on decentralised exchanges, as well as freely use tools that generate passive income.

Recall, a blockchain bridge based on the Grail protocol was announced in October by a team of developers supporting Cardano. The bridge could be the first step towards creating DeFi applications centred entirely on Bitcoin.

However, this detail also reveals the nature of Hoskinson’s comments on the matter. In essence, he is simply promoting his own project, capitalising on the popularity and reputation of BTC to do so.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

According to The Block, Bitcoin is now in a position to become a great tool for capital accumulation. This is especially true for relatively small firms that could follow in MicroStrategy’s footsteps.

Michael Saylor at MicroStrategy’s company presentation

The company’s accumulation of BTC on its balance sheet has helped boost MicroStrategy’s share price to record highs and a capitalisation of $85 billion. The giant’s executive chairman Michael Saylor believes that other corporate players should follow his company’s example, as the benefits of the cryptocurrency’s limited maximum supply amid its popularity are obvious.

This view was echoed by Nathan McCauley, CEO and co-founder of Anchorage Digital. Here’s his rejoinder.

Placing BTC on the balance sheet was once a reality only for cryptocurrency companies. Now, however, it is becoming mainstream amid promising prospects following the US presidential election. More and more publicly traded companies are expected to utilise their surplus funds by looking at Bitcoin as a reserve asset.

Even tech giant Microsoft has already put “evaluating Bitcoin investments” on the agenda of its annual shareholder meeting on 10 December.

Earlier, Sailor had offered to personally meet Microsoft CEO Satya Nadella to discuss the possibility of direct investment in BTC, but was turned down. As a result, he will make a presentation to the company’s board representatives and try to convince them to get involved with the first cryptocurrency.

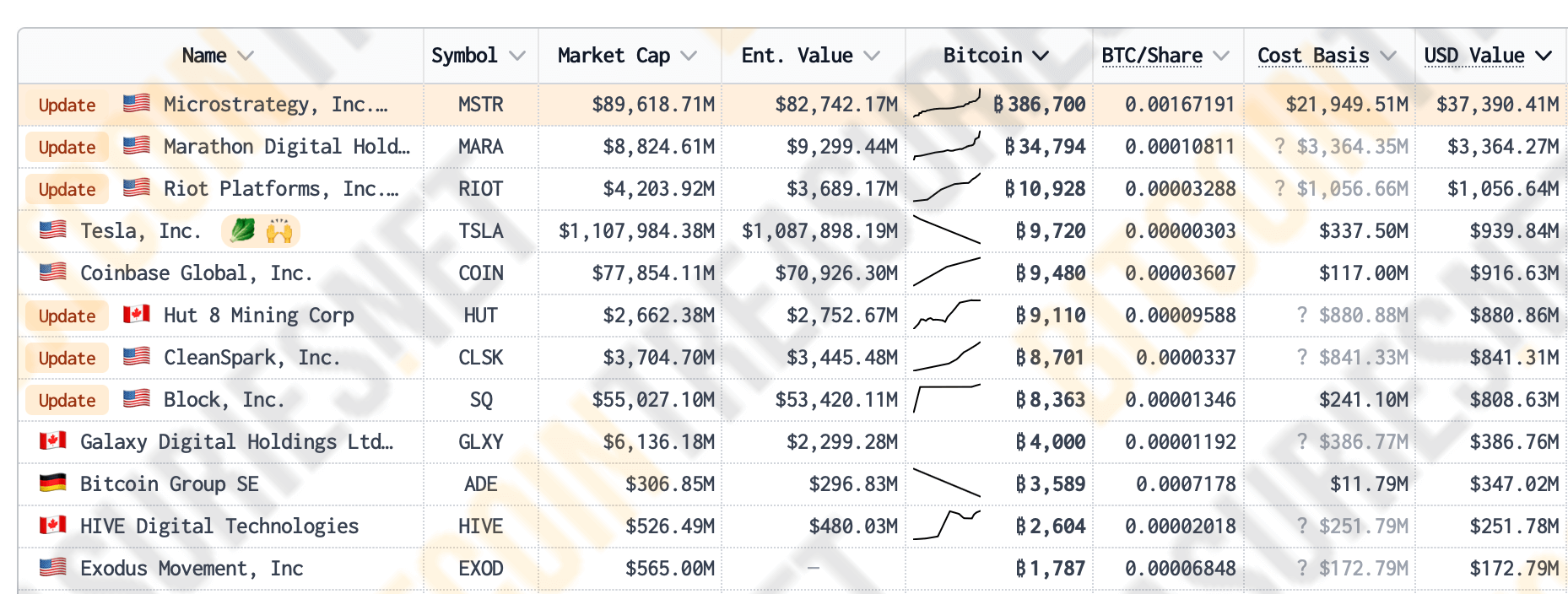

If the company does decide to make such a move, it would make Microsoft the largest company by market capitalisation to own Bitcoin. So far, by this metric, the largest public corporate holder is Tesla, which owns 9,720 BTC.

Meanwhile, MicroStrategy has accumulated an incredible 386,700 coins, which is now valued at $37.3 billion. Here’s the corresponding ranking of public companies by number of bitcoins acquired.

Ranking of public companies by number of bitcoins accumulated

Charles Hoskinson's comments may not be the most sincere, because in the end the entrepreneur still found a reason to promote his own project. However, the Bitcoin network is growing anyway, as evidenced by all the new platforms along with the volume of user transactions. And although BTC will not surpass Solana and other next-generation blockchains in terms of convenience, the platforms on it will definitely find their fans.

.

Look for more interesting things in our crypto chat of millionaires. There we will talk about other important topics from the world of blockchain and decentralised platforms.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO KEEP UP TO DATE.