Bitcoin’s price set a record this week. How else will Trump’s presidency change the cryptocurrency market?

After the US election, the cryptocurrency market issued a sharp rise. In particular, Bitcoin reached an all-time high of $93,265 on the Binance exchange on Wednesday. All thanks to the victory of Republican Donald Trump, on whom there are high hopes. In particular, Trump is expected to become the first crypto-friendly president in US history, with him already becoming the first president to conduct a transaction on the Bitcoin network.

But that's not all - under the new presidential administration, a number of important changes are expected in the context of the digital asset industry. This was stated in a fresh report by analysts at banking giant JPMorgan. They highlighted six key changes that could reshape the digital asset ecosystem in the U.S. and globally, which means investors should be sure to familiarise themselves with them.

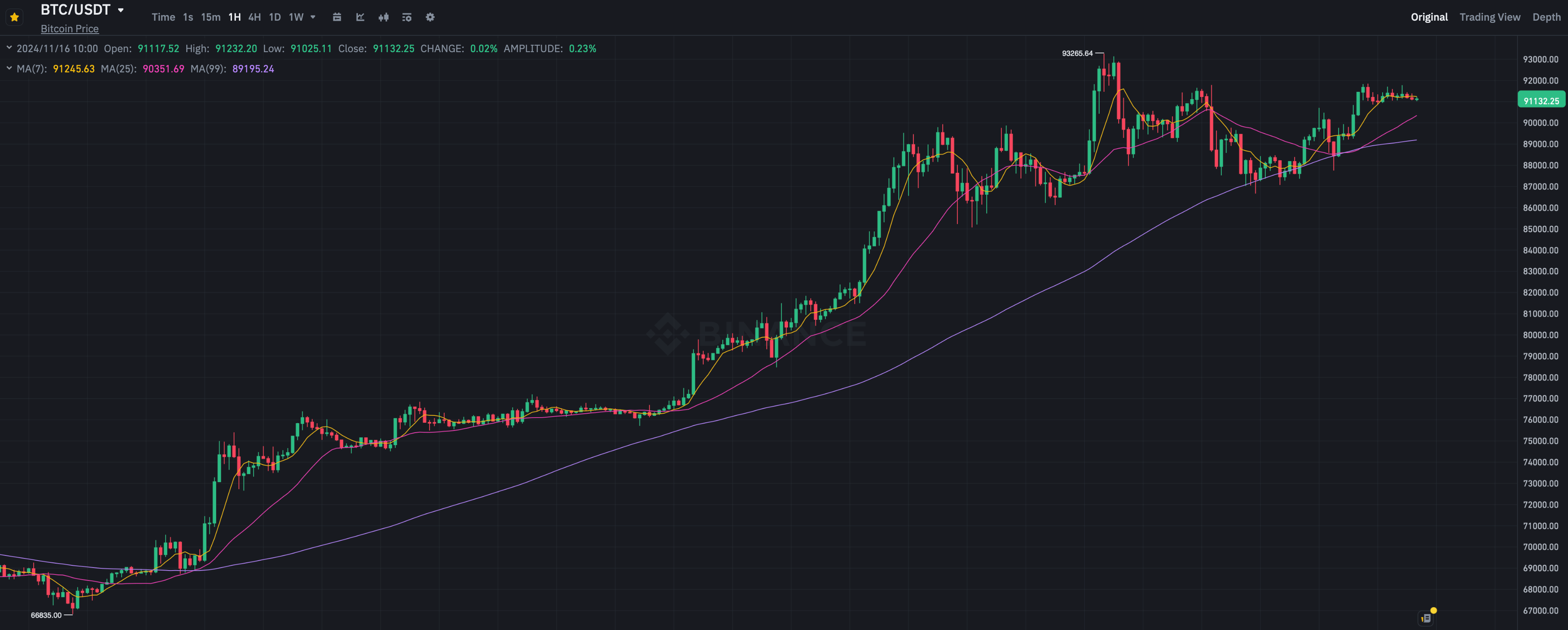

Hourly Bitcoin rate chart

What will happen to cryptocurrencies in 2025

According to The Block, experts are confident that a number of “stalled” cryptocurrency bills are certain to be quickly approved after Trump’s inauguration.

Among them was the 21st Century Financial Innovation and Technology Act – also known as FIT21 – which could provide long-awaited regulatory clarity by defining the roles of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

New US President Donald Trump

Also up for debate will be a bill on stablecoins, which would establish a regulatory framework for this class of coins and exclude them from being categorised as securities under US law.

In addition, the Trump team has repeatedly sounded outbursts in the direction of central bank digital currency (CBDC) – the development of such projects in the country will certainly be prohibited at the legislative level. At least the newly elected president has previously repeatedly stated that the launch of CBDC in case of his victory in the elections will not take place.

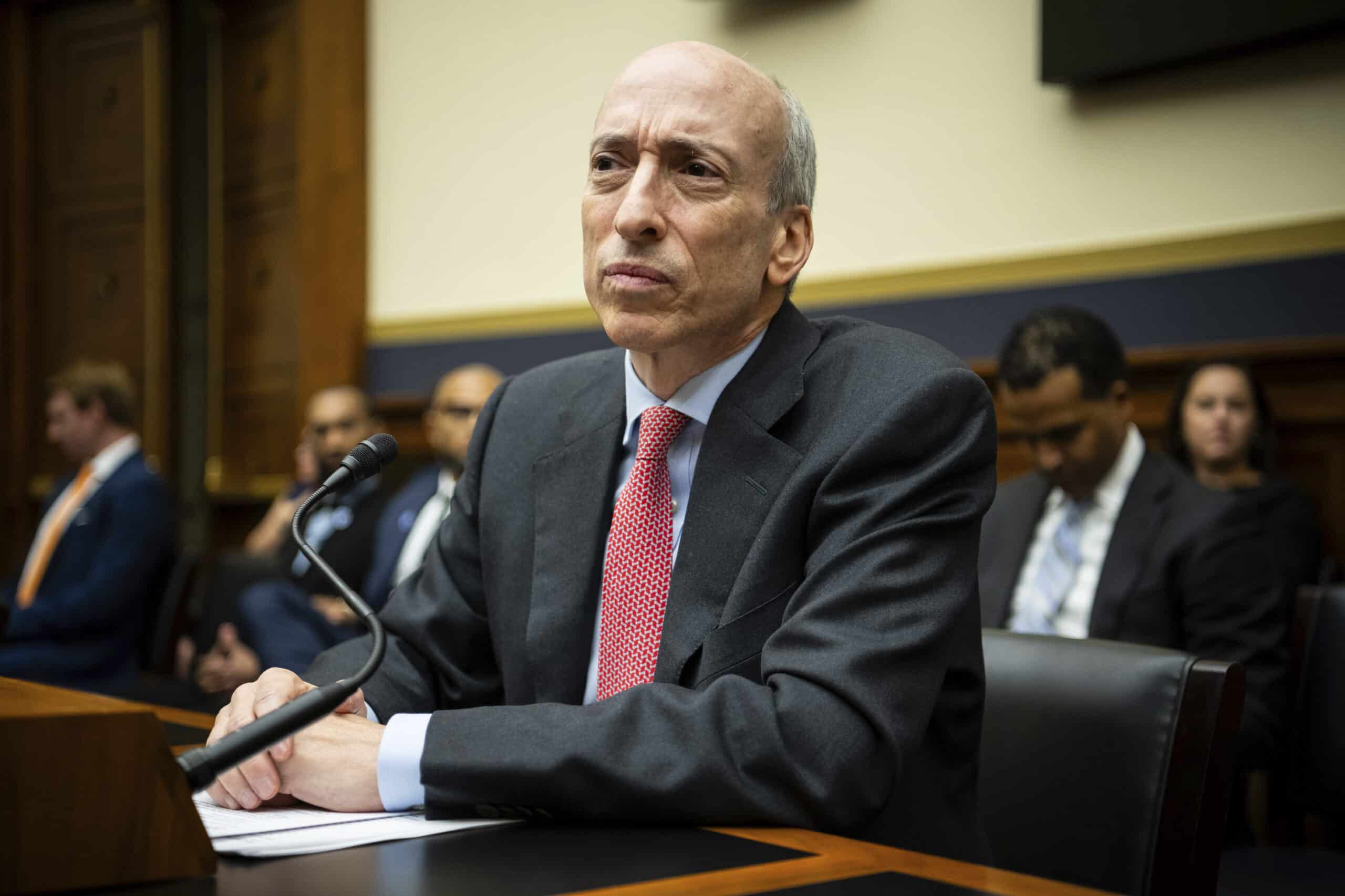

The analysts’ second point concerns the Securities Commission – namely the regulator’s expected new approach to controlling cryptocurrency companies. On Trump’s list of campaign promises was a new candidate for the role of SEC chairman. Apparently, he will be much more positive towards cryptocurrencies than current head Gary Gensler.

SEC head Gary Gensler

The third point is the greater involvement of banks in the crypto industry. They will be able to store digital assets in their accounts without unnecessary obstacles after the repeal of the bill SAB 121. Currently, the document requires custodians to account for customers' crypto assets as liabilities on the balance sheet. The repeal of this law will eliminate the need for individual capital management authorisations.

Experts are also betting on the emergence of new spot cryptocurrency ETFs. Despite the growing optimism about these instruments based on popular altcoins, there are still obstacles to development here. However, if new exchange-traded funds do appear, it will stimulate the growth of venture capital investments in the industry – this is exactly what the fifth point in the analysts’ report says.

Unfortunately, the forecast mentions some things that are not quite optimistic. For example, analysts consider unlikely the approval of BITCOIN Act 2024 – a law that proposes to establish BTC as a strategic reserve asset of the United States, similar to gold. It involves the government buying a million bitcoins over several years, which corresponds to about 5 per cent of the current supply of the first cryptocurrency.

Such a move would definitely be good for Bitcoin’s reputation and could increase its value, but the likelihood of its adoption remains low. Although if the US authorities do go ahead with such a move, other countries may follow suit, thus strengthening Bitcoin’s status as a reserve asset.

😈 MORE INTERESTING STUFF CAN BE FOUND IN OUR YANDEX.ZEN!

In the meantime, the price of BTC has yet to get close to the $100,000 level. After the US presidential election, the first noticeable pullback formed on the chart of the main cryptocurrency on Friday – it is associated with the remarks of the head of the US Federal Reserve Board Jerome Powell. Here is his statement from a conference in Dallas, which Cointelegraph quotes.

The economy is not giving any signals that we need to rush to lower the base lending rate.

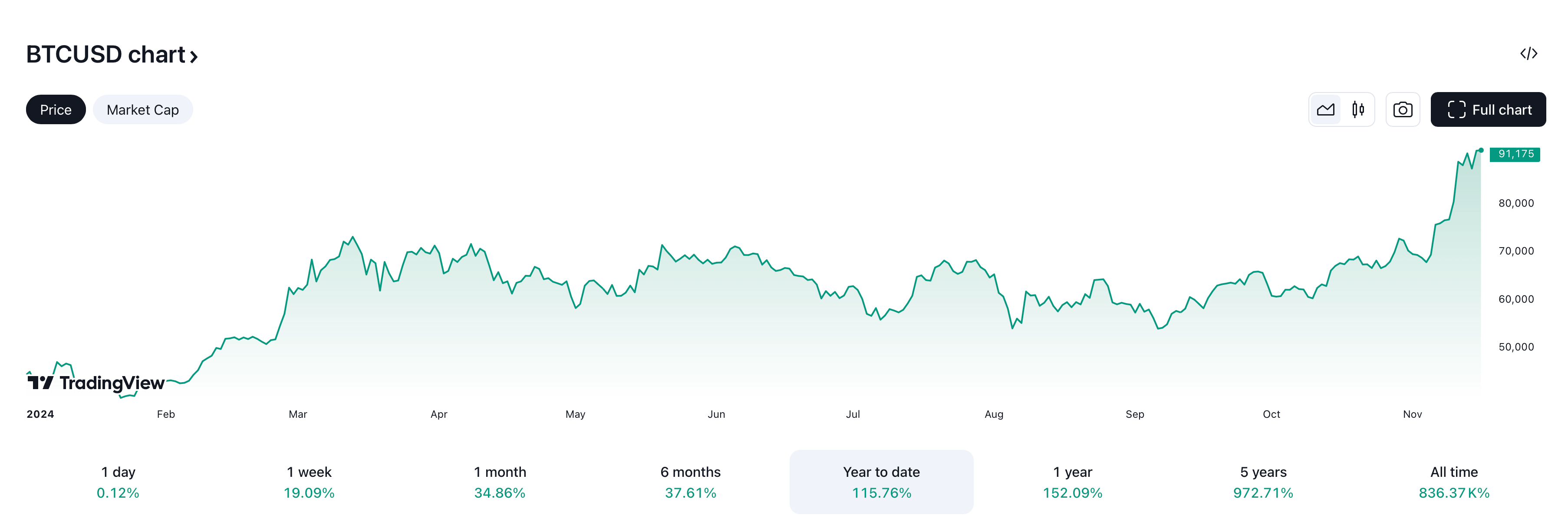

Bitcoin BTC value growth in 2024

Cryptocurrency investors are keeping a close eye on whether the Fed will cut the interest rate at the next FOMC meeting on 18 December. A rate cut makes safe-haven assets such as bonds and time deposits less profitable.

In turn, this makes investors consider riskier and alternative investments like Bitcoin and stocks of tech giants.

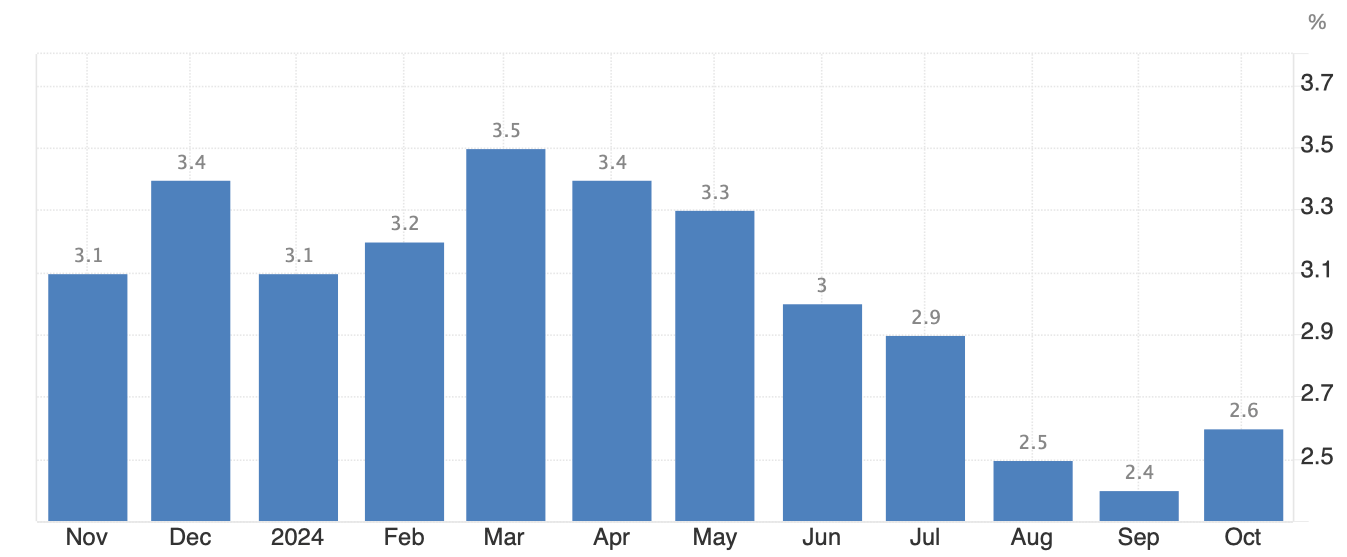

Change in the US inflation index

Meanwhile, on November 14, the US Producer Price Index (PPI) for October showed an annual increase of 2.4 percent, which was slightly higher than the predicted 2.3 percent. Meanwhile, the consumer price index (CPI) reading came in at 2.6 per cent year-on-year, which was in line with analysts’ forecast.

The close to expectations inflation data may prove to be another factor that reduces the urgency of the need to adjust the Fed Funds rate. This is not in doubt among analysts.

Experts continue to bet on the growth of the cryptocurrency market as Donald Trump's presidential term approaches. Still, a head of state who has already transacted on the Bitcoin network, launched NFT collections and generally supports niche coins is expensive. So the reputation of digital assets is sure to improve in the coming years.

Look for more interesting stuff in our crypto chat. There we’ll talk about other important topics related to the world of decentralised platforms and blockchain.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.