‘Buy everything you can’: Bernstein analysts confirm the start of a full-blown bullrun in cryptocurrencies

Bitcoin continues to gain momentum: after Donald Trump’s victory in the US presidential election, the main cryptocurrency is setting new all-time highs every day. And according to analysts of Bernstein brokerage firm, now is the best time to buy as many promising assets as possible, if you haven’t done it yet. Special attention should be paid to the meme-token sector.

The bullrun in the crypto market has clearly moved into a new and more obvious phase. According to some experts, we are talking about the beginning of the so-called euphoria, which in previous cycles lasted for several months.

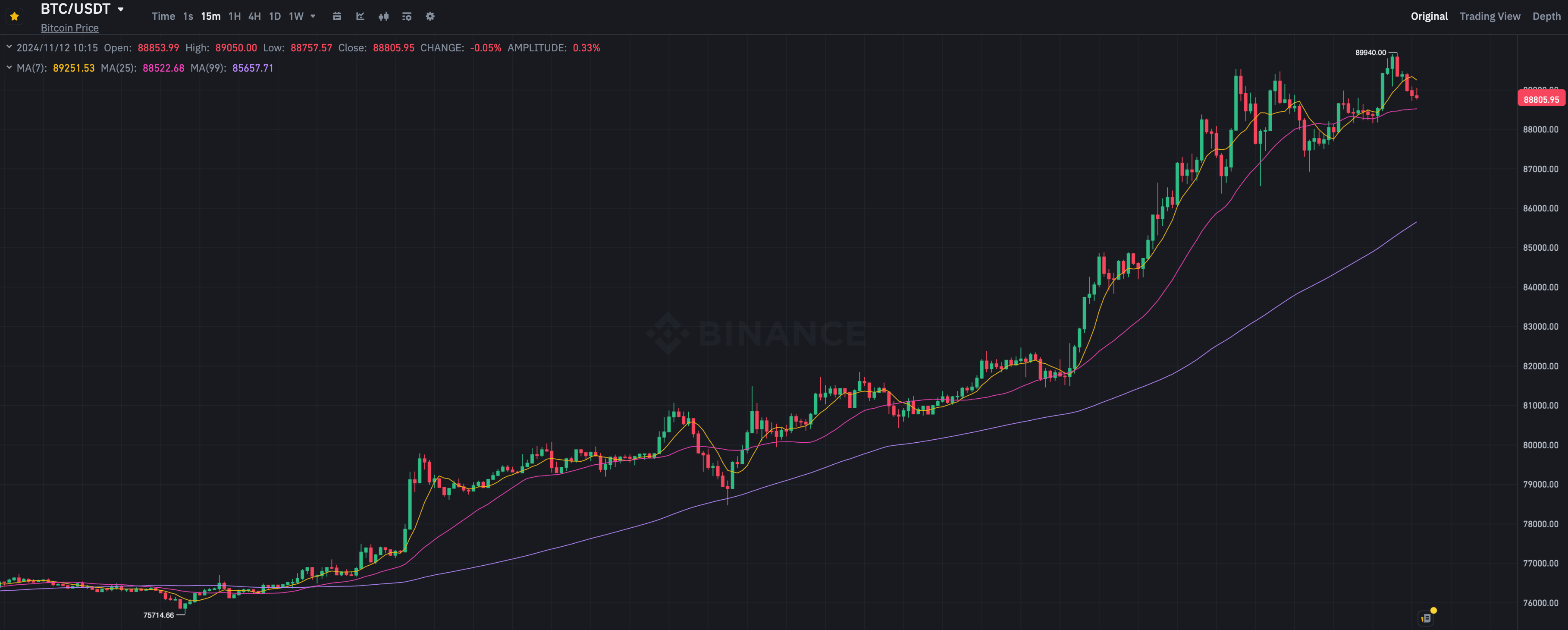

The signs of this are obvious: this morning Bitcoin set a new all-time high of $89,940. Over the past week, its value has risen by 29 per cent.

A 15-minute chart of the Bitcoin exchange rate on the Binance exchange

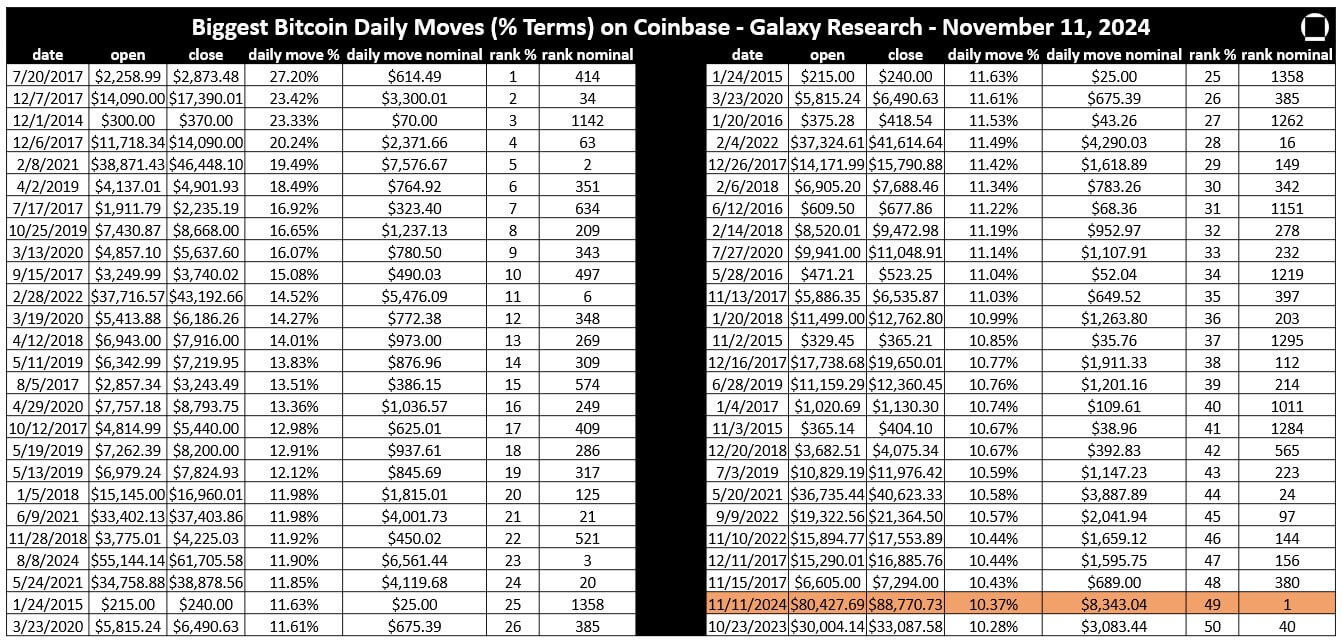

More importantly, Monday 11 November recorded the largest daily increase in the value of BTC in dollar terms. It jumped $8.3,000 during the day, which was a record. Here’s the corresponding chart of the first cryptocurrency’s biggest jumps.

Ranking of the largest jumps of the Bitcoin exchange rate in a day in dollars

In percentage terms, this result turned out to be 49 in the history of BTC. We are talking about 10.37 per cent.

Ranking of the largest jumps in the Bitcoin exchange rate for the day in percentage terms

When it’s best to buy cryptocurrency

In a fresh address to clients, Bernstein experts shared the following opinion on what is happening in the market. The replica is quoted by The Block.

Don’t fight back. Welcome the bullish trend – buy everything you can.

Cryptocurrency investors are on a bullrun

Investors who have refrained from investing in cryptocurrencies due to regulatory concerns should “flip their mental attitudes” after the US election results, analysts say. Still, under Trump, the country will clearly have a favourable environment for regulating the industry.

The newly elected president promised to remove Gary Gensler, chairman of the US Securities and Exchange Commission, who created a lot of problems for cryptocurrency companies.

Newly elected US President Donald Trump

Since the spring of this year, Donald has laid out a number of policies regarding cryptocurrencies. These include the creation of a national reserve with the intention of permanently acquiring BTC, as well as a promise to “end the war on the crypto sector”.

Although the creation of a new strategic reserve requires legislation and may not be realised until 2025, analysts welcome the direction of travel chosen by the Republicans. Well, crypto in such conditions will obviously be perceived by people much more positively.

Newly elected US Vice President J.D. Vance

Aides in Trump’s transition team are also clearly in favour of cryptocurrencies. For example, Vice President-elect J.D. Vance, Robert Kennedy Jr. and Vivek Ramaswamy have previously disclosed BTC ownership and support for the industry. Representatives of the crypto industry itself made a significant contribution to Trump’s victory, investing over $130 million in lobbying their interests.

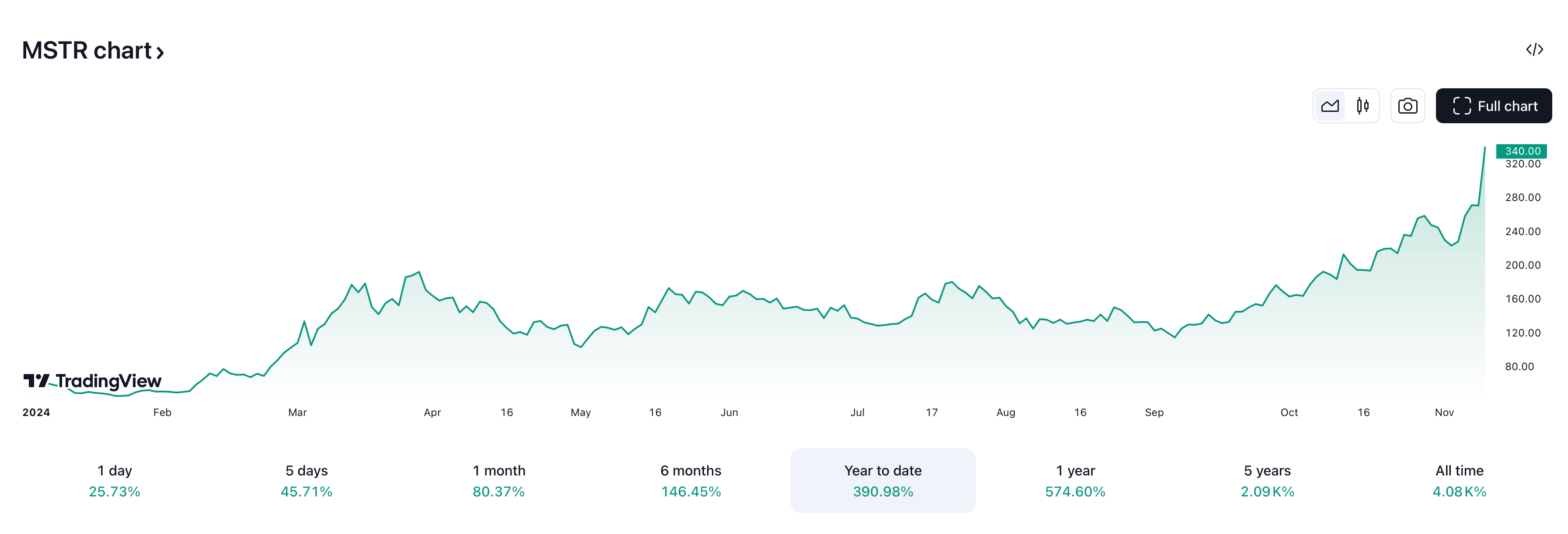

In an appeal to clients, Bernstein experts also mentioned a wide range of tools with which to make money on fluctuations in the value of Bitcoin. Now large institutional investors can fully join the bullrun by buying ETFs based on BTC and ETH on American exchanges, shares of large mining companies or securities of MicroStrategy, the largest holder of BTC in the corporate environment.

MicroStrategy’s stock price growth in 2024

At the same time, individual investors are more likely to buy crypto directly, analysts said. And a significant part of them will pay attention to altcoins: in this case, Bernstein experts advise to study what is happening with coins like SOL, OP, ARB, POL, UNI, AAVE and LINK.

Finally, for Bitcoin itself, analysts once again confirmed their previous forecast. They still expect its price to rise to the $200,000 level in the medium term and within the current bull market in the industry. Earlier, Bernstein experts, among others, called this benchmark “conservative” taking into account all the positive conditions in the economy and the world as a whole.

😈 MORE INTERESTING STUFF FROM US AT YANDEX.ZEN!

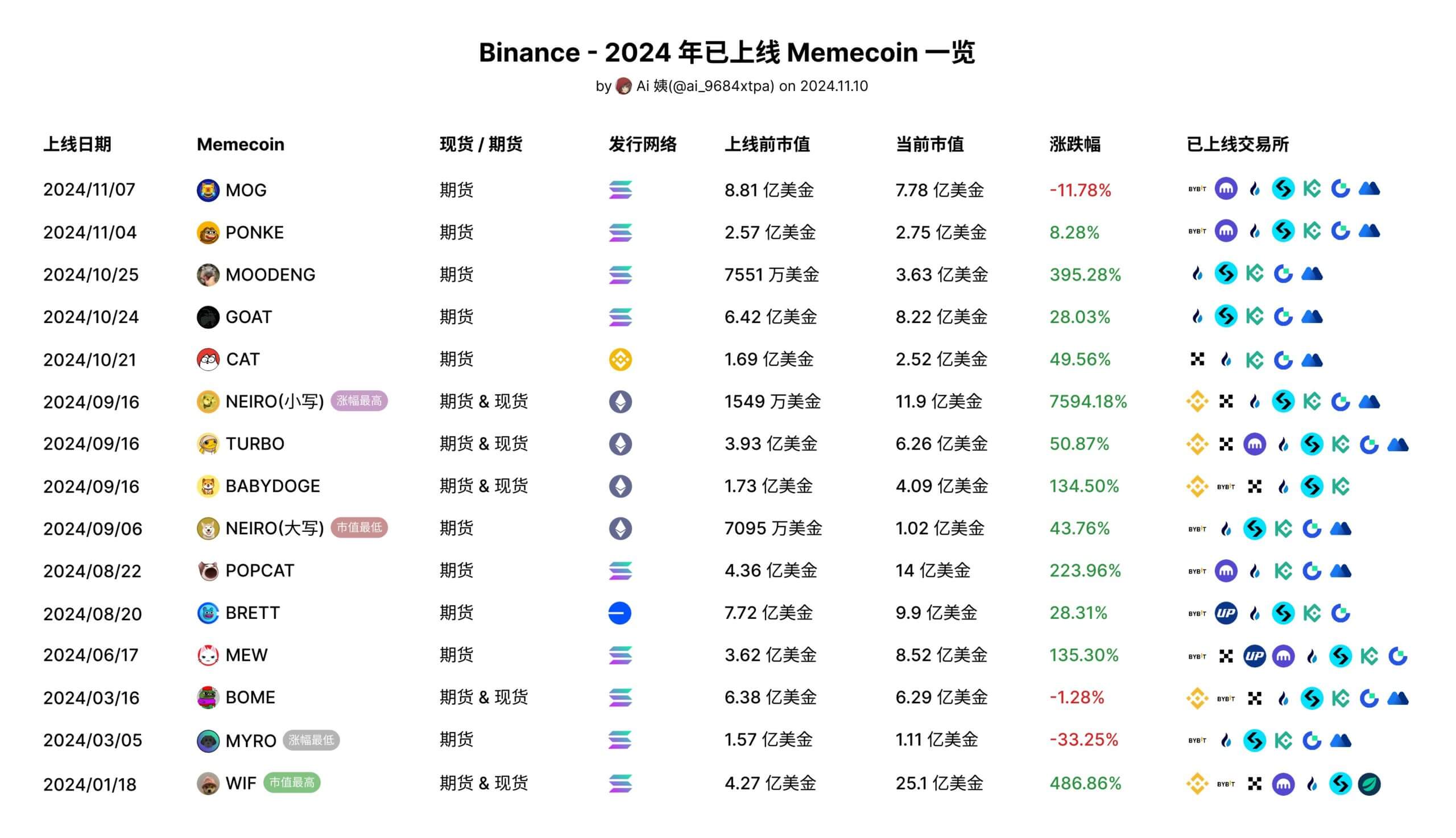

Fans of high yield meme tokens will be interested in the statistics on this sector for 2024. We are talking about the profitability of such assets after listing on the largest crypto exchange Binance – the corresponding data was published on Twitter by a crypto user under the nickname ai_9684xtpa.

Mem tokens added to Binance this year

Based on the statistics, the prices of Moo deng, Dogwifhat and Popcat coins rose by more than 200 per cent after listing on Binance, with the price of the Neiro meme token jumping by almost 7,600 per cent after listing.

However, there are also negative results. In this cohort are Mog Coin, Myro and Book of Meme, which showed a slight decrease in price after listing on Binance. MYRO’s price dropped 33.3 percent, while MOG and BOME fell 11.8 and 1.28 percent, respectively, according to Cointelegraph.

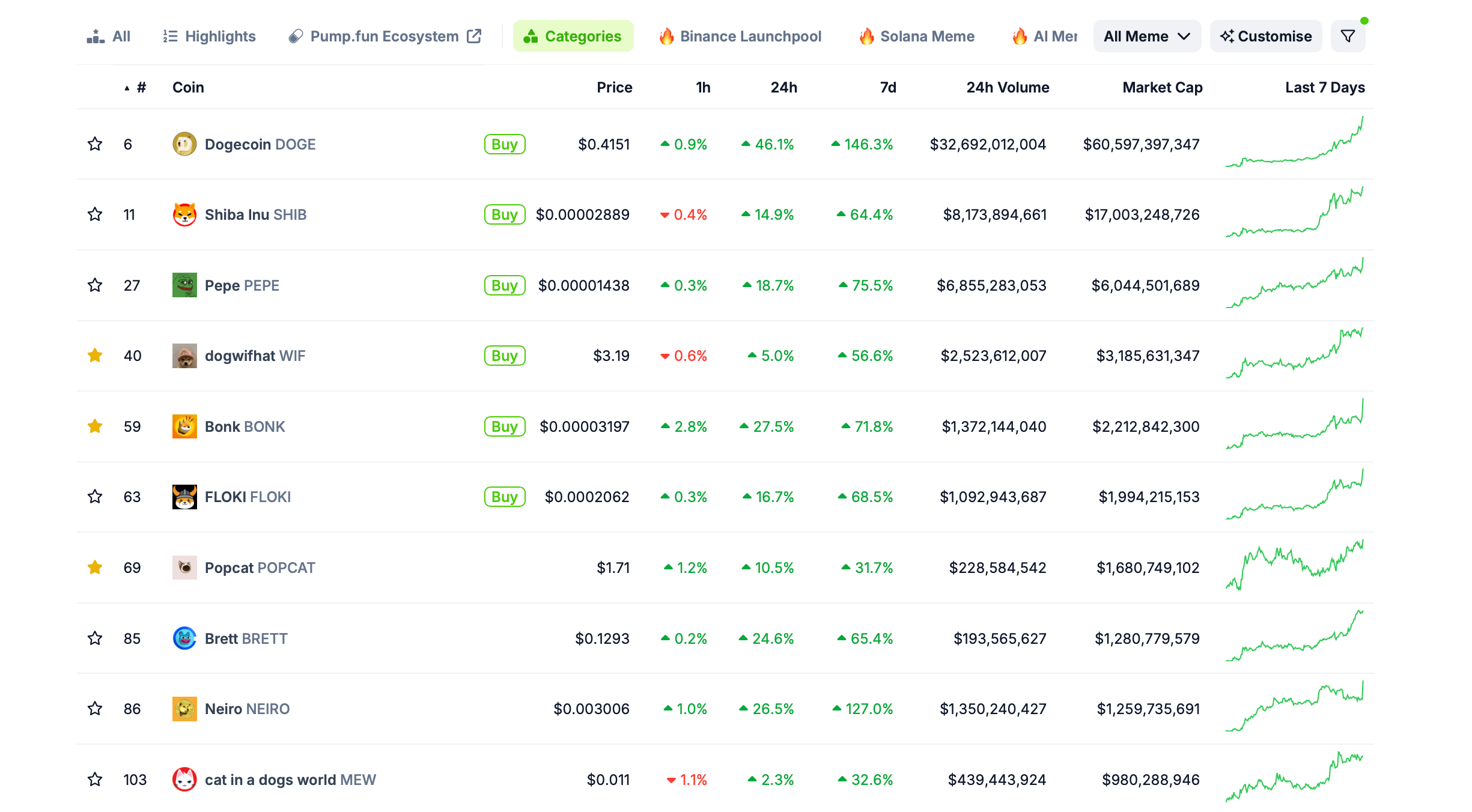

Ranking the largest meme tokens by market capitalisation

60 per cent of meme tokens added to Binance in 2024 are created on the Solana blockchain. Another 26.7 per cent of the figure comes from Efirium, while the rest were developed on BNB Smart Chain and Base.

Among the listed memcoins, only five are available for spot and futures trading. According to the analyst, Binance is relatively cautious about spot listings. Taking into account the data obtained, the expert concluded that Binance as a whole does not have special requirements for the capitalisation of assets in this sector. A common factor that could influence the listing process is the combined popularity of the project and the cohesion of its community.

Bullrun is really gaining momentum in the industry. How long this will last is unknown. However, if we focus on previous stages of growth, we should have at least a few months of positivity in the digital asset industry.

Look for more interesting stuff in our crypto chat. We look forward to seeing you there so that you don’t miss the continuation of the current bullrun and capitalise on it properly.

SUBSCRIBE TO OUR TELEGRAM CHANNEL TO STAY UP TO DATE.